Charges & Fees - Dutch-Bangla Bank Limited

Charges & Fees - Dutch-Bangla Bank Limited

Charges & Fees - Dutch-Bangla Bank Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

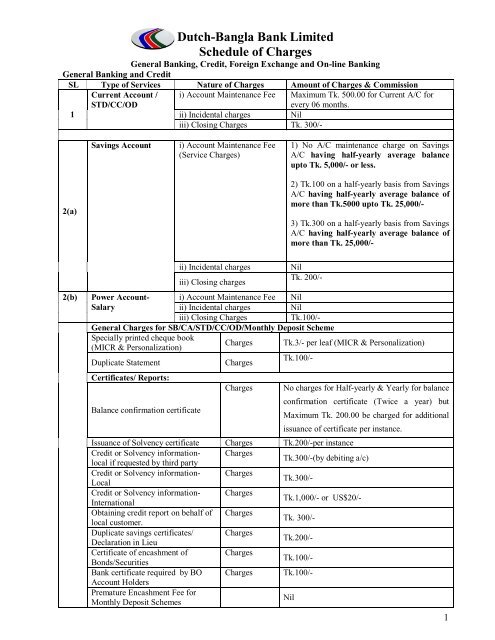

<strong>Dutch</strong>-<strong>Bangla</strong> <strong>Bank</strong> <strong>Limited</strong><br />

Schedule of <strong>Charges</strong><br />

General <strong>Bank</strong>ing, Credit, Foreign Exchange and On-line <strong>Bank</strong>ing<br />

General <strong>Bank</strong>ing and Credit<br />

SL Type of Services Nature of <strong>Charges</strong> Amount of <strong>Charges</strong> & Commission<br />

1<br />

2(a)<br />

Current Account /<br />

STD/CC/OD<br />

Savings Account<br />

2(b) Power Account-<br />

Salary<br />

i) Account Maintenance Fee Maximum Tk. 500.00 for Current A/C for<br />

every 06 months.<br />

ii) Incidental charges Nil<br />

iii) Closing <strong>Charges</strong> Tk. 300/-<br />

i) Account Maintenance Fee<br />

(Service <strong>Charges</strong>)<br />

ii) Incidental charges Nil<br />

iii) Closing charges<br />

Tk. 200/-<br />

i) Account Maintenance Fee Nil<br />

ii) Incidental charges Nil<br />

iii) Closing <strong>Charges</strong> Tk.100/-<br />

General <strong>Charges</strong> for SB/CA/STD/CC/OD/Monthly Deposit Scheme<br />

Specially printed cheque book<br />

(MICR & Personalization)<br />

Duplicate Statement <strong>Charges</strong><br />

Certificates/ Reports:<br />

Balance confirmation certificate<br />

1) No A/C maintenance charge on Savings<br />

A/C having half-yearly average balance<br />

upto Tk. 5,000/- or less.<br />

2) Tk.100 on a half-yearly basis from Savings<br />

A/C having half-yearly average balance of<br />

more than Tk.5000 upto Tk. 25,000/-<br />

3) Tk.300 on a half-yearly basis from Savings<br />

A/C having half-yearly average balance of<br />

more than Tk. 25,000/-<br />

<strong>Charges</strong> Tk.3/- per leaf (MICR & Personalization)<br />

Tk.100/-<br />

<strong>Charges</strong> No charges for Half-yearly & Yearly for balance<br />

confirmation certificate (Twice a year) but<br />

Maximum Tk. 200.00 be charged for additional<br />

issuance of certificate per instance.<br />

Issuance of Solvency certificate <strong>Charges</strong> Tk.200/-per instance<br />

