2006 FOR VALUE RECEIVED, the und - FCI Exchange

2006 FOR VALUE RECEIVED, the und - FCI Exchange

2006 FOR VALUE RECEIVED, the und - FCI Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

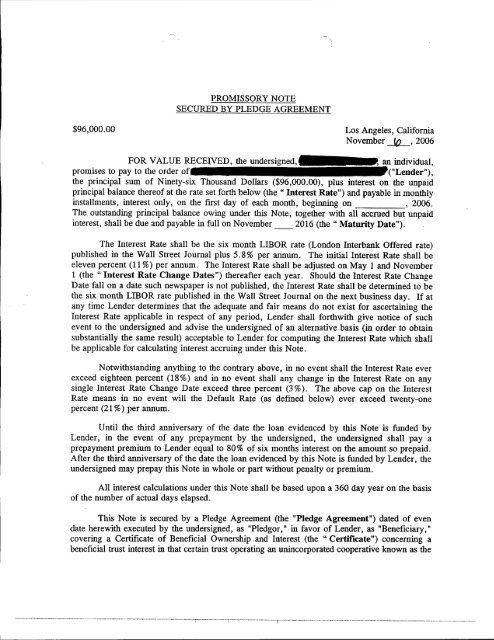

$96,000.00<br />

PROMISSORY NOTE<br />

SECURED BY PLEDGE AGREEMENT<br />

Los Angeles, California<br />

November -!i2.-, <strong>2006</strong><br />

<strong>FOR</strong> <strong>VALUE</strong> <strong>RECEIVED</strong>, <strong>the</strong> <strong>und</strong>ersigned,_ an individual,<br />

promises to pay to <strong>the</strong> order of ("Lender"),<br />

<strong>the</strong> principal sum of Ninety-six Thousand Dollars ($96,000.00), plus interest on <strong>the</strong> unpaid<br />

principal balance <strong>the</strong>reof at <strong>the</strong> rate set forth below (<strong>the</strong>" Interest Rate") and payable in monthly<br />

installments, interest only, on <strong>the</strong> first day of each month, beginning on , <strong>2006</strong>.<br />

The outstanding principal balance owing <strong>und</strong>er this Note, toge<strong>the</strong>r with all accrued but unpaid<br />

interest, shall be due and payable in full on November 2016 (<strong>the</strong>" Maturity Date").<br />

The Interest Rate shall be <strong>the</strong> six month LIBOR rate (London Interbank Offered rate)<br />

published in <strong>the</strong> Wall Street Journal plus 5.8% per annum. The initial Interest Rate shall be<br />

eleven percent (11 %) per annum. The Interest Rate shall be adjusted on May 1 and November<br />

1 (<strong>the</strong>" Interest Rate Change Dates") <strong>the</strong>reafter each year. Should <strong>the</strong> Interest Rate Change<br />

Date fall on a date such newspaper is not published, <strong>the</strong> Interest Rate shall be determined to be<br />

<strong>the</strong> six month LIBOR rate published in <strong>the</strong> Wall Street Journal on <strong>the</strong> next business day. If at<br />

any time Lender determines that <strong>the</strong> adequate and fair means do not exist for ascertaining <strong>the</strong><br />

Interest Rate applicable in respect of any period, Lender shall forthwith give notice of such<br />

event to <strong>the</strong> <strong>und</strong>ersigned and advise <strong>the</strong> <strong>und</strong>ersigned of an alternative basis (in order to obtain<br />

substantially <strong>the</strong> same result) acceptable to Lender for computing <strong>the</strong> Interest Rate which shall<br />

be applicable for calculating interest accruing <strong>und</strong>er this Note.<br />

Notwithstanding anything to <strong>the</strong> contrary above, in no event shall <strong>the</strong> Interest Rate ever<br />

exceed eighteen percent (18 %) and in no event shall any change in <strong>the</strong> Interest Rate on any<br />

single Interest Rate Change Date exceed three percent (3% ). The above cap on <strong>the</strong> Interest<br />

Rate means in no event will <strong>the</strong> Default Rate (as defined below) ever exceed twenty-one<br />

percent (21 %) per annum.<br />

Until <strong>the</strong> third anniversary of <strong>the</strong> date <strong>the</strong> loan evidenced by this Note is f<strong>und</strong>ed by<br />

Lender, in <strong>the</strong> event of any prepayment by <strong>the</strong> <strong>und</strong>ersigned, <strong>the</strong> <strong>und</strong>ersigned shall pay a<br />

prepayment premium to Lender equal to 80% of six months interest on <strong>the</strong> amount so prepaid.<br />

After <strong>the</strong> third anniversary of <strong>the</strong> date <strong>the</strong> loan evidenced by this Note is f<strong>und</strong>ed by Lender, <strong>the</strong><br />

<strong>und</strong>ersigned may prepay this Note in whole or part without penalty or premium.<br />

All interest calculations <strong>und</strong>er this Note shall be based upon a 360 day year on <strong>the</strong> basis<br />

of <strong>the</strong> number of actual days elapsed.<br />

This Note is secured by a Pledge Agreement (<strong>the</strong> "Pledge Agreement") dated of even<br />

date herewith executed by <strong>the</strong> <strong>und</strong>ersigned, as "Pledgor," in favor of Lender, as "Beneficiary, n<br />

covering a Certificate of Beneficial Ownership and Interest (<strong>the</strong> "Certificate") concerning a<br />

beneficial trust interest in that' certain trust operating an unincorporated cooperative known as <strong>the</strong>

Glen-Donald Apartments (<strong>the</strong>" Trust"), which owns <strong>the</strong> real property located a••••••<br />

•••••••••••••••• ~, situated in <strong>the</strong> County of Los Angeles, State of<br />

