The Non-resident Landlords Scheme - HM Revenue & Customs

The Non-resident Landlords Scheme - HM Revenue & Customs

The Non-resident Landlords Scheme - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

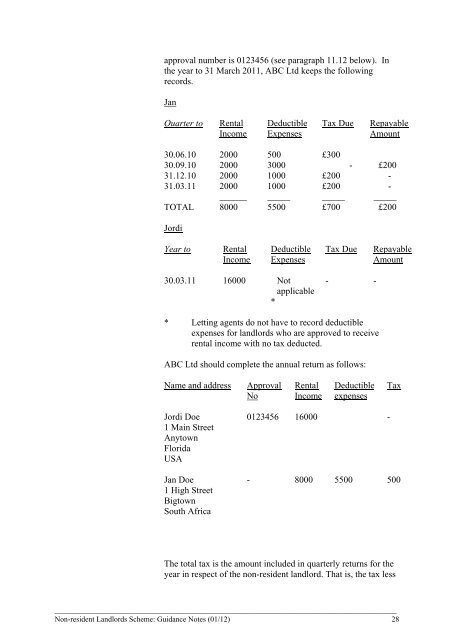

approval number is 0123456 (see paragraph 11.12 below). In<br />

the year to 31 March 2011, ABC Ltd keeps the following<br />

records.<br />

Jan<br />

Quarter to Rental<br />

Income<br />

Deductible<br />

Expenses<br />

Tax Due Repayable<br />

Amount<br />

30.06.10 2000 500 £300<br />

30.09.10 2000 3000 - £200<br />

31.12.10 2000 1000 £200 -<br />

31.03.11 2000 1000 £200 -<br />

______ _____ _____ _____<br />

TOTAL 8000 5500 £700 £200<br />

Jordi<br />

Year to Rental<br />

Income<br />

Deductible<br />

Expenses<br />

30.03.11 16000 Not<br />

applicable<br />

*<br />

Tax Due Repayable<br />

Amount<br />

- -<br />

* Letting agents do not have to record deductible<br />

expenses for landlords who are approved to receive<br />

rental income with no tax deducted.<br />

ABC Ltd should complete the annual return as follows:<br />

Name and address Approval<br />

No<br />

Jordi Doe<br />

1 Main Street<br />

Anytown<br />

Florida<br />

USA<br />

Jan Doe<br />

1 High Street<br />

Bigtown<br />

South Africa<br />

Rental<br />

Income<br />

Deductible<br />

expenses<br />

0123456 16000 -<br />

Tax<br />

- 8000 5500 500<br />

<strong>The</strong> total tax is the amount included in quarterly returns for the<br />

year in respect of the non-<strong>resident</strong> landlord. That is, the tax less<br />

__________________________________________________________________________________________<br />

<strong>Non</strong>-<strong>resident</strong> <strong>Landlords</strong> <strong>Scheme</strong>: Guidance Notes (01/12) 28