HÖGSKOLAN I BORÅS INTERNATIONELL REDOVISNING 7,5 ...

HÖGSKOLAN I BORÅS INTERNATIONELL REDOVISNING 7,5 ...

HÖGSKOLAN I BORÅS INTERNATIONELL REDOVISNING 7,5 ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

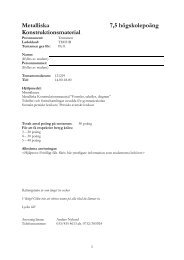

<strong>HÖGSKOLAN</strong> I <strong>BORÅS</strong><br />

<strong>INTERNATIONELL</strong> <strong>REDOVISNING</strong><br />

7,5 Högskolepoäng<br />

Provmoment: Tentamen<br />

Ladokkod: 22IR1D<br />

Tentamen ges för: Civilekonomprogrammet, Magisterutbildning i Företagsekonomi och fristående kurs.<br />

Namn: …………………………………………………………………………..<br />

Personnummer: ………………………………………………………………..<br />

Tentamensdatum: 2012-12-11<br />

Tid: 13.00 – 17:00<br />

Hjälpmedel: Miniräknare samt engelsk-svenskt lexikon.<br />

Totalt antal frågor på tentamen: 4 frågor.<br />

Totalt antal poäng på tentamen: 35 poäng.<br />

För att få respektive betyg krävs: För godkänt på tentamen krävs minst 17,5 poäng.<br />

Nästkommande tentamenstillfälle: Augusti 2013<br />

Rättningstiden är tre veckor.<br />

Viktigt! Glöm inte att skriva namn och personnummer på alla blad du lämnar in.<br />

Ansvarig lärare: Glenn Fihn (0704-942420)<br />

1 (11)

<strong>HÖGSKOLAN</strong> I <strong>BORÅS</strong> – (GF)<br />

Namn ……………………………………… Personnummer …………………………………<br />

Uppgift nr __ 1 __ (20 poäng)<br />

UPPGIFT: besvara nedanstående flervalsfrågor (bara ett kryss per fråga).<br />

1. International accounting can be defined in terms of which the following levels?<br />

A) Supranational organizations<br />

B) Company<br />

C) Country<br />

D) All of the above<br />

2. What is the term used to describe the possibility that a foreign currency will decrease in US $ value over the<br />

life of an asset such as Accounts Receivable?<br />

A) foreign exchange translation<br />

B) foreign exchange risk<br />

C) hedging<br />

D) foreign currency options<br />

3. As used in international accounting, a “hedge” is:<br />

A) a business transaction made to reduce the exposure of foreign exchange risk.<br />

B) the legal barrier between the various divisions of a multinational company.<br />

C) the loss in US $ resulting from a decline in the value of the US $ relative to foreign currencies.<br />

D) one form of foreign direct investment.<br />

4. A translation adjustment may be necessary when:<br />

A) notes to financial statements are converted from one language to another.<br />

B) foreign currency financial statements are converted to another currency.<br />

C) consolidated financial statements are prepared.<br />

D) hedging foreign currency.<br />

5. Why would a company want its stock cross-listed on the stock exchanges of several countries?<br />

A) To make financial reporting less burdensome for its accounting firm<br />

B) In order to use International Financial Reporting Standards<br />

C) To gain access to more financial resources than are available in its home country<br />

D) All of the above<br />

6. Which of the following is not a problem caused by accounting diversity?<br />

A) Lack of qualified international auditors<br />

B) Preparation of consolidated financial statements<br />

C) Access to foreign capital markets<br />

D) Comparability of financial statements<br />

7. In code law countries such as Germany, France, and Japan, tax law and accounting standards tend to be:<br />

A) unrelated.<br />

B) very different.<br />

C) similar.<br />

D) more confusing than those in the U.S.<br />

8. How are the concepts of professionalism, uniformity, conservatism, and secrecy classified in Gray's<br />

framework for accounting system development?<br />

A) Accounting values<br />

B) Accounting systems<br />

C) Institutional consequences<br />

D) Cultural dimensions<br />

2 (11)