California (<strong>the</strong> " Property").<br />

All payments on this Note shall, at <strong>the</strong> option of <strong>the</strong> holder hereof, be applied first to <strong>the</strong><br />

payment of accrued and unpaid interest, and after all such interest has been paid, any remainder<br />

shall be applied to reduction of <strong>the</strong> principal balance.<br />

The <strong>und</strong>ersigned acknowledges that if any payment required <strong>und</strong>er this Note is not paid<br />

within fifteen (15) days after <strong>the</strong> same becomes due and payable, <strong>the</strong> holder hereof will incur<br />

extra administrative expenses, in addition to expenses incident to receipt of timely payment, and<br />

<strong>the</strong> loss of <strong>the</strong> use of f<strong>und</strong>s in connection with <strong>the</strong> delinquency in payment. Because, from <strong>the</strong><br />

nature of <strong>the</strong> case, <strong>the</strong> actual damages suffered by <strong>the</strong> holder hereof by reason of such extra<br />

administrative expenses and loss of use of f<strong>und</strong>s would be impracticable or extremely difficult to<br />

ascertain, <strong>the</strong> <strong>und</strong>ersigned agrees that five percent (5%) of <strong>the</strong> amount of <strong>the</strong> delinquent payment<br />

and <strong>the</strong> imposition of <strong>the</strong> default interest rate provided for below shall be <strong>the</strong> amount of damages<br />

to which such holder is entitled, upon such breach, in compensation <strong>the</strong>refor. The <strong>und</strong>ersigned<br />

shall, <strong>the</strong>refore, in such event, without fur<strong>the</strong>r notice, pay to <strong>the</strong> holder hereof as such holder's<br />

sale monetary recovery to cover such extra administrative expenses and loss of use of f<strong>und</strong>s,<br />

liquidated damages in <strong>the</strong> amount of five percent (5%) of <strong>the</strong> amount of such delinquent payment<br />

and any additional interest owed as a result of <strong>the</strong>. imposition of <strong>the</strong> default interest rate as<br />

provided below. The provisions of this paragraph are intended to govern only <strong>the</strong> determination<br />

of damages in <strong>the</strong> event of a breach in <strong>the</strong> performance of <strong>the</strong> obligation of <strong>the</strong> <strong>und</strong>ersigned to<br />

make timely payments here<strong>und</strong>er. Nothing in this Note shall be construed as an express or<br />

implied agreement by <strong>the</strong> holder hereof to forbear in <strong>the</strong> collection of any delinquent payment, or<br />

be construed as in any way giving <strong>the</strong> <strong>und</strong>ersigned <strong>the</strong> right, express or implied, to fail to make<br />

timely payments here<strong>und</strong>er, whe<strong>the</strong>r upon payment of such damages or o<strong>the</strong>rwise. The right of<br />

<strong>the</strong> holder hereof to receive payment of such liquidated and actual damages, and receipt <strong>the</strong>reof,<br />

are without prejudice to <strong>the</strong> right of such holder to collect such delinquent payments and any<br />

o<strong>the</strong>r amounts provided to be paid here<strong>und</strong>er or <strong>und</strong>er any security for this Note or to declare a<br />

default here<strong>und</strong>er or <strong>und</strong>er any security for this Note.<br />

All payments on this Note are to be made payable to Lender's servicing agent, FC!<br />

National Lender Services whose address for this purpose is 8180 East Kaiser Boulevard,<br />

Anaheim Hills, California 92808 or to such o<strong>the</strong>r person or at such o<strong>the</strong>r place as <strong>the</strong> holder<br />

hereof may from time to time direct by written notice to <strong>the</strong> <strong>und</strong>ersigned.<br />

The <strong>und</strong>ersigned waives any right of offset it now has or may hereafter have against <strong>the</strong><br />

holder hereof and its successors and assigns, and agrees to make <strong>the</strong> payments called for<br />

here<strong>und</strong>er in accordance with <strong>the</strong> terms hereof. The holder hereof and all successors <strong>the</strong>reof<br />

shall have all <strong>the</strong> rights of a holder in due course as provided in <strong>the</strong> California Uniform<br />

Commercial Code and o<strong>the</strong>r laws of <strong>the</strong> State of California.<br />

The <strong>und</strong>ersigned and any endorsers, guarantors or sureties hereof severally waive<br />

J: \ J6463\OO2\documents\promissory nOle<br />

2

presentment and demand for payment, notice of intent to accelerate maturity, protest or notice of<br />

protest or non-payment, bringing of suit and diligence in taking any action to collect any sums<br />

owing here<strong>und</strong>er or in proceeding against any of <strong>the</strong> rights and properties securing payment<br />

here<strong>und</strong>er; expressly agree that this Note, or any payment here<strong>und</strong>er, may be extended from time<br />

to time; and consent to <strong>the</strong> acceptance of fur<strong>the</strong>r security or <strong>the</strong> release of any security for this<br />

Note, all without in any way affecting <strong>the</strong> liability of <strong>the</strong> <strong>und</strong>ersigned and any endorsers or<br />

guarantors hereof. No extension of time for <strong>the</strong> payment of this Note, or any installment hereof,<br />

made by agreement by <strong>the</strong> holder hereof with any person now or hereafter liable for <strong>the</strong> payment<br />

of this Note, shall affect <strong>the</strong> original liability <strong>und</strong>er this Note of <strong>the</strong> <strong>und</strong>ersigned, even if <strong>the</strong><br />

<strong>und</strong>ersigned is not a party to such agreement.<br />

The failure of <strong>the</strong> <strong>und</strong>ersigned to payor perform as required here<strong>und</strong>er or <strong>the</strong> default of<br />

<strong>the</strong> <strong>und</strong>ersigned <strong>und</strong>er <strong>the</strong> Pledge Agreement or any o<strong>the</strong>r instrument securing this Note or<br />

secured by <strong>the</strong> Pledge Agreement shall constitute a default here<strong>und</strong>er. Upon <strong>the</strong> occurrence of a<br />

default here<strong>und</strong>er, at <strong>the</strong> option of <strong>the</strong> holder hereof, all amounts <strong>the</strong>n unpaid <strong>und</strong>er this Note, <strong>the</strong><br />

