City Ordinance No. 627 - Bacolod City

City Ordinance No. 627 - Bacolod City

City Ordinance No. 627 - Bacolod City

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

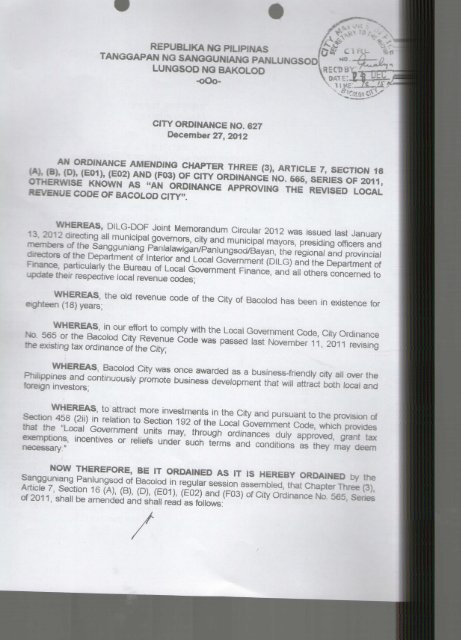

REPUBLIKA NG PILIPINAS<br />

TANGGAPAN NG SANGGUNIANG PANLUNGSOD<br />

LUNGSOO NG BAKOLOO<br />

-oOo-<br />

CITY ORDINANCE NO. <strong>627</strong><br />

December 27, 2012<br />

AN ORDINANCE AMENDING CHAPTER THREE (3), ARTICLE 7, SECTION 16<br />

(A), (B), (D), (E01), (E02) AND (F03) OF CITY ORDINANCE NO. 565, SERIES OF 2011,<br />

OTHERWISE KNOWN AS "AN ORDINANCE APPROVING THE REVISED LOCAL<br />

REVENUE CODE OF BACOLOD CITY".<br />

WHEREAS, DILG-DOF Joint Memorandum Circular 2012 was issued last January<br />

13, 2012 directing all municipal governors, city and municipal mayors, presiding officers and<br />

members of the Sangguniang Panlalawigan/Panlungsod/Bayan, the regional and provincial<br />

directors of the Department of Interior and Local Government (DILG) and the Department of<br />

France, particularly the Bureau of Local Government Finance, and all others concerned to<br />

update their respective local revenue codes;<br />

WHEREAS, the old revenue code of the <strong>City</strong> of <strong>Bacolod</strong> has been in existence for<br />

eighteen (18) years;<br />

WHEREAS, in our effort to comply with the Local Government Code, <strong>City</strong> <strong>Ordinance</strong><br />

<strong>No</strong>. 565 or the <strong>Bacolod</strong> <strong>City</strong> Revenue Code was passed last <strong>No</strong>vember 11, 2011 revising<br />

the existing tax ordinance of the <strong>City</strong>;<br />

WHEREAS, <strong>Bacolod</strong> <strong>City</strong> was once awarded as a business-friendly city all over the<br />

Philippines and continuously promote business development that will attract both local and<br />

foreign investors;<br />

WHEREAS, to attract more investments in the <strong>City</strong> and pursuant to the provision of<br />

Section 458 (2ii) in relation to Section 192 of the Local Government Code, which provides<br />

that the "Local Government units may, through ordinances duly approved, grant tax<br />

exemptions, incentives or reliefs under such terms and conditions as they may deem<br />

necessary"<br />

NOW THEREFORE, BE IT ORDAINED AS IT IS HEREBY ORDAINED by the<br />

Sangguniang Panlungsod of <strong>Bacolod</strong> in regular session assembled, that Chapter Three (3),<br />

Article 7, Section 16 (A), (B), (D), (E01), (E02) and (F03) of <strong>City</strong> <strong>Ordinance</strong> <strong>No</strong>. 565, Series<br />

of 2011, shall be amended and shall read as follows:

<strong>City</strong> <strong>Ordinance</strong> <strong>No</strong>. <strong>627</strong><br />

