Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Problems <strong>and</strong> <strong>Solutions</strong><br />

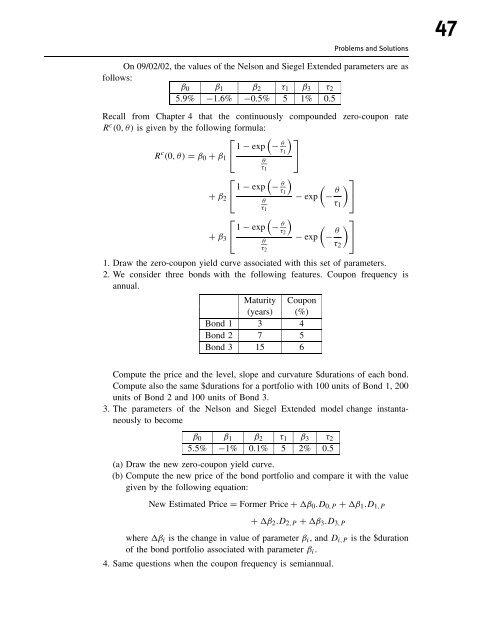

On 09/02/02, the values of the Nelson <strong>and</strong> Siegel Extended parameters are as<br />

follows:<br />

β0 β1 β2 τ1 β3 τ2<br />

5.9% −1.6% −0.5% 5 1% 0.5<br />

Recall from Chapter 4 that the continuously compounded zero-coupon rate<br />

Rc (0,θ) is given by the following formula:<br />

R c ⎡ <br />

1 − exp −<br />

(0,θ)= β0 + β1 ⎣ θ ⎤<br />

τ1 ⎦<br />

+ β2<br />

+ β3<br />

θ<br />

τ1<br />

⎡ <br />

1 − exp −<br />

⎣ θ <br />

τ1<br />

θ<br />

τ1<br />

⎡ <br />

1 − exp −<br />

⎣ θ <br />

τ2<br />

θ<br />

τ2<br />

<br />

− exp − θ<br />

<br />

τ1<br />

⎤<br />

⎦<br />

<br />

− exp − θ<br />

<br />

τ2<br />

⎤<br />

⎦<br />

1. Draw the zero-coupon yield curve associated with this set of parameters.<br />

2. We consider three bonds with the following features. Coupon frequency is<br />

annual.<br />

Maturity Coupon<br />

(years) (%)<br />

Bond 1 3 4<br />

Bond 2 7 5<br />

Bond 3 15 6<br />

Compute the price <strong>and</strong> the level, slope <strong>and</strong> curvature $durations of each bond.<br />

Compute also the same $durations for a portfolio with 100 units of Bond 1, 200<br />

units of Bond 2 <strong>and</strong> 100 units of Bond 3.<br />

3. The parameters of the Nelson <strong>and</strong> Siegel Extended model change instantaneously<br />

<strong>to</strong> become<br />

β0 β1 β2 τ1 β3 τ2<br />

5.5% −1% 0.1% 5 2% 0.5<br />

(a) Draw the new zero-coupon yield curve.<br />

(b) Compute the new price of the bond portfolio <strong>and</strong> compare it with the value<br />

given by the following equation:<br />

New Estimated Price = Former Price + β0.D0,P + β1.D1,P<br />

+ β2.D2,P + β3.D3,P<br />

where βi is the change in value of parameter βi, <strong>and</strong>Di,P is the $duration<br />

of the bond portfolio associated with parameter βi.<br />

4. Same questions when the coupon frequency is semiannual.<br />

47