Joe Smolira - Belmont University

Joe Smolira - Belmont University

Joe Smolira - Belmont University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

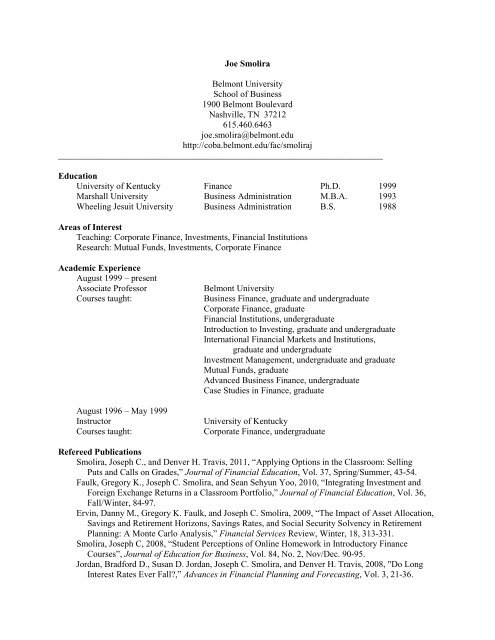

<strong>Joe</strong> <strong>Smolira</strong><br />

<strong>Belmont</strong> <strong>University</strong><br />

School of Business<br />

1900 <strong>Belmont</strong> Boulevard<br />

Nashville, TN 37212<br />

615.460.6463<br />

joe.smolira@belmont.edu<br />

http://coba.belmont.edu/fac/smoliraj<br />

_________________________________________________________________________<br />

Education<br />

<strong>University</strong> of Kentucky Finance Ph.D. 1999<br />

Marshall <strong>University</strong> Business Administration M.B.A. 1993<br />

Wheeling Jesuit <strong>University</strong> Business Administration B.S. 1988<br />

Areas of Interest<br />

Teaching: Corporate Finance, Investments, Financial Institutions<br />

Research: Mutual Funds, Investments, Corporate Finance<br />

Academic Experience<br />

August 1999 – present<br />

Associate Professor <strong>Belmont</strong> <strong>University</strong><br />

Courses taught: Business Finance, graduate and undergraduate<br />

Corporate Finance, graduate<br />

Financial Institutions, undergraduate<br />

Introduction to Investing, graduate and undergraduate<br />

International Financial Markets and Institutions,<br />

graduate and undergraduate<br />

Investment Management, undergraduate and graduate<br />

Mutual Funds, graduate<br />

Advanced Business Finance, undergraduate<br />

Case Studies in Finance, graduate<br />

August 1996 – May 1999<br />

Instructor <strong>University</strong> of Kentucky<br />

Courses taught: Corporate Finance, undergraduate<br />

Refereed Publications<br />

<strong>Smolira</strong>, Joseph C., and Denver H. Travis, 2011, “Applying Options in the Classroom: Selling<br />

Puts and Calls on Grades,” Journal of Financial Education, Vol. 37, Spring/Summer, 43-54.<br />

Faulk, Gregory K., Joseph C. <strong>Smolira</strong>, and Sean Sehyun Yoo, 2010, “Integrating Investment and<br />

Foreign Exchange Returns in a Classroom Portfolio,” Journal of Financial Education, Vol. 36,<br />

Fall/Winter, 84-97.<br />

Ervin, Danny M., Gregory K. Faulk, and Joseph C. <strong>Smolira</strong>, 2009, “The Impact of Asset Allocation,<br />

Savings and Retirement Horizons, Savings Rates, and Social Security Solvency in Retirement<br />

Planning: A Monte Carlo Analysis,” Financial Services Review, Winter, 18, 313-331.<br />

<strong>Smolira</strong>, Joseph C, 2008, “Student Perceptions of Online Homework in Introductory Finance<br />

Courses”, Journal of Education for Business, Vol. 84, No. 2, Nov/Dec. 90-95.<br />

Jordan, Bradford D., Susan D. Jordan, Joseph C. <strong>Smolira</strong>, and Denver H. Travis, 2008, "Do Long<br />

Interest Rates Ever Fall?,” Advances in Financial Planning and Forecasting, Vol. 3, 21-36.

Faulk, Gregory K. and Joseph C. <strong>Smolira</strong>, 2007, "Implementing a Comprehensive Team Project in<br />

an Introductory Finance Class," Journal of Financial Education, Vol. 33, Fall, 74-87.<br />

Ervin, Danny M. and Joseph C. <strong>Smolira</strong>, 2005, “Shortfall Risk, Asset Allocation, and Overfunding a<br />

Retirement Account,” Southern Business and Economic Journal, Vol. 28, No. 1 & 2, 55-73.<br />

Ervin, Danny M., Larry H. Filer, and Joseph C. <strong>Smolira</strong>, 2005, “International Diversification and<br />

Retirement Withdrawals,” Mid-American Journal of Business, Vol. 20, No. 1, 55-62.<br />

