Who benefits from the leverage in LBOs? - Said Business School ...

Who benefits from the leverage in LBOs? - Said Business School ...

Who benefits from the leverage in LBOs? - Said Business School ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

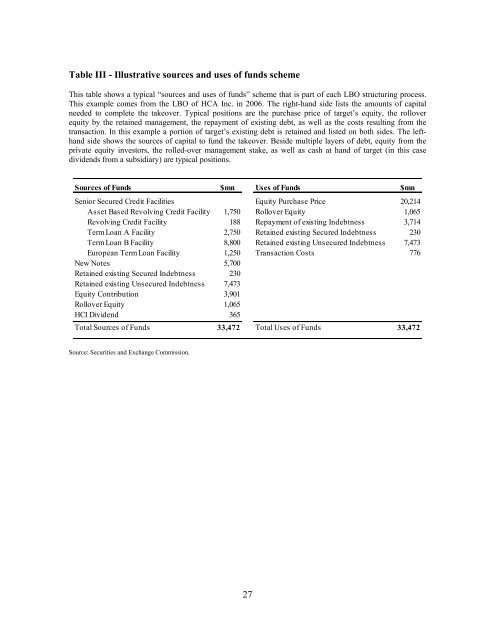

Table III - Illustrative sources and uses of funds scheme<br />

This table shows a typical “sources and uses of funds” scheme that is part of each LBO structur<strong>in</strong>g process.<br />

This example comes <strong>from</strong> <strong>the</strong> LBO of HCA Inc. <strong>in</strong> 2006. The right-hand side lists <strong>the</strong> amounts of capital<br />

needed to complete <strong>the</strong> takeover. Typical positions are <strong>the</strong> purchase price of target’s equity, <strong>the</strong> rollover<br />

equity by <strong>the</strong> reta<strong>in</strong>ed management, <strong>the</strong> repayment of exist<strong>in</strong>g debt, as well as <strong>the</strong> costs result<strong>in</strong>g <strong>from</strong> <strong>the</strong><br />

transaction. In this example a portion of target’s exist<strong>in</strong>g debt is reta<strong>in</strong>ed and listed on both sides. The lefthand<br />

side shows <strong>the</strong> sources of capital to fund <strong>the</strong> takeover. Beside multiple layers of debt, equity <strong>from</strong> <strong>the</strong><br />

private equity <strong>in</strong>vestors, <strong>the</strong> rolled-over management stake, as well as cash at hand of target (<strong>in</strong> this case<br />

dividends <strong>from</strong> a subsidiary) are typical positions.<br />

Sources of Funds $mn Uses of Funds $mn<br />

Senior Secured Credit Facilities Equity Purchase Price 20,214<br />

Asset Based Revolv<strong>in</strong>g Credit Facility 1,750 Rollover Equity 1,065<br />

Revolv<strong>in</strong>g Credit Facility 188 Repayment of exist<strong>in</strong>g Indebtness 3,714<br />

Term Loan A Facility 2,750 Reta<strong>in</strong>ed exist<strong>in</strong>g Secured Indebtness 230<br />

Term Loan B Facility 8,800 Reta<strong>in</strong>ed exist<strong>in</strong>g Unsecured Indebtness 7,473<br />

European Term Loan Facility 1,250 Transaction Costs 776<br />

New Notes 5,700<br />

Reta<strong>in</strong>ed exist<strong>in</strong>g Secured Indebtness 230<br />

Reta<strong>in</strong>ed exist<strong>in</strong>g Unsecured Indebtness 7,473<br />

Equity Contribution 3,901<br />

Rollover Equity 1,065<br />

HCI Dividend 365<br />

Total Sources of Funds 33,472 Total Uses of Funds 33,472<br />

Source: Securities and Exchange Commission.<br />

27