I~II~IIIIIIIII~~IIIIIIIIIIIIII - FCI Exchange

I~II~IIIIIIIII~~IIIIIIIIIIIIII - FCI Exchange

I~II~IIIIIIIII~~IIIIIIIIIIIIII - FCI Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

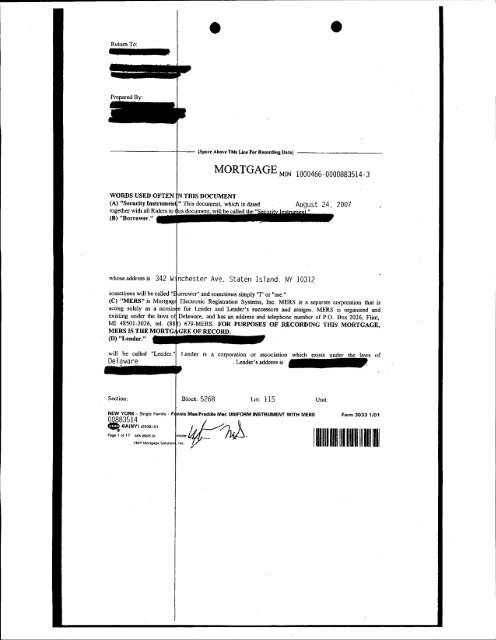

Return To:<br />

i<br />

•<br />

ISpn« Above Tbis Lllle For Recording Oalnj<br />

WORDS USED OFTEN N THIS DOCUMENT<br />

(A) "Security Instrumen "This document, which is dated<br />

together with all Riders to lis document will be called the "<br />

(D) "Borrower,"<br />

Lot 115<br />

Unit:<br />

•<br />

MORTGAGE MIN 1000466-0000883514-3<br />

whoseaddressis 342 W nchester Ave. Staten Island. NY 10312<br />

Block: 5268<br />

August 24. 2007<br />

sometimes will be called" orrower" and sometimes simply "I" or "me."<br />

(e) "MERS" i.~Mortgag Electronic Registration Systems, Inc. MERS is a separate corporation that is<br />

acting solely as a nomin for Lender and Lender's successors and assigns. MERS is organized and<br />

existing under the laws 0 Delaware, and has an address and telephone number of P.O. Box 2026, Flint,<br />

MI 48501.2026, leI. (88 ) 679-MERS. FOR PURPOSES OF RECORDING THIS MORTGAGE,<br />

MERS IS THE MORTG GEE OF RECORD,<br />

(D) "I,ender."<br />

will be called<br />

Delaware<br />

Section:<br />

corporation or association which exists under the laws of<br />

. Lender's address is<br />

NEW YORK. Single Family. F nnie Mae/Freddie Mil

• •<br />

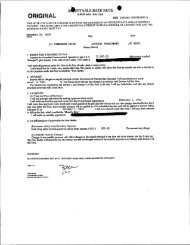

("~) "No/e." The note si ned by Borrow.er and dated August 24. 2007 ,will be called<br />

the "Note." The Note sho 'S thaI I owe Lender Thirty Three Thousand Eight l-lundred<br />

Seventeen Dollar ard 73/100<br />

Dollars (U.S. $ 33,817.73 )<br />

plus interest and other a lount~ that may be' payable. I have promised to pay this debt in Periodic Payments<br />

and to pay the debt in ful by September I, 2047<br />

(F) "Property," TIle pr perty thai is described below .in the section tilled "Description of the Property,"<br />

will be called the "Prope y."<br />

(G) "),oan," The "Loilll' means the debt evidenced by the Note, plus interest, any prepayment charges and<br />

late charges due under ~!.Note, and all sums due under this Security Instrument, plus interest.<br />

(Ill) "SUnts Secured," T e amounts described below UI the section titled "Borrower's Transfer to Lender of<br />

Rights in the Property" s metunes will be called the "Sums Secured."<br />

(I) "Riders." All Rider attached to this Sec.urity Instrument that are signed by Borrower will be called<br />