Pledge Agreement or any o<strong>the</strong>r instrument securing this Note or secured by <strong>the</strong> Pledge<br />

Agreement shall bear interest for <strong>the</strong> period beginning with <strong>the</strong> date of occurrence of such default<br />

at a default rate equal to three percent (3%) above <strong>the</strong> rate stated herein (<strong>the</strong>" Default Rate"),<br />

payable monthly on <strong>the</strong> fIrst day of each and every month, and in addition such holder may, at its<br />

option, declare immediately due and owing <strong>the</strong> entire unpaid principal sum toge<strong>the</strong>r with all<br />

interest <strong>the</strong>reon, plus any o<strong>the</strong>r sums owing at <strong>the</strong> time of such declaration pursuant to this Note,<br />

<strong>the</strong> Pledge Agreement or any o<strong>the</strong>r instrument securing this Note.<br />

The failure to exercise <strong>the</strong> foregoing option shall not constitute a waiver of <strong>the</strong> right to<br />

exercise <strong>the</strong> same at any subsequent time in respect of <strong>the</strong> same event or any o<strong>the</strong>r event. The<br />

acceptance by <strong>the</strong> holder hereof of any payment here<strong>und</strong>er which is less than payment in full of<br />

all amounts due and payable at <strong>the</strong> time of such payment shall not constitute a waiver of <strong>the</strong> right<br />

to exercise any of <strong>the</strong> foregoing options at that time or at any subsequent time or nullify any prior<br />

exercise of any such option without <strong>the</strong> express consent of such holder, except as and to <strong>the</strong><br />

extent o<strong>the</strong>rwise provided by law.<br />

All amounts payable here<strong>und</strong>er are payable in lawful money of <strong>the</strong> United States.<br />

The <strong>und</strong>ersigned agrees to pay all costs of collection when incurred, including reasonable<br />

attorneys' fees, whe<strong>the</strong>r or not an action shall be instituted to enforce this Note.<br />

Nei<strong>the</strong>r <strong>the</strong> Certificate, nor <strong>the</strong> <strong>und</strong>ersigned's interest in <strong>the</strong> Trust or <strong>the</strong><br />

Property, shall be sold, agreed to be sold, conveyed, transferred, assigned, disposed of, or<br />

fur<strong>the</strong>r encumbered, whe<strong>the</strong>r voluntarily, involuntarily, by operation of law or o<strong>the</strong>rwise,<br />

without <strong>the</strong> written consent of <strong>the</strong> holder hereof being fIrst obtained, which consent may be<br />

withheld in holder' s sale and absolute discretion. Any transaction in violation of <strong>the</strong> above<br />

restrictions shall cause <strong>the</strong> <strong>the</strong>n outstanding principal balance and interest <strong>the</strong>reon and o<strong>the</strong>r sums<br />

secured by said Pledge Agreement, at <strong>the</strong> option of said holder, to immediately become due and<br />

payable.<br />

1:\16463\OO2\documents\promissory note<br />

3

The parties hereto intend to conform strictly to <strong>the</strong> applicable usury laws. In no<br />

event, regardless of any provisions contained <strong>the</strong>rein or in any o<strong>the</strong>r document executed or<br />

delivered in connection herewith, shall <strong>the</strong> holder hereof ever be deemed to have contracted for<br />

or be entitled to receive, collect or apply as interest on this Note, any amount in excess of <strong>the</strong><br />

maximum amount permitted by applicable law (<strong>the</strong>" Maximum Rate"). In no event, whe<strong>the</strong>r<br />

by reason of demand for payment, prepayment, acceleration of <strong>the</strong> maturity hereof or<br />

o<strong>the</strong>rwise, shall <strong>the</strong> interest contracted for, charged or received by <strong>the</strong> holder here<strong>und</strong>er or<br />

o<strong>the</strong>rwise exceed <strong>the</strong> Maximum Rate. If for any circumstance whatsoever interest would<br />

o<strong>the</strong>rwise be payable to <strong>the</strong> holder in excess of <strong>the</strong> maximum lawful amount, <strong>the</strong> interest<br />

payable to <strong>the</strong> holder shall be reduced automatically to <strong>the</strong> Maximum Rate.<br />

This Note is subject to Section 2966 of <strong>the</strong> Civil Code, which provides that <strong>the</strong> holder<br />

of this Note shall give written notice to <strong>the</strong> <strong>und</strong>ersigned, or his successor in interest, of<br />

prescribed information at least 90 and not more than 150 days before any balloon payment is<br />

due.<br />

California.<br />

1:\l6463\OO2\documenls\promissory note<br />

This Note shall be governed by and construed according to <strong>the</strong> laws of <strong>the</strong> State of<br />

'-~---"-"'----""-'-'-'-'-"-'---'-"-"'--"-'-_.---~._-- -.-_ .._._--.------:._---- ..-._--_...,-_._-_ .•.----_.,-_ __._._-_ _-_ .._.._..__ ._.._---_ _----- -_.-----_ ---_..•-----_. _.•_ _- _ .<br />

4

PLEDGE AGREEMENT<br />

This Pledge Agreement (" Agreement") is made and entered into as of November __ '<br />

20~ (" Pledgor") and<br />

~a California limited liability company (" Lender").<br />

Recitals<br />

A. Lender has agreed to advance certain f<strong>und</strong>s to Pledgor (<strong>the</strong>" Loan"), pursuant to<br />

that certain Secured Promissory Note in <strong>the</strong> amount of Ninety-six Thousand Dollars ($96,000.00)<br />

dated of even date <strong>the</strong>rewith (<strong>the</strong>" Note"), which indebtedness is secured by this Agreement (<strong>the</strong><br />

Note and this Agreement shall be referred to herein toge<strong>the</strong>r as <strong>the</strong> " Loan Documents").<br />

