Who benefits from the leverage in LBOs? - Said Business School ...

Who benefits from the leverage in LBOs? - Said Business School ...

Who benefits from the leverage in LBOs? - Said Business School ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

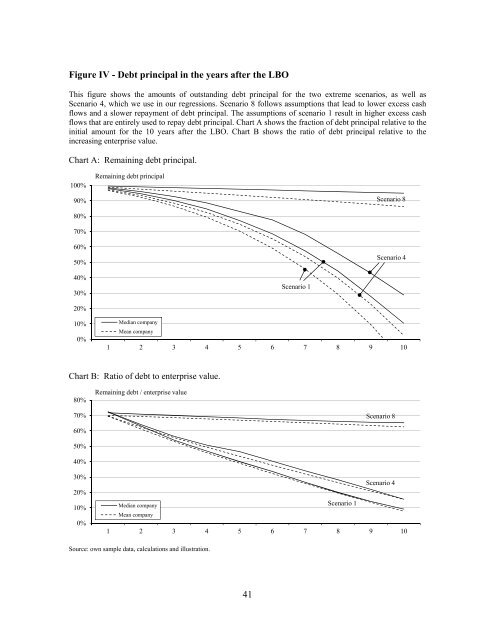

Figure IV - Debt pr<strong>in</strong>cipal <strong>in</strong> <strong>the</strong> years after <strong>the</strong> LBO<br />

This figure shows <strong>the</strong> amounts of outstand<strong>in</strong>g debt pr<strong>in</strong>cipal for <strong>the</strong> two extreme scenarios, as well as<br />

Scenario 4, which we use <strong>in</strong> our regressions. Scenario 8 follows assumptions that lead to lower excess cash<br />

flows and a slower repayment of debt pr<strong>in</strong>cipal. The assumptions of scenario 1 result <strong>in</strong> higher excess cash<br />

flows that are entirely used to repay debt pr<strong>in</strong>cipal. Chart A shows <strong>the</strong> fraction of debt pr<strong>in</strong>cipal relative to <strong>the</strong><br />

<strong>in</strong>itial amount for <strong>the</strong> 10 years after <strong>the</strong> LBO. Chart B shows <strong>the</strong> ratio of debt pr<strong>in</strong>cipal relative to <strong>the</strong><br />

<strong>in</strong>creas<strong>in</strong>g enterprise value.<br />

Chart A: Rema<strong>in</strong><strong>in</strong>g debt pr<strong>in</strong>cipal.<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Chart B: Ratio of debt to enterprise value.<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Rema<strong>in</strong><strong>in</strong>g debt pr<strong>in</strong>cipal<br />

Median company<br />

Mean company<br />

1 2 3 4 5 6 7 8 9 10<br />

Rema<strong>in</strong><strong>in</strong>g debt / enterprise value<br />

Median company<br />

Mean company<br />

Source: own sample data, calculations and illustration.<br />

41<br />

Scenario 1<br />

Scenario 1<br />

Scenario 8<br />

Scenario 4<br />

Scenario 8<br />

Scenario 4<br />

1 2 3 4 5 6 7 8 9 10