Reebok Business Performance In 2008, the Reebok segment was ...

Reebok Business Performance In 2008, the Reebok segment was ...

Reebok Business Performance In 2008, the Reebok segment was ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Reebok</strong> <strong>Business</strong> <strong>Performance</strong><br />

<strong>In</strong> <strong>2008</strong>, <strong>the</strong> <strong>Reebok</strong> <strong>segment</strong> <strong>was</strong> impacted by<br />

<strong>the</strong> deteriorating economic environment in key<br />

markets and ongoing efforts to improve <strong>the</strong><br />

positioning of <strong>the</strong> <strong>Reebok</strong> brand. Sales and<br />

profi tability both developed below Management’s<br />

initial expectations. Currency-neutral<br />

sales for <strong>the</strong> <strong>Reebok</strong> <strong>segment</strong> decreased 2%.<br />

<strong>In</strong> euro terms, <strong>segment</strong> sales decreased 8% to<br />

€ 2.148 billion in <strong>2008</strong> from € 2.333 billion in<br />

2007. The gross margin of <strong>the</strong> <strong>Reebok</strong> <strong>segment</strong><br />

declined by 1.7 percentage points to 37.0% in<br />

<strong>2008</strong> from 38.7% in 2007. This <strong>was</strong> mainly a<br />

result of higher clearance sales in <strong>the</strong> second<br />

half of <strong>the</strong> year, compared to <strong>the</strong> previous year.<br />

Gross profi t decreased 12% to € 795 million in<br />

<strong>2008</strong> versus € 902 million in 2007. <strong>Reebok</strong>’s<br />

operating margin declined by 5.0 percentage<br />

points to negative 0.3% in <strong>2008</strong> from positive<br />

4.7% in <strong>the</strong> prior year. This <strong>was</strong> due to <strong>the</strong><br />

decline in gross margin and <strong>the</strong> increase in<br />

net o<strong>the</strong>r operating expenses and income as<br />

a percentage of sales. As a result, <strong>Reebok</strong>’s<br />

operating profi t decreased to negative € 7 million<br />

in <strong>2008</strong> versus positive € 109 million in <strong>the</strong><br />

prior year.<br />

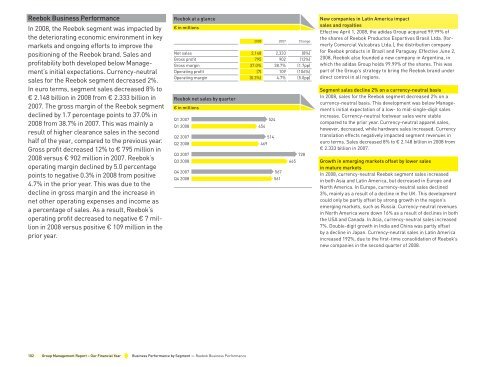

<strong>Reebok</strong> at a glance<br />

€ in millions<br />

102 Group Management Report – Our Financial Year <strong>Business</strong> <strong>Performance</strong> by Segment — <strong>Reebok</strong> <strong>Business</strong> <strong>Performance</strong><br />

<strong>2008</strong> 2007 Change<br />

Net sales 2,148 2,333 (8%)<br />

Gross profi t 795 902 (12%)<br />

Gross margin 37.0% 38.7% (1.7pp)<br />

Operating profi t (7) 109 (106%)<br />

Operating margin (0.3%) 4.7% (5.0pp)<br />

<strong>Reebok</strong> net sales by quarter<br />

€ in millions<br />

Q1 2007<br />

Q1 <strong>2008</strong><br />

Q2 2007<br />

Q2 <strong>2008</strong><br />

Q3 2007<br />

Q3 <strong>2008</strong><br />

Q4 2007<br />

Q4 <strong>2008</strong><br />

454<br />

524<br />

514<br />

469<br />

567<br />

561<br />

728<br />

665<br />

New companies in Latin America impact<br />

sales and royalties<br />

Effective April 1, <strong>2008</strong>, <strong>the</strong> adidas Group acquired 99.99% of<br />

<strong>the</strong> shares of <strong>Reebok</strong> Productos Esportivos Brasil Ltda. (formerly<br />

Comercial Vulcabras Ltda.), <strong>the</strong> distribution company<br />

for <strong>Reebok</strong> products in Brazil and Paraguay. Effective June 2,<br />

<strong>2008</strong>, <strong>Reebok</strong> also founded a new company in Argentina, in<br />

which <strong>the</strong> adidas Group holds 99.99% of <strong>the</strong> shares. This <strong>was</strong><br />

part of <strong>the</strong> Group’s strategy to bring <strong>the</strong> <strong>Reebok</strong> brand under<br />

direct control in all regions.<br />

Segment sales decline 2% on a currency-neutral basis<br />

<strong>In</strong> <strong>2008</strong>, sales for <strong>the</strong> <strong>Reebok</strong> <strong>segment</strong> decreased 2% on a<br />

currency-neutral basis. This development <strong>was</strong> below Management’s<br />

initial expectation of a low- to mid-single-digit sales<br />

increase. Currency-neutral footwear sales were stable<br />

compared to <strong>the</strong> prior year. Currency-neutral apparel sales,<br />

however, decreased, while hardware sales increased. Currency<br />

translation effects negatively impacted <strong>segment</strong> revenues in<br />

euro terms. Sales decreased 8% to € 2.148 billion in <strong>2008</strong> from<br />

