JBF Industries Limited - BSE

JBF Industries Limited - BSE

JBF Industries Limited - BSE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

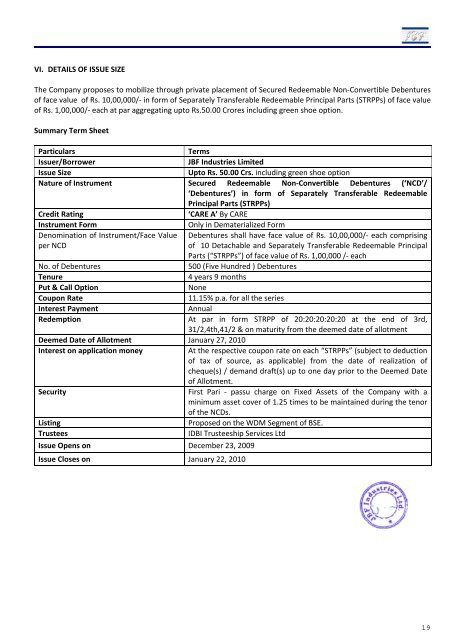

VI. DETAILS OF ISSUE SIZE<br />

The Company proposes to mobilize through private placement of Secured Redeemable Non‐Convertible Debentures<br />

of face value of Rs. 10,00,000/‐ in form of Separately Transferable Redeemable Principal Parts (STRPPs) of face value<br />

of Rs. 1,00,000/‐ each at par aggregating upto Rs.50.00 Crores including green shoe option.<br />

Summary Term Sheet<br />

Particulars Terms<br />

Issuer/Borrower <strong>JBF</strong> <strong>Industries</strong> <strong>Limited</strong><br />

Issue Size Upto Rs. 50.00 Crs. including green shoe option<br />

Nature of Instrument Secured Redeemable Non‐Convertible Debentures (‘NCD’/<br />

Credit Rating<br />

‘Debentures’) in form of Separately Transferable Redeemable<br />

Principal Parts (STRPPs)<br />

‘CARE A’ By CARE<br />

Instrument Form Only in Dematerialized Form<br />

Denomination of Instrument/Face Value<br />

per NCD<br />

Debentures shall have face value of Rs. 10,00,000/‐ each comprising<br />

of 10 Detachable and Separately Transferable Redeemable Principal<br />

Parts (“STRPPs”) of face value of Rs. 1,00,000 /‐ each<br />

No. of Debentures 500 (Five Hundred ) Debentures<br />

Tenure 4 years 9 months<br />

Put & Call Option None<br />

Coupon Rate 11.15% p.a. for all the series<br />

Interest Payment Annual<br />

Redemption At par in form STRPP of 20:20:20:20:20 at the end of 3rd,<br />

31/2,4th,41/2 & on maturity from the deemed date of allotment<br />

Deemed Date of Allotment January 27, 2010<br />

Interest on application money At the respective coupon rate on each “STRPPs” (subject to deduction<br />

of tax of source, as applicable) from the date of realization of<br />

cheque(s) / demand draft(s) up to one day prior to the Deemed Date<br />

of Allotment.<br />

Security<br />

First Pari ‐ passu charge on Fixed Assets of the Company with a<br />

minimum asset cover of 1.25 times to be maintained during the tenor<br />

of the NCDs.<br />

Listing Proposed on the WDM Segment of <strong>BSE</strong>.<br />

Trustees IDBI Trusteeship Services Ltd<br />

Issue Opens on December 23, 2009<br />

Issue Closes on January 22, 2010<br />

19