Answer Key - Mypage

Answer Key - Mypage

Answer Key - Mypage

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

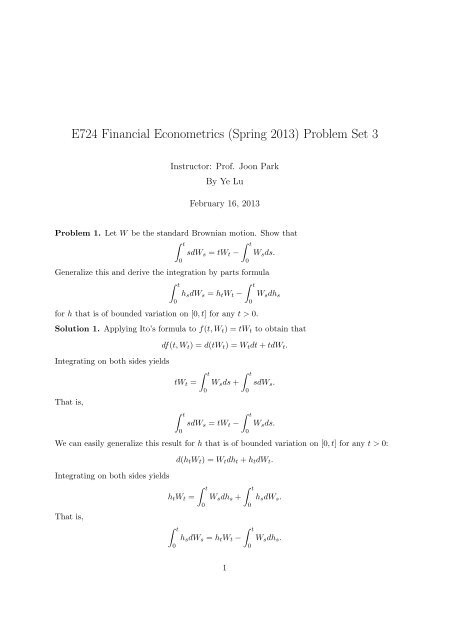

E724 Financial Econometrics (Spring 2013) Problem Set 3<br />

Instructor: Prof. Joon Park<br />

By Ye Lu<br />

February 16, 2013<br />

Problem 1. Let W be the standard Brownian motion. Show that<br />

t<br />

t<br />

sdWs = tWt − Wsds.<br />

Generalize this and derive the integration by parts formula<br />

t<br />

t<br />

hsdWs = htWt − Wsdhs<br />

for h that is of bounded variation on [0, t] for any t > 0.<br />

0<br />

0<br />

Solution 1. Applying Ito’s formula to f(t, Wt) = tWt to obtain that<br />

Integrating on both sides yields<br />

That is,<br />

df(t, Wt) = d(tWt) = Wtdt + tdWt.<br />

t t<br />

tWt = Wsds + sdWs.<br />

0<br />

t<br />

t<br />

sdWs = tWt − Wsds.<br />

0<br />

We can easily generalize this result for h that is of bounded variation on [0, t] for any t > 0:<br />

d(htWt) = Wtdht + htdWt.<br />

Integrating on both sides yields<br />

t t<br />

htWt = Wsdhs + hsdWs.<br />

That is,<br />

0<br />

t<br />

t<br />

hsdWs = htWt − Wsdhs.<br />

0<br />

1<br />

0<br />

0<br />

0<br />

0<br />

0<br />

0

2<br />

Problem 2. Let W be the standard Brownian motion, and suppose h : [0, ∞) → R is continuous.<br />

Show that<br />

t<br />

t<br />

hsdWs ∼ N 0, h 2 <br />

sds .<br />

Generalize this and obtain the joint distribution of<br />

t t <br />

hsdWs, ksdWs<br />

0<br />

0<br />

where k : [0, ∞) → R is another continuous function. Use this result to find the joint distribution<br />

of<br />

t <br />

Wt, sdWs .<br />

Note that Wt = t<br />

0 dWs.<br />

Solution 2. (i) Firstly we show that<br />

t<br />

t<br />

hsdWs ∼ N 0,<br />

0<br />

0<br />

0<br />

0<br />

0<br />

h 2 <br />

sds .<br />

Let Pt = t<br />

0 hsdWs, it suffices to show the moment generating function of Pt has the<br />

following form:<br />

E(e uPt <br />

) = E exp(u<br />

t<br />

0<br />

<br />

hsdWs)<br />

<br />

= exp µu + 1<br />

2 σ2u 2<br />

<br />

<br />

1<br />

= exp<br />

2 u2<br />

t<br />

0<br />

h 2 <br />

sds ,<br />

which is equivalent to showing that<br />

t<br />

E exp(u hsdWs −<br />

0<br />

1<br />

2 u2<br />

t<br />

h<br />

0<br />

2 <br />

sds) = 1. (1)<br />

<br />

Denote Xt = exp u t<br />

0 hsdWs − 1<br />

2u2 t<br />

0 h2 <br />

sds and note that it is a martingale. Hence<br />

<br />

E(Xt) = E(X0) = E exp u<br />

which gives us equation (1) as desired.<br />

0<br />

0<br />

hsdWs − 1<br />

2 u2<br />

Below we show that X = (Xt) is a martingale process. Notice that<br />

t<br />

Xt = exp u hsdWs − 1<br />

2 u2<br />

t<br />

h 2 <br />

sds<br />

0<br />

0<br />

0<br />

0<br />

h 2 <br />

sds = E(e 0 ) = 1,

E724 Financial Econometrics (Spring 2013) Problem Set 3 3<br />

with X0 = 1 is a generalized geometric Brownian motion which is the solution to the<br />