B. The purpose of <strong>the</strong> Loan is to enable Pledgor to purchase a beneficial trust interest<br />

in <strong>the</strong> Glen-Donald Apartments, an unincorporated cooperative (<strong>the</strong>" Glen-Donald Apartments")<br />

governed by that certain Declaration of Trust dated September 16, 1925 (<strong>the</strong>" Trust").<br />

C. To induce Lender to loan f<strong>und</strong>s to Pledgor, Pledgor has agreed to pledge his<br />

beneficial interest in <strong>the</strong> Trust to Lender as security for <strong>the</strong> repayment of all indebtedness due<br />

<strong>und</strong>er <strong>the</strong> Loan Documents.<br />

For good and valuable consideration, receipt of which is acknowledged, <strong>the</strong> parties hereby<br />

agree as follows:<br />

ARTICLE I<br />

PLEDGE OF BENEFICIAL INTEREST<br />

Pledgor hereby pledges, assigns and grants a security interest to Lender in all of Pledgor' s<br />

right title and interest represented by Certificate of Beneficial Ownership and Interest No.<br />

_____ (<strong>the</strong> " Certificate") relating to <strong>the</strong> Glen-Donald Apartments, duly endorsed in blank<br />

and delivered to Lender (<strong>the</strong>" Collateral") as security for <strong>the</strong> repayment of all indebtedness due<br />

<strong>und</strong>er <strong>the</strong> Loan Documents. Pledgor hereby appoints Lender as his attorney-in-fact to arrange for<br />

<strong>the</strong> transfer of <strong>the</strong> Collateral on <strong>the</strong> books of <strong>the</strong> trustee of <strong>the</strong> Trust to <strong>the</strong> name of Lender.<br />

ARTICLE II<br />

VOTING RIGHTS; DISTRIBUTIONS<br />

Prior to <strong>the</strong> occurrence of an Event of Default (as defined in Section 6.1 below):<br />

Section 2.1 Voting. Pledgor shall be entitled to exercise any and all voting and/or<br />

consensual rights and powers relating to or pertaining to Collateral or any part <strong>the</strong>reof given as<br />

security for repayment of <strong>the</strong> Note for any purpose not in violation of <strong>the</strong> terms of this Agreement;<br />

provided, however, that Pledgor shall not be permitted to exercise or refrain from exercising any<br />

such right or power if, in <strong>the</strong> reasonable judgment of Lender, such action would have a material<br />

adverse effect on <strong>the</strong> value of <strong>the</strong> Collateral or any part <strong>the</strong>reof; and, provided, fur<strong>the</strong>r, that

Pledgor shall give Lender at least ten (10) days written notice of <strong>the</strong> manner in which Pledgor<br />

intends to exercise, or <strong>the</strong> reasons for refraining from exercising, any such right or power o<strong>the</strong>r<br />

than with respect to <strong>the</strong> election of a board of governors and voting with respect to incidental<br />

matters at any meeting of holders of beneficial trust interest'. in <strong>the</strong> Trust. Notwithstanding<br />

anything to <strong>the</strong> contrary in this Agreement, in no event may Pledgor vote to dissolve <strong>the</strong> Trust<br />

without Lender' s prior written consent, which may be withheld in Lender' s sole and absolute<br />

discretion.<br />

Section 2.2 Distributions. Until repayment in full of <strong>the</strong> Loan, Lender shall be entitled<br />

to receive and retain any and all dividends or distributions and interest payable on <strong>the</strong> Collateral;<br />

provided, however, that any and all such dividends, distributions or interest shall be applied to<br />

amounts owing on <strong>the</strong> Loan.<br />

Section 2.3 Execution of Instruments. Lender shall execute and deliver (or cause to be<br />

executed and delivered) to Pledgor all such proxies, powers of attorney, dividend orders, interest<br />

coupons and o<strong>the</strong>r instruments as Pledgor may reasonably request for <strong>the</strong> purpose of enabling<br />

Pledgor to exercise <strong>the</strong> voting and/or consensual rights and powers which it is entitled to exercise<br />

pursuant to Section 2.1 above and/or to receive <strong>the</strong> dividends and/or interests payments which it is<br />

authorized to receive and retain pursuant to Section 2.2 above.<br />

ARTICLE III<br />

REPRESENTATIONS AND WARRANTIES<br />

Pledgor warrants and represents that:<br />

Section 3.1 Ownership of Collateral. Pledgor is <strong>the</strong> sole legal and beneficial owner of<br />

<strong>the</strong> Collateral;<br />

Section 3.2 Transfer. Pledgor has <strong>the</strong> right to transfer <strong>the</strong> Collateral and that <strong>the</strong><br />

Collateral free of any encumbrances, liens or claims;<br />

Section 3.3 Legal Valid and Binding Obligation of Pledgor. With respect to <strong>the</strong><br />

Collateral, this Agreement constitutes <strong>the</strong> legal, valid and binding obligation of Pledgor<br />

enforceable against Pledgor in accordance with its terms except as enforcement may be limited by<br />

bankruptcy, insolvency, reorganization, moratorium or similar laws or equitable principles relating<br />

to or limiting creditors' rights generally;<br />

Section 3.4 Valid Security Interest and Lien. With respect to <strong>the</strong> Collateral, this<br />

Agreement creates a valid security interest and lien in and upon <strong>the</strong> Collateral pledged or assigned<br />

here<strong>und</strong>er;<br />

Section 3.5 No Defenses. No dispute, right of setoff, counterclaim or defense exists<br />

with respect to all or any part of <strong>the</strong> Collateral;<br />

1:\16463\OO2\ooCUMENTS\PLEDGE AGREEMENT<br />

2

Section 3.6 No Hypo<strong>the</strong>cation. The Collateral is not subject to any liens, security<br />

interests or encumbrances whatsoever;<br />

Section 3.7 No Consents. The execution, delivery and performance hereof are not in<br />

contravention of any indenture, agreement or <strong>und</strong>ertaking to which Pledgor is a party or by which<br />

