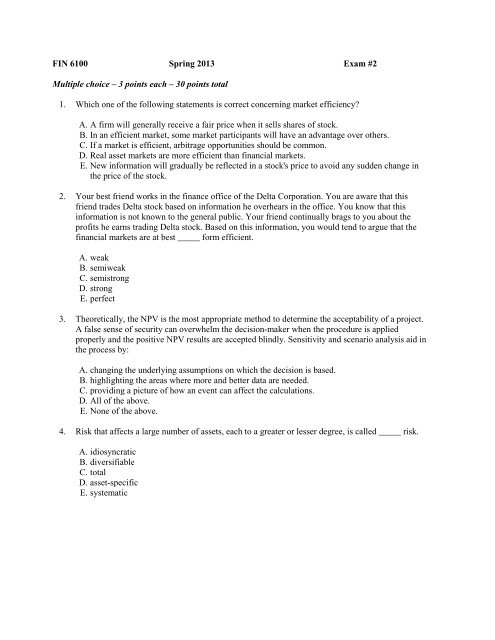

Exam 2A

Exam 2A

Exam 2A

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FIN 6100 Spring 2013 <strong>Exam</strong> #2<br />

Multiple choice – 3 points each – 30 points total<br />

1. Which one of the following statements is correct concerning market efficiency?<br />

A. A firm will generally receive a fair price when it sells shares of stock.<br />

B. In an efficient market, some market participants will have an advantage over others.<br />

C. If a market is efficient, arbitrage opportunities should be common.<br />

D. Real asset markets are more efficient than financial markets.<br />

E. New information will gradually be reflected in a stock's price to avoid any sudden change in<br />

the price of the stock.<br />

2. Your best friend works in the finance office of the Delta Corporation. You are aware that this<br />

friend trades Delta stock based on information he overhears in the office. You know that this<br />

information is not known to the general public. Your friend continually brags to you about the<br />

profits he earns trading Delta stock. Based on this information, you would tend to argue that the<br />

financial markets are at best _____ form efficient.<br />

A. weak<br />

B. semiweak<br />

C. semistrong<br />

D. strong<br />

E. perfect<br />

3. Theoretically, the NPV is the most appropriate method to determine the acceptability of a project.<br />

A false sense of security can overwhelm the decision-maker when the procedure is applied<br />

properly and the positive NPV results are accepted blindly. Sensitivity and scenario analysis aid in<br />

the process by:<br />

A. changing the underlying assumptions on which the decision is based.<br />

B. highlighting the areas where more and better data are needed.<br />

C. providing a picture of how an event can affect the calculations.<br />

D. All of the above.<br />

E. None of the above.<br />

4. Risk that affects a large number of assets, each to a greater or lesser degree, is called _____ risk.<br />

A. idiosyncratic<br />

B. diversifiable<br />

C. total<br />

D. asset-specific<br />

E. systematic

5. Which one of the following statements is correct concerning the expected rate of return on an<br />

individual stock given various states of the economy?<br />

A. The expected return is a geometric average where the probabilities of the economic states are<br />

used as the exponential powers.<br />

B. The expected return is a weighted average where the probabilities of the economic states are<br />

used as the weights.<br />

C. The expected return is an arithmetic average of the individual returns for each state of the<br />

economy.<br />

D. The expected return is equal to the summation of the values computed by dividing the<br />

expected return for each economic state by the probability of the state.<br />

E. As long as the total probabilities of the economic states equal 100%, then the expected return<br />

on the stock is a geometric average of the expected returns for each economic state.<br />

6. Which one of the following is an example of a nondiversifiable risk?<br />

A. A poorly managed firm suddenly goes out of business due to lack of sales.<br />

B. A well-managed firm reduces its work force and automates several jobs.<br />

C. A key employee of a firm suddenly resigns and accepts employment with a key competitor.<br />

D. A well respected president of a firm suddenly resigns.<br />

E. A well respected chairman of the Federal Reserve suddenly resigns.<br />

7. The use of WACC to select investments is acceptable when the:<br />

A. correlation of all new projects are equal.<br />

B. NPV is positive when discounted by the WACC.<br />

C. firm is well diversified and the unsystematic risk is negligible.<br />

D. risk of the projects are equal to the risk of the firm.<br />

E. None of the above.<br />

8. Which one of the following statements is correct concerning the standard deviation of a portfolio?<br />

A. The greater the diversification of a portfolio, the greater the standard deviation of that<br />

portfolio.<br />

B. Standard deviation measures only the systematic risk of a portfolio.<br />

C. The standard deviation of a portfolio can often be lowered by changing the weights of the<br />

securities in the portfolio.<br />

D. Standard deviation is used to determine the amount of risk premium that should apply to a<br />

portfolio.<br />

E. The standard deviation of a portfolio is equal to a weighted average of the standard deviations<br />

of the individual securities held within the portfolio.