stochastic differential equation<br />

dXt = uhtXtdWt. (2)<br />

To see this, we apply Ito formula and then plug in (2) to obtain<br />

d ln Xt = dXt<br />

Xt<br />

Integrating on both sides of (3) yields<br />

and thus<br />

With X0 = 1,<br />

From (2) we can see that<br />

t<br />

ln Xt − ln X0 = u<br />

<br />

Xt = X0 exp u<br />

<br />

Xt = exp u<br />

− 1 d[X]t<br />

2 X2 t<br />

= uhtdWt − 1<br />

2 u2 h 2 t dt (3)<br />

t<br />

t<br />

0<br />

0<br />

0<br />

Xt = X0 +<br />

hsdWs − 1<br />

2 u2<br />

hsdWs − 1<br />

2 u2<br />

hsdWs − 1<br />

2 u2<br />

t<br />

t<br />

h 2 sds,<br />

t<br />

0<br />

t<br />

uhsXsdWs<br />

0<br />

0<br />

0<br />

h 2 <br />

sds .<br />

h 2 <br />

sds .<br />

where the RHS of (4) is a constant plus an Ito integral, which turns out to be a martingale.<br />

This shows that (Xt) is a martingale.<br />

Given Pt follows normal distribution, then by computing its mean and variance:<br />

we have<br />

t <br />

E(Pt) = E hsdWs = 0<br />

0<br />

Var(Pt) = E (Pt) 2 t<br />

= E ([P ]t) = h 2 sds,<br />

t<br />

Pt =<br />

0<br />

<br />

hsdWs ∼ N 0,<br />

t<br />

0<br />

0<br />

h 2 <br />

sds .<br />

(4)

4<br />

(ii) Another way to show<br />

t<br />

Pt =<br />

0<br />

<br />

hsdWs ∼ N 0,<br />

t<br />

0<br />

h 2 <br />

sds .<br />

is given as follows. Let Pnt = n hti−1 (Wti i=1 − Wti−1 ). By definition of Ito integral,<br />

This implies<br />

Pnt →p Pt as πn → 0.<br />

Pnt →d Pt as πn → 0. (5)<br />

By the properties of Brownian motion, we know that<br />

<br />

n<br />

Pnt ∼ N 0, h 2 ti−1 (ti<br />

<br />

− ti−1)<br />

i=1<br />

Then the moment generating function of Pnt is given by<br />

Mn(u) = E e uPnt<br />

<br />

1<br />

= exp<br />

2 u2<br />

n<br />

h<br />

i=1<br />

2 ti−1 (ti<br />

<br />

− ti−1)<br />

<br />

1<br />

→ exp<br />

2 u2<br />

t<br />

h 2 <br />

sds ≡ M(u), as πn → 0. (6)<br />

0<br />

Since Xn →d X if and only if moment generating function of Xn converges to moment<br />

generating function of X, from (5) and (6) it follows that Pt <br />

must have moment generating<br />

function M(u) in (6). That is Pt ∼ N 0, t<br />

0 h2 <br />

sds as desired.<br />

(iii) Generalizing the above result, denote<br />

t t<br />

′<br />

Qt = hsdWs, ksdWs ,<br />

0<br />

and Qt follows multivariate normal distribution with mean and variance given by<br />

t t<br />

′<br />

E(Qt) = E hsdWs, ksdWs = (0, 0)<br />

0<br />

0<br />

′ ;<br />

Var(Qt) = E QtQ ′ <br />

t<br />

t = E ([Q]t) = 0 h2 t<br />

sds 0 hsksds<br />

<br />

.<br />

0<br />

t<br />

0 hsksds<br />

(iv) Specifically, the joint distribution of<br />

t t t <br />

Wt, sdWs = 1dWs, sdWs<br />

0<br />

0<br />

0<br />

t<br />

0 k2 sds

E724 Financial Econometrics (Spring 2013) Problem Set 3 5<br />

is<br />

0 t<br />

N , 0<br />

0<br />

ds<br />

t<br />

0 sds<br />

t<br />

0 sds t<br />

0 s2ds <br />

= N<br />

<br />

0<br />

,<br />

0<br />

t 1/2t 2<br />

1/2t 2 1/3t 3<br />

<br />

.<br />

Problem 3. Let Bt = (Bit) be a vector Brownian motion with variance Σ = (σij). Show that<br />