Pledgor is bo<strong>und</strong>; and o<strong>the</strong>r than approval of <strong>the</strong> Board of Governors of <strong>the</strong> Trust, no<br />

authorization, approval or o<strong>the</strong>r action is required ei<strong>the</strong>r for <strong>the</strong> grant by Pledgor of <strong>the</strong> security<br />

interest granted hereby or for <strong>the</strong> execution, delivery or performance of this Agreement by<br />

Pledgor.<br />

ARTICLE IV<br />

COVENANTS AND AGREEMENTS OF PLEDGOR<br />

Pledgor covenants and agrees as follows:<br />

Section 4.1 Delivery of Collateral. Pledgor will deliver to Lender <strong>the</strong> original<br />

Certificate evidencing <strong>the</strong> Collateral to Lender;<br />

Section 4.2 Fur<strong>the</strong>r Acts and Assurances. Pledgor shall from time to time promptly<br />

execute and deliver to Lender all such o<strong>the</strong>r assignments, certificates, supplemental writings, ..trust<br />

receipts, escrow agreements and financing statements and do all o<strong>the</strong>r acts or things as Lender may<br />

reasonable request in order to more fully evidence and perfect <strong>the</strong> security interest in <strong>the</strong><br />

Collateral. Pledgor shall at Pledgor's own cost and expense execute and deliver such fur<strong>the</strong>r<br />

documents and instruments and shall take such o<strong>the</strong>r actions as may be reasonably required or<br />

requested by Lender to carry out <strong>the</strong> intent and purposes of this Agreement;<br />

Section 4.3 No Transfer or Hypo<strong>the</strong>cation. Pledgor will not, without <strong>the</strong> prior written<br />

consent of Lender, transfer any of Pledgor's rights in <strong>the</strong> Collateral or create any lien or<br />

o<strong>the</strong>rwise encumber <strong>the</strong> Collateral or permit any of <strong>the</strong> Collateral to ever be or become subject to<br />

any lien, attachment, execution, sequestration, or encumbrance of any kind, except Lender's<br />

security interest in <strong>the</strong> Collateral;<br />

Section 4.4 Enforcement. Pledgor shall enforce, or secure in <strong>the</strong> name of Lender, <strong>the</strong><br />

performance of each and every obligation, term, covenant, condition and agreement in or<br />

pertaining to <strong>the</strong> Collateral by any o<strong>the</strong>r party <strong>the</strong>re<strong>und</strong>er to be performed, and Pledgor shall<br />

appear in and defend any action or proceeding arising <strong>und</strong>er, occurring out of or in any manner<br />

connected with <strong>the</strong> Collateral or <strong>the</strong> obligations, duties or liabilities of any o<strong>the</strong>r party <strong>the</strong>re<strong>und</strong>er,<br />

and upon request by Lender, Pledgor will do so in <strong>the</strong> name and on behalf of Lender, but at <strong>the</strong><br />

expense of <strong>the</strong> Pledgor, and Pledgor shall pay all costs and expenses of Lender, including but not<br />

limited to, reasonable attorneys' fees and disbursements in any action or proceeding in which<br />

Lender may appear;<br />

Section 4.5 Fur<strong>the</strong>r Information. Pledgor shall promptly furnish to Lender any<br />

information or writings which Lender may reasonably request concerning <strong>the</strong> Collateral;<br />

1:\16463\OO2\oocUMENTS\PLEDGE AGREEMENT<br />

-_..__._--.__ ._.__ .__ .•.- _ _.•.--_ _ -.-•....-.- _ .......•-_.__._.__ ..-_._,._._._-,.,.--~--~_.__.-.._-_ ...•- ,- _ ..-•._---_._-_._-- ,.,'--_.._--- •..._._ ,.._ ,., _.._ --.....•.... _._ .....•_-- .<br />

3

Section 4.6 Inspection. Pledgor shall allow Lender to inspect all records of Pledgor<br />

relating to <strong>the</strong> Collateral or <strong>the</strong> secured indebtedness, and to make and take away copies of such<br />

records during normal business hours;<br />

Section 4.7 Changes. Pledgor shall promptly notify Lender of any material change in<br />

any fact or circumstances warranted or furnished by Pledgor to Lender in connection with <strong>the</strong><br />

Collateral. and<br />

Section 4.8 Claims. Pledgor shall promptly notify Lender of any claim, action or<br />

proceeding affecting title to <strong>the</strong> Collateral, or any part <strong>the</strong>reof, or <strong>the</strong> security interest created<br />

here<strong>und</strong>er, and Pledgor will appear in, contest and defend against any action or proceeding<br />

purporting to affect title to, or any o<strong>the</strong>r interest in, any portion of <strong>the</strong> Collateral, or <strong>the</strong> rights or<br />

powers of Lender, its successors assigns, or <strong>the</strong> right or interest of Lender, legal or beneficial, in<br />

any portion of <strong>the</strong> Collateral. Pledgor waives any right it may have to require Lender to pursue<br />

any third party for obligations with respect to <strong>the</strong> Collateral.<br />

ARTICLE V<br />

CERTAIN RIGHTS OF LENDER<br />

Section 5.1 Proceeds of Collateral. Should <strong>the</strong> Collateral of any part <strong>the</strong>reof ever be in<br />

any manner converted by Pledgor into ano<strong>the</strong>r type of property, or any money or o<strong>the</strong>r proceeds<br />

ever be paid or delivered to Pledgor as a result of Pledgor' s rights in <strong>the</strong> Collateral, <strong>the</strong>n in any<br />

such event, all such property, money, and o<strong>the</strong>r proceeds shall immediately be and become part of<br />