Series of 2012 - Page 2 -<br />

CHAPTER THREE<br />

TAX ON BUSINESS<br />

ARTICLE 7<br />

IMPOSITION AND TIME OF PAYMENT<br />

SECTION 16. Imposition of Tax - There is hereby levied an annua<br />

following business undertaking at the rates prescribed herein.<br />

(A) ON MANUFACTURERS, ASSEMBLERS, REPACKERS, PROCESS!<br />

BREWERS, DISTILLERS, RECTIFIERS, AND COMPOUNDERS OF IJGUTJ<br />

DISTILLED SPIRITS, AND WINES OR MANUFACTURERS OF ANY ART :<br />

COMMERCE OF WHATEVER KIND OR NATURE, IN ACCORDANCE W<br />

FOLLOWING SCHEDULE.<br />

• With gross receipts or sales for the preceding calendar year in the a~: -<br />

FROM<br />

TO LESS THAN<br />

10,000.00 24/ SO<br />

10,000.00 15,000.00 33-: :c<br />

15,000.00 20,000.00 453 •<br />

20,000.00 30,000.00 56: m<br />

30,000.00 40,000.00 ?9C 3C<br />

40,000.00 50,000.00 1 23700<br />

50,000.00 75,000.00 1 98000<br />

75,000.00 100,000.00 Z475 OD<br />

100,000.00 150,000.00 3 30000<br />

150,000.00 200,000 00 - "2? X<br />

200,000.00 300,000.00<br />

300,000.00 500,000.00 3 337 3*7<br />

500,000.00 750,000.00 -o: : -<br />

750,000.00 1,000,000.00 15.UU09B<br />

1,000,000.00<br />

2,000,000.00<br />

2,000,000.00<br />

3,000,000.00<br />

20 625m<br />

24 75000<br />

3,000,000.00 4,000,000.00 29, /'UU 00<br />

4,000,000.00 5,000,000.00 34.65000<br />

5,000,000.00<br />

6,500,000.00 and above<br />

6,500,000.00 36.56250<br />

at a rate not exceeding thirtyseven<br />

and a half percent (37 %%|<br />

of one percent (1%).<br />

/

<strong>City</strong> <strong>Ordinance</strong> <strong>No</strong>. <strong>627</strong><br />

Series of 2012 -Page 3-<br />

Provided, that in no case shall the tax on Gross Sales of 6,500,000.00 or more be<br />

less than 36,562.50.<br />

(B) ON WHOLESALERS, DISTRIBUTORS, OR DEALERS IN ANY ARTICLE<br />

OF COMMERCE OF WHATEVER KIND OR NATURE IN ACCORDANCE WITH<br />

THE FOLLOWING SCHEDULE:<br />

• With gross receipts or sales for the preceding calendar year in the amount of<br />

FROM TO LESS THAN ANNUAL TAX<br />

1,000.00 27.00<br />

1,000.00 2,000.00 49.50<br />

2,000.00 3,000.00 75.00<br />

3,000.00 4,000.00 108.00<br />

4,000.00 5,000.00 150.00<br />

5,000.00 6,000.00 181.50<br />

6,000.00 7,000.00 214.50<br />

7,000.00 8,000.00 247.50<br />

8,000.00 10,000.00 280.50<br />

10,000.00 15,000.00 330.00<br />

15,000.00 20,000.00 412.50<br />

20,000.00 30,000.00 495.00<br />

30,000.00 40,000.00 660.00<br />

40,000.00 50,000.00 990.00<br />

50,000.00 75,000.00 1,485.00<br />

75,000.00 100,000.00 1,980.00<br />

100,000.00 150,000.00 2,805.00<br />

150,000.00 200,000.00 3,630.00<br />

200,000.00 300,000.00 4,950.00<br />

300,000.00 500,000.00 6,600.00<br />

500,000.00 750,000.00 9,900.00<br />

750,000.00 1,000,000.00 13,200.00<br />

1,000,000.00 2,000,000.00 15,000.00<br />

2,000,000.00 and above at a rate not exceeding thirtyseven<br />

and a half percent (37 %%)<br />

of one percent (1%).<br />

Provided, that in no case shall the tax on Gross Sales of 2,000,000.00 or more be less<br />

than 15,000.00<br />

t

<strong>City</strong> <strong>Ordinance</strong> <strong>No</strong>. <strong>627</strong><br />

Series of 2012 Page 4 -<br />

(C) ON RETAILERS<br />

• with gross sales or receipts<br />

for the preceding calendar<br />

year of<br />

P 50,000.00 to P400, 000.00<br />

P400,000.00 and above<br />

Per Annum<br />

Rate of Tax<br />

2%<br />

P8,000.00 plus 37 % % of 1% of<br />

gross receipts in excess of<br />

P400, 000.00<br />

Provided however, that barangays shall have the exclusive power to levy taxes ar»<br />

retailers with gross sales or receipts for the proceeding calendar year of FIFTY THOUGAW<br />