[Bi, Bj]t = σijt<br />

for all i and j. In particular, [Bi, Bj]t = 0 for all t ≥ 0, if σij = 0.<br />

Solution 3. We can solve this problem by two ways.<br />

(i) We can show that n <br />

Bi,tk k=1 − Bi,tk−1 Bj,tk − Bj,tk−1 →L2 σijt as πn → 0:<br />

<br />

n<br />

2 <br />

E Bi,tk − Bi,tk−1 Bj,tk − Bj,tk−1 − σijt<br />

= E<br />

= E<br />

=<br />

=<br />

=<br />

k=1<br />

n<br />

k=1<br />

n<br />

n<br />

k=1<br />

− 2<br />

<br />

Bi,tk − Bi,tk−1<br />

Bj,tk<br />

− Bj,tk−1<br />

<br />

Bi,tk − Bi,tk−1 Bj,tk − Bj,tk−1<br />

k=1<br />

Bi,tk 2 <br />

E − Bi,tk−1 Bj,tk − Bj,tk−1<br />

n<br />

σij(tk − tk−1)E Bi,tk<br />

k=1<br />

n<br />

(σiiσjj + 2σ 2 ij)(tk − tk−1) 2 − 2<br />

k=1<br />

n<br />

k=1<br />

(σiiσjj + σ 2 ij)(tk − tk−1) 2<br />

≤ (σiiσjj + σ 2 ij) max<br />

1≤k≤n |tk − tk−1|<br />

− Bi,tk−1<br />

− σij(tk − tk−1) 2<br />

− σij(tk − tk−1) 2<br />

2 <br />

Bj,tk<br />

− Bj,tk−1<br />

n<br />

σ 2 ij(tk − tk−1) 2 +<br />

k=1<br />

n<br />

(tk − tk−1)<br />

k=1<br />

<br />

+<br />

n<br />

k=1<br />

n<br />

k=1<br />

σ 2 ij(tk − tk−1) 2<br />

σ 2 ij(tk − tk−1) 2<br />

= t(σiiσjj + σ 2 ij) max<br />

1≤k≤n |tk − tk−1| → 0, as πn → 0.<br />

Therefore n <br />

Bi,tk k=1 − Bi,tk−1 Bj,tk − Bj,tk−1 →p σijt as πn → 0, thus<br />

[Bi, Bj]t = plim<br />

n<br />

<br />

Bi,tk − Bi,tk−1<br />

πn→0<br />

k=1<br />

Bj,tk<br />

− Bj,tk−1<br />

= σijt.

6<br />

(ii) Since Bt = (Bit) is a vector Brownian motion with variance Σ = (σij), it can be written<br />

as<br />

Bt = Σ 1/2 Wt<br />

where Wt = (Wit) is a vector of independent standard Brownian motions W1t, W2t, · · · , Wnt.<br />