<strong>the</strong> Collateral and Pledgor covenants to forthwith pay and deliver all money so received to Lender;<br />

provided however, that prior to <strong>the</strong> occurrence of an Event of Default Pledgor shall be entitled to<br />

retain any cash dividend issued in <strong>the</strong> ordinary course of business and. not in liquidation or<br />

dissolution of <strong>the</strong> Collateral. If Lender deems it necessary and so requests, Pledgor shall properly<br />

endorse or assign any and all such proceeds to Lender and deliver to Lender any and all o<strong>the</strong>r<br />

proceeds that require perfection by possession <strong>und</strong>er <strong>the</strong> California Commercial Code. With<br />

respect to any property of a kind requiring an additional security agreement, fmancing statement or<br />

o<strong>the</strong>r writing to perfect a security interest in it in favor of Lender, Pledgor will execute and deliver<br />

to Lender whatever Lender deems necessary or proper for that purpose ..<br />

Section 5.2 Preservation of Collateral. Lender shall never be liable for failure to use<br />

diligence to collect any amount payable with respect to <strong>the</strong> Collateral, or any part <strong>the</strong>reof, but shall<br />

be liable only to account to Pledgor for that which Lender may actually collect or receive <strong>the</strong>reon.<br />

Section 5.3 Financing Statements. Pledgor hereby authorizes Lender to file fmancing<br />

statements and amendments <strong>the</strong>reto relative to all or any part of <strong>the</strong> Collateral where necessary or<br />

desirable in Lender's judgment to perfect or to continue <strong>the</strong> security interest granted herein<br />

without <strong>the</strong> signature of Pledgor.<br />

Section 5.4 O<strong>the</strong>r Security. Should any o<strong>the</strong>r person have heretofore executed or<br />

hereafter execute, in favor of Lender, any deed of trust, mortgage or security agreement, or have<br />

heretofore pledged or hereafter pledge any o<strong>the</strong>r property to secure <strong>the</strong> payment of <strong>the</strong> secured<br />

1:\16463\002\DOCUMENTS\PLEDGE AGiIEEMENT<br />

.----..-.--..---.- ..--.- - --..-.-----~:-------.---- •.. ,..--.•--.--•..------, --.---..---.-.-,--.--.-- ..---.--.-.- --.-..,-r--- -----.,--~.--._ ..--..--------- ..-.- ---.----.----.-.- - -- -.------.--.- --..-..<br />

4

indebtedness, or any part <strong>the</strong>reof, <strong>the</strong> exercise by Lender of any right or power conferred upon it<br />

in any such instrument, or by any such pledge, shall be wholly discretionary with it, and <strong>the</strong><br />

exercise or failure to exercise any such right or power shall not impair or diminish Lender' s<br />

rights, titles, interest, liens and powers existing here<strong>und</strong>er.<br />

ARTICLE VI<br />

DEFAULT<br />

Section 6.1 Event of Default. For purposes of this Agreement a default in <strong>the</strong><br />

performance of any of <strong>the</strong> terms or obligations of this Agreement or any of <strong>the</strong> o<strong>the</strong>r Loan<br />

Documents by Pledgor or any o<strong>the</strong>r obligated party o<strong>the</strong>r than Lender shall constitute an event of<br />

default (" Event of Default") here<strong>und</strong>er.<br />

Section 6.2 Remedies. Upon <strong>the</strong> occurrence of an Event of Default:<br />

6.2.1 Lender shall have all of <strong>the</strong> rights and remedies at law or in equity,<br />

including but not limited to <strong>the</strong> rights and remedies provided in <strong>the</strong> California Commercial Code.<br />

In this connection, Lender may, on ten (10) days' written notice to Pledgor, and without liability<br />

for any diminution in price that may have occurred, sell <strong>the</strong> Collateral in <strong>the</strong> manner and for <strong>the</strong><br />

price that Lender may determine. At any bona fide public sale, Lender shall be free to purchase<br />

all or any part of <strong>the</strong> Collateral. Out of <strong>the</strong> proceeds of any sale, Lender may retain an amount<br />

equal to <strong>the</strong> amounts <strong>the</strong>n due to Lender <strong>und</strong>er <strong>the</strong> Loan Documents, plus <strong>the</strong> amount of <strong>the</strong><br />

expenses of <strong>the</strong> sale including fees and disbursements of counsel and shall pay any balance of <strong>the</strong><br />

proceeds of any sale to Pledgor. If <strong>the</strong> proceeds of <strong>the</strong> sale are insufficient to cover <strong>the</strong> amounts<br />

<strong>the</strong>n due <strong>und</strong>er <strong>the</strong> Note, plus expenses of <strong>the</strong> sale, Pledgor shall remain liable to Lender for any<br />

deficiency, in accordance with <strong>the</strong> provisions of California Commercial Code Section 9608;<br />

6.2.2 Lender, without <strong>the</strong> consent of Pledgor, may at any time vote and give<br />

consents, ratifications and waivers with respect to <strong>the</strong> Collateral and Pledgor hereby irrevocably<br />

constitutes and appoints Lender its sole proxy and attorney-in-fact with full power of substitution<br />

to vote and act with respect to <strong>the</strong> Collateral outstanding in <strong>the</strong> name of Pledgor or with respect to<br />

which Pledgor is entitled to vote and act. The proxy and power of attorney herein granted are<br />

coupled with an interest, are irrevocable and shall continue throughout <strong>the</strong> term of this Agreement;<br />

6.2.3 Lender, without <strong>the</strong> consent of Pledgor, may with respect to <strong>the</strong> Collateral,<br />

join in and become a party to any plan of recapitalization, reorganization or readjustment (whe<strong>the</strong>r<br />

voluntary or involuntary) as shall seem desirable to Lender, to protect or fur<strong>the</strong>r <strong>the</strong> interest of<br />

Lender with respect to <strong>the</strong> Collateral and deposit any of <strong>the</strong> Collateral <strong>und</strong>er any such plan; make<br />

any exchange, substitution, cancellation or surrender of <strong>the</strong> Collateral required by any such plan or<br />

take such action with respect to <strong>the</strong> Collateral that may be required by any such plan or for <strong>the</strong><br />

accomplishment <strong>the</strong>reof; and no such disposition, exchange, substitution, cancellation or surrender<br />

shall be deemed to constitute a release of <strong>the</strong> Collateral from <strong>the</strong> lien of this Agreement; and<br />

