Annual Report 2009 - melitta.info

Annual Report 2009 - melitta.info

Annual Report 2009 - melitta.info

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

56 Melitta Group <strong>Annual</strong> <strong>Report</strong> <strong>2009</strong> Consolidated Balance Sheet<br />

57<br />

with, individual asset items – and amortized over an expected useful life of no more than<br />

15 years. This consolidation method is also used for investments in associated<br />

companies.<br />

Investments in associated companies are consolidated using the book value method.<br />

Inter-group trading profits from transactions with associated companies were not<br />

eliminated.<br />

Debt was consolidated according to Sec. 303 (1) HGB, while income and expenditure<br />

were consolidated pursuant to Sec. 305 (1) HGB and unrealized results eliminated in<br />

accordance with Sec. 304 (1) HGB.<br />

Uniform valuation of assets throughout the Group is guaranteed by the application of<br />

corporate guidelines, valid for all members of the Melitta Group. These corporate guidelines<br />

correspond to commercial law regulations.<br />

The annual statements of foreign Group companies were translated as of December 31,<br />

<strong>2009</strong> using the current rate method, while positions of the profit and loss accounts were<br />

translated using average annual exchange rates of <strong>2009</strong>.<br />

Intangible assets are valued at cost, while property, plant and equipment is valued at<br />

acquisition or production cost; they are written down using the straight-line or diminishing<br />

balance method. In addition to direct costs, production costs also include a proportionate<br />

amount of overhead costs and depreciation. Financial assets are valued at the<br />

lower of cost and fair value.<br />

Inventories are valued at acquisition or production cost. Raw materials, supplies and<br />

merchandise are valued at the lower of average purchase prices and current values.<br />

Unfinished and finished goods are valued at production cost, which also includes a reasonable<br />

amount of necessary overhead cost and depreciation. Production costs are lowered<br />

accordingly, should this be necessary to avoid valuation losses. Suitable allowances<br />

are made to cover inventory risk.<br />

Advanced payments, accounts receivable and other assets are carried at their nominal<br />

values or the lower buying rate for foreign currencies and the lower rate in the case of<br />

recognizable risks. Lump-sum allowances have been made to cover general credit risks.<br />

Accruals for pensions are made on the basis of actuarial calculations in Germany and in<br />

accordance with tax regulations. A total of € 664k (prior year: € 753k) for pension commitments<br />

made before January 1, 1987 (Art. 28 EGHGB) is not considered in the balance<br />

sheet.<br />

Other accruals cover all recognizable risks and uncertain commitments.<br />

Liabilities are carried at their current repayment values.<br />

In all other cases, foreign currency receivables and payables or assets acquired in foreign<br />

currencies and the resulting income and expenses are always translated at the exchange<br />

rates valid on the date of acquisition or incurred, or at average monthly rates.<br />

The Melitta Group has issued internal binding guidelines regulating responsibilities,<br />

scope and control with regard to the use of derivative financial instruments.<br />

Derivative financial instruments are used by the Melitta Group to secure its operating<br />

business and the related risks. The instruments used are marketable options, foreign<br />

exchange futures and swaps.<br />

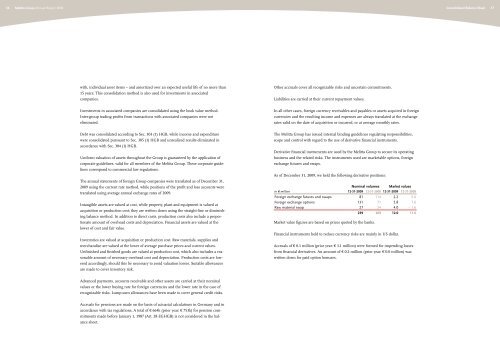

As of December 31, <strong>2009</strong>, we held the following derivative positions:<br />

Nominal volumes Market values<br />

in € million 12-31-<strong>2009</strong> 12-31-2008 12-31-<strong>2009</strong> 12-31-2008<br />

Foreign exchange futures and swaps 81 114 2.2 5.6<br />

Foreign exchange options 131 71 5.8 7.6<br />

Raw material swap 27 24 4.0 – 1.6<br />

239 209 12.0 11.6<br />

Market value figures are based on prices quoted by the banks.<br />

Financial instruments held to reduce currency risks are mainly in US dollar.<br />

Accruals of € 0.1 million (prior year: € 3.1 million) were formed for impending losses<br />

from financial derivatives. An amount of € 0.2 million (prior year: € 0.0 million) was<br />

written down for paid option bonuses.