Let<br />

It then follows that<br />

<br />

n<br />

[Bi, Bj]t =<br />

A = Σ 1/2 = (aij), and hence AA = AA ′ = Σ = (σij). (7)<br />

= 1<br />

4<br />

= 1<br />

4<br />

k=1<br />

k=1<br />

aikWk,<br />

n<br />

k=1<br />

ajkWk<br />

<br />

t<br />

<br />

n<br />

n<br />

<br />

aikWk + ajkWk −<br />

k=1<br />

k=1 t<br />

1<br />

<br />

n<br />

n<br />

aikWk −<br />

4<br />

k=1<br />

k=1<br />

<br />

n<br />

<br />

(aik + ajk)Wk − 1<br />

<br />

n<br />

<br />

(aik − ajk)Wk<br />

4<br />

t<br />

k=1<br />

= 1<br />

n<br />

(aik + ajk)<br />

4<br />

k=1<br />

2 [Wk]t − 1<br />

n<br />

4<br />

k=1<br />

= 1<br />

n <br />

(aik + ajk)<br />

4<br />

k=1<br />

2 − (aik − ajk) 2 [Wk]t<br />

= 1<br />

n<br />

4aikajk[Wk]t<br />

4<br />

k=1<br />

n<br />

=<br />

k=1<br />

(aik − ajk) 2 [Wk]t<br />

t<br />

ajkWk<br />

aikajkt = σijt (9)<br />

where (9) is obtained from (7), and (8) is obtain by the fact that<br />

[X, Y ]t = 1<br />

4 ([X + Y ]t − [X − Y ]t) .<br />

Problem 4. Prove directly from the definition of Ito integrals that<br />

t<br />

t<br />

sdMs = tMt − Msds,<br />

0<br />

where M is a continuous martingale. Can this formula be generalized to<br />

t<br />

t<br />

f(s)dMs = f(t)Mt Msdf(s)<br />

0<br />

for any function f that is of bounded variation over any compact interval?<br />

0<br />

0<br />

<br />

t<br />

(8)

E724 Financial Econometrics (Spring 2013) Problem Set 3 7<br />

Solution 4. By definition of Ito integral,<br />

Similarly,<br />

t<br />

0<br />

t<br />

0<br />

sdMs = plim<br />

πn→0<br />

f(s)dMs = plim<br />

πn→0<br />

n<br />

ti−1(Mti<br />

i=1<br />

n <br />

ti−1Mti<br />

− Mti−1 )<br />

<br />

= plim<br />

− tiMti + tiMti − ti−1Mti−1<br />

πn→0<br />

i=1<br />

n <br />

= plim (tiMti − ti−1Mti−1 ) − (tiMti − ti−1Mti )<br />

πn→0<br />

i=1<br />

n<br />

n<br />

= plim (tiMti − ti−1Mti−1 ) − plim Mti<br />

πn→0<br />

πn→0<br />

i=1<br />

i=1<br />

(ti − ti−1)<br />

t t<br />

= d(sMs) − Msds<br />

0<br />

t<br />

0<br />

= tMt − Msds.<br />

0<br />

n<br />

f(ti−1)(Mti − Mti−1 )<br />

i=1<br />

n <br />

f(ti−1)Mti<br />

<br />

= plim<br />

− f(ti)Mti + f(ti)Mti − f(ti−1)Mti−1<br />

πn→0<br />

i=1<br />

n <br />

= plim (f(ti)Mti − f(ti−1)Mti−1 ) − (f(ti)Mti − f(ti−1)Mti )<br />

πn→0<br />

i=1<br />

n<br />

n<br />

= plim (f(ti)Mti − f(ti−1)Mti−1 ) − plim Mti<br />

πn→0<br />

πn→0<br />

i=1<br />

i=1<br />

(f(ti) − f(ti−1))<br />

t<br />

t<br />

= d(f(s)Ms) − Msdf(s)<br />

0<br />

t<br />

0<br />

= f(t)Mt − Msdf(s),<br />

0<br />

for any function f that is of bounded variation over any compact interval.<br />

Problem 5. Check whether the following processes X are martingales with respect to the<br />

filtration (Ft) generated by the standard Brownian motion W (for (a) - (c)), or the two<br />

independent standard Brownian motions W and V (for (d)).<br />

(a) Xt = Wt + 4t<br />

(b) Xt = W 3 t − 3tWt

8<br />

(c) Xt = t 2 Wt − 2 t<br />

0 sWsds<br />

(d) Xt = WtVt<br />

Solution 5. (a) Note that for s < t,<br />

E (Xt|Fs) = E (Wt + 4t|Fs) = Ws + 4t = Xs.<br />

Therefore X is not a martingale with respect to Ft.<br />

(b) Apply Ito formula to obtain that<br />

Then<br />

dXt = (3W 2 t − 3t)dWt − 3Wtdt + 1<br />

· 6Wtdt<br />

2<br />

= 3(W 2 t − t)dWt.<br />

Xt = X0 + 3<br />

t<br />

(W 2 s − s)dWs,<br />

0<br />

which shows that Xt is constant plus a continuous martingale. So X is a martingale with<br />