Jordan, Bradford D., Randy D. Jorgenson, and Joseph C. <strong>Smolira</strong>, 2003, “The Performance of<br />

Mutual Funds that Close to New Investors,” The Journal of Investment Consulting, Vol. 6 No. 2,<br />

47-57.<br />

Jordan, Bradford D., Dennis T. Officer and Joseph C. <strong>Smolira</strong>, 2001, “Turnover and Taxable<br />

Distributions in Mutual Funds,” The Journal of Investment Consulting, Vol. 2 No. 3, 24-35.<br />

Research Grants<br />

Real Estate Research Institute (RERI), 2006, Proposal: REITS and Diversification in a Retirement<br />

Withdrawal Portfolio, Co-recipient with Danny Ervin.<br />

Investment Management Consultants Association (IMCA), 2002, Proposal: The Performance of<br />

Mutual Funds that Close to New Investors, Co-recipient with Bradford Jordan and Randy<br />

Jorgenson<br />

Working Papers<br />

“REITS and Diversification in a Retirement Withdrawal Portfolio” with Danny Ervin<br />

“What’s the PE on the NYSE?” with Jon Fulkerson, Brad Jordan, and Susan Jordan.<br />

Presentations at Professional Meetings<br />

“Long Real Interest Rates and the Real Term Structure” with Denver Travis, 2012 SFA meeting.<br />

“Integrating Investment and Foreign Exchange Returns in a Classroom Portfolio<br />

Simulation” with Greg Faulk and Seyhun Yoo, 2009 ABE/FEA meeting.<br />

“Saving for and Spending in Retirement: A Monte Carlo Analysis” with Danny Ervin and Greg<br />

Faulk, 2007 SFA meeting, 2009 FMA meeting.<br />

"Do Long Interest Rates Ever Fall?" with Brad Jordan, Susan Jordan, and Denver Travis, 2006<br />

FMA meeting, 2006 SFA meeting.<br />

“REITS and Diversification in a Retirement Withdrawal Portfolio” with Danny Ervin, 2006 FMA<br />

meeting, 2006 SFA meeting.<br />

“International Diversification and Retirement Withdrawals,” with Danny Ervin and Larry Filer,<br />

2004 FMA meeting, 2004 SFA meeting.<br />

“The Performance of Mutual Funds that Close to New Investors,” with Bradford Jordan and<br />

Randy Jorgenson, 2004 IMCA Spring Professional Development Conference.<br />

“Why Mutual Funds Die,” with Danny Ervin and Bradford Jordan, 2002 FMA meeting.<br />

“The Performance of Mutual Funds that Close to New Investors,” with Bradford Jordan and<br />

Randy Jorgenson, 2002 SFA meeting.<br />

“Taxes and Mutual Fund Performance Persistence,” 1999 FMA meeting, 2000 SFA meeting<br />

“Turnover and Distributions in Mutual Funds,” 1999 SFA meeting, 2000 FMA meeting.<br />

“Stock Price Discontinuities and Stock Performance,” with Leonard J. Schneck, 1998 FMA<br />

meeting and the 1997 SFA meeting.<br />

“Individual Investor Sentiment as a Market Predictor,” with Leonard J. Schneck and Larry H. Filer,<br />

1997 SFA meeting.

Textbook Blogs<br />

Responsible for blog maintenance and posts. All blogs accompany the named textbook and are co-<br />

authored with S.A. Ross, R.W. Westerfield, J.F. Jaffe, and B.D. Jordan<br />

Corporate Finance, http://rwjcorporatefinance.blogspot.com, ongoing from 2012-present<br />

Corporate Finance: Core Principles and Applications, http://corecorporatefinance.blogspot.com,<br />

ongoing from 2012-present<br />

Essentials of Corporate Finance, http://essentialsofcorporatefinance.blogspot.com,<br />

ongoing from 2012-present<br />

Textbook Development<br />

Instructor’s Manual, Fundamentals of Corporate Finance, 10th ed., McGraw-<br />

Hill/Irwin (2012), by S.A. Ross, R.W. Westerfield, and B.D. Jordan.<br />

Excel Master for Fundamentals of Corporate Finance, 10 th edition, McGraw-Hill/Irwin (2011),<br />

with Brad Jordan.<br />

Instructor’s Manual, Essentials of Corporate Finance, 7th ed., McGraw-<br />

Hill/Irwin (2011), by S.A. Ross, R.W. Westerfield, and B.D. Jordan.<br />

Excel Master for Essentials of Corporate Finance, 9 th edition, McGraw-Hill/Irwin (2011), with Brad<br />

Jordan.<br />

Student Solutions Manual, Corporate Finance: Core Principles and Applications, 3rd ed., McGraw-<br />

Hill/Irwin (2011), by S.A. Ross, R.W. Westerfield, J.F. Jaffe, and B.D. Jordan.<br />

Excel Master for Essentials of Corporate Finance, 3rd edition, McGraw-Hill/Irwin (2011), with Brad<br />

Jordan.<br />

Student Solutions Manual, Corporate Finance, 9th ed., McGraw-Hill/Irwin (2010), by S.A. Ross,<br />