€ 2.333 billion in 2007.<br />

Growth in emerging markets offset by lower sales<br />

in mature markets<br />

<strong>In</strong> <strong>2008</strong>, currency-neutral <strong>Reebok</strong> <strong>segment</strong> sales increased<br />

in both Asia and Latin America, but decreased in Europe and<br />

North America. <strong>In</strong> Europe, currency-neutral sales declined<br />

3%, mainly as a result of a decline in <strong>the</strong> UK. This development<br />

could only be partly offset by strong growth in <strong>the</strong> region’s<br />

emerging markets, such as Russia. Currency-neutral revenues<br />

in North America were down 16% as a result of declines in both<br />

<strong>the</strong> USA and Canada. <strong>In</strong> Asia, currency-neutral sales increased<br />

7%. Double-digit growth in <strong>In</strong>dia and China <strong>was</strong> partly offset<br />

by a decline in Japan. Currency-neutral sales in Latin America<br />

increased 192%, due to <strong>the</strong> fi rst-time consolidation of <strong>Reebok</strong>’s<br />

new companies in <strong>the</strong> second quarter of <strong>2008</strong>.

Currency translation effects negatively impacted sales in<br />

euro terms in all regions. <strong>In</strong> euro terms, <strong>segment</strong> sales in<br />

Europe decreased 8% to € 691 million in <strong>2008</strong> from € 748 million<br />

in 2007. <strong>In</strong> North America, revenues declined 22% to<br />

€ 964 million in <strong>2008</strong> from € 1.231 billion in 2007. Sales in Asia<br />

decreased 1% to € 267 million in <strong>2008</strong> (2007: € 269 million),<br />

and in Latin America revenues increased 170% to € 226 million<br />

in <strong>2008</strong> (2007: € 84 million).<br />

Currency-neutral sales of brand <strong>Reebok</strong> stable<br />

Brand <strong>Reebok</strong> sales were almost unchanged compared to <strong>the</strong><br />

prior year on a currency-neutral basis. An increase in <strong>the</strong> running<br />

category <strong>was</strong> offset by declines in lifestyle and in most<br />

major sports categories. <strong>In</strong> euro terms, sales decreased 6% to<br />

€ 1.717 billion (2007: € 1.831 billion).<br />

Currency-neutral sales of <strong>Reebok</strong>-CCM Hockey down 6%<br />

Sales of <strong>Reebok</strong>-CCM Hockey decreased 6% on a currencyneutral<br />

basis in <strong>2008</strong>. This <strong>was</strong> due to <strong>the</strong> decline in <strong>the</strong><br />

licensed jersey business compared to <strong>the</strong> prior year. <strong>In</strong> euro<br />

terms, sales decreased 11% to € 188 million in <strong>2008</strong> versus<br />

€ 210 million in <strong>the</strong> prior year.<br />

Rockport sales decline 10% on a currency-neutral basis<br />

Rockport sales decreased 10% on a currency-neutral basis<br />

in <strong>2008</strong>. This mainly refl ects <strong>the</strong> challenging market environment<br />

in <strong>the</strong> USA, in particular in <strong>the</strong> department store and<br />

mall-based retail channels. <strong>In</strong> euro terms, Rockport revenues<br />

decreased 17% to € 243 million in <strong>2008</strong> (2007: € 291 million).<br />

<strong>2008</strong> <strong>Reebok</strong> net sales by division<br />

<strong>Reebok</strong> 80%<br />

<strong>2008</strong> <strong>Reebok</strong> net sales by region<br />

North America 45%<br />

Europe 32%<br />

<strong>Reebok</strong>-<br />

CCM Hockey 9%<br />

Rockport 11%<br />

Latin America 11%<br />

Asia 12%<br />

Currency-neutral own-retail sales grow 17%<br />

<strong>In</strong> <strong>2008</strong>, <strong>Reebok</strong> own-retail sales grew 17% on a currencyneutral<br />

basis. <strong>In</strong> euro terms, revenues increased 8% to<br />

€ 379 million from € 350 million in 2007. The increase <strong>was</strong><br />

largely driven by new store openings in emerging markets,<br />

especially Russia. <strong>Reebok</strong> own-retail activities made up 18% of<br />

<strong>Reebok</strong> <strong>segment</strong> sales in <strong>2008</strong>, up from 15% in <strong>the</strong> prior year.<br />