<strong>HÖGSKOLAN</strong> I <strong>BORÅS</strong> – (GF)<br />

Namn ……………………………………… Personnummer …………………………………<br />

Uppgift nr __ 1 __ (fortsättning)<br />

9. The 1993 study by Doupnik and Salter found that a cluster of Latin American countries indicated that the<br />

similarity of their accounting systems was related to:<br />

A) a common currency.<br />

B) the effect of persistent inflation.<br />

C) the colonial influence of Spain.<br />

D) the colonial influence of the United States of America.<br />

10. In the Nobes classification of accounting systems, micro-based accounting systems are derived from:<br />

A) government models.<br />

B) business models.<br />

C) tax laws.<br />

D) code law.<br />

11. Which of the following statements is true about accounting convergence?<br />

A) Convergence is a synonym for harmonization.<br />

B) Convergence is the opposite of standardization.<br />

C) Convergence, unlike harmonization, takes place over a period of time.<br />

D) Convergence means developing high-quality standards in partnership with national standard-setters.<br />

12. The “Seventh Directive” issued by the European Commission is a statement to the European Union (EU)<br />

members concerning:<br />

A) adoption of the Euro as the currency used throughout the EU.<br />

B) consolidated financial statements.<br />

C) rules for valuation, financial statement disclosures, and financial statement format.<br />

D) authority of the European Commission to pass laws.<br />

13. Of the 16 members of the International Accounting Standards Board (IASB), how many work for the board on<br />

a full-time basis?<br />

A) 8<br />

B) 13<br />

C) 10<br />

D) 0<br />

14. What basis does the International Accounting Standards Board use in formulating its IFRS?<br />

A) Detailed rules to govern accounting practice<br />

B) A framework of accounting principles<br />

C) Typical tax laws of western nations<br />

D) Exceptions or unusual circumstances that require special attention<br />

15. What was the 2002 finding by the six largest public accounting firms regarding International Financial<br />

Reporting Standards?<br />

A) Of the countries surveyed, almost all planned to make their GAAP converge with IFRS.<br />

B) Very few of the countries studied planned to move their national accounting standards toward<br />

convergence with IFRS.<br />

C) There were almost as many convergence strategies as there were countries in the study.<br />

D) The countries that planned to make their GAAP converge with IFRS were predominantly western<br />

European nations.<br />

3 (11)

<strong>HÖGSKOLAN</strong> I <strong>BORÅS</strong> – (GF)<br />

Namn ……………………………………… Personnummer …………………………………<br />

Uppgift nr __ 1 __ (fortsättning)<br />

16. Which of the following inventory valuation methods commonly used in the U.S. is NOT allowed under IAS 2<br />

(Inventories)?<br />

A) LIFO<br />

B) FIFO<br />

C) weighted average<br />

D) retail inventory method<br />

17. What is the basis for choosing depreciation methods for fixed assets under IAS 16 (Property, Plant, &<br />

Equipment)?<br />

A) Tax minimization<br />

B) Profit maximization<br />

C) Useful life of the fixed asset<br />

D) Pattern of economic benefits to be derived from the asset<br />

18. IASB standards address related party transactions. According to these standards, which of the following is<br />

considered a “related party?”<br />

A) parent companies<br />

B) subsidiary companies<br />

C) key members of management<br />

D) All of the above could be related parties.<br />

19. What is one major difference between IFRS and U.S. GAAP relative to discontinued operations?<br />

A) U.S. GAAP requires that the after-tax gain or loss from operations and the after-tax gain or loss on asset<br />

disposal be shown as a combined item.<br />

B) U.S. GAAP requires the above components to be shown separately.<br />

C) IFRS requires that the after-tax gain or loss from operations and the after-tax gain or loss on asset<br />

