'F# SUPREME PETROCHEM LTD - Moneycontrol.com

'F# SUPREME PETROCHEM LTD - Moneycontrol.com

'F# SUPREME PETROCHEM LTD - Moneycontrol.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

I<br />

1 <strong>'F#</strong><br />

i . January<br />

<strong>SUPREME</strong> <strong>PETROCHEM</strong> <strong>LTD</strong><br />

ple<br />

& »PL 1)<br />

Ref: CF/VCS/86/AGM_3/2012-2013<br />

Corporate Office :<br />

Solltalro Corporato Park, Building No. 11, 5th Floor, 167, Gunl Hargovindji Marg,<br />

Andhorl-Ghatkopor Link Road, Chakala, Andherl (E), Mumbal-400 093. INDIA<br />

I ; 91·224709 1900 • Website WWW.supremepetrochem.<strong>com</strong><br />

21, 2013 I<br />

National Stock Exchange of India Ltd.<br />

Exchange Plaza,<br />

Bandra Kurla Complex,<br />

Bandra (E),<br />

MUMBAI - 400 051 1<br />

Dear Sir,<br />

In accordance with the provisions of Clause 41 of the Listing Agreement, we enclose<br />

Limited Review Report of the Auditors for the quarter ended<br />

December 31, 2012 alongwlth copy of the result.<br />

The results were taken on record by the Board of Directors of the Company at its<br />

meeting held on Monday, January 21, 2013 at Solltalre Corporate Park, Building No. 11,<br />

5th Floor, Andherl-Ghatkopar Link Road, Chakala, Andheri (East), Mumbai - 400 093.<br />

ThankIng you<br />

Yours falthfully,<br />

for <strong>SUPREME</strong> PETRO HEM <strong>LTD</strong><br />

'&6*'Rt-<br />

RAVI V KUDDYAD'ru<br />

DY. COMPANY SECRETARY<br />

Ul r m/lhlrid/AdM-S,cloa<br />

.....<br />

--2 , v *yl Ragd Oflice. 812 Ral:010 Chombom Narlmon Point Mur bal „ 400 021<br />

,<br />

Fow·Morketing 6709 1926 • FOM /tout, & Docremriol 41005 5681 Export 0/09 1924 1.9tE 4,<br />

38,r- Fox.CMS 67001928 COMM 40056682 HRI) ADMIN 400551}85<br />

mat;::J;lt»189,'tl- 9:Ajol ,2],t'„,2D ,1'F., ita EM abbd #77h ;A,;51<br />

T.d JeRJes *93:01 T895 500t 22 T6 17 W3HDO&13d 3W32dnS:WOJJ 20:LT £T02-Ner-T2<br />

I<br />

1<br />

1

PaRI<br />

1 1,toomil,om Op•,111*M<br />

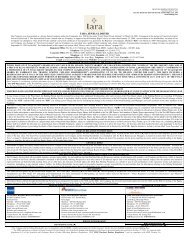

<strong>SUPREME</strong> <strong>PETROCHEM</strong> <strong>LTD</strong><br />

Unaudlted Financial Results fortho Quarter/ Balf Year Enced Do<strong>com</strong>ber 31, 2012<br />

PaMIotli r<br />

(Fl.for Noto• 0•low)<br />

fl' 4<br />

Ch<br />

& SPL ,)<br />

N IM Ies '*000 FT •haM da'<br />

d Monthi Krocealng 4 Corre.pgr,dIng Y,Ir*, dis= Y-r b *p Apomindng<br />

Inele erl Months inded 3 Monthl flgurei Igr till lIguM Iorthe r indld on<br />

31"'-2 -"-201' 5 3;S gu n od ' 362 """12 1<br />

Uniudlled Unalalted Unlualloct Unaudlt,d UniudltN Audlt.d<br />

fil Net 8,180/Introma from dix,mtion,(Net of exc1114 duly} 78855.72 81375.01 49148.28 140230 73 103225.le 224925.20<br />