"Riders." The following iders are to be signed by Borrower {check box as applicable):<br />

o Adjustable Rate Ri r 0 Condomulium Rider 0 Second Home Rider<br />

o Balloon Rider 0 Planned Unit Development Rider 0 1-4 family Rider<br />

o VA Rider C] Biweekly Payment Rider IX] Other(s) [specify)<br />

LEGAL DESCRIPTION<br />

(J) "Applicable Law." II controllulg applicable federal, state and local statutes, regulations, ordinances<br />

and administrative rule and orders (that have the effect of law) as well as all applicable fmal,<br />

non.appe.alabJe, judicial 0 inions will be called "Applicable Law."<br />

(K) "Community' Asso iation Dues, Fees, and Assessments." 'All dues, fees, assessments and other<br />

charges that are impos d on Borruwer or the Property by a condomulium association, homeowners<br />

association or similar org nization will be called "Community Association Dues, Fees, and Assessments."<br />

(L) "Electronic Funds ransfer." "Electronic funds Transfer" means any transfer of money, other than<br />

by check, draft, or simi! r paper instrument, which is initiated through an electronic terminal, telephonic<br />

instrument, computer, 0 magnetic tape so as to order, instruct, or authorize a financial institution to debit<br />

or credit an account So e cOllunon examples of an Electronic Funds Transfer are point-of-sale transfers<br />

(where a card such as a assel or debil card is used at a merchant), automated. teller machine (or AIM)<br />

transactions, transfers inil ted by telephone, wire transfers, and automated clearinghouse transfers.<br />

(M) "Escrow Items." T se items that are described in Section 3 will be called "Escrow Items."<br />

(N) "Miscellaneous Pro eeds." "Miscellaneous Proceeds" means any compensation, settlement, award of<br />

damages, or proceeds pai by any third party (other than Insurance Proceeds, as defined in, and paid under<br />

Ihe coverage described j Section 5) for: (i) damage to, or destruction of~ the Property; (ii) Condemnation<br />

or other taking of all or ny part of the Property; (iii) conveyance in lieu of Condemnation or sale to avoid<br />

Condemnation; or (iv) isrepresentations of, or omissions as to, the value and/or condition of the<br />

Property. A taking of e Property by any govenunental authority by emUlent domain is known as<br />

"CondenUlation." .<br />

(0) "Mortgage In sura ce." "Mortgage Insurance" means insurance protecting Lender against the<br />

nonpayment of, or default on, the Loan.<br />

(P) "Periodic J!>ayment.' 11le regularly scheduled amount due for (i) principal and interest under the Note,<br />

and (ii) any amounts un,d $cctioll 3 wit! be called "Periodic Payment."<br />

(Q) "RESPA." "RESPA means the Real Estate Settlement Procedures Act (12 U.S.C. Section 2601 et<br />

seq.) and its implement g regulation, Regulation X (24 C.F.R. Part 3500), as tIley might be amended<br />

from time to time, or a additional or successor legislation or regulation that governs the same subject<br />

matter. As used Ul this ecurity Instrument, "RESPA" refers 10 at! requirements and reHtrictions that are<br />

itnposed in regard to a" derally related mortgage loan" even if the Loan does not qualify as a "federally<br />

related mortgage loan" un er RESP A.<br />

00883514<br />

.'GAINYllo50B).O'<br />

<br />

Page20f 11<br />

Ini,i.', I~ fitll--<br />

;; Form 3033 1/01

• •<br />

BORROWER'S TRANS ER TO LENDER OF RIGHTS IN THE PROPERTY<br />

I mortgage, grant convey the Property to MERS (solely as nominee for Lender and Lender's<br />

successors in intere.st) and its successors in interest subject 10 the terms of this Security Instrument. This<br />

means that, by signing th s Security Instrument, I am giving Lender those rights that are stated in this<br />