6.2.4 Lender, without <strong>the</strong> consent of Pledgor, may transfer into its name or into<br />

<strong>the</strong> name or names of its nominee or nominees, all or any portion of <strong>the</strong> Collateral.<br />

1:\16463\002\DOCUMENTS\PLBDGB AGREEMENT<br />

5<br />

- ----- --------1<br />

..-.__ _- ..~_.~~ .._--,_._~_.- _-,,- .,. _.---.-.------.---, ..-..---'""'.-.---~.--.-----~-..,..--- ----.:_--.- -.-----.-~-_ ..- -.-,-- .•~ ---.------~-- '~~.._-_._._ ..- --_ _ _.__ ~_._.--_-•..r-.-~ ---~.--~-

Section 6.3 Cumulative. All remedies here<strong>und</strong>er are cumulative and are not exclusive of<br />

any o<strong>the</strong>r remedies provided by law.<br />

ARTICLE VII<br />

MISCELLANEOUS<br />

Section 7.1 Adjustments. In <strong>the</strong> event that, during <strong>the</strong> term of this Agreement, any<br />

dividend, reclassification, readjustment, or o<strong>the</strong>r change is declared or made in <strong>the</strong> structure of <strong>the</strong><br />

Trust, all new, substituted and additional certificates or securities issued by reason of any change<br />

shall be immediately delivered by Pledgor to Lender and held by Lender in <strong>the</strong> same manner as <strong>the</strong><br />

shares originally pledged <strong>und</strong>er this Agreement.<br />

Section 7.2 Payment of Note. On complete payment of <strong>the</strong> principal of and interest on<br />

<strong>the</strong> Note and any o<strong>the</strong>r amounts due <strong>und</strong>er <strong>the</strong> Loan Documents, Lender shall transfer to Pledgor<br />

all <strong>the</strong> Collateral and all rights received by Lender as a result of Lender' s record ownership of <strong>the</strong><br />

Collateral, and upon such transfer this Agreement shall terminate; provided, however, that Section<br />

7.7 shall survive termination of this Agreement.<br />

Section 7.3 Entire Agreement; Successors. This Agreement, and <strong>the</strong> terms, covenants<br />

and conditions hereof, shall be binding upon and inure to <strong>the</strong> benefit of Pledgor, Lender and <strong>the</strong>ir<br />

respective successors and assigns (and any reference in this Agreement to any of <strong>the</strong>m shall<br />

include <strong>the</strong>ir respective successors and assigns), except that Pledgor shall not be permitted to<br />

assign this Agreement or any interest herein to any person without <strong>the</strong> prior written consent of<br />

Lender, which consent Lender may withhold in its sole and absolute discretion. This Agreement<br />

constitutes <strong>the</strong> entire agreement between <strong>the</strong> parties hereto with respect to <strong>the</strong> matters set forth<br />

herein.<br />

Section 7.4 Governing Law. This Agreement shall be governed by and construed in<br />

accordance with <strong>the</strong> laws of California, without giving effect to conflict of laws. In <strong>the</strong> event of a<br />

dispute with respect to <strong>the</strong> interpretation of this Agreement, <strong>the</strong> parties agree that, at Lender' s<br />

option, <strong>the</strong> courts located in Los Angeles, California shall have exclusive jurisdiction and be <strong>the</strong><br />

exclusive venue for resolution of any dispute resolution or legal proceeding arising from this<br />

Agreement. Nothing contained herein shall affect <strong>the</strong> rights of Lender to bring a suit, action or<br />

proceeding in any o<strong>the</strong>r appropriate jurisdiction.<br />

Section 7.5 Modification of Agreement. No modification, amendment or waiver of any<br />

provision of this Agreement shall be effective unless <strong>the</strong> same shall be in writing and executed by<br />

Lender, and <strong>the</strong>n such waiver or consent shall be effective only in <strong>the</strong> specific instance and for <strong>the</strong><br />

sole purpose for which given.<br />

Section 7.6 Headings; Gender. Section headings used herein are for convenience only<br />

and are not to affect <strong>the</strong> construction of, or to be taken into consideration in interpreting, this<br />

Agreement. In this Agreement, whenever <strong>the</strong> context so requires, <strong>the</strong> masculine gender includes<br />

<strong>the</strong> feminine and/or neuter, and <strong>the</strong> singular number includes <strong>the</strong> plural.<br />

I:\16463\002\oocUMENTS\PLEDGE AGREEMENT<br />

6

Section 7.7 Indemnity. Pledgor agrees to indemnify, defend and hold harmless Lender<br />

(and any nominee, custodian, co-assignee or agent of Lender) and its respective officers, directors,<br />

attorneys, employees and agents from and against any and all liabilities, obligations, losses,<br />

damages, penalties, actions, judgments, suits, costs, expenses or disbursements of any kind or<br />

nature whatsoever which may be imposed on, incurred by or asserted against Lender or such o<strong>the</strong>r<br />

person in any way relating to or arising out of this Agreement or any o<strong>the</strong>r instrument delivered<br />

pursuant to this Agreement or any action taken or omitted by Lender or such o<strong>the</strong>r person <strong>und</strong>er<br />

this Agreement or such o<strong>the</strong>r instrument, o<strong>the</strong>r than those resulting from Lender' s gross<br />

negligence or willful misconduct.<br />

Section 7.8 No Waiver. No failure on <strong>the</strong> part of Lender to exercise, and no delay in<br />

exercising, any right, power or remedy here<strong>und</strong>er shall operate as a waiver <strong>the</strong>reof, nor shall any<br />

single or partial exercise of any such right, power or remedy by Lender preclude any o<strong>the</strong>r or<br />

fur<strong>the</strong>r exercise <strong>the</strong>reof or <strong>the</strong> exercise of any o<strong>the</strong>r right, power or remedy.<br />