(b) 011,11, 01// Ing Ineomo Blpt70 478.00 828.05 1318.50 10]ag.Ag 2341.90<br />

Total In<strong>com</strong>o fro,noper tle,Ii (1,•11 79"90.41 81803.81 49877,11 14104913 104314./8 22728117<br />

R EXPON'.<br />

(It) Coutor mw malarl ls coniumM 00062 27 G5512.60 30003.02 88874.87 .._B)179.75 139028.38<br />

bl PurchaRe 01 stoebln-11040<br />

r-'<br />

19803.50 20269,29 14991.37 40132.85 30182.96 80230.27<br />

(c) Chot,Ve, 1, Inymitelio# bl BilihBd goodo,twl*·Difmgmil And slock.In·trad[ 11,281.84) 287.88) 1,108.80 (1,549.BO). 1,291.28 2078.24<br />

(dl mployeo bol,8111• expenig 701.87 800,80 848,10 12903 .24 2100,10<br />

fol Depmolallon Ind emortl#,11181, 8*P -<br />

70097 678,38 022,64 1370.30 1043,63 2292.34<br />

4984.71 8479.03 8471.13 13325.09<br />

3814.32._ _ 2929.74<br />

M Qth#r *Ime.<br />

Ta.1 eipns,I 76011,74 00292,70 60154.ST 138304.dS 101888,N 210138.8*<br />

3 proilt/(Le..1 from Operittons boforo ether In<strong>com</strong>e,fln•I,c• eDit ind<br />

e,Coptlonal ti.mi (1,2)<br />

4 Othor In<strong>com</strong>e<br />

8 Pmfltl(Loss) trum ottll,lify ictlvltle, bolo,8 nninoi oost and exceptlonal<br />

Itimm (2*4) 810.02<br />

4883,88 1/1.02 (477.26) ou44.70 2424.79 7328.23<br />

128,34 84.38 147,08 210,72 229.Be 848.76<br />

/648.40 (339,21) 840"AI 2604.08 7970.9,<br />

8 FIrtuncO coilm Ind. Fore* loss on Foreign Guir'ilicy liolrowl,IMI) 789.40.-043(111_78010 -1439·91 1426.48 3199,28<br />

4 Proflti(les•) from ofdl,laty .cdvitlos Iflir Ii,•tic• co ts Dux D•mrs<br />

01[ceptlonall m• (84)<br />

* 8 Ejoaptional' temi<br />

9 pron,1(Lo:Is} fl, m arell,i ly activiti,0 bebi k, 17*81 4080.62 984.89<br />

4080.82 904.89 (1,099.41] -8010 M 122/.21 4777.71<br />

0,099,41)<br />

....<br />

8018.81 ing.22 4777,71<br />

10 4% expertli 1270.11 324.88 073,793 _ 1504,77 366.21 1440.25<br />

11 NIt Ploflt/ Less) tem ottllnary idlvitlillittor Tnli (9,10) 2700,81 640-23 (726.62) 3420.74 880.01 3 7,48<br />

12 Extlialtj n ly Item (not d imx IxpeM 0 I NII)<br />

Pllor P•dod A®ist,t,•nis (Nvt)<br />

8119111(0*Memm) Pruv 111011 01 tal„B for H111*r illari<br />

74,11<br />

0.14 0.22 D.09<br />

13 Not Pront/(Lo,*1 for Uwl perlod (11.121 9700 AO 840.23 (7= MI-:Mu,W ao'.r" #137,47<br />

14 P«111} iquity 111- coplit (face v lue : 1019 9088,08 0083.06 9083.86 9883.80 9683.80 983831.88<br />

10 808-• excudIng mvaluallen reserveo<br />

18 (11 EI Inos Pei Bllari 1 efor,1 littrierdll,ary 11-mil (of Iloi. i:-dh) (not<br />

