Evolving Criteria - Reinsurance Thought Leadership | Aon Benfield

Evolving Criteria - Reinsurance Thought Leadership | Aon Benfield

Evolving Criteria - Reinsurance Thought Leadership | Aon Benfield

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Evolving</strong> <strong>Criteria</strong><br />

Profitability Trends<br />

Rating agencies have become increasingly focused on<br />

companies’ ability to underwrite profitably. P&C insurers<br />

are facing several impediments to earnings, including an<br />

extended soft market cycle, weak economic conditions,<br />

inadequate rates due to government restrictions, and<br />

catastrophe frequency losses.<br />

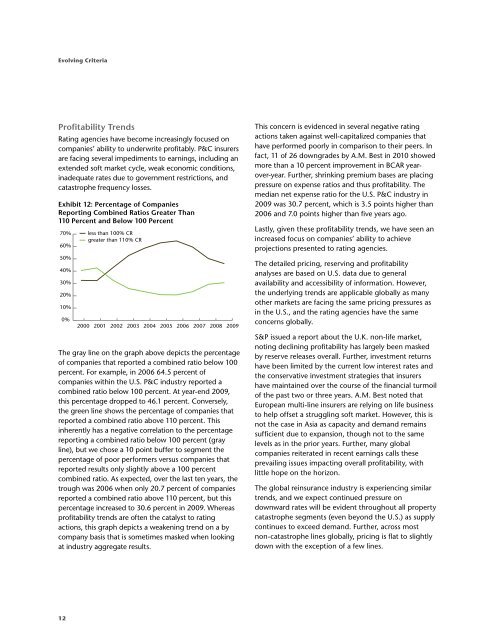

Exhibit 12: Percentage of Companies<br />

Reporting Combined Ratios Greater Than<br />

110 Percent and Below 100 Percent<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

12<br />

less than 100% CR<br />

greater than 110% CR<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009<br />

The gray line on the graph above depicts the percentage<br />

of companies that reported a combined ratio below 100<br />

percent. For example, in 2006 64.5 percent of<br />

companies within the U.S. P&C industry reported a<br />

combined ratio below 100 percent. At year-end 2009,<br />

this percentage dropped to 46.1 percent. Conversely,<br />

the green line shows the percentage of companies that<br />

reported a combined ratio above 110 percent. This<br />

inherently has a negative correlation to the percentage<br />

reporting a combined ratio below 100 percent (gray<br />

line), but we chose a 10 point buffer to segment the<br />

percentage of poor performers versus companies that<br />

reported results only slightly above a 100 percent<br />

combined ratio. As expected, over the last ten years, the<br />

trough was 2006 when only 20.7 percent of companies<br />

reported a combined ratio above 110 percent, but this<br />

percentage increased to 30.6 percent in 2009. Whereas<br />

profitability trends are often the catalyst to rating<br />

actions, this graph depicts a weakening trend on a by<br />

company basis that is sometimes masked when looking<br />

at industry aggregate results.<br />

This concern is evidenced in several negative rating<br />

actions taken against well-capitalized companies that<br />

have performed poorly in comparison to their peers. In<br />

fact, 11 of 26 downgrades by A.M. Best in 2010 showed<br />

more than a 10 percent improvement in BCAR yearover-year.<br />

Further, shrinking premium bases are placing<br />

pressure on expense ratios and thus profitability. The<br />

median net expense ratio for the U.S. P&C industry in<br />

2009 was 30.7 percent, which is 3.5 points higher than<br />

2006 and 7.0 points higher than five years ago.<br />

Lastly, given these profitability trends, we have seen an<br />

increased focus on companies’ ability to achieve<br />

projections presented to rating agencies.<br />

The detailed pricing, reserving and profitability<br />

analyses are based on U.S. data due to general<br />

availability and accessibility of information. However,<br />

the underlying trends are applicable globally as many<br />

other markets are facing the same pricing pressures as<br />

in the U.S., and the rating agencies have the same<br />

concerns globally.<br />

S&P issued a report about the U.K. non-life market,<br />

noting declining profitability has largely been masked<br />

by reserve releases overall. Further, investment returns<br />

have been limited by the current low interest rates and<br />

the conservative investment strategies that insurers<br />

have maintained over the course of the financial turmoil<br />

of the past two or three years. A.M. Best noted that<br />

European multi-line insurers are relying on life business<br />

to help offset a struggling soft market. However, this is<br />

not the case in Asia as capacity and demand remains<br />

sufficient due to expansion, though not to the same<br />

levels as in the prior years. Further, many global<br />

companies reiterated in recent earnings calls these<br />

prevailing issues impacting overall profitability, with<br />

little hope on the horizon.<br />

The global reinsurance industry is experiencing similar<br />

trends, and we expect continued pressure on<br />

downward rates will be evident throughout all property<br />

catastrophe segments (even beyond the U.S.) as supply<br />

continues to exceed demand. Further, across most<br />

non-catastrophe lines globally, pricing is flat to slightly<br />

down with the exception of a few lines.