Credit or Solvency informationlocal<br />

if requested by third party<br />

<strong>Charges</strong><br />

Tk.300/-(by debiting a/c)<br />

Credit or Solvency information-<br />

Local<br />

<strong>Charges</strong><br />

Tk.300/-<br />

Credit or Solvency information-<br />

International<br />

<strong>Charges</strong><br />

Tk.1,000/- or US$20/-<br />

Obtaining credit report on behalf of<br />

local customer.<br />

<strong>Charges</strong><br />

Tk. 300/-<br />

Duplicate savings certificates/<br />

Declaration in Lieu<br />

<strong>Charges</strong><br />

Tk.200/-<br />

Certificate of encashment of<br />

Bonds/Securities<br />

<strong>Charges</strong><br />

Tk.100/-<br />

<strong>Bank</strong> certificate required by BO<br />

Account Holders<br />

<strong>Charges</strong> Tk.100/-<br />

Premature Encashment Fee for<br />

Monthly Deposit Schemes<br />

Nil<br />

1

SL Type of Services<br />

Nature of<br />

<strong>Charges</strong><br />

Amount of <strong>Charges</strong> & Commission<br />

3 Collection:<br />

a) Collection of Local cheques <strong>Charges</strong> i) Where there is a clearing house-Free<br />

<strong>Charges</strong> ii) Where there is no clearing house:- actual<br />

conveyance, Minimum of Tk. 50/- per<br />

b) Cheques returned, unpaid<br />

from clearing house<br />

instance<br />

<strong>Charges</strong>. Tk. 50/- (flat) per instance from the account<br />

of the depositor of cheques.<br />

c) Bounced cheque drawn on us<br />

(cash, clearing and transfer)<br />

<strong>Charges</strong><br />

Tk.100/-(flat) per instance from the account<br />

holder of cheques.<br />

d) Collection of outstation Commission i) Upto Tk. 50,000/- Tk. 50/-(flat)<br />

cheques/bills (Clean/<br />

ii) From Tk. 50,001/- to Tk. 100,000/-<br />

Documents)<br />

@0.20%<br />

iii) From Tk. 100,001/- to Tk. 500,000/-<br />

@0.15%, Minimum Tk. 200/-.<br />

iv) Over Tk. 500,000/- @0.10%, Minimum<br />

.<br />

Tk. 600/- and Maximum Tk. 3,000/-<br />

Postage(Regist<br />

ered)<br />

Telephone/Telex/<br />

At actual, Minimum Tk. 20/e-mail/Telegram/<br />

Fax/SWIFT<br />

At actual, Minimum Tk. 100/-<br />

4. Remittance(Inland):<br />

a) Issuance of DD<br />

Commission @ 0.10%, Minimum Tk. 50/-, Max-<br />

Tk.3,000/- (For walking customer &<br />

account holder)<br />

Telegram/Tele<br />

x/Fax/ SWIFT<br />

for DD:<br />

At actual, Minimum Tk. 50/b)<br />

Issuance of Pay Order (PO) Commission<br />

Tk.50/-(Flat) for any amount (For walking<br />

customer & account holder)<br />

c) Cancellation of DD/PO For DD i) Upto Tk. 1,000/-, Tk. 25/ii)<br />

Above Tk. 1000/-, Tk 50/-<br />

For PO i) Upto Tk. 1,000/-, Tk. 20/ii)<br />

Above Tk. 1,000/-, Tk. 35/iii)<br />

Above Tk. 1.00 lac, Tk. 100/d)<br />

Issuance of cheque on <strong>Charges</strong><br />

<strong>Bangla</strong>desh <strong>Bank</strong> at clients<br />

request Remittance (Inland)<br />

