You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

38 Problems <strong>and</strong> <strong>Solutions</strong><br />

where DP is the portfolio duration, Di the duration of bond, i, <strong>and</strong>wi = Pi(y)<br />

P(y) is<br />

the weight of bond i in the portfolio P .<br />

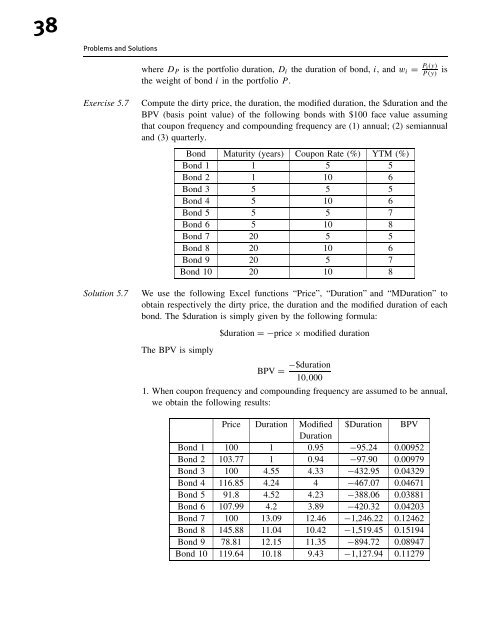

Exercise 5.7 Compute the dirty price, the duration, the modified duration, the $duration <strong>and</strong> the<br />

BPV (basis point value) of the following bonds with $100 face value assuming<br />

that coupon frequency <strong>and</strong> compounding frequency are (1) annual; (2) semiannual<br />

<strong>and</strong> (3) quarterly.<br />

Bond Maturity (years) Coupon Rate (%) YTM (%)<br />

Bond 1 1 5 5<br />

Bond 2 1 10 6<br />

Bond 3 5 5 5<br />

Bond 4 5 10 6<br />

Bond 5 5 5 7<br />

Bond 6 5 10 8<br />

Bond 7 20 5 5<br />

Bond 8 20 10 6<br />

Bond 9 20 5 7<br />

Bond 10 20 10 8<br />

Solution 5.7 We use the following Excel functions “Price”, “Duration” <strong>and</strong> “MDuration” <strong>to</strong><br />

obtain respectively the dirty price, the duration <strong>and</strong> the modified duration of each<br />

bond. The $duration is simply given by the following formula:<br />

The BPV is simply<br />

$duration =−price × modified duration<br />

BPV = −$duration<br />

10,000<br />

1. When coupon frequency <strong>and</strong> compounding frequency are assumed <strong>to</strong> be annual,<br />

we obtain the following results:<br />

Price Duration Modified $Duration BPV<br />

Duration<br />

Bond 1 100 1 0.95 −95.24 0.00952<br />

Bond 2 103.77 1 0.94 −97.90 0.00979<br />

Bond 3 100 4.55 4.33 −432.95 0.04329<br />

Bond 4 116.85 4.24 4 −467.07 0.04671<br />

Bond 5 91.8 4.52 4.23 −388.06 0.03881<br />

Bond 6 107.99 4.2 3.89 −420.32 0.04203<br />

Bond 7 100 13.09 12.46 −1,246.22 0.12462<br />

Bond 8 145.88 11.04 10.42 −1,519.45 0.15194<br />

Bond 9 78.81 12.15 11.35 −894.72 0.08947<br />

Bond 10 119.64 10.18 9.43 −1,127.94 0.11279