disposal be shown separately.<br />

D) IFRS requires no separate disclosure for discontinued operations.<br />

20. Under IAS 16 (Property, Plant, and Equipment), subsequent revaluation decreases are:<br />

A) never recognized.<br />

B) credited to a revaluation surplus account.<br />

C) recognized as an expense on the Income Statement.<br />

D) first recognized as a reduction in any related revaluation surplus.<br />

21. The term “provision” as it is used in IAS 37, is most closely related to what term in U.S. GAAP?<br />

A) Contingent liability, where the outflow of resources is “remote.”<br />

B) Contingent liability, where the outflow of resources is “probable.”<br />

C) Current liability, where the outflow is difficult to measure.<br />

D) Reserve for bad debt, where the amount recoverable is “uncertain.”<br />

22. Which of the following represents a difference in the classification of current liabilities between IFRS and<br />

U.S. GAAP?<br />

A) refinanced short-term debt<br />

B) amounts payable on demand due to violation of debt covenants<br />

C) bank overdrafts<br />

D) all of the above<br />

4 (11)

<strong>HÖGSKOLAN</strong> I <strong>BORÅS</strong> – (GF)<br />

Namn ……………………………………… Personnummer …………………………………<br />

Uppgift nr __ 1 __ (fortsättning)<br />

23. Under both IFRS and U.S. GAAP, in an equity-settled share-based payment transaction, how are such<br />

payments to non-employees measured?<br />

A) at the cost of the goods or services received<br />

B) Both standards are silent as to the treatment of non-employees.<br />

C) always the fair value of the equity instrument<br />

D) at the fair value of goods or services received, if a reliable determination is available—otherwise, the fair<br />

value of the equity instrument<br />

24. Under IFRS 2, with respect to choice-of-settlement share-based payments, if it is the entity that has the right<br />

to choose between equity settlement and cash settlement, when must the entity choose the cash settlement?<br />

A) if the supplier provides services<br />

B) if the supplier provides goods<br />

C) if the entity has a present obligation to settle in cash<br />

D) The entity always has the option to choose either method.<br />

25. Under IAS 18, when it is probable that the economic benefits of interest, royalties, and dividends will flow to<br />

the enterprise and can be measured reliably, how should revenue be recognized?<br />

A) Interest income shall be recognized based on an effective yield basis.<br />

B) Royalties are recognized on an accrual basis with reference to the terms of the agreement.<br />

C) Dividends are recognized when the shareholders’ right to receive payment is established.<br />

D) All of the above govern revenue recognition under these circumstances.<br />

26. The number of U.S. dollars ($) today to buy one U.K. pound (£) six months from now is called:<br />

A) the spot rate<br />

B) the exact rate<br />

C) the forward rate<br />

D) the prime rate<br />

27. What has occurred when one company purchases the right to buy a foreign currency some time in the future at<br />

an exchange rate quoted today?<br />

A) The company has acquired a call option.<br />

B) The company has entered a forward contract.<br />

C) The currency has appreciated relative to the dollar.<br />

D) The company has acquired a put option.<br />

28. What is a “strike price?”<br />

A) the exchange rate that is used to buy a foreign currency today<br />

B) the price that will be paid for goods in a forward contract<br />

C) the exchange rate that will be used if a foreign currency option is executed<br />

D) the difference between the wholesale rate and the retail rate for foreign currency exchange<br />

29. What is foreign exchange risk exposure?<br />

A) the possibility of a loss because of changes in the value of a foreign currency<br />

B) losses caused by paying for purchased goods in a foreign currency<br />

C) losses caused by receiving payment in a foreign currency for goods sold<br />

D) All of the above<br />

5 (11)

<strong>HÖGSKOLAN</strong> I <strong>BORÅS</strong> – (GF)<br />

Namn ……………………………………… Personnummer …………………………………<br />

Uppgift nr __ 1 __ (fortsättning)<br />

30. Why must the two-transaction approach be used for recording foreign currency transactions under U.S.<br />

GAAP?<br />

A) The two-transaction approach is required under IFRS.<br />

B) U.S. GAAP requires conservatism in financial reporting.<br />

C) All other methods are excessively complicated to use and therefore obscure the essence of the transaction.<br />

