What Is the International Monetary Fund? - the JVI eCampus!

What Is the International Monetary Fund? - the JVI eCampus!

What Is the International Monetary Fund? - the JVI eCampus!

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

- 3 -<br />

In October 2000, <strong>the</strong> IMF approved an additional $52 million loan for<br />

Kenya to help it cope with <strong>the</strong> effects of a severe drought, as part of a<br />

three-year $193 million loan under <strong>the</strong> IMF's Poverty Reduction and<br />

Growth Facility, a concessional lending program for low-income<br />

countries.<br />

• provides <strong>the</strong> governments and central banks of its member countries with technical<br />

assistance and training in its areas of expertise. For example:<br />

Following <strong>the</strong> collapse of <strong>the</strong> Soviet Union, <strong>the</strong> IMF stepped in to help<br />

<strong>the</strong> Baltic states, Russia, and o<strong>the</strong>r former Soviet countries set up<br />

treasury systems for <strong>the</strong>ir central banks as part of <strong>the</strong> transition from<br />

centrally planned to market-based economic systems.<br />

As <strong>the</strong> only international agency whose mandated activities involve active dialogue with<br />

virtually every country on economic policies, <strong>the</strong> IMF is <strong>the</strong> principal forum for discussing<br />

not only national economic policies in a global context, but also issues important to <strong>the</strong><br />

stability of <strong>the</strong> international monetary and financial system. These include countries' choice<br />

of exchange rate arrangements, <strong>the</strong> avoidance of destabilizing international capital flows,<br />

and <strong>the</strong> design of internationally recognized standards and codes for policies and institutions.<br />

By working to streng<strong>the</strong>n <strong>the</strong> international financial system and to accelerate progress toward<br />

reducing poverty, as well as promoting sound economic policies among all its member<br />

countries, <strong>the</strong> IMF is helping to make globalization work for <strong>the</strong> benefit of all.<br />

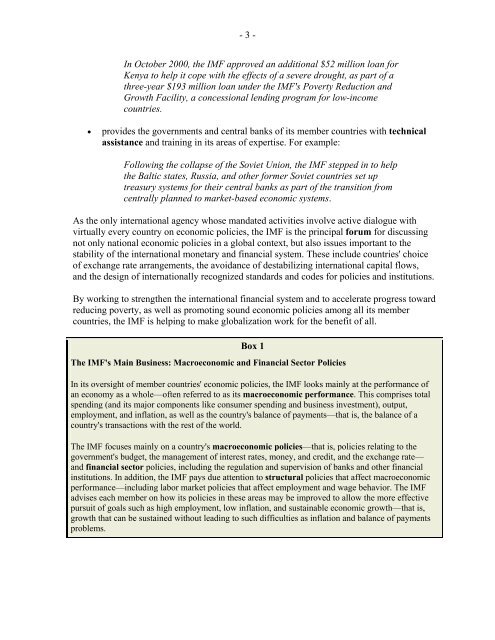

Box 1<br />

The IMF's Main Business: Macroeconomic and Financial Sector Policies<br />

In its oversight of member countries' economic policies, <strong>the</strong> IMF looks mainly at <strong>the</strong> performance of<br />

an economy as a whole—often referred to as its macroeconomic performance. This comprises total<br />

spending (and its major components like consumer spending and business investment), output,<br />

employment, and inflation, as well as <strong>the</strong> country's balance of payments—that is, <strong>the</strong> balance of a<br />

country's transactions with <strong>the</strong> rest of <strong>the</strong> world.<br />

The IMF focuses mainly on a country's macroeconomic policies—that is, policies relating to <strong>the</strong><br />

government's budget, <strong>the</strong> management of interest rates, money, and credit, and <strong>the</strong> exchange rate—<br />

and financial sector policies, including <strong>the</strong> regulation and supervision of banks and o<strong>the</strong>r financial<br />

institutions. In addition, <strong>the</strong> IMF pays due attention to structural policies that affect macroeconomic<br />

performance—including labor market policies that affect employment and wage behavior. The IMF<br />

advises each member on how its policies in <strong>the</strong>se areas may be improved to allow <strong>the</strong> more effective<br />

pursuit of goals such as high employment, low inflation, and sustainable economic growth—that is,<br />

growth that can be sustained without leading to such difficulties as inflation and balance of payments<br />

problems.