9. Including the option to expand in your project analysis will tend to:<br />

A. extend the duration of a project but not affect the project's net present value.<br />

B. increase the net present value of a project.<br />

C. increase the cash flows of a project but decrease the project's net present value.<br />

D. decrease the net present value of a project.<br />

E. have no effect on either a project's cash flows or its net present value.<br />

10. Which of the following are examples of erosion?<br />

I. the loss of sales due to increased competition in the product market<br />

II. the loss of sales because your chief competitor just opened a store across the street from your<br />

store<br />

III. the loss of sales due to a new product which you recently introduced<br />

IV. the loss of sales due to a new product recently introduced by your competitor<br />

A. III only<br />

B. III and IV only<br />

C. I, III and IV only<br />

D. II and IV only<br />

E. I, II, III, and IV<br />

Partial Credit Problems --- SHOW ALL WORK<br />

Problem 1 (8 points) What is the WACC for the following company?<br />

Debt: 150,000 bonds with a par value of $1,000 and a quoted price of 108.35. The bonds<br />

have coupon rate of 6.2 percent and 25 years to maturity.<br />

Common Stock: 2,500,000 shares of stock selling at a market price of $85. The beta for the stock is<br />

1.25. The company just paid an annual dividend of $1.10 and the dividend growth<br />

rate is 3.8 percent.<br />

Market: The market risk premium is 7 percent and the risk-free rate is 2.1 percent. The<br />

company is in the 35 percent tax bracket.<br />

Problem 2 (10 points) RDH, Inc., manufactures high quality ladies boots. The company is considering the<br />

launch of a new boot style. The new boots would well for $345, with variable costs of $153 per pair. Fixed<br />

production costs are $3.75 million per year and the equipment necessary for the new line costs $8.5 million.<br />

The equipment will be depreciated on a 5-year MACRS schedule. The line would require an initial<br />

investment in NWC of 15 percent of sales, the tax rate is 40 percent, and the required return is 9 percent. The<br />

company expects that because of changes in styles, the new design can only be sold for the next four years.<br />

In four years, the equipment can be sold for $2.2 million, although the company believes it will keep the<br />

machinery for another product line. What is the minimum number of boots that the company must sell each<br />

year in order to undertake the new boot?

Problem 3 (10 points) A company has a project under consideration that will produce cash flows of<br />

$850,000 per year for 17 years. The project will cost $4.25 million today to begin production. In one year, it<br />

is possible that the project will be a runaway success. If this is true, the company can spend $1,500,000 at<br />

that time to expand production. After expansion, the annual cash flows would be $1,280,000 per year. There<br />

is a 40 percent likelihood that the company will expand. Assume the project will still end 17 years from<br />

today. What is the value of the option to expand assuming a required return of 13 percent?<br />

Problem 4 (12 points) Oile Motors is considering the production of a new car-trike that gets 84MPG on the<br />

interstate.<br />

The production facility and equipment will cost $195 million and will be depreciated on a 5-year MACRS<br />

schedule. In today’s dollars, the car will sell for $6,800, variable costs per car are $3,400, and fixed costs are<br />

$15 million per year. The sales price, variable costs, and fixed costs will all increase at the inflation rate of<br />

3.2 percent. The company expects to sell 18,000, 30,000, 55,000, 40,000, and 25,000 each year for the next<br />

five years, respectively. The project will require an immediate investment of $17.5 million in NWC, which<br />

will be recovered at the end of the project. The tax rate will be 40 percent and the nominal required return is<br />

14 percent. Ignore any salvage value on the plant and equipment. What is the NPV for the new car?<br />

Problem 5 (5 points) You have been asked to evaluate a new expansion project for your company. Since the<br />

expansion is similar to your company’s current operations you used the company’s WACC. Your analysis<br />

indicates that the NPV of the project is negative and the IRR is less than the company’s WACC. At the end<br />

of your presentation, the president of the company states “We plan to fund the expansion entirely with debt.<br />

Since the expansion is funded with debt, the required return on the project is the YTM of our bonds, which<br />

results in a positive NPV.” How should you respond to this statement?

Problem 6 (25 points)<br />

Grant’s Whiskey<br />

As a lifelong connoisseur of fine whiskey, Granville Grant has decided to explore the possibility of opening a<br />

whiskey distillery in Bellevue, Tennessee. Granville has a tract of land that could be used for the distillery.<br />

He purchased the land 10 years ago for $500,000. The land could currently be sold for $850,000 after taxes.<br />

The Problem: Granville’s bourbon recipe is the traditional 70 percent corn mash, with a proprietary<br />

combination of rye and malted barley. After processing, the resulting fermented mash is aged in charred oak<br />

barrels for three years. This means that whatever bourbon is produced in today will not be available to be<br />

bottled, shipped, and sold for three years, in which case the sales for the current production will occur in<br />

Year 4. The building and equipment necessary for production will cost $14.5 million and must be purchased<br />

immediately. The bottling equipment, which costs $2.8 million, will be purchased three years from today.<br />

The original equipment and bottling equipment will be depreciated on a 20-year MACRS schedule.<br />

A barrel of whiskey contains about 53 fifths. Granville expects that each barrel could be sold for $1,590, with<br />

variable costs equal to $425 per barrel. Variable costs are expensed when the whiskey is manufactured.<br />

Inventory is 30 percent of the sales and must be built up ahead of the sales, taking into account the aging<br />

process. Fixed costs are expected to be $3.6 million per year and begin as soon as production begins, not<br />

when sales begin. The unit sales each year in barrels is projected to be:<br />

Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11<br />

12,000 15,000 19,000 23,000 23,700 24,400 25,200 26,000<br />

Other Issues: Production of the whiskey is expected to continue indefinitely. After Year 7, the total cash<br />

flows of the project are expected to increase at 3.5 percent indefinitely. The tax rate is 42 percent and the cost<br />

of capital for the project is 12 percent. Grant Whiskey has an optimum capital structure of 30 percent debt<br />

and 70 percent equity. The floatation costs are 3 percent for debt and 6 percent for equity. Grant typically<br />

funds all projects with internal equity. Assume that inventory does not require floatation costs.<br />

Analysis: Calculate the NPV, IRR, and profitability index for the new distillery. Can you use each of these in<br />

your analysis? Why or why not?