Security Instrument and al 0 those rights that Applicable Law gives to lenders who hold mortgages on real<br />

property. I anl giving Len er these rights to protect Lender from possible loss'es that might result if I fail<br />

10:<br />

(A) Pay all the amoUllts th t lowe Lender as stated in the Note including, but not linJiled to, all renewals,<br />

extensions and modifieatio s of the Note;<br />

(B) Pay, with interest, an amounts that Lender spends under this Security Instrument 10 protect the value<br />

of the Property and Lender rights in the Property; and<br />

(C) Keep all of my other pr mises aud agreements under this Security Instrument and the Note.<br />

r understand and agr that MERS holds only legal title to the rights .granted by me in this Security<br />

Instrument, but, jf necess to comply with law or custom, MERS (a. nominee for Lender and Lender's<br />

successors and assigns) has he right:<br />

(A) to exercise any or aU f those rights, including, but not linJited to, the right 10 foreclose and sell the<br />

Property; and<br />

(B) to take any action re uired of Lender including, but not JinJit.ed to, releasing and cimceling this<br />

Security Instrument.<br />

DESCRIPTION OF THE<br />

I give MERS (solely<br />

described ill (A) through (<br />

(A) The Property which is I<br />

Staten Island<br />

This Property is in Ri ehm nd<br />

description:<br />

SEE ATTACHED LEGAL DESCRIPTION<br />

ROPERTY<br />

. nominee for Lender and Lender's successors in interest) rights in the Property<br />

below:<br />

caledat 342 Winchester Ave<br />

[Street]<br />

[Cily, Townor Village],New York 10312 {ZipCode].<br />

County. il has the following legal<br />

(B) AU buildings' and othe improvements that are loc-aled on the Property described in subsection (A) of<br />

this section; .<br />

(C) All rights in other pro erty that I have as owner of the Property described in subsection (A) of this<br />

section. These rights are kn wn as "easements and appurtenances attached to the Property;"<br />

(D) All rights thaI I have' tIle land which lies in the streets or roads in front of, or next to, the Property<br />

described in subsection (A) ,f this section;<br />

00883514<br />

COll1l.tumuntioJlh of Seilledlllle 11 11<br />

Title No: RT-244092 .<br />

AlLlL THAT CIER AHNPLOT, PIECE OR PARCEL OF LAND, situate, lying and being in the<br />

Borough of Staten Island, C unty of Richmond, City and State of New York, known and designated as Lots<br />

NO.8, 9 and 10 on a map e titled "Heights Section, Great Kills Beach, situated at Great Kills" surveyed by<br />

H.S. Thompson and attache to L. 254 cp 195 in the Richmond County Clerk's Office which said lots are<br />

bounded and described as fa lows:<br />

BEGINNING at a point in the westerly side of Winchester Avenue distant 200 feet southerly from<br />

the corner fonned by the in rsection of the westerly side of Winchester Avenue with the southerly side of<br />

Sycamore Street; .<br />

Avenue;<br />

RUNNING THE CE south 53 degrees 02 minutes 39 seconds west 73.34 feet to a point;<br />

THENCE south 3 degrees 56 minutes 16 seconds east 70.04 feet to a point;<br />

THENCE north 5 degrees 02 minutes 39 seconds east 75.80 feet to the westerly side of Winchester<br />

THENCE along t e westerly side of Winchester Avenue north 36 degrees 57 minutes 21 seconds<br />

west 70 feet to the point or lace of BEGINNING.<br />

:..-.'