respect to Ft.<br />

(c) Apply Ito formula to obtain that<br />

Then<br />

dXt = t 2 dWt + (2tWt − 2tWt) dt = t 2 dWt.<br />

Xt = X0 +<br />

t<br />

s 2 dWs,<br />

which shows that Xt is constant plus a continuous martingale. So X is a martingale with<br />

respect to Ft.<br />

(d) Since W and V are independent to each other, we have [W, V ]t = 0. Then by applying Ito<br />

formula, we obtain that<br />

Then<br />

Xt = X0 +<br />

dXt = WtdVt + VtdWt.<br />

0<br />

t t<br />

WsdVs + VsdWs,<br />

0<br />

which shows that Xt is constant plus two continuous martingales. So X is a martingale<br />

with respect to Ft.<br />

0

E724 Financial Econometrics (Spring 2013) Problem Set 3 9<br />

Problem 6. Let B be the m-dimensional standard vector Brownian motion, i.e., B is defined<br />

by B = (B1, · · · , B ′ ) , where Bi’s are independent standard Brownian motions. Use Ito’s formula<br />

to write the following n-dimensional stochastic process X on the standard form<br />

for suitable choice of u ∈ R n and v ∈ R n×m .<br />

(a) Xt = B 2 t , where B is 1-dimensional<br />

dXt = u(t, ω)dt + v(t, ω)dBt<br />

(b) Xt = 2 + t + e Bt , where B is 1-dimensional<br />

(c) Xt = (t, B 2 1t + B2 2t )′ , where B = (B1, B2) ′ is 2-dimensional<br />

(d) Xt = (B1t + B2t + B3t, B 2 2t − B1tB3t) ′ , where B = (B1, B2, B3) ′ is 3-dimensional<br />

Solution 6. (a) Applying Ito’s formula,<br />

Therefore we have<br />

(b) Applying Ito’s formula,<br />

Therefore we have<br />

(c) Applying Ito’s formula,<br />

<br />

t<br />

dXt = d<br />

B2 1t + B2 <br />

2t<br />

<br />

1 0 0<br />

= dt +<br />

0<br />

<br />

1 0 0<br />

= dt +<br />

2<br />

Therefore we have<br />

dXt = 2BtdBt + d[B]t = dt + 2BtdBt.<br />

u(t, ω) = 1, v(t, w) = 2Bt.<br />

dXt = dt + e Bt dBt + 1<br />

2 eBtd[B]t <br />

= 1 + 1<br />

2 eBt<br />

<br />

dt + e Bt dBt.<br />

u(t, ω) = 1 + 1<br />

2 eBt , v(t, w) = e Bt .<br />

u(t, ω) =<br />

2B1t 2B2t<br />

2B1t 2B2t<br />

<br />

d<br />

<br />

B1t<br />

dBt<br />

B2t<br />

<br />

0 0 [B1]t<br />

+ d<br />

1 1 [B2]t<br />

<br />

<br />

1<br />

0 0<br />

, v(t, w) =<br />

.<br />

2<br />

2B1t 2B2t

10<br />

(d) Applying Ito’s formula,<br />

<br />

B1t + B2t + B3t<br />

dXt = d<br />

Therefore we have<br />

B2 2t − B1tB3t<br />

⎛ ⎞<br />

⎛ ⎞<br />

B1t [B1]t<br />

1 1 1<br />

=<br />

d ⎝B2t⎠<br />

0 0 0<br />

+<br />

d ⎝[B2]t⎠<br />

−B3t 2B2t −B1t<br />

0 1 0<br />

B3t<br />

[B3]t<br />

<br />

0 1 1 1<br />

= dt +<br />

dBt<br />

1<br />

u(t, ω) =<br />

−B3t 2B2t −B1t<br />

<br />

<br />

0<br />

1 1 1<br />

, v(t, w) =<br />

.<br />

1<br />

−B3t 2B2t −B1t<br />

Problem 7. Let W be the standard Brownian modtion. Verify that the given processes solve<br />