Tk. 100/- per instance<br />

e) Issuance of Duplicate<br />

instrument<br />

<strong>Charges</strong><br />

Tk.100/- (flat)<br />

f) Counter Transaction Fee Nil<br />

2

5<br />

6<br />

SL Type of Services<br />

Standing Instruction<br />

Purchase of Cheques, Inland<br />

Bills & Instruments<br />

(outstation)<br />

Nature of<br />

<strong>Charges</strong><br />

<strong>Charges</strong>/<br />

commission<br />

<strong>Charges</strong><br />

Amount of <strong>Charges</strong> & Commission<br />

Tk.100/- for compliance of each instruction.<br />

No standing instruction charge for transfer<br />

of balance from any deposit account to<br />

scheme account<br />

Commission i) Upto Tk. 25,000/- @ 0.15%, Minimum Tk.<br />

25/-<br />

ii) Tk. 25,001/- to Tk. 1.00 lac @ 0.15%,<br />

Minimum Tk. 50/-<br />

iii) From Tk.100,001/- to Tk.5,00,000/- @<br />

0.15%, Minimum Tk. 200/-<br />

iv) Over Tk. 5.00 lac @0.10%, Minimum Tk.<br />

600/- & Maximum Tk. 3,000/-<br />

Postage At actual but Minimum Tk. 20/-<br />

Telephone/<br />

e-mail /FAX/<br />

SWIFT/<br />

Telegram.<br />

At actual but Minimum Tk. 50/-<br />

Rate of interest <strong>Charges</strong> Interest to be charged as per commercial<br />

lending rate.<br />

7 Issuance of Guarantee Commission i) @ Tk. 0.60% per quarter, Min. Tk.500/-<br />

ii) 100% cash margin;<br />

@ 0.20% per quarter, Min. Tk. 300/-<br />

8 Parcel <strong>Charges</strong>: <strong>Charges</strong> Tk.20/- each for parcel 1st 10 days and<br />

additional Tk. 5/- for every subsequent days<br />

9 Locker & Safe custody<br />

10 Loan Documentation Fee:<br />

(Except loan against Financial<br />

Obligation)<br />

11 Loan Processing/ Appraisal<br />

Fee: (other than retail product)<br />

or part thereof<br />

<strong>Charges</strong> a) Small size Tk.1,000/-yearly.<br />

b) Medium size Tk.2,000/- yearly.<br />

c) Large size Tk. 3,000/- yearly.<br />

d) Security money:<br />

i) Small-Tk.1,000/-(refundable)<br />

ii) Medium Tk. 2,000/-(refundable)<br />

iii) Large Tk. 3,000/-(refundable)<br />

e) Replacement of lost key- At actual.<br />

Fee i)Upto Tk. 2,00,000/-, Tk. 300/-,<br />

ii) From Tk. 2,00,001/- to Tk. 5,00,000/-, Tk.<br />

500/-<br />

iii) From Tk. 5,00,001/- to Tk. 10,00,000/-Tk.<br />

1,000/- and<br />

iv)Above Tk. 10,00,000/-, Tk. 2,000/-<br />

v) For subsequent enhancement/renewal<br />

(without further registration), 50% of above<br />

prescribed fees.<br />

Fee For Commercial Loan:<br />

i) Upto Tk. 10.00 lac, Free<br />

ii) Above Tk. 10.00 lac, Tk. 500/-<br />

For Industrial Loan:<br />

i) Upto Tk. 10 lac - Free.<br />

ii) Above Tk. 10 lac to 50 lac, Tk.2,000/-<br />

iii) Above Tk. 50 lac, Tk. 3,000/-<br />

12 Early Settlement Fee Maximum @ 2.00% on outstanding balance<br />

3

Foreign Exchange Transactions<br />

SL Type of Services Nature of <strong>Charges</strong> Amount of <strong>Charges</strong> & Commission<br />