~--------------------------------_._----- -------<br />

MIN:.<br />

WORDS USED OFTEN IN Tl IS DOCUMENT<br />

(A) "Agreement." This document, which is dated<br />

this document will be called the 'Agreement."<br />

(B) "Borrower."<br />

(C) "Lender." Equity<br />

will be called "Lender" and SOH<br />

Jersey 08053<br />

(Space Above This Line For Recording Data]<br />

CO SOLIDATION, EXTENSION, AND<br />

ODIFICATION AGREEMENT<br />

ne Mortgage Company<br />

(Page I o/9pages)<br />

August 24, 2007<br />

, and exhibits and riders attached to<br />

will be called "Borrower" and somelimes "I" or "me." Borrower's address is<br />

342 Winchester Avenue, 5t ten Island, NY 10312<br />

times "Note Holder." Lender is a corporation or associalion w.hich exists under the laws of<br />

. Lender's address is<br />

(D) "Mortgages." The mortgages, deeds of trust, or other security instruments and any additional security<br />

instruments and related agree! ents (such as assignments, extensions, modifications, or cOllsolidiltious of mortgilges)<br />

identified in Exhibit A to this A rccment will be called the "Mortgages."<br />

(E) "MERS" is Mortga e Electronic Registration Systems, Inc_ MERS is a separate corporation that is acting solely<br />

as a nominee for Lender and Lc der's successors and assigns. MERS is organized and existing under the laws of Delaware,<br />

and has an address and tclephon number of P.O. Box 2026, Flint, MI 48501-2026, tel. (888) 679-MERS. FOR PURPOSES<br />

OF RECORDING THIS AGR EMRNT, MERS IS THE MORTGAGEE OJ.

(H) "PrOllerty." Ibe p .perty which is described in the Morlgage(s) and in Exhibit B (Property Description) to this<br />

Agreement, will be called the "P operty:' The Property is located at:<br />

Staten Island<br />

ICityl<br />

I promise and I agree wit Lender as follows:<br />

III. AGREEMENT TO C NGE TERMS OF THE CONSOLIDATED NOTE<br />

Lender and I agree that he terms of the Notes are changed and restated to be the tenns of the "Consolidated Note"<br />

which is attached to this Agrecllent as Exhibit C. The Consolidated Note contains the terms of payment for the amounts that<br />

1owe to Note Holder. I agree t pay the amounts due under the Notcs in accordance with the tem1S of the Consolidated Note.<br />

The Consolidated Note will sup rsede all terms, covenants, and provisions of the Notes.<br />

V. NOSET-OFF,DEFEN ES<br />

I agree that I have no rig 1t of set-off or count.erclaim, or any defense to the obligations of the Consolidated Note or the<br />

Consolidated Mortgage.<br />

342 Winchester Avenue<br />

(Street]<br />

Richmond<br />

(Coonlyl<br />

(Page 2 of 9l'ages)<br />

New York 10312<br />

(State and Zip CodeJ<br />

I. BORROWER'S AGRE MENT ABOUT OBLIGATION UNDER THE NOTES AND MORTGAGES<br />

I agree to take over all of the obligations under the Notes and Mortgages as consolidated and modified by this<br />

Agreement as Bonower. This L1 eans that I will keep all of the promises and agreements made in the Notes and Mortgages<br />

even if some other person made those promises and agreements before me. The total unpaid principal balance of the Notes is<br />

U.S. $390,500.00 of this amount, U.s. $33,817.73 was advanced to me (or for my<br />

account) immediately prior to ths consolidation.<br />

U. AGREEMENT TO CO BINE NOTES AND MORTGAGES<br />

(A) By signing this Agl ement, Lender and I are combining into one set of rights and obligations all of the promises<br />

and agreements stated in the N es and Mortgages including any earlier agreements which combined, modified, or extended<br />

rights and obligations under ill of the Notcs and Mortgages. This means that all of Lender's rights in the Property are<br />

combined so that under the law ender has one mortgage and I have one loan obligation which I will pay as provided in this<br />

Agreement. This combining of otes and mortgages is known as a "Consolidation."<br />

(B) In the event that xhibil A indicates that all of the Notes and Mortgages have already been combined by a<br />

previous agreement, then Lend rand r agree to change the terms of Section II, paragraph (A) of this Agreement to the<br />

following:<br />

IV. AGREEMENT TO CI ANGE TERMS OF THE CONSOLIDATED MORTGAGE<br />

Lender and I agree that the tenus of the Mortgages are changed and restated to be the terms of the "Consolidated<br />

