Permanency Guide - Los Angeles County Department of Children ...

Permanency Guide - Los Angeles County Department of Children ...

Permanency Guide - Los Angeles County Department of Children ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

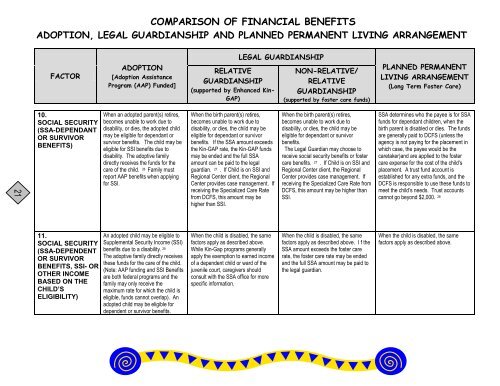

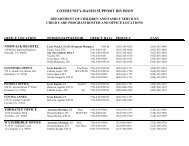

COMPARISON OF FINANCIAL BENEFITS<br />

ADOPTION, LEGAL GUARDIANSHIP AND PLANNED PERMANENT LIVING ARRANGEMENT<br />

FACTOR<br />

10.<br />

SOCIAL SECURITY<br />

(SSA-DEPENDANT<br />

OR SURVIVOR<br />

BENEFITS)<br />

11.<br />

SOCIAL SECURITY<br />

(SSA-DEPENDENT<br />

OR SURVIVOR<br />

BENEFITS, SSI- OR<br />

OTHER INCOME<br />

BASED ON THE<br />

CHILD’S<br />

ELIGIBILITY)<br />

ADOPTION<br />

[Adoption Assistance<br />

Program (AAP) Funded]<br />

When an adopted parent(s) retires,<br />

becomes unable to work due to<br />

disability, or dies, the adopted child<br />

may be eligible for dependant or<br />

survivor benefits. The child may be<br />

eligible for SSI benefits due to<br />

disability. The adoptive family<br />

directly receives the funds for the<br />

care <strong>of</strong> the child. 26 Family must<br />

report AAP benefits when applying<br />

for SSI.<br />

An adopted child may be eligible to<br />

Supplemental Security Income (SSI)<br />

benefits due to a disability. 29<br />

The adoptive family directly receives<br />

these funds for the care <strong>of</strong> the child.<br />

(Note: AAP funding and SSI Benefits<br />

are both federal programs and the<br />

family may only receive the<br />

maximum rate for which the child is<br />

eligible, funds cannot overlap). An<br />

adopted child may be eligible for<br />

dependent or survivor benefits.<br />

RELATIVE<br />

GUARDIANSHIP<br />

(supported by Enhanced Kin-<br />

GAP)<br />

When the birth parent(s) retires,<br />

becomes unable to work due to<br />

disability, or dies, the child may be<br />

eligible for dependant or survivor<br />

benefits. If the SSA amount exceeds<br />

the Kin-GAP rate, the Kin-GAP funds<br />

may be ended and the full SSA<br />

amount can be paid to the legal<br />

guardian. 27 . If Child is on SSI and<br />

Regional Center client, the Regional<br />

Center provides case management. If<br />

receiving the Specialized Care Rate<br />

from DCFS, this amount may be<br />

higher than SSI.<br />

When the child is disabled, the same<br />

factors apply as described above.<br />

While Kin-Gap programs generally<br />

apply the exemption to earned income<br />

<strong>of</strong> a dependent child or ward <strong>of</strong> the<br />

juvenile court, caregivers should<br />

consult with the SSA <strong>of</strong>fice for more<br />

specific information.<br />

LEGAL GUARDIANSHIP<br />

NON-RELATIVE/<br />

RELATIVE<br />

GUARDIANSHIP<br />

(supported by foster care funds)<br />

When the birth parent(s) retires,<br />

becomes unable to work due to<br />

disability, or dies, the child may be<br />

eligible for dependant or survivor<br />

benefits.<br />

The Legal Guardian may choose to<br />

receive social security benefits or foster<br />

care benefits. 27 . If Child is on SSI and<br />

Regional Center client, the Regional<br />

Center provides case management. If<br />

receiving the Specialized Care Rate from<br />

DCFS, this amount may be higher than<br />

SSI.<br />

When the child is disabled, the same<br />

factors apply as described above. I f the<br />

SSA amount exceeds the foster care<br />

rate, the foster care rate may be ended<br />

and the full SSA amount may be paid to<br />

the legal guardian.<br />

PLANNED PERMANENT<br />

LIVING ARRANGEMENT<br />

(Long Term Foster Care)<br />

SSA determines who the payee is for SSA<br />

funds for dependant children, when the<br />

birth parent is disabled or dies. The funds<br />

are generally paid to DCFS (unless the<br />

agency is not paying for the placement in<br />

which case, the payee would be the<br />

caretaker)and are applied to the foster<br />

care expense for the cost <strong>of</strong> the child’s<br />

placement. A trust fund account is<br />

established for any extra funds, and the<br />

DCFS is responsible to use these funds to<br />

meet the child’s needs. Trust accounts<br />

cannot go beyond $2,000. 28<br />

When the child is disabled, the same<br />

factors apply as described above.