The share of own-retail activities as a percentage of brand<br />

sales at Rockport <strong>was</strong> signifi cantly above <strong>the</strong> <strong>segment</strong> average.<br />

During <strong>the</strong> year, <strong>the</strong> number of <strong>Reebok</strong> and Rockport stores<br />

increased by 123 to 647 (2007: 524). The store base at <strong>the</strong> end<br />

of <strong>2008</strong> comprised 253 concept stores and 327 factory outlets.<br />

<strong>Reebok</strong> <strong>segment</strong> gross margin declines 1.7 percentage points<br />

The gross margin of <strong>the</strong> <strong>Reebok</strong> <strong>segment</strong> decreased 1.7 percentage<br />

points to 37.0% in <strong>2008</strong> from 38.7% in 2007. This<br />

development <strong>was</strong> below Management’s initial expectation of a<br />

gross margin increase. The <strong>segment</strong> gross margin <strong>was</strong> negatively<br />

affected by clearance initiatives in particular in <strong>the</strong> USA<br />

and <strong>the</strong> UK in <strong>the</strong> second half of <strong>the</strong> year. <strong>Reebok</strong> gross profi t<br />

decreased 12% to € 795 million in <strong>2008</strong> versus € 902 million in<br />

2007.<br />

adidas Group Annual Report <strong>2008</strong> 103

<strong>Reebok</strong> gross margin by quarter<br />

in %<br />

Q1 2007<br />

Q1 <strong>2008</strong><br />

Q2 2007<br />

Q2 <strong>2008</strong><br />

Q3 2007<br />

Q3 <strong>2008</strong><br />

Q4 2007<br />

Q4 <strong>2008</strong><br />

<strong>Reebok</strong> operating profi t by quarter<br />

€ in millions<br />

Q1 2007<br />

Q1 <strong>2008</strong><br />

Q2 2007<br />

Q2 <strong>2008</strong><br />

Q3 2007<br />

Q3 <strong>2008</strong><br />

Q4 2007<br />

Q4 <strong>2008</strong><br />

6<br />

(13)<br />

(1)<br />

(11)<br />

(9)<br />

21<br />

25<br />

36.8<br />

37.1<br />

39.1<br />

41.2<br />

40.2<br />

36.4<br />

38.1<br />

34.1<br />

84<br />

Royalty and commission income decreases<br />

<strong>In</strong> <strong>2008</strong>, <strong>Reebok</strong> royalty and commission income decreased<br />

29% to € 30 million from € 42 million in <strong>the</strong> prior year. The<br />

decline <strong>was</strong> largely due to <strong>the</strong> non-recurrence of royalties<br />

from distribution partners in Brazil /Paraguay and Argentina.<br />

The distribution partnerships in <strong>the</strong>se countries were replaced<br />

by own companies whose sales were consolidated for <strong>the</strong><br />

fi rst time in <strong>2008</strong>. <strong>Reebok</strong>’s royalty and commission income<br />

primarily relates to royalty income for fi tness equipment.<br />

Net o<strong>the</strong>r operating expenses and income increase<br />

Net o<strong>the</strong>r operating expenses and income as a percentage<br />

of sales increased by 2.9 percentage points to 38.7% in <strong>2008</strong><br />

versus 35.8% in 2007. <strong>Reebok</strong>’s revenue decline in <strong>2008</strong> could<br />

not be offset by a corresponding reduction in costs. On an<br />

a bsolute basis, <strong>Reebok</strong>’s net o<strong>the</strong>r operating expenses and<br />

income decreased modestly to € 831 million in <strong>2008</strong> from<br />

€ 835 million in <strong>the</strong> prior year.<br />

Lower operating margin<br />

<strong>In</strong> <strong>2008</strong>, <strong>the</strong> operating margin of <strong>the</strong> <strong>Reebok</strong> <strong>segment</strong><br />

decreased by 5.0 percentage points to negative 0.3% from<br />

positive 4.7% in <strong>the</strong> prior year. This development <strong>was</strong> below<br />

Management’s initial expectation of an operating margin<br />

increase. This <strong>was</strong> due to a lower gross margin and higher<br />

net o<strong>the</strong>r operating expenses and income as a percentage<br />

of sales. As a result, <strong>Reebok</strong>’s operating profi t decreased to<br />

negative € 7 million in <strong>2008</strong> versus positive € 109 million in<br />

<strong>the</strong> prior year.<br />

104 Group Management Report – Our Financial Year <strong>Business</strong> <strong>Performance</strong> by Segment — <strong>Reebok</strong> <strong>Business</strong> <strong>Performance</strong> — TaylorMade-adidas Golf <strong>Business</strong> <strong>Performance</strong><br />

<strong>Reebok</strong> own-retail stores<br />

Concept Stores 253<br />

Factory Outlets 327<br />

Concession Corners 67<br />

<strong>2008</strong> 2007<br />

Total 647 524<br />

164<br />

287<br />

73