FIN480-01 Course Syllabus Department of Economics & Finance ...

FIN480-01 Course Syllabus Department of Economics & Finance ...

FIN480-01 Course Syllabus Department of Economics & Finance ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

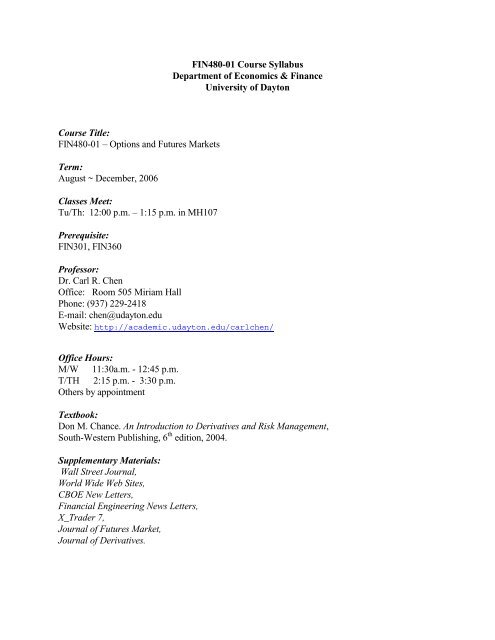

<strong>Course</strong> Title:<br />

<strong>FIN480</strong>-<strong>01</strong> – Options and Futures Markets<br />

Term:<br />

August ~ December, 2006<br />

Classes Meet:<br />

Tu/Th: 12:00 p.m. – 1:15 p.m. in MH107<br />

Prerequisite:<br />

FIN3<strong>01</strong>, FIN360<br />

<strong>FIN480</strong>-<strong>01</strong> <strong>Course</strong> <strong>Syllabus</strong><br />

<strong>Department</strong> <strong>of</strong> <strong>Economics</strong> & <strong>Finance</strong><br />

University <strong>of</strong> Dayton<br />

Pr<strong>of</strong>essor:<br />

Dr. Carl R. Chen<br />

Office: Room 505 Miriam Hall<br />

Phone: (937) 229-2418<br />

E-mail: chen@udayton.edu<br />

Website: http://academic.udayton.edu/carlchen/<br />

Office Hours:<br />

M/W 11:30a.m. - 12:45 p.m.<br />

T/TH 2:15 p.m. - 3:30 p.m.<br />

Others by appointment<br />

Textbook:<br />

Don M. Chance. An Introduction to Derivatives and Risk Management,<br />

South-Western Publishing, 6 th edition, 2004.<br />

Supplementary Materials:<br />

Wall Street Journal,<br />

World Wide Web Sites,<br />

CBOE New Letters,<br />

Financial Engineering News Letters,<br />

X_Trader 7,<br />

Journal <strong>of</strong> Futures Market,<br />

Journal <strong>of</strong> Derivatives.

<strong>Course</strong> Objectives and Description:<br />

Methodology:<br />

The purpose <strong>of</strong> this course is to extend the student's knowledge <strong>of</strong> security valuation by<br />

examining the structure, valuation, and uses <strong>of</strong> derivative contracts. The course develops a<br />

general, but rigorous framework for valuing futures and options contracts and shows the<br />

interrelations between these contract markets and the markets for the underlying securities.<br />

Specific examples are drawn from derivative contract markets on stocks, stock indexes,<br />

debt instruments, and foreign currencies.<br />

The first part <strong>of</strong> the course will focus on the options markets, options pricing, and options<br />

trading strategies. The second part <strong>of</strong> the course will be devoted to the pricing <strong>of</strong> the futures<br />

contracts, and futures trading strategies. Wall Street Journal articles, CBOE News Letters,<br />

and Financial Engineering News Letters that are related to the derivatives will be discussed<br />

in the class.<br />

Although lecture is the principal class format, I encourage all students to engage in<br />

discussions. Interactive instructing methodology is the key to successful learning. Students<br />

should participate in the class discussion by asking and answering questions and by<br />

presenting information relevant to the topic area. Lectures are needed to present the<br />

concepts, but questions and discussions are likewise necessary in order to clarify<br />

misconceptions and explore certain topic areas. All lecture notes will be posted on my web<br />

site and they can be downloaded in PDF format. You should read the class notes before<br />

class.<br />

Class Attendance:<br />

Class participation is mandatory. A 5-point credit will be deducted from your “class<br />

attendance credit” for each additional class missed after allowable two absences. Class<br />

attendance is very important to your doing well in this class. Furthermore, you are<br />

responsible for knowing everything that happens in the class including announcements <strong>of</strong><br />

any changes in test dates that may be necessary.<br />

Homework Assignment:<br />

All homework assignments are due on the following Tuesday after the date <strong>of</strong> the<br />

assignment. Homework could be in the form <strong>of</strong> end-<strong>of</strong>-chapter problems, take home short<br />

projects, or take-home quizzes. Grade <strong>of</strong> late homework is subject to the following discount<br />

on a daily basis: 10% first day; 20% second day; 40% third day; 50% fourth day and after.<br />

