Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

52<br />

Problems <strong>and</strong> <strong>Solutions</strong><br />

7 CHAPTER 7—Problems<br />

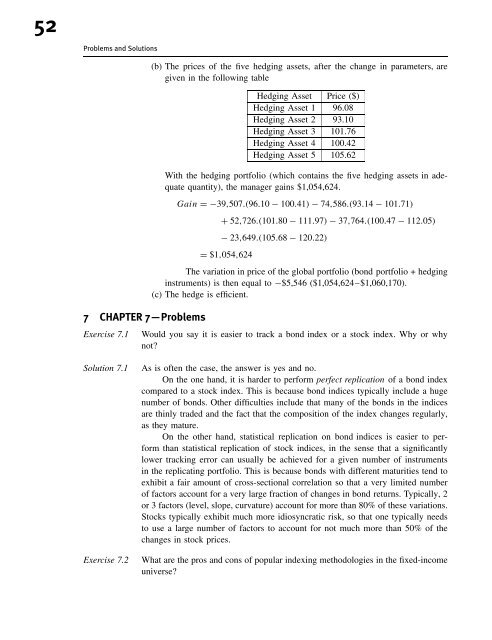

(b) The prices of the five hedging assets, after the change in parameters, are<br />

given in the following table<br />

Hedging Asset Price ($)<br />

Hedging Asset 1 96.08<br />

Hedging Asset 2 93.10<br />

Hedging Asset 3 101.76<br />

Hedging Asset 4 100.42<br />

Hedging Asset 5 105.62<br />

With the hedging portfolio (which contains the five hedging assets in adequate<br />

quantity), the manager gains $1,054,624.<br />

Gain =−39,507.(96.10 − 100.41) − 74,586.(93.14 − 101.71)<br />

+ 52,726.(101.80 − 111.97) − 37,764.(100.47 − 112.05)<br />

− 23,649.(105.68 − 120.22)<br />

= $1,054,624<br />

The variation in price of the global portfolio (bond portfolio + hedging<br />

instruments) is then equal <strong>to</strong> −$5,546 ($1,054,624–$1,060,170).<br />

(c) The hedge is efficient.<br />

Exercise 7.1 Would you say it is easier <strong>to</strong> track a bond index or a s<strong>to</strong>ck index. Why or why<br />

not?<br />

Solution 7.1 As is often the case, the answer is yes <strong>and</strong> no.<br />

On the one h<strong>and</strong>, it is harder <strong>to</strong> perform perfect replication of a bond index<br />

compared <strong>to</strong> a s<strong>to</strong>ck index. This is because bond indices typically include a huge<br />

number of bonds. Other difficulties include that many of the bonds in the indices<br />

are thinly traded <strong>and</strong> the fact that the composition of the index changes regularly,<br />

as they mature.<br />

On the other h<strong>and</strong>, statistical replication on bond indices is easier <strong>to</strong> perform<br />

than statistical replication of s<strong>to</strong>ck indices, in the sense that a significantly<br />

lower tracking error can usually be achieved for a given number of instruments<br />

in the replicating portfolio. This is because bonds with different maturities tend <strong>to</strong><br />

exhibit a fair amount of cross-sectional correlation so that a very limited number<br />

of fac<strong>to</strong>rs account for a very large fraction of changes in bond returns. Typically, 2<br />

or 3 fac<strong>to</strong>rs (level, slope, curvature) account for more than 80% of these variations.<br />

S<strong>to</strong>cks typically exhibit much more idiosyncratic risk, so that one typically needs<br />

<strong>to</strong> use a large number of fac<strong>to</strong>rs <strong>to</strong> account for not much more than 50% of the<br />

changes in s<strong>to</strong>ck prices.<br />

Exercise 7.2 What are the pros <strong>and</strong> cons of popular indexing methodologies in the fixed-income<br />

universe?