Mortgage" which is attached to this Agreement as Exhibit D. The Consolidated Mortgage secmes the Consolidated Note and<br />

will constitute in law a single Ii II upon the Property. I agree to be bound by the terms set forth in the Consolidated Mortgage<br />

which will supersede all terms, .ovenants, and provisions of the Mortgages.<br />

NEW YORK CONSOLIDATION, E 'n:NSION, AND MODIFICATION AGREEMENT-Single F~llIi1y-<br />

Fannie Mae!Fre(tdle Mac UNIFORI\o INSTRUMENT<br />

ITEM 7'331.2 (0401)-MERS<br />

Lender and I agre that all of the promises and agreemeJits stated in the Notes and Mortgages--including<br />

any earl. r agreements which combined, modified, or extended rights and obligations<br />

under any of the N tes and Mortgages--have been combined into one set of rigHts and obligations<br />

by an earlier agrec lent wbidl is referred to in Exhibit A.This means that all of the Lender's rights<br />

ill the Property hay already been combined so that under the Jaw Lender already has one mortgage<br />

and I have one loa 1 obligation which I will pay as provided in this Agreement. The combining of<br />

notes and mortgag is known as a "Consolidation." .<br />

Form 31721/01 (rev. 5101)<br />

GAEA Tl.ANO •<br />

ro Or~ef Cal., .800.530-93930 Fa>.:516.791-1131

VI. BORROWER'S INTE EST IN THE PROPERTY<br />

1 promise that I am the awful owner occupying the Property and that I have the right to consolidate, modify, lmd<br />

extend the Notes and Mortgage .<br />

VD. WRITTEN TERMINA ION OR CHANGE OF THIS AGREEMENT<br />

This Agreement may n t be terminated, changed, or amended except by a written agreement signed by the party<br />

whose rights or obligations are eing changed by that agreement.<br />

VIII. OBLIGATIONS OF B RROWERS AND OF PERSONS TAKING OVER BORROWER'S OR LENDER'S<br />

RIGHTS OR OBLlGA IONS<br />

If more than one person igns this Agreement as Borrower, each of us is fully and personally obligated to keep all of<br />

Borrower's promises and obli ations contained in this Agreement. The Note Holder Ulay enforce its rights under this<br />

Agreement against each of us in ividually or against all of us together.<br />

The temlS of the Consol dated Note and the Consolidated Mortgage may not allow any person to take over my rights<br />

or obligations under this Agree lcnt. Lender and I agree that if any person is permitted to take over my rights and obligations<br />

under this Agreement, that pers n will have all of my rights and will be obligated to keep all of my promist'.sand agreements<br />

made in this Agreement. Simil ly, any person who takes over Lender's rights or obligations under this Agreement will have<br />

all of Lenucr' s rights and will b obligated to keep all of Lender's agreements made in this ,\greement.<br />

IX. LIEN LAW<br />

Iwill receive all amoLlII lent to me by Lender subject to the trust fund provisions of Section 13 of the New York Lien<br />

Law. This means that I will: (A hold all amounts which Ireceive and which I have a right to receive from Lender under the<br />

Consolidated Note as a "trust md;" and (B) use those amounts to pay for "cost of improvement" (as defined in the New<br />

York Lien Law) before I use th m for any other purpose. The fact that I am holding those amounts as a "trust fund" means<br />

that for any building or other illprovement located on the Property Ihave a special responsibility under the law to use thc<br />

amount ill the manner described in this Section IX.<br />

x. TYPE OF PRO PERT<br />

Check box(es) as appliC' Ie.<br />

D This Agreement covers r al propet;typrincipally improved, or to be improved, by one or more structures containing, in<br />

the aggregate, not more an six.(6) residential dwelling units with each dwelling unit having its own separate cooking<br />

facilities.<br />

This Agreement covers r al property improved, or to be improved, by a one (1) or two (2) frunily dwelling.<br />

