Permanency Guide - Los Angeles County Department of Children ...

Permanency Guide - Los Angeles County Department of Children ...

Permanency Guide - Los Angeles County Department of Children ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

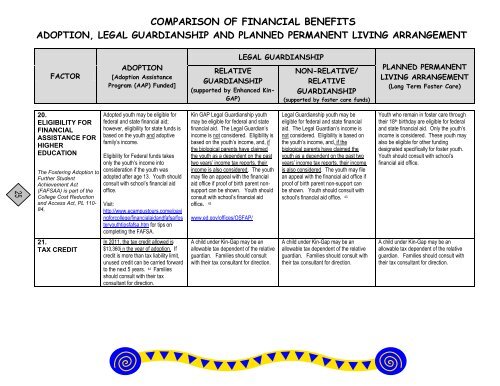

COMPARISON OF FINANCIAL BENEFITS<br />

ADOPTION, LEGAL GUARDIANSHIP AND PLANNED PERMANENT LIVING ARRANGEMENT<br />

FACTOR<br />

20.<br />

ELIGIBILITY FOR<br />

FINANCIAL<br />

ASSISTANCE FOR<br />

HIGHER<br />

EDUCATION<br />

The Fostering Adoption to<br />

Further Student<br />

Achievement Act<br />

(FAFSAA) is part <strong>of</strong> the<br />

College Cost Reduction<br />

and Access Act, PL 110-<br />

84,<br />

21.<br />

TAX CREDIT<br />

ADOPTION<br />

[Adoption Assistance<br />

Program (AAP) Funded]<br />

Adopted youth may be eligible for<br />

federal and state