D) Management made two decisions: one to sell and another to extend credit in a foreign currency.<br />

31. Homeko, Inc. is located in the U.S., but it has subsidiaries in Germany. When the euro appreciates relative to<br />

the U.S. dollar, what is the direction of the translation adjustment to consolidate Homeko's financial<br />

statements?<br />

A) When there is net asset exposure, the translation adjustment will be positive.<br />

B) When there is net liability exposure, the translation adjustment will be positive.<br />

C) The direction of the adjustment is indeterminate.<br />

D) There will be no adjustment necessary unless the difference is realized.<br />

32. Essco Ltd, a foreign subsidiary of Peako Corp., has written down its inventory to current market value under a<br />

“lower of cost or market” rule. When consolidating Essco's balance sheet into Peako's balance sheet, what<br />

exchange rate should be used for the inventory under the temporal method?<br />

A) historical rate<br />

B) current rate<br />

C) average rate<br />

D) cannot be determined with the information given<br />

33. When would the balance sheet exposure arising from the current rate method become realized?<br />

A) It is realized once the financial statements of the subsidiary and the parent are consolidated.<br />

B) It is realized any time the historical exchange rate is different from the spot rate at the balance sheet date.<br />

C) It is realized when the subsidiary is sold at book value and the proceeds are converted to parent company<br />

currency.<br />

D) It can never be realized because it is only the result of the choice of accounting methods and does not<br />

reflect real exposure.<br />

34. Under the current rate method of translating foreign currency financial statements, what exchange rate should<br />

be used for cost of goods sold?<br />

A) spot rate at the end of the year<br />

B) average rate during the year<br />

C) spot rate mid-year<br />

D) There is no single rate because beginning and ending inventory must be converted at different exchange<br />

rates than purchases.<br />

35. Which of the following is a non-derivative hedging instrument?<br />

A) forward contract on foreign currency<br />

B) foreign currency call option<br />

C) foreign currency loan<br />

D) foreign currency put option<br />

36. Which of the following is a reason for analyzing the financial statements of foreign corporations?<br />

A) making credit decisions about foreign customers<br />

B) evaluating international business combinations<br />

C) diversifying an investment portfolio<br />

D) All of the above are reasons for analyzing foreign financial statements.<br />

6 (11)

<strong>HÖGSKOLAN</strong> I <strong>BORÅS</strong> – (GF)<br />

Namn ……………………………………… Personnummer …………………………………<br />

Uppgift nr __ 1 __ (fortsättning)<br />

37. How should currency translation be done in order to appropriately compare a financial statement presented in<br />

Japanese yen to a financial statement presented in Chinese yuan?<br />

A) The temporal method should be used.<br />

B) The historical exchange rates should be used convert financial statement amounts.<br />

C) All amounts should be converted at the current exchange rate.<br />

D) Current year statements should be converted at the current exchange rate and prior year statements should<br />

be converted at prior year exchange rate.<br />

38. What is the best short-term solution to alleviate problems of financial statement analysis arising from<br />

international differences in accounting terminology?<br />

A) Require all countries to conform to IASB standards.<br />

B) Create standard financial statement terminology for all companies around the world.<br />

C) Analysts should carefully read the notes to financial statements and learn about the business environments<br />

of countries they analyze.<br />

D) Convert all financial statements into English.<br />

39. What is OIBD?<br />

A) This is the Organization of International Boards of Directors, which is attempting to harmonize<br />

accounting standards.<br />

B) It stands for “operating income before depreciation,” which some analysts use to remove the effect of<br />

international accounting standard diversity.<br />

C) It is the Organization of International Bond Dealers, whose financial analysts developed EBITDA.<br />