annuills*)<br />

b..10<br />

DIluted<br />

2.87 0,138 {10.70)<br />

Cash %PS befoR extrnerdlnaly Itemo a BO 136 (0211-<br />

le {111 eirnings Pir Bhare (alt,Ir **t,Rordln,0 Itlml} (el flm, leah) (not<br />

annu811,41<br />

011810<br />

blluted<br />

Cish EPS amr Blttrsodhety Nomi<br />

--<br />

74.11<br />

191.00<br />

21148.30<br />

--.<br />

3,53 0.89 3.48<br />

2,BY 080 (0.78) 3,03 0.09 3.45<br />

4,98<br />

----- ------«irrT ·ri--•·<br />

1.97 5.81<br />

270 O.06 (0,75) 3.40 0.89 3,24<br />

2.79 0,66 (0,70) _<br />

3.40 0.00 3.24<br />

362 136 ---3,71 ) 4.08 1.97 5.01<br />

2'd 3@AJ@R X94:01 TOOC PRAL 33 TI 1 7 1171 lin\117 I 7, iMN ..A.„- ,<br />

i

L<br />

A<br />

part 11<br />

A Partlculars of Shireholding<br />

1 PUMia-Shamholding<br />

No, of ehare,<br />

<strong>SUPREME</strong> <strong>PETROCHEM</strong> <strong>LTD</strong><br />

Unaudited Financial Results for the Quarter/ Half Year Ended December 31, 2012<br />

% of mhareholdIAL-<br />

441<br />

& 'P, 1)<br />

14,<br />

3 Months Preceding 3 Cormsounding Year to date Year to d.ta Accounting<br />

onded on Months ended 3 Months flgurel for the figures for thi Yesr Indid<br />

Pattlaulara 31/1212012 on 30/09/2012 ended In the corrint period previous porlod on 30/08/2012<br />