Section 7.9 Notices. All notices or o<strong>the</strong>r communications required or permitted by this<br />

Agreement (for purposes of this Section referred to collectively as " Notices"), to be effective,<br />

shall be in writing, properly addressed, and shall be given: (i) by personal delivery; (ii) by<br />

certified mail postage prepaid; or (iii) by facsimile with confirmation of transmission received or<br />

mailed, to <strong>the</strong> following address or facsimile number specified below.<br />

-- To Lender:<br />

-- To Pledgor:<br />

Facsimile No.: (_) _<br />

Notices delivered by personal delivery shall be deemed to have been given upon tender to a natural<br />

person at <strong>the</strong> address shown. Notices delivered by certified mail shall be deemed to have been<br />

given <strong>the</strong> third business day after deposit in <strong>the</strong> mail. Notices delivered by facsimile shall be<br />

deemed to have been given upon printed confirmation by <strong>the</strong> transmitting facsimile machine of<br />

receipt by <strong>the</strong> receiving facsimile machine. Each party may change its address for notices by<br />

giving notice in accordance with this Section.<br />

Section 7.10 Fees and Expenses. Pledgor shall pay all costs and expenses incurred by<br />

Lender in connection with <strong>the</strong> preparation, negotiation and execution of this Agreement and <strong>the</strong><br />

1:\ 16463\002\DoCUMENTS\PLEDGE AGREEMENT<br />

7

o<strong>the</strong>r Loan Documents executed pursuant hereto and any and all amendments, modifications and<br />

supplements <strong>the</strong>reto, including, without limitation, <strong>the</strong> costs and fees of Lender's legal counsel<br />

and any applicable title company fees, title insurance premiums, filing fees or escrow fees.<br />

Section 7.11 Counterparts. This Agreement may be executed in counterparts, all of<br />

which toge<strong>the</strong>r shall constitute a single instrument, and each of which shall be deemed an original<br />

of this Agreement for all purposes, notwithstanding that fewer than all signatures appear on any<br />

one counterpart.<br />

Section 7.12 Severability of Provisions. Any provision or term of this Agreement which<br />

is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to <strong>the</strong><br />

extent of such prohibition or unenforceability without invalidating <strong>the</strong> remaining provisions and<br />

terms hereof or affecting <strong>the</strong> validity or enforceability of such provision or term in any o<strong>the</strong>r<br />

jurisdiction.<br />

Section 7.13 Ambiguities Not to be Construed Against Drafting Party. The doctrine that<br />

any ambiguity contained in a contract shall be construed against <strong>the</strong> party whose counsel has<br />

drafted <strong>the</strong> contract is expressly waived by each of <strong>the</strong> parties hereto with respect to this<br />

Agreement.<br />

Section 7.14 Execution of Agreement. This Agreement was executed voluntarily without<br />

any duress or <strong>und</strong>ue influence on <strong>the</strong> part of or on behalf of <strong>the</strong> parties hereto. The parties<br />

acknowledge that <strong>the</strong>y have read and <strong>und</strong>erstood this Agreement, its legal effect and its tax<br />

ramifications. Each party acknowledges that such party has had a reasonable opportunity to obtain<br />

independent legal counsel for'3.dvice and representation in connection with this Agreement. Each<br />

party fur<strong>the</strong>r acknowledges that such party is not relying on <strong>the</strong> legal counsel employed by any of<br />

<strong>the</strong> o<strong>the</strong>r parties to this Agreement.<br />

IN WITNESS WHEREOF, <strong>the</strong> parties hereto have caused this Agreement to be<br />

duly executed as of <strong>the</strong> date first above written.<br />

1:\16463\OO2\oocUMENTS\PLEDGE AGREEMENT<br />

LENDER:<br />

==121112 =L22=2=E:::~::?:m:[~ •• -<br />

~=====<br />

Title: --.t_.-f 2<br />

_.._._._ .._._ _..__.,.,.._..~.._ _._.__ ..-_ __.._,_~. _~_...,....., __ _ .._'._~.h_"_~ .._._. ,_. ._._.__ .._., .._.__ .._.._.,.~ __.._. __ , _"'~~_. .._ __ , _~. __ .__._~H _._ _.._.•. _ _.__ __ . : . .. .__.__<br />

8

STATE OF CALI<strong>FOR</strong>NIA<br />

COUNTY OF tA7..s /1-1/ 5eles,<br />

-~_ .. '----=-=.-<br />

NOTARY ACKNOWLEDGEMENT<br />

)<br />

)<br />

)<br />

On /lJ 01/ ~"" !:J ' '" G- , <strong>2006</strong>, before me, <strong>the</strong> <strong>und</strong>ersigned, a Notary<br />

Public in and for said State, personally appeared<br />

~rseflall, 1mBwR-tome (or proved on <strong>the</strong> basis of sa IS ac ory evidence) to be <strong>the</strong> person whose name<br />

is subscribed to <strong>the</strong> within instrument and acknowledged to me that he/~t~ executed <strong>the</strong> same in<br />

his/I}M/t~r authorized capacity(~, and that by his/h~~signature on <strong>the</strong> instrument <strong>the</strong> person, or<br />

<strong>the</strong> entity upon behalf of which <strong>the</strong> person acted, executed <strong>the</strong> instrument.<br />

WITNESS MY HAND AND OFFICIAL SEAL.<br />

J: \ 16463\OO2\oOCUMENTS\PLEOGE AGREEMENT<br />

~-..--,..--._-~_. __ .-.--_._,-- .•~_._..-------_._--- •.._._ .._-~~~_.,~._-_., _._._-_. __..~--_.~--.._-_.__..__ ~- ~':-__._.~ _._ _.._'._ __.__. ~ ~__ ._.._._~_'_'~_"_~_~~M_~. __ .__.. ._ _.~ .._.n. __. ~ .__ .<br />

9