D) None of the above.<br />

40. Which of the following is most likely to affect an analyst's ability to make meaningful comparisons of<br />

financial statement ratios for companies in different countries?<br />

A) differences in currency<br />

B) language differences<br />

C) varying business traditions<br />

D) mathematical degrees of magnitude<br />

7 (11)

<strong>HÖGSKOLAN</strong> I <strong>BORÅS</strong> – (HP)<br />

Namn ……………………………………… Personnummer …………………………………<br />

Uppgift nr __ 2 __ (5 poäng)<br />

(Revaluation by replacement cost – IAS 16)<br />

A company purchased an item of plant for 200 000 SEK on 1 January 2001. The plant was depreciated on a<br />

strait-line basis over estimated life at 10 years. On 1 January 2003 the entity decided to revaluate its plan.<br />

No fair value was available for the item of plant that had been purchased for 200 000 kr. The replacement<br />

cost of the plant at 1 January 2003 was 300 000 kr.<br />

(a) What is the carrying value of the plant immediately before the revaluation (1 p);<br />

(b) What is the carrying value of the plant after the revaluation (1 p);<br />

(c) Suppose that the asset, which was revalued in the end of second period, is sold in 2007 for 60 000.<br />

Record the transactions and discuss about the elimination of the revaluation reserve. (3 p)<br />

8 (11)

<strong>HÖGSKOLAN</strong> I <strong>BORÅS</strong> – (HP)<br />

Namn ……………………………………… Personnummer …………………………………<br />

Uppgift nr __ 3 __ (5 poäng)<br />

The (Swedish) company Y prepares its financial statements in accordance with IFRS. The company seeks a listing on<br />

a US stock exchange. The company needs a guide for reconciliation in restating the financial statements from IFRSbased<br />

interpretation to the US GAAP. For the application of reconciliation we need to look up the general ledger for<br />

the accounting period and debiting and crediting various accounts. The balance sheet and income statement for the<br />

latest financial period are presented below.<br />

Borrowing costs:<br />

IAS 23: According to the standard the borrowing costs for putting the asset should be capitalized and increased the<br />

initial value of the assets. The Swedish company expensed the borrowing costs.<br />

US-GAAP: It should be capitalized (not expensed)<br />

Problem: In the previous year an asset was bought. The useful life is 5 years. The current interest expense (before the<br />

asset was used in production) is 25 and the previous year was 75 millions.<br />

Your task is to adjust the accounts and correct the balance respectively income sheets which are attached to this<br />

question (5 p).<br />

9 (11)