This Agreement does 110 cover real property improved as described above.<br />

NEW YORK CONSOLIDATION, E TENSION, AND MODIFICATION AGREEMENT-Single Family-.<br />

Fannie Mae/Freddie Mac UNIFORM INSTRUl\1ENT<br />

HEM 7133L3 (G401)-MERS<br />

(f'".~e 3 of 9pages)<br />

Form :H72 JlOI (rev. 5101)<br />

GAEATLAND ••<br />

fo Order C.all: 1.800.530-9393 0 fax. 616.791-1131

STATE OF<br />

COUNTY OF<br />

(s=Al)<br />

l$paC&IIw7lllsIJllol?or~tl _<br />

On the 24th day of August in the year2lJO~7before me the<br />

undersigJ1ed, a nolary po • in and fot' s:aid State, person.aJ)y appeared William 5eidenfa.den and<br />

eri te Seidenfa n petSOnally known to me or Proveell0 I7Ieon the ba$i$ of<br />

satisfacto!y evidence to tfle indhridUlll($1 Whose n3m$S are sutJ!scribed to tJIe Within instnJment and<br />

acl

MERS,<br />

By:<br />

STATE OF<br />

COUNTY OF<br />

• Lend and I agree to all of the above.<br />

ominee for<br />

.Lender<br />

.BorrowcT<br />

-Borrower<br />

(Spa"" Below This Line PrAd:lIowledgmentJ _<br />

On the 24th ayof August in the year2@Onbdore me the<br />

undersigned, a notary pub.ic I and for said State, personally appeared ••••••••••• ,<br />

. .. personalfy known to me or proved to me on the basis of<br />

satisfactory evidence to be th individual(s) whose names are subscribed to the within instrlJt'llent and<br />

acknowledged to me that the executed the same in their capacities and that by their signatures on the<br />

~nstrument, the individuals, 0 the person on behalf of Which the individuals acted, executed the<br />

Instrument.<br />

Notary Public<br />

My Commission Expires:<br />

(SEAl)<br />

STATE OF<br />

COUNTYOIF<br />

NEW YORK (:ONSOLIDATION,<br />

Fanm"M:l~M:ae 'UNIFORM<br />

(Spa~Below ThisLlneF?l' Ac:kDowI~tJ _<br />

Onthe 24th d yof August intheyear~OO!l7beforemethe<br />

undersigned, a notary public i and for said State, personally appeared Ross K. Hetlinger, AVP<br />

satisfactory evidence to be th<br />

.<br />

individual(s)<br />

t personally known to me or proved to me on the basis of<br />

whose 'names are subscribed to the within instrument and<br />

acknowledged to me that they xecuted the sam~ in their capacities and that by th~ir signatures on the<br />

instrument, the individuals, or the person on behalf of which the individuals acted, executed tbe<br />

il]stni,lllent. / j. ,1." "t<br />

.. -, "}' I ,., l t."/ I<br />

'll 'J J, .J. /f ., . (. l / i I'<br />

f/\.;jf-IU~L'J l,/'C:t{, i:..-L.<br />

Notary Public<br />

My Commission Expires:<br />

(SEAl)<br />

SION, AND MODIFlCA nON AGREEMENT-Si~le tamity-<br />

UI\1ENT<br />

F~nn 3172 1101 {rev. 5/01)<br />

G'AEATlAND iI<br />

To~rt:lp:,~s;ro.931l3 0 1'oX:616-7~.11:11

tt.<br />

(1) This Mortgage given by<br />

EXHlBIT A<br />

(List of Mortgages, Notes, and Agreements)<br />

and dated August 24, 007 in favor of Mortgage Electronic Registration Systems,Inc. (MERS), solely as nominee<br />

fur Lender and Lender's I';ucce,ors and assigns, securing the original principal amount of U.S. $ 33,817,73<br />

