Nonprofit Organizations Law and Policy Third Edition - Libraries ...

Nonprofit Organizations Law and Policy Third Edition - Libraries ...

Nonprofit Organizations Law and Policy Third Edition - Libraries ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SEC. II ORGANIZATIONAL STRUCTURE 27<br />

--------------------------<br />

petitioner has failed to prove that its activities are charitable <strong>and</strong> educational<br />

within the meaning of section 501(c)(3).<br />

* * *<br />

The few activities of petitioner that have been disclosed fall outside of<br />

the definitions of "charitable" <strong>and</strong> "educational" under section 501(c)(3).<br />

Section 1.501(c)(3)-1(d)(2), Income Tax Regs., specifically states that<br />

examples of charitable activities are ones designed "to lessen neighborhood<br />

tension" <strong>and</strong> "to eliminate prejudice <strong>and</strong> discrimination." Petitioner's<br />

actions serve the purpose of increasing social activism of promajority<br />

<strong>and</strong> rightist beliefs <strong>and</strong> are antithetical to these examples.<br />

* * *<br />

For the reasons stated, we conclude that petitioner is not operated as<br />

a section 501(c)(3) organization. We have considered the remaining arguments<br />

of petitioner, <strong>and</strong> they are either irrelevant or otherwise lack merit.<br />

Decision will be entered upholding respondent's determination.<br />

PROBLEM<br />

You are an employee of the IRS <strong>and</strong>, as such, you are reviewing the<br />

application for tax exempt § 501(c)(3) status of the Satanic Society of America.<br />

The organization prints a monthly newsletter <strong>and</strong> devotes considerable<br />

time promoting Satanic worship <strong>and</strong> rituals through workshops, seminars,<br />

lectures, <strong>and</strong> a weekly radio program. Would you grant or deny exemption?<br />

On what basis?<br />

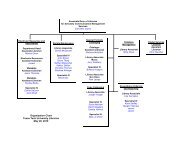

II. ORGANIZATIONAL STRUCTURE OF<br />

A NONPROFIT ORGANIZATION<br />

<strong>Nonprofit</strong> organizations have one of three forms-trust, association,<br />

or corporation. Many small nonprofits are unincorporated associations.<br />

Although a nonprofit organization can be organized as a trust or an<br />

unincorporated association, the preferable organizational structure is the<br />

nonprofit corporation.<br />

A. TRUST<br />

A nonprofit charitable organization can be established as a charitable<br />

trust. A trust is not a statutory organization <strong>and</strong>, thus, does not report to<br />

the state (absent m<strong>and</strong>atory reporting for charities in a particular state).<br />

Few formalities are required in creating a trust, <strong>and</strong> the enabling document<br />

is not filed with the secretary of state (as is the case for a nonprofit<br />

corporation). As a result, a trust structure may provide the organization<br />

more privacy than would organization <strong>and</strong> operation as a nonprofit<br />

corporation.<br />

The procedures to create a trust are not complicated. The grantor or<br />

trustor must execute a declaration of trust to transfer property to another