<strong>HÖGSKOLAN</strong> I <strong>BORÅS</strong> – (HP)<br />

Namn ……………………………………… Personnummer …………………………………<br />

Uppgift nr __ 3 __ (fortsättning)<br />

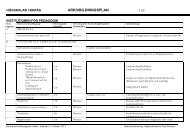

Balance Sheet (Under IFRS),<br />

December 31, 2004<br />

Current assets:<br />

Cash and bank<br />

Accounts receivable<br />

Inventories<br />

Total current assets<br />

Current liabilities:<br />

Bank overdraft<br />

Accounts payable<br />

Accruals and provisions<br />

Total current liabilities<br />

Net current assets<br />

Property, plant and equipment<br />

Accumulated depreciation<br />

Intangible assets<br />

Accumulated amortization<br />

Long-terms loan<br />

Share-holder equity<br />

Equity capital<br />

Retained earnings<br />

Revaluation reserve<br />

Income sheet<br />

Ended December 31, 2004<br />

Sale<br />

Less:Cost of sale<br />

Gross profit<br />

Distribution costs<br />

Adm. costs<br />

Operating expenses:<br />

Depreciation<br />

Amortization<br />

Staff costs<br />

Other operating expenses<br />

Total distribution<br />

Income from operation<br />

Interest expense<br />

Interest income<br />

Net income<br />

500<br />

7 500<br />

3 500<br />

11 500<br />

1 000<br />

5 000<br />

4 000<br />

10 000<br />

15 500<br />

9 000<br />

3 000<br />

1 000<br />

3 000<br />

4 000<br />

2 000<br />

1 000<br />

Debit Credit US-GAAP<br />

IFRS Debit Credit US-GAAP<br />

27,000<br />

14,000<br />

13,000<br />

5 000<br />

1 500<br />

1 000<br />

1 000<br />

1 500<br />

1 500<br />

11 500<br />

1 500<br />

700<br />

200<br />

1 000<br />

10 (11)<br />

27 000<br />

14 000<br />

13 000<br />

5 000<br />

1 500

<strong>HÖGSKOLAN</strong> I <strong>BORÅS</strong> – (GF)<br />

Namn ……………………………………… Personnummer …………………………………<br />

Uppgift nr __ 4 __ (5 poäng)<br />

Aktiebolaget AB MB bildar dotterbolaget AB DB i Tyskland den 1/1 år 1 och satsar 400 Euro (4 000 SEK) i<br />

det nybildade bolaget. Omedelbart vid bildandet köper AB DB in varor till lagret för 200 Euro. I övrigt<br />

gäller följande för AB DB:<br />

(a) Försäljning och samtliga kostnader uppstod jämnt fördelat under räkenskapsåret.<br />

(b) Varuinköpen uppstod jämnt fördelade under räkenskapsåret.<br />

(c) Inventarierna anskaffades vid en tidpunkt då valutakursen var 10,25 SEK/Euro.<br />

(d) Utdelningen fastställdes i mitten av december år 1 när valutakursen var 10,75 SEK/Euro.<br />

(e) Lagret vid årets slut inköptes i mitten av december år 1 när valutakursen var 10,75 SEK/Euro.<br />

(f) Det långfristiga lånet togs när valutakursen var 10,25 SEK/Euro.<br />

UPPGIFT: Räkna om balansräkningar och resultaträkning från Euro till SEK med hjälp av ”The<br />

Current Rate Method”.<br />

Valutakurser (SEK/EURO)<br />

Januari 1 År 1 10,00 SEK/Euro<br />

December 31 År 1 11,00 SEK/Euro<br />

Genomsnittlig valutakurs År 1 10,50 SEK/Euro<br />

Genomsnittlig valutakurs December År 1 10,75 SEK/Euro<br />

Valutakurs vid fastställandet av utdelningen År 1 10,75 SEK/Euro<br />

Valutakurs vid anskaffandet av inventarier År 1 10,25 SEK/Euro<br />

Valutakurs vid långfristig upplåning År 1 10,25 SEK/Euro<br />

Balansräkning<br />

BR (euro) valuta- BR (SEK) BR (euro) valuta- BR (SEK))<br />

1/1 ÅR 1 kurs 1/1 ÅR 1 31/12 ÅR 1 kurs 31/12 ÅR 1<br />

Bank 200 640<br />

Kundfordringar 300<br />

Lager 200 260<br />

Inventarier 800<br />

Ackumulerade värdeminskningar -80<br />

Summa tillgångar 400 1 920<br />

Leverantörsskulder 240<br />

Långfristiga skulder 1 200<br />

Aktiekapital 400 400<br />

Balanserad vinst 80<br />

Ackumulerade kursdifferenser<br />

Summa skulder och eget kapital 400 1 920<br />

Resultaträkning Balanserad vinst<br />

RR (euro) valuta- RR (SEK) Euro valuta- SEK<br />

ÅR 1 kurs ÅR 1 kurs<br />

Försäljning 3 000 Balanserad vinst (1/1 år 1) 0<br />

Kostnader: Årsresultat 120<br />

Kostnad sålda varor -2 400 Utdelningar -40<br />

Löner -300 Balanserad vinst (31/12 år 1) 80<br />

Avskrivningar -80<br />

Räntekostnader -60<br />

Resultat före skatter 160<br />

Skatter -40<br />

Årsresultat 120<br />

11 (11)