R.W. Westerfield, and J.F. Jaffe.<br />

Excel Master for Fundamentals of Corporate Finance, 9 th edition, with Brad Jordan.<br />

Instructor’s Manual, Fundamentals of Corporate Finance, with Steve Dolvin, 9th ed., McGraw-<br />

Hill/Irwin (2010), by S.A. Ross, R.W. Westerfield, and B.D. Jordan.<br />

Student Solutions Manual, Corporate Finance: Core Principles and Applications, 2nd ed., McGraw-<br />

Hill/Irwin (2009), by S.A. Ross, R.W. Westerfield, J.F. Jaffe, and B.D. Jordan.<br />

Instructor’s Manual, Fundamentals of Investments, with Thomas W. Miller, 5th ed., McGraw-<br />

Hill/Irwin (2009), by B.D. Jordan and T.W. Miller.<br />

Instructor’s Manual, Essentials of Corporate Finance, with Kent Ragan, 6th ed., McGraw-<br />

Hill/Irwin (2008), by S.A. Ross, R.W. Westerfield, and B.D. Jordan.<br />

Instructor’s Manual, Fundamentals of Corporate Finance, with Kent Ragan, 8th ed., McGraw-<br />

Hill/Irwin (2008), by S.A. Ross, R.W. Westerfield, and B.D. Jordan.<br />

Student Solutions Manual, Corporate Finance, 8th ed., McGraw-Hill/Irwin (2008), by S.A. Ross,<br />

R.W. Westerfield, and J.F. Jaffe.<br />

Instructor’s Manual, Fundamentals of Investments, with Thomas W. Miller, 4th ed., McGraw-<br />

Hill/Irwin (2007), by B.D. Jordan and T.W. Miller.<br />

Student Solutions Manual, Corporate Finance: Core Principles and Applications, 1st ed., McGraw-<br />

Hill/Irwin (2007), by S.A. Ross, R.W. Westerfield, J.F. Jaffe, and B.D. Jordan.<br />

Instructor’s Manual, Essentials of Corporate Finance, with Kent Ragan, 5th ed., McGraw-<br />

Hill/Irwin (2007), by S.A. Ross, R.W. Westerfield, and B.D. Jordan.<br />

Instructor’s Manual, Fundamentals of Corporate Finance, with Cheri Etling, 7th ed., McGraw-<br />

Hill/Irwin (2006), by S.A. Ross, R.W. Westerfield, and B.D. Jordan.<br />

Test Bank, Fundamentals of Investments, 3rd ed., McGraw-Hill/Irwin (2005), by C.J.<br />

Corrado, and B.D. Jordan<br />

Instructor’s Manual, Fundamentals of Investments, with Thomas W. Miller, 3rd ed., McGraw-<br />

Hill/Irwin (2005), by C.J. Corrado, and B.D. Jordan

Instructor’s Manual, Essentials of Corporate Finance, with Cheri Etling, 4th ed., McGraw-<br />

Hill/Irwin (2004), by S.A. Ross, R.W. Westerfield, and B.D. Jordan<br />

Instructor’s Manual, Fundamentals of Corporate Finance, with Cheri Etling, 6th ed., McGraw-<br />

Hill/Irwin (2003), by S.A. Ross, R.W. Westerfield, and B.D. Jordan<br />

Test Bank, Fundamentals of Investments, 2nd ed., McGraw-Hill/Irwin (2002), by C.J.<br />

Corrado, and B.D. Jordan<br />

Instructor’s Manual, Essentials of Corporate Finance, with Cheri Etling, 3rd ed., McGraw-<br />

Hill/Irwin (2001), by S.A. Ross, R.W. Westerfield, and B.D. Jordan<br />

Ad hoc Reviews<br />

Journal of the Academy of Business Education, Journal of Financial Education, Journal of<br />

Economics and Business, American Journal of Business<br />

NASD Arbitration Cases<br />

Edward H. Martin and Joyce V. Martin v. Wachovia Securities, LLC and Allen Minton,<br />

Arbitration number 04-05414, 04/13/2005.<br />

Ralph M. Snyder II v. Morgan Stanley DW Inc. and Richard P. Wilkinson, Arbitration<br />

number 03-04995, 04/28/2004<br />

David L. Hubbs v. Merrill Lynch Pierce Fenner & Smith Inc., Arbitration number 02-06601,<br />

11/04/2003

Other Professional Activities<br />

CFA Society of Nashville Board of Directors, 2004-2006<br />

Financial Risk Manager – Certified by the Global Association of Risk Professionals<br />

1999 SFA Program Committee<br />

Memberships: AFA, FMA, SFA, SWFA, CFA Society of Nashville, GARP<br />

Discussant: FMA (1996, 1999, 2000, 2002, 2006), SFA (1996, 1997, 1999, 2000, 2007)<br />

Session chair: FMA (2002), SFA (1999)<br />

Conducted study seminars for CFA Level I candidates, 2003.