You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

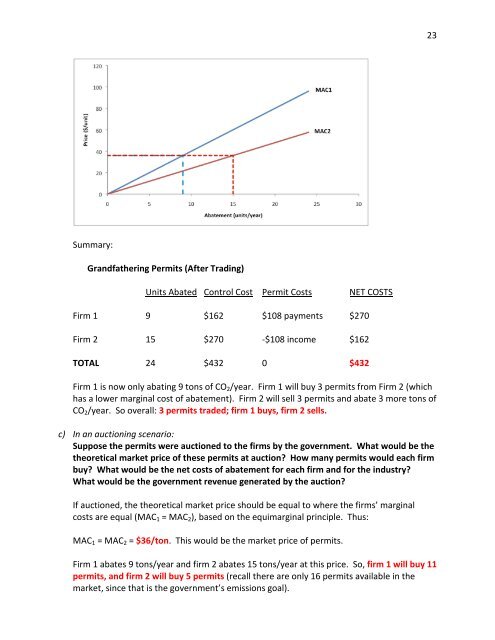

Summary:<br />

Grandfathering Permits (After Trading)<br />

Units Abated Control Cost Permit Costs NET COSTS<br />

Firm 1 9 $162 $108 payments $270<br />

Firm 2 15 $270 -$108 income $162<br />

TOTAL 24 $432 0 $432<br />

Firm 1 is now only abating 9 tons of CO2/year. Firm 1 will buy 3 permits from Firm 2 (which<br />

has a lower marginal cost of abatement). Firm 2 will sell 3 permits and abate 3 more tons of<br />

CO2/year. So overall: 3 permits traded; firm 1 buys, firm 2 sells.<br />

c) In an auctioning scenario:<br />

Suppose the permits were auctioned to the firms by the government. What would be the<br />

theoretical market price of these permits at auction? How many permits would each firm<br />

buy? What would be the net costs of abatement for each firm and for the industry?<br />

What would be the government revenue generated by the auction?<br />

If auctioned, the theoretical market price should be equal to where the firms’ marginal<br />

costs are equal (MAC1 = MAC2), based on the equimarginal principle. Thus:<br />

MAC1 = MAC2 = $36/ton. This would be the market price of permits.<br />

Firm 1 abates 9 tons/year and firm 2 abates 15 tons/year at this price. So, firm 1 will buy 11<br />

permits, and firm 2 will buy 5 permits (recall there are only 16 permits available in the<br />

market, since that is the government’s emissions goal).<br />

23