Previous Year ended on ended on<br />

(Rwfir Notea Below) Unaudlted Unaudlted Unaudlted<br />

2 ' ' Promoten and Promotor Group Shareholdlng<br />

9 Pledged/Encumbered<br />

-.<br />

No, Of Shoren<br />

96 of shares (ae e % el the total eharoholding of<br />

Promoter und Promoter Group)<br />

% Of shires (le a % of the total sham Capital of<br />

the Company)<br />

b Non.encumbered<br />

No ofshmme<br />

% of,haroo (mi I % of the totml mhareholdlng of<br />

Promotor md Promotor Group)<br />

% of shares (98 a % of the totel share capital of<br />

__0031/1 011 31/121201L_31/lwoti<br />

Unaudlted Un0udlted Audited<br />

38126613 38126813 38128813 38128613 38120013 38126613<br />

39.37% 3-937% 39.37% 39.3796 39.37% 39.37%<br />

58712000 68712000 68712000 58712000 58712000 88712000<br />

100% 100% 100% 100% 100% 100%<br />

ha ompeny) 6063% 60.63% 60.63% 60 63% 80.03% 60.83%<br />

8 INVESTOR COMPLAINTS<br />

311Ionthl<br />

Partlcularo ended on<br />

-31/12/2012<br />

Pending at the beginning of the Quirter 0<br />

Recelvad duting lili qualter<br />

Olsposed off during the Qugrter 21<br />

Rmmaining unrosolved mt the Ind of the quarter 0<br />

c. a #- A,<br />

CA Y-Ya<br />

tti M' 1<br />

.# 0<br />

3<br />

i<br />

1<br />

t<br />

21<br />

11<br />

-<br />

I-- l1<br />

2.d 3@AJ@S X93:01 I89S S00h 22 I6 17 W3HD0M13d 3W3MdnS:W0 J3 20:1I £I02-N8f-I2

1<br />

1 c)<br />

NOTES:<br />

1 STATEMENT OF ASSETS & LIABLITIES<br />

A EQUITY ANO LIABILITIES<br />

1 Shamholders'Funds<br />

8 Spre Capltal<br />

W Resem.1 & Sum us<br />

0 Honey received agplnst shate warrants<br />

Perticulars<br />

'')<br />

& SPL 1)<br />

Ve<br />

M I.CS)<br />

unaudlted- Audited<br />

H.lf Ylar Year<br />

Ended Ended<br />

31/12/2012 30/06/2012<br />

I d:lglldd I:T;< lar;!<br />

24492.98 IBI:1<br />

SGb·tainharcho gers' Funcs 34176,84-30830,24<br />

2 Non·current 1.lablltles<br />

-_taj_Long.term Borrow rios<br />

[b) D-dferred Tex 1,»IlltlemINe _<br />

(el other long·term Liablli ies<br />

._(d) Lona-term Provls ons<br />

6989.04 9408.57<br />

4573,87 Il£#751811<br />

Y09.87 98,87<br />

--Ta4.86 163.51<br />

su64661-- Th:current .labl top 11857,64 --14086.54<br />

3 Current Llabll ties<br />

[a) Shol:term Barrov,1.10,1<br />

(b) Trace payab es 62696.83 50772.48<br />

10 Other Current L ab ties<br />

(d) SH ort-term Provisions<br />

1081.20<br />

=<br />

- Current Clabllitles 70465.37 I-yf%-311<br />

8 ASSETS<br />

1 Non-currents Asseta<br />

6887.34 I....frin-rii<br />

TOTAL- EqUITY*FO71*bILl¥189 116499.85 104842.13<br />

M Fixed Assets 3986# 58 40038.16<br />

995,56<br />

b) Lona·term -oans & Advancen<br />

1151,66<br />

Other Non-current Assets miNT,1 610.71<br />

subbotelrNon·cur,ent Assets 41393.74 3160535<br />

2 Current Assets<br />

.al Current nvestment,<br />

b) Inventor es<br />

31512,60 IIIIEGMIL W<br />

30991/9 24328.92<br />

el Tmde Rece vables<br />

m cash & ci,si-Equ vBle ts -<br />

4161,19<br />

e) Sfort·term Loans & Advances 8099.68 8325,46<br />

4 Otler Current Assets 341.35 344.64<br />

SUbkeaF;-Current A ts 75106.11 63041.60<br />

'1= S<br />

lif,<br />

CW MU 6-*31<br />

"r- 3-49<br />

E. 9<br />

116499.85 10£1F,i3<br />

A.d 3@AJ@S X93:01 I89S S00h 22 I6 17 W3HD0M13d 3W3MdnS:W0 J3 20:1I £I02-N8f-I2<br />

-

44<br />

(l „, 1)<br />

.b<br />

2 The trend of Increasing Styrene Monomer (Raw Materlal) prices during the half year under review although resulting In better Mles revenue<br />

haS allo put tho Domqstic Polystyrene (PS) market growth under prepure leadIng to flat PS demand as <strong>com</strong>pared to the corresponding six<br />

months In the previous year,<br />

3 The second phase of debottlenecklng of the Polystyrene (PS) plant to Increase the proportion of value added PS grades by another10,000 TPA<br />

(40,000 TPA Increase achieved In the first phase In August, 2012) has for the time being been deferred.<br />

4 Styrenks 19 the primary business segment of the Company. The socondaly segment (Geographical) IS as under:<br />

(P lacs)<br />

3 Months Preceding 3 Corrosponding Year to date Year to datD Accounting<br />

erded on Months ended 3 Months flgural for thl flgurll for the Year ended On<br />

Partlculam 31/12/2012 on 30/00/2012 endid In the currerit period DIvIous 30/06/2012<br />

Previous Year inded on period ended<br />

on 31/1212011 11/12/2012 on 31/12/2011<br />

Unaudited Unaualtod Uoludltud Unaudltod Uniudned Audltid<br />

(a) Net Slles/InGome from Operations :<br />

Within India 57020.74 52110,51 37636,63 109131.25 80393,16 180906.19<br />

Outside India 22674.68 9743.30 12040.48 32417.98 23921.52 46281.03<br />

79695.42 61853.81 49677,11 141549,23 104314.68 227267.22<br />

(b) All the Assets of the <strong>com</strong>pany are within India 6012,41 2777,79 3037,49 6012,41 3037,49 3727,44<br />

except these Debtors<br />

5 Tax expended Inelude Cuttent taxand defetted tax .<br />

6 Figures of the previous year/period/quarter are regrouped where necessory,<br />

7 The Audit Committee has reviewed the above regults, whkh have been subjected to a Limited Review by the Statutory Auditorj.<br />