This Mortgage [is oft a Fanni MaelFre&lie Mac Security lilStrument and will be recorded together with this Agreement)<br />

K*)6X~Ij(~XXXX){)( , in the County of Richmond<br />

State of New York, at to be r corded simeltaneously herewith. .]<br />

[Strike and complete as app opriate.] At this date, the unpaid principal balance secured by this Mortgage is U.S.<br />

$33,817 .73 . [Strike if not applicahle.] This Mortgage secures a Note dated<br />

August24.2007X~~~~~~XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX~<br />

XXXXXXXXXXXXXXXXXXX XXXXXXXXXXXX~~~~~~XXXXXXXXXXXXXXXXXXXXXXxX<br />

~~~~~XXXXXXXXX XXXXXXX»~KXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX<br />

X~XXXXXXXXXXXXXXXXX XXXXXXXX~~X~XK~~~XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX<br />

XXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX}((Strike and complete as appropriate.]<br />

(2) This Mortgage given by iIIiam Seidenfaden and Marguerite Seidenfaden<br />

and dated July 25. 2005 in favor of MERS, as nominee for Somerset Investors Corp.<br />

securing the original principal mount of U.S, $ 364,000.00 dba Somerset Mortgage Bankers<br />

This Mortgage was recorded 0 September 30, 2005 , in the County<br />

of Richmond ,State of New York, at Document Number 75753<br />

. 1\[ this date, the unpaid principal balance secured by this<br />

Mortgage is U.S. $ 356,682.2 . [Strike if not applicable.] This Mortgage secures a Note dated<br />

July 25, 2005 xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx~<br />

xxxxxxxxxxxxxxxxxx XXXXXXXXXXXXXX~~~~~X~~~~~~XXXXXXXXXXXXXXXXXXXXxXX<br />

~X~~~M~XXXXXXXX XXXXXXXXXXXXX~KXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX~<br />

ooxxxxxxxxxxxxxxxxx XXXXXXXXXXXXX~~~~~~XXXXXXXXXXXXXXXXXxX~<br />

XXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXxxx[Strike and complete as appropriate.}.<br />

~X~~"~~~X XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX<br />

~~KXXXXXXXXXXX XXXXXXXXXXXXX~~~K~XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX~<br />

~~~~~K~~ ~~~~XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX<br />

~WX~XX~~X~~K XXXXXXXXXXXXXXXXXXX~KXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX~<br />

~M~XXXXXXXX XXXXXXXXX~~~X«~X~~XKXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX~<br />

XXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXX:' ~XblI)()4)Q)(X.X])I!~«¥iM~~XlXCCX~~koc(~~<br />

~X«Q[XX3(XXXXXX XXXXXXXXXXXXXX}(, [Strike if not applicable.} JQUXDCD6j(~~iUiX;X~~Xlmd{<br />

XXXXXXXXXXXXXXXXXX XXX~~~~~~~~~XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX}(X<br />

XXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXX~X~~~~~KXXXXXXXXXXXXX}(XXXXXXXXX<br />

~X~~~XXXXXXXX XXXXXXXXXXXXXX~XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX<br />

~~X}(XXXXXXXXXXXXXX XXXXXXXXXXXXX~~~~~XOOX~XXXXXXXXXXXXXXXXXXXXXXXXX}(XXXX<br />

XXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX~~«~~«~~~~<br />

NEW YORK CONSOLIDATION, XTENSlON, AND MODIFICA nON AGREEMENT -Single. F~mily-<br />

FannJe MaelFreddie Mac UNIFOR 'I INSTRUMENT<br />

ITEM 1133'_6 I0401}-MERS<br />

(Page 6 of9 pages)<br />

Form 3HZ 1101(tev. 51'01)<br />

GREATLAND 0<br />

To '),der Call:1.80tl-530-939:fo fax: 616-'191-1131