STANDARD LOAN PURCHASE AND SALE AGREEMENT

STANDARD LOAN PURCHASE AND SALE AGREEMENT

STANDARD LOAN PURCHASE AND SALE AGREEMENT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Deposits are refunded if the sale is not closed due to no fault of the Buyer. Deposit is forfeited if the sale is not closed<br />

within the designated time frames due to non performance by the Buyer.<br />

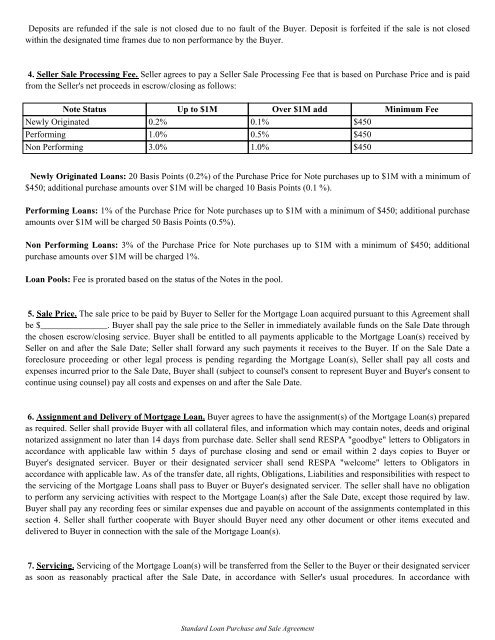

4. Seller Sale Processing Fee. Seller agrees to pay a Seller Sale Processing Fee that is based on Purchase Price and is paid<br />

from the Seller's net proceeds in escrow/closing as follows:<br />

Note Status Up to $1M Over $1M add Minimum Fee<br />

Newly Originated 0.2% 0.1% $450<br />

Performing 1.0% 0.5% $450<br />

Non Performing 3.0% 1.0% $450<br />

Newly Originated Loans: 20 Basis Points (0.2%) of the Purchase Price for Note purchases up to $1M with a minimum of<br />

$450; additional purchase amounts over $1M will be charged 10 Basis Points (0.1 %).<br />

Performing Loans: 1% of the Purchase Price for Note purchases up to $1M with a minimum of $450; additional purchase<br />

amounts over $1M will be charged 50 Basis Points (0.5%).<br />

Non Performing Loans: 3% of the Purchase Price for Note purchases up to $1M with a minimum of $450; additional<br />

purchase amounts over $1M will be charged 1%.<br />

Loan Pools: Fee is prorated based on the status of the Notes in the pool.<br />

5. Sale Price. The sale price to be paid by Buyer to Seller for the Mortgage Loan acquired pursuant to this Agreement shall<br />

be $_______________. Buyer shall pay the sale price to the Seller in immediately available funds on the Sale Date through<br />

the chosen escrow/closing service. Buyer shall be entitled to all payments applicable to the Mortgage Loan(s) received by<br />

Seller on and after the Sale Date; Seller shall forward any such payments it receives to the Buyer. If on the Sale Date a<br />

foreclosure proceeding or other legal process is pending regarding the Mortgage Loan(s), Seller shall pay all costs and<br />

expenses incurred prior to the Sale Date, Buyer shall (subject to counsel's consent to represent Buyer and Buyer's consent to<br />

continue using counsel) pay all costs and expenses on and after the Sale Date.<br />

6. Assignment and Delivery of Mortgage Loan. Buyer agrees to have the assignment(s) of the Mortgage Loan(s) prepared<br />

as required. Seller shall provide Buyer with all collateral files, and information which may contain notes, deeds and original<br />

notarized assignment no later than 14 days from purchase date. Seller shall send RESPA "goodbye" letters to Obligators in<br />

accordance with applicable law within 5 days of purchase closing and send or email within 2 days copies to Buyer or<br />

Buyer's designated servicer. Buyer or their designated servicer shall send RESPA "welcome" letters to Obligators in<br />

accordance with applicable law. As of the transfer date, all rights, Obligations, Liabilities and responsibilities with respect to<br />

the servicing of the Mortgage Loans shall pass to Buyer or Buyer's designated servicer. The seller shall have no obligation<br />

to perform any servicing activities with respect to the Mortgage Loan(s) after the Sale Date, except those required by law.<br />

Buyer shall pay any recording fees or similar expenses due and payable on account of the assignments contemplated in this<br />

section 4. Seller shall further cooperate with Buyer should Buyer need any other document or other items executed and<br />

delivered to Buyer in connection with the sale of the Mortgage Loan(s).<br />

7. Servicing. Servicing of the Mortgage Loan(s) will be transferred from the Seller to the Buyer or their designated servicer<br />

as soon as reasonably practical after the Sale Date, in accordance with Seller's usual procedures. In accordance with<br />

Standard Loan Purchase and Sale Agreement