the given corresponding stochastic differential equations.<br />

(a) Xt = e Wt solves<br />

for t > 0.<br />

(b) Xt = Wt/(1 + t) with W0 = 0 solves<br />

for t > 0 with X0 = 0.<br />

(c) Xt = sin Wt with W0 ∈ (−π/2, π/2) solves<br />

for t < T = inf{s|Ws ∈ [−π/2, π/2]}.<br />

dXt = 1<br />

2 Xtdt + XtdWt<br />

dXt = − 1<br />

1 + t Xtdt + 1<br />

1 + t dWt<br />

dXt = − 1<br />

2 Xtdt +<br />

(d) Xt = (X1t, X2t) ′ with X1t = t and X2t = etWt solves<br />

<br />

dX1t<br />

<br />

1<br />

<br />

for t > 0.<br />

dX2t<br />

=<br />

X2t<br />

<br />

1 − X 2 t dWt<br />

<br />

0<br />

dt +<br />

eX1t <br />

dWt<br />

Solution 7. (a) Given Xt = f(Wt) = e Wt , by Ito’s formula,<br />

dXt = e Wt dWt + 1<br />

2 eWt dt = 1<br />

2 Xtdt + XtdWt.<br />

Therefore Xt = e Wt is a weak solution to (10).<br />

(10)<br />

(11)<br />

(12)<br />

(13)

E724 Financial Econometrics (Spring 2013) Problem Set 3 11<br />

(b) Given Xt = Wt<br />

1+t with W0, firstly note<br />

Moreover, by Ito’s formula,<br />

X0 = W0<br />

1 + 0 = W0 = 0.<br />

dXt = − Wt 1<br />

dt +<br />

(1 + t) 2 1 + t dWt<br />

= − 1<br />

1 + t Xtdt + 1<br />

1 + t dWt.<br />

Therefore, Xt = Wt/(1 + t) with W0 = 0 is a weak solution to (11).<br />

(c) Given Xt = sin Wt, by Ito’s formula,<br />

dXt = cos WtdWt − 1<br />

sin Wtdt<br />

2<br />

= − 1<br />

2 sin Wtdt + 1 − (sin Wt) 2 dWt<br />

= − 1<br />

2 Xtdt +<br />

<br />

1 − X 2 t dWt.<br />

Therefore, Xt = sin Wt is a weak solution to (12).<br />

(d) Again, given Xt = (t, etWt) ′ , by Ito’s formula we have<br />

<br />

dX1t t<br />

= d<br />

dX2t et <br />

1<br />

=<br />

Wt et <br />

Wt<br />

<br />

1<br />

= dt +<br />

X2t<br />

Therefore, Xt = (t, e t Wt) ′ solves (13).<br />

dt +<br />

<br />

0<br />

eX1t <br />

dWt.<br />

Problem 8. Consider the Ornstein-Uhlenbeck diffusion<br />

dXt = −Xtdt + dWt,<br />

<br />

0<br />

et <br />

dWt<br />

and compute the two methods in (a) and (b) below to obtain its quadratic variation. Which<br />

one is wrong and why?<br />

(a) We may derive directly from the diffusion equation<br />

t<br />

Xt = X0 − Xsds + Wt<br />

that<br />

since t<br />

0 Xsds is of bounded variation.<br />

0<br />

[X]t = [W ]t = t,

12<br />

(b) We should first solve the diffusion equation to obtain<br />

from which we may deduce<br />

Xt = e −t t<br />

X0 + e −(t−s) dWs,<br />

t<br />

[X]t =<br />

using the formula we learned from the class.<br />

0<br />

0<br />

e 2(t−s) ds = 1<br />

2 (1 − e−2t )<br />

Solution 8. Computation in (b) is WRONG. The right way to tackle this problem is as follows.<br />

By solving the diffusion equation we can obtain<br />

Xt = e −t t<br />

X0 + e<br />

0<br />

−(t−s) dWs<br />

= e −t X0 + e −t<br />

t<br />

e s dWs<br />

Let Pt = e −t Mt, where Mt = t<br />

0 es dWs is a martingale. Xt and Pt has the same quadratic<br />

variation since e −t X0 is of bounded variation. Consider<br />

Then<br />

dPt = e −t Mtdt + e −t dMt<br />

= e −t Mtdt + e −t e t dWt<br />

= e −t Mtdt + dWt.<br />

Pt = P0 +<br />

0<br />

t<br />

e −s Msds + Wt.<br />

0<br />

Since the first term P0 is constant, the second term t<br />

0 e−s Msds is of bounded variation and<br />

the third term, Wt, has quadratic variaton t, we have [P ]t = t.<br />

Therefore [X]t = [P ]t = t, which is the same as what has been derived in (a).