Christopher Ragan, "Canada's Looming Fiscal Squeeze," November

Christopher Ragan, "Canada's Looming Fiscal Squeeze," November

Christopher Ragan, "Canada's Looming Fiscal Squeeze," November

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Spending programs<br />

can be reduced or<br />

eliminated or taxes<br />

can be increased.<br />

There is nothing else.<br />

28<br />

the scale of changes necessary to fully offset the coming fiscal squeeze could be at once<br />

feasible and politically acceptable.<br />

The inconvenient truth that Canadians and their governments must immediately face<br />

is that the existing demographic forces and the fiscal implications that follow are so<br />

large that governments will need to respond by making fundamental adjustments to<br />

their fiscal frameworks. As is always the case, the simple arithmetic of government<br />

budgets implies that there are only two broad fiscal choices available to address the<br />

looming fiscal squeeze. Spending programs can be reduced or eliminated or taxes can<br />

be increased. There is nothing else.<br />

Difficult <strong>Fiscal</strong> Choices<br />

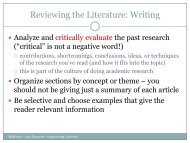

Figure 14 puts Canada’s looming fiscal squeeze in recent historical perspective. For all Canadian governments<br />

combined, the figure shows total revenues and expenditures as a share of GDP since 1992. The data from<br />

1992 through 2010 are the actual historical data. We maintain the ImF’s assumption that the consolidated<br />

government sector achieves a balanced budget by 2016, and for simplicity we assume that this balance is<br />

achieved by making equal changes on the spending and revenue side. 16 From 2016 through 2040, we<br />

assume that tax revenues remain constant as a share of GDP while expenditures increase by 4.2 percentage<br />

points. The result is a path of spending and revenues that would occur if Canadian governments made no<br />

fundamental adjustments to their fiscal policies in response to the fiscal squeeze.<br />

Figure 14<br />

PERCENT OF GDP<br />

CANADA’S FISCAL SquEEzE IN HISToRICAL PERSPECTIvE<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

1992<br />

1994<br />

1996<br />

1998<br />

2000<br />

2002<br />

2004<br />

2006<br />

2008<br />

<strong>Christopher</strong> <strong>Ragan</strong>: Canada’s <strong>Looming</strong> <strong>Fiscal</strong> <strong>Squeeze</strong><br />

2010<br />

Revenues Expenditure<br />

Source: Statistics Canada and author’s calculations. Data exclude CPP/QPP<br />

revenues and expenses<br />

2012<br />

2014<br />

2016<br />

2018<br />

2020<br />

2022<br />

2024<br />

2026<br />

2028<br />

2030<br />

2032<br />

2034<br />

2036<br />

2038<br />

2040<br />

16 If overall budget balance is not achieved by 2016, or is achieved with a different split between spending and revenue changes, the<br />

beginning of the “triangle” in Figure 12 will occur at a different year and/or different percentage of GDP. This would change the details but<br />

not the essence of the central message regarding the magnitude of the fiscal squeeze in historical context.