The Non-resident Landlords Scheme - HM Revenue & Customs

The Non-resident Landlords Scheme - HM Revenue & Customs

The Non-resident Landlords Scheme - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Reg. 10<br />

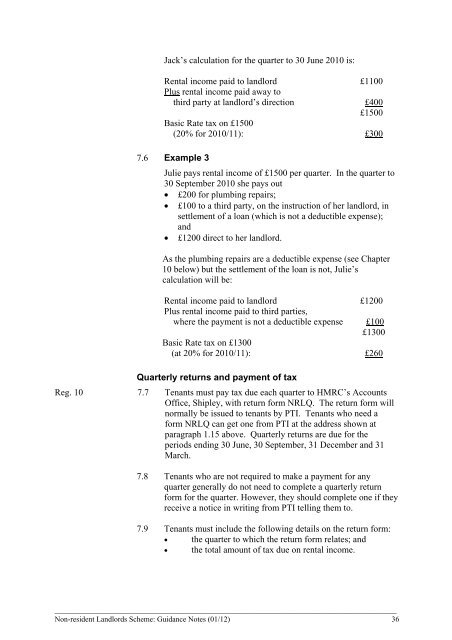

Jack’s calculation for the quarter to 30 June 2010 is:<br />

Rental income paid to landlord £1100<br />

Plus rental income paid away to<br />

third party at landlord’s direction £400<br />

£1500<br />

Basic Rate tax on £1500<br />

(20% for 2010/11): £300<br />

7.6 Example 3<br />

Julie pays rental income of £1500 per quarter. In the quarter to<br />

30 September 2010 she pays out<br />

• £200 for plumbing repairs;<br />

• £100 to a third party, on the instruction of her landlord, in<br />

settlement of a loan (which is not a deductible expense);<br />

and<br />

• £1200 direct to her landlord.<br />

As the plumbing repairs are a deductible expense (see Chapter<br />

10 below) but the settlement of the loan is not, Julie’s<br />

calculation will be:<br />

Rental income paid to landlord £1200<br />

Plus rental income paid to third parties,<br />

where the payment is not a deductible expense £100<br />

£1300<br />

Basic Rate tax on £1300<br />

(at 20% for 2010/11): £260<br />

Quarterly returns and payment of tax<br />

7.7 Tenants must pay tax due each quarter to <strong>HM</strong>RC’s Accounts<br />

Office, Shipley, with return form NRLQ. <strong>The</strong> return form will<br />

normally be issued to tenants by PTI. Tenants who need a<br />

form NRLQ can get one from PTI at the address shown at<br />

paragraph 1.15 above. Quarterly returns are due for the<br />

periods ending 30 June, 30 September, 31 December and 31<br />

March.<br />

7.8 Tenants who are not required to make a payment for any<br />

quarter generally do not need to complete a quarterly return<br />

form for the quarter. However, they should complete one if they<br />

receive a notice in writing from PTI telling them to.<br />

7.9 Tenants must include the following details on the return form:<br />

• the quarter to which the return form relates; and<br />

• the total amount of tax due on rental income.<br />

__________________________________________________________________________________________<br />

<strong>Non</strong>-<strong>resident</strong> <strong>Landlords</strong> <strong>Scheme</strong>: Guidance Notes (01/12) 36