8 This statement was taken on record by the Board of Directors at the meeting held on January 21, 2013.<br />

Place: Mumbal<br />

Date: j.nuiry 21, 2013<br />

40Ih .<br />

/F'/A 33,1<br />

01(9101,13)<br />

Ploose visit us at httpt//www.supremepetroChem.<strong>com</strong><br />

For <strong>SUPREME</strong> <strong>PETROCHEM</strong> <strong>LTD</strong><br />

N.1 .121' 'L<br />

CHAIRMAN<br />

g.d 3@AJ@S X93:01 I89S S00h 22 I6 17 W3HD0M13d 3W3MdnS:W0 J3 £0:1I £I02-N8f-I2<br />

I

m<br />

)<br />

11<br />

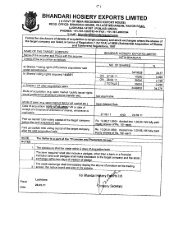

PARIKH & SHAH (REGD·)<br />

f 2363 02 69<br />

Phonos . < 2363 23 74<br />

CHARTERED ACCOUNTANTS l 2361 8373<br />

H. S. PARKH, B.Com,,F.C,A.<br />

Fax : 91-22-2361 84 72<br />

E-mail . parlkhnshall@gmail.Com<br />

Bhupati Chambers, 1 st Floor,<br />

0.8, MOHINI, B,Com.,F.C.A. 13, Mathew Fload,<br />

V. M. PARIKH, B.Com,F.C.A. Opera House,<br />

H. K. DESAI, 8.Com.,F.C.A. MUMBAI . 400 004.<br />

To,<br />

The Board of Directors,<br />

Supreme Petroohem Ltd,<br />

MUMBAI - 400 021<br />

We have reviewed the ac<strong>com</strong>panying statement of unaudlted financial results of Supreme<br />

Petrochem Ltd for the period ended December 31, 2012 except for the disclosures<br />

regarding 'Public Shareholding' and 'Promoter and Promoter Group Shareholding' which<br />

have been traced from disclosures made by the Management and have not been audited<br />

by us, This statement is the responsibility of the Company's Management and has been<br />

dipproved by the Board of Directors. Our responsibility is to issue a report on these<br />

fin ncial statements based on our review.<br />

We conducted our review in accordance with the Standard on Review Engagement (SRE)<br />

2400, Engagements to Rev/ew Financial Statements issued by the Institute of Charlered<br />

Accountants of India. This standard requires that we plan and perform the review to<br />

obtain moderate assurance as to whether the financial statements are free of material<br />

misstatement. A review is limited primarily to inquiries of Company personnel and<br />

analytical procedures applied to financial data and thus provides less assurance than an<br />

audit. We have not performed aM audit and accordingly, we do not express an audit<br />

opinion.<br />

Based on our review conducted am above, nothing has <strong>com</strong>e to our attention that causes<br />

us to believe that the ac<strong>com</strong>panying statement of unaudited financial results prepared in<br />

accordance with applicable accounting standards and other recognised accounting<br />

practices and policies has not disclosed the information required to be disclosed In terms<br />

of clause 41 of the Listing Agreement Including the manner in which it is to be disclosed or<br />

thal it contains any material misstatement.<br />

Date January 21, 2013<br />

Place: Mumbai<br />

e (V.<br />

For PARIKH & SHAH<br />

CHARTERED ACCOUNTANTS<br />

Firm Registration No.107528W<br />

M. PARIKH)<br />

PARTNER<br />

MEMBERSHIP NO. 7878<br />

I n A I jp y 10 1 • n I Toor rmak. 33 TC 1 3 1.131-17n>11 ),A 21.,1»1.413g : Wo J -4 .C'13 :) T ZIB2-Nt3/- I2<br />

/