PESOS (P50.000.00) or less.<br />

(E.01) In the case of PRIVATE HOSPITAL - Shall be taxed on the gross sereceipt<br />

of the preceding year, at the rate of 12% of 1%.<br />

(E.02) In the case of HOTELS, MOTELS, LODGING INNS, BOARDtr.<br />

PENSION HOUSES - Shall be taxed on the gross sales or receipt of the pmuafm<br />

year, at the rate of 25% of 1%.<br />

Provided that in no case shall the tax on gross sales of P2, 000,000.00 or nc» *<br />

less than P17,250.00.<br />

(F 03) Tax on the Gross Receipts of Banks and Financial Institutions- ~m J<br />

banks and financial institutions shall be levied on their gross income/reoBOK<br />

the actual transaction took place and/or the property is located for the<br />

calendar year at the following rates:<br />

1 Banks:<br />

a. Those with Head Office within the <strong>City</strong> of <strong>Bacolod</strong> or the<br />

Negros Occidental, at the rate of Twenty Five Percent C25Vp<br />

Percent (1 %).<br />

b. Those with Head Office located elsewhere in the P1M|M—<br />

rate of Fifty Percent (50%) of One Percent (1 %).

<strong>City</strong> <strong>Ordinance</strong> <strong>No</strong>. <strong>627</strong><br />

Series of 2012 - Page 5 -<br />

2. Financial institutions:<br />

a. Those with Head Office within the <strong>City</strong> of <strong>Bacolod</strong> or the Province of<br />

Negros Occidental, at the rate not exceeding FIFTEEN PERCENT<br />

(15%) of ONE PERCENT (1%);<br />

b. Those with Head Office located elsewhere in the Philippines at the<br />

rate not exceeding FIFTY PERCENT (50%) of ONE PERCENT (1 %).<br />

SECTION 16.1 The provisions of this ordinance shall also apply to all business<br />

establishments that are paying their business taxes on quarterly basis.<br />

SECTION 16.2 SEPARABILITY CLAUSE- If any part or provision of this <strong>Ordinance</strong><br />

is held invalid or unconstitutional, other provisions not affected thereby shall remain in force<br />

and effect.<br />

2013.<br />

SECTION 16.3 EFFECTIVITY. This ordinance shall take effect on January 1,<br />

CARRIED BY THE VOTE OF"<br />

Affirmative:<br />

Councilors El Cid M. Familiaran, Homer Q. Bais, Archie S. Baribar,<br />

Roberto M. Rojas, Em L. Ang, Dindo C. Ramos, Elmer T Sy,<br />

Sonya M. Verdeflor, Al Victor A. Espino, Caesar Z. Distrito,<br />

Carlos Jose V Lopez, Mona Dia G. Jardin.<br />

Negative Councilor Catalino T Alisbo<br />

Absent <strong>No</strong>ne<br />

Author Councilor Al Victor A. Espino<br />

Passed December 27, 2012 (130m Regular/Special Session).<br />

Comments Passed.<br />

Councilor Archie S. Baribar voted in the affirmative with<br />

qualification that the reduction should have been lower than<br />

what is being proposed.<br />

Councilor Caesar Z. Distrito voted in the affirmative with<br />

qualification that the cases filed against the city be withdrawn.

<strong>City</strong> <strong>Ordinance</strong> <strong>No</strong>. <strong>627</strong><br />

Series of 2012<br />

ATTESTED:<br />

HELEN P. LEGASPI<br />

Board Secretary IV<br />

OIC, Secretary to the Sanggunian<br />

APPROVED: December 2£ 2012.<br />

HPUjbz<br />

SP<br />

LEGISLATIVE SEf?VICC< SECTION<br />

Page<br />

Councilor Sonya M. Verdeflor voted in the<br />

qualification that she would have preferred a<br />

reduction.<br />

Councilor Keith Emmanuel L Ramos was not<br />

this ordinance was passed..<br />

EVELIO R. LEONARDIA<br />

<strong>City</strong> Mayor<br />

—<br />

k CERTiFicO PHOTOCOPY<br />

OF THE ORIGINAL