No homework will be accepted after the solutions are posted on my web.<br />

Tests and Final Exam:<br />

There will be two tests during the semester and a final exam in the last week <strong>of</strong> the<br />

semester. All tests and final exam have two components: multiple choices and problem

solving. You are permitted to bring one 5 x 6 index card with anything you wanted<br />

written on it for the exam. Honor code is strictly enforced in the exam. Any cheating or<br />

attempt to cheat will automatically result in a failing grade in the course. You must turn<br />

in your exam when the time is over. I will not accept any exam that is turned in seconds<br />

late. The university policy requires that all students take final exam. Failure to comply<br />

with this policy may result in a failing grade in the course.<br />

Policy on Make-up Test & “Extra Credit”:<br />

You are expected to take tests and exam at the scheduled time. Make-up exams are rarely<br />

granted. Students who have to miss a test with legitimate reasons such as personal or family<br />

emergency may request in advance, in writing, for a make-up. Such written requests must<br />

be submitted before the scheduled test, and I will decide on the make-up date. I will not<br />

grant any “extra credit” for extra work; you have plenty opportunities to perform well in the<br />

class.<br />

Grading and Evaluation:<br />

Grading will be based on two tests, a final exam, class attendance credit, and homework<br />

assignments. The breakdown <strong>of</strong> the total points is:<br />

Tests & Exam: 100 points each; 300 points in total<br />

Homework assignments: 125 points<br />

Class attendance: 30 points<br />

Final course letter grades will be assigned to your weighted course average computed<br />

above, as follows:<br />

Letter Grade Quality Points Total <strong>Course</strong> Approximate<br />

Points<br />

Percentage Range<br />

A 4.00 432 - 455 95% - 100%<br />

A- 3.67 409 - 431 90% - 94%<br />

B+ 3.33 395 - 408 87% - 89%<br />

B 3.00 368 - 394 81% - 86%<br />

B- 2.67 355 - 367 78% - 80%<br />

C+ 2.33 341 - 354 75% - 77%<br />

C 2.00 318 - 340 70% - 74%<br />

C- 1.67 295 - 317 65% - 69%<br />

D 1.00 263 - 294 58% - 64%<br />

F 0.00 Below 263 Below 58%

Class Schedule<br />

Week Dates Subject Contents Chapter #<br />

1 8/22, 8/24 Introduction to the course<br />

Structure <strong>of</strong> options Markets<br />

2<br />

2 8/29, 8/31 Principles <strong>of</strong> options pricing<br />

Principles <strong>of</strong> options pricing: upper and lower limits<br />

<strong>of</strong> call and put prices, put-call parity<br />

3 9/5, 9/7 Binomial option pricing model<br />

4 9/12, 9/14 Binomial option pricing model<br />

Black-Scholes option pricing model<br />

5 9/19, 9/21 Black-Scholes option pricing model<br />

Test #1 (9/21)<br />

6 9/26, 9/28 Return and Review 1 st Test<br />

Basic Option Strategies<br />

7 10/3, 10/5 Basic Option Strategies<br />

Advanced Option Strategies<br />

8 10/10, 10/12 Mid-Term Break (10/10); no classes<br />

FMA Conference (10/12); no classes<br />

9 10/17, 10/19 Advanced Option Strategies<br />

Market Structure <strong>of</strong> Forward and Futures Markets<br />

10 10/24, 10/26 Market Structure <strong>of</strong> Forward and Futures Markets<br />

Principles <strong>of</strong> Forward , Futures Pricing & Options on<br />

Futures<br />

11 10/31, 11/2 Principles <strong>of</strong> Forward , Futures Pricing & Options on<br />

Futures<br />

Test #2 (11/2)<br />

12 11/7, 11/9 11/6: Last day to withdraw<br />

Return and Review 2 nd Test<br />

Futures Hedging Strategies<br />

3<br />

3<br />

4<br />

4<br />

5<br />

5<br />

6<br />

6<br />

7<br />

☺<br />

7<br />

8<br />

8<br />

9<br />

9<br />

10

Week Dates Subject Contents Chapter #<br />

13 11/14, 11/16 Futures Hedging Strategies<br />

Advanced Futures Strategies – Arbitrage, Implied<br />

Repo, Cost <strong>of</strong> Carry, Futures Spread, Stock Index<br />

Arbitrage<br />

14 11/21, 11/23 Advanced Futures Strategies – Arbitrage, Implied<br />

Repo, Cost <strong>of</strong> Carry, Futures Spread, Stock Index<br />

Arbitrage<br />

Thanksgiving Recess (11/23) – No classes<br />

15 11/28, 11/30 Advanced Futures Strategies – Arbitrage, Implied<br />

Repo, Cost <strong>of</strong> Carry, Futures Spread, Stock Index<br />

Arbitrage<br />

Swaps<br />

16 12/5 Swaps<br />

17 12/13 Final Exam (Wednesday; 2:30 – 4:20 p.m.)<br />

10<br />

11<br />

11<br />

☺<br />

11<br />

12<br />

12