1 (i) L/C opening commissions<br />

under cash (sight)<br />

Maximum @ 0.40% for each quarter<br />

(ii) L/C opening commissions<br />

under cash (usance)<br />

Maximum @ 0.50% for each quarter<br />

iii) L/C Opening Commission for<br />

Back to Back L/C on account of<br />

export oriented garments or<br />

specialized textiles<br />

Maximum @ 0.40% for each quarter<br />

iv) Acceptance commission<br />

under deferred payment LCs<br />

(including Back to Back L/Cs).<br />

Maximum @ 0.40% for each quarter<br />

2 L/C opening commission where<br />

100% cash margin is received.<br />

Maximum @ 0.25% for each quarter<br />

3 Transmission/ Despatch.<br />

i) L/C <strong>Charges</strong> Tk. 3000/- (At Actual Basis)<br />

ii) L/C Amendment <strong>Charges</strong> Tk. 750/- (At Actual Basis)<br />

iii) LC Confirmation <strong>Charges</strong> Tk. 750/- (At Actual Basis)<br />

iv) LC Cancellation/ Other<br />

Message<br />

<strong>Charges</strong> Tk. 500/- (At Actual Basis)<br />

v) FCC <strong>Charges</strong> At Actual<br />

4 Amendment of L/C<br />

5<br />

6<br />

7<br />

8<br />

9<br />

LC Amendment Commission Maximum Tk.750/-<br />

Arrangement of confirmation<br />

by third <strong>Bank</strong> (Confirmation<br />

charges at actual to be borne<br />

by either opener or<br />

beneficiary as the case may<br />

be)<br />

Collection of credit report of<br />

the beneficiary of the L/C by<br />

Telex/ SWIFT/ Mail<br />

Supply of stationery set for<br />

L/C opening<br />

Certification of Import<br />

Documents for Customer<br />

Assessment Purpose<br />

Issuance of Shipping<br />

Guarantee<br />

Commission Maximum @ 0.20%<br />

Telex/ SWIFT/<br />

Mail<br />

<strong>Charges</strong><br />

<strong>Charges</strong> Tk. 500 (flat)<br />

<strong>Charges</strong><br />

At actual plus service charges but<br />

Minimum Tk. 500/-<br />

Actual stamp charges plus Tk. 100/-<br />

Nil<br />

4

SL Type of Services<br />

10 Others:<br />

i) For discrepant import L/C<br />

documents (charges to be<br />

realized from beneficiary/bill<br />

forwarding bank)<br />

ii) <strong>Charges</strong> for communicating<br />

acceptance of usance<br />

L/C(including Back to Back)<br />

iii) Issuance of Back to Back<br />

LC Certificate<br />

Nature of <strong>Charges</strong><br />

<strong>Charges</strong><br />

<strong>Charges</strong><br />

<strong>Charges</strong><br />

Amount of <strong>Charges</strong> & Commission<br />

i) USD50/- for foreign bill<br />

ii) USD20/- or equivalent Taka for<br />

Local Bill.<br />

i) Tk.500/- flat for foreign<br />

ii) Tk.200/- flat –for Local<br />

Maximum Tk. 500/-<br />

iv) C & F certificate <strong>Charges</strong> Maximum Tk. 500/-<br />

11 Foreign Remittance:<br />

i) Purchase of FDD<br />

Commission Tk. 0.40 per Dollar/GBP but Minimum<br />

Tk.200/- and postage at actual<br />

ii) TC encashment<br />

<strong>Charges</strong> As per approved purchase rate plus postage at<br />

actual<br />

iii) Payment of FTT in Tk. on our<br />

<strong>Bank</strong><br />

Handling <strong>Charges</strong><br />

Free<br />

iv) Collection of foreign currency<br />

draft from abroad.<br />

Handling <strong>Charges</strong> Tk.500/-(flat) plus postage at actual<br />

v) Issuance of TC Endorsement in Dollar/GBP selling Dollar/GBP selling commission: Ruling<br />

passport.<br />

vi) Issuance of<br />

commission<br />

approved sale rate plus 1%<br />

i) F.C (Cash)<br />

i) Commission i) No Commission<br />

ii) Endorsement in passport. ii) Fee<br />

ii) Tk. 200/vii)<br />

Issuance of FC Draft Commission i) Upto USD.500/- $5/-<br />

ii) USD501/- to USD5000/- $20/-<br />

iii) USD5001/- to 10,000/- $30/-<br />

iv) Above USD10,000/-$50/-<br />

viii) Remittance by TT(FC) through<br />

Foreign correspondent<br />

Telex/SWIFT <strong>Charges</strong><br />

NB: BC selling rate will be applied for<br />

conversion of FC if realization of charges in<br />

Taka.<br />

Tk. 700/- (flat)<br />

ix) Cancellation of FC drafts <strong>Charges</strong> Tk. 300/- (flat)<br />

x) Collection of Clean Bill <strong>Charges</strong> Nil<br />

xi) Student file –per student <strong>Charges</strong> Tk.2,000/-yearly per file/instance<br />

5

SL Type of Services Nature of <strong>Charges</strong> Amount of <strong>Charges</strong> & Commission<br />

12A Export<br />

i) Negotiation commission for export<br />

bills in foreign currency (where<br />

exchange gain is involved )<br />

Handling <strong>Charges</strong> Maximum Tk. 500/ii)<br />

Collection commission for export<br />

bills in foreign currency (where<br />

exchange gain is involved )<br />

Handling charge Maximum Tk. 500/iii)<br />

Negotiation commission for export Handling charge<br />

biills in foreign currency (where<br />

exchange gain is not involved )<br />

Maximum @ 0.15%<br />

iv) Collection commission for export<br />

bills in foreign currency (where<br />

exchange gain is not involved)<br />

Commission Maximum @ 0.15%<br />

v) Negotiation for Export Bills in Local<br />

Currency<br />

Handling charge Maximum @ 0.15%<br />

vi) Collection Commission for Export<br />

Bills in Local Currency<br />

Commission Maximum @ 0.15%<br />

vii) Advising of Foreign <strong>Bank</strong> L/C to<br />

beneficiary.<br />

Commission Maximum Tk.750/viii)<br />

(a) Advising of amendments of Foreign<br />

bank L/C to the Local beneficiary.<br />

Commission<br />

Maximum Tk.750/-<br />

b) Advising to Local <strong>Bank</strong> L/C to<br />

beneficiary.<br />

<strong>Charges</strong><br />

Maximum Tk.750/c)<br />

Advising Amendment of L/C <strong>Charges</strong> Maximum Tk.750/d)<br />

Authentication of Transfer <strong>Charges</strong> Maximum Tk.750/e)<br />

Transfer of L/C amendment with value <strong>Charges</strong> Maximum Tk.750/f)<br />

Adding of Confirmation to L/C<br />

Commission Maximum @ 0.20% (each quarter).<br />

g) Local FCC, Data Max, Handling Charge,<br />

Copy Document Endorsement Charge, LC<br />

Cancellation or unutilized expired LC<br />

Nil<br />

h) Foreign <strong>Bank</strong>’s Guarantee charges<br />

against discrepant bills.<br />

<strong>Charges</strong><br />

At actual<br />

i) Collecting bank charges abroad. <strong>Charges</strong> At Actual<br />

j) Processing of documents under<br />

collection of Foreign Currency.<br />

Handling <strong>Charges</strong><br />

Tk.500/k)<br />

Processing of documents under<br />

collection of Local Currency.<br />

Commission<br />

Maximum @ 0.15%<br />

l) Mailing of Export Documents<br />

(Foreign)<br />

m) SWIFT/Telex charges for<br />

transmitting reimbursement instruction<br />

i) By Courier<br />

ii) By Postage<br />

<strong>Charges</strong><br />

i) At actual but Minimum Tk. 2,000/-<br />

ii) At actual but Minimum Tk. 750/-<br />

Tk. 500/-<br />

6

SL Type of Services Nature of <strong>Charges</strong> Amount of <strong>Charges</strong> & Commission<br />

12B Export Other<br />

i) Exp. Form certification <strong>Charges</strong> Tk. 100 per unit/ set.<br />

ii) other stationeries <strong>Charges</strong> Tk. 100/iii)<br />

Issuance of Export<br />

<strong>Charges</strong><br />

Maximum Tk.500/-<br />

13<br />

Transaction certificate/PRC<br />

iv) Issuance of Foreign Currency<br />

balance certificate/solvency<br />

certificate<br />

v) Indentor’s registration<br />

certificate, money changers<br />

license or special permission etc.<br />

from <strong>Bangla</strong>desh <strong>Bank</strong><br />

vi) Cash incentive/duty drawback<br />

facilities<br />

Foreign <strong>Bank</strong> Guarantee<br />

i) Advising of Guarantee to the<br />

beneficiary in original without<br />

any engagement on our part<br />

ii) Advising of Guarantee in<br />

original by adding our<br />

confirmation.<br />

iii) Advising of Guarantee in our<br />

format or the format supplied by<br />

the opening bank with our full<br />

engagement.<br />

14 Collection (inward):<br />

i) For collection of clean items<br />

(inward)<br />

ii) For documentary collection<br />

bills(under all types of L/C)<br />

ii) For documentary bills under<br />

grant(without L/C)<br />

iii) Other charges including<br />

telex/SWIFT etc.<br />

v) For documentary bills under<br />

grant(without L/C)<br />

<strong>Charges</strong><br />

Tk. 200/- per certificate.<br />

Handling <strong>Charges</strong> Tk.750/- per instance.<br />

<strong>Charges</strong> Tk.2,000/- per case/per bill.<br />

Commission Tk. 500/-<br />

Commission<br />

Commission<br />

0.50% per quarter or part thereof but<br />

Minimum Tk. 1,000/- or US $ 25.00 if<br />

payable by foreign correspondent/<br />

beneficiary.<br />

Commission Tk.100/-(flat)<br />

0.50% per quarter or part thereof but<br />

Minimum Tk. 1,000/- or US $ 25.00 if<br />

payable by foreign correspondent/<br />

beneficiary.<br />

Commission @ 0.25% Minimum Tk.200/-<br />

Commission @ 0.25% with Min.Tk.200/-<br />

Commission At Actual<br />

Commission @ 0.25%(flat) with Min.Tk.200/-<br />

7

<strong>Charges</strong> & <strong>Fees</strong> for On-line <strong>Bank</strong>ing<br />

(VAT will be recovered from the clients as per VAT Rules)<br />

SL Cash Deposit to the Counter<br />

1 Amount of Transactions <strong>Fees</strong> per transaction for<br />

inter-zonal transactions (Tk)<br />

Charge to be<br />

realized from<br />

Below Tk. 0.50 lac 20 Bearer<br />

Tk. 0.50 lac to Tk.1.00 lac 50 Bearer<br />

Above Tk. 1.00 lac to Tk. 5.00 lac 100 Bearer<br />

Above Tk. 5.00 lac to Tk. 15.00 lac 200 Bearer<br />

Above Tk. 15.00 lac to Tk. 50.00 lac 300 Bearer<br />

Above Tk. 50.00 lac 500 Bearer<br />

SL Cash withdrawal from the Counter<br />

2 Amount of Transactions <strong>Fees</strong> per transaction for<br />

inter-zonal transactions (Tk)<br />

Charge to be<br />

realized from<br />

Below Tk. 0.50 lac 50 Bearer<br />

Tk. 0.50 lac to Tk.1.00 lac 100 Bearer<br />

Above Tk. 1.00 lac to Tk. 5.00 lac 200 Bearer<br />

Above Tk. 5.00 lac to Tk. 15.00 lac 400 Bearer<br />

Above Tk. 15.00 lac 1000 Bearer<br />

SL Inter-Zone Fund Transfer<br />

3 Amount of Transactions <strong>Fees</strong> per transaction for inter-<br />

Zones:<br />

zonal transactions (Tk)<br />

Charge to be realized<br />

from<br />

Up to Tk.1.00 lac Nil<br />

Above Tk. 1.00 lac to Tk. 5.00 lac 100 Account Holder<br />

Above Tk. 5.00 lac to Tk. 15.00 lac 200 Account Holder<br />

Above Tk. 15.00 lac to Tk. 50.00 lac 300 Account Holder<br />

Above Tk. 50.00 lac 500 Account Holder<br />

1. Dhaka Zone: Dhaka city branches, Dhaka EPZ, Donia, Board Bazar, Shimrail, Joypara, Savar Bazar,<br />

Gazipur, Baburhat., Bhulta<br />

2. Narayangonj Zone: Narayangonj, BB Road, Netaigonj, Baburhat.<br />

3. Chittagong Zone: Chittagong city branches, Patherhat & Hathazari.<br />

4. Sylhet: Sylhet, Biswanath, Golapgonj. Chattak<br />

5. Moulvibazar Zone<br />

6. Khulna Zone<br />

7. Barishal Zone<br />

8. Bogra Zone<br />

9. Rajshahi Zone<br />

Note: Transactions make from one district to other district except the above will be considered as Inter-<br />

Zonal Transactions.<br />

SL<br />

4 On-line refund of IPO/Crediting Cash<br />

Dividend<br />

i) Against direct credit of IPO application<br />

money to the unsuccessful IPO applicant’s<br />

Account<br />

ii) For crediting cash dividend of other<br />

companies to the account of their shareholders<br />

those who are maintaining account with<br />

DBBL<br />

<strong>Fees</strong> per transaction (Tk.) Charge to be<br />

realized from<br />

Tk.10/- Account Holder<br />

Tk.10/- Account Holder<br />

8

SL <strong>Charges</strong> & <strong>Fees</strong> for Debit Card:<br />

5 Type of services Classic Silver Gold Maestro Visa Electron<br />

Issuance fee(1 st year only) Free 1000 1500 500 500<br />

Annual Fee(2 nd year onward) 400 1000 2000 500 500<br />

Replacement Fee 400 500 700 500 500<br />

PIN Change Fee 200 200 200 200 200<br />

SL Cash withdrawal Fee<br />

6 Type of services Class<br />

ic<br />

Silver Gold Maestro Visa Electron<br />

a) Own ATM Free Free Free Free Free<br />

b) ATM in the same Network or<br />

in the Agreement with DBBL<br />

10 10 10 10 10<br />

c) ATM in<br />

Network in BD<br />

another N/A N/A N/A Tk.150/- or 2.50% Tk.150/- or 2.50%<br />

whichever is higher whichever is higher<br />

d) ATM abroad N/A N/A N/A Tk.150/- or 2.50% Tk.150/- or 2.50%<br />

whichever is higher whichever is higher<br />

Balance Inquiry Fee Free Free Free Free Free<br />

Mini Statement Fee Free Free Free Free Free<br />

Other Transactions Free Free Free Free Free<br />

Rate of Interest on OD<br />

(% per annum)<br />

N/A 18 18 N/A N/A<br />

SL Master Card ATM Interchange Fee<br />

Type of Services Amount of <strong>Charges</strong> & Commission<br />

7 Local Card Tk.10.00<br />

International Card $ 1.25<br />

8 VISA ATM Interchange Fee<br />

Local Card Tk.10.00<br />

International Card $1.00<br />

9 Internet <strong>Bank</strong>ing Annual fee: Tk.200/-<br />

10 SMS <strong>Bank</strong>ing Nil<br />

11 Alert <strong>Bank</strong>ing Nil<br />

Type of the Services Rate<br />

“ATM Network Charge” for debit card<br />

Annual fee: Tk.200/holder<br />

(Except Salary Account, Staff<br />

Account, School Saver Account & Excel<br />

Account)<br />

Type of the Services Rate<br />

Merchant Commission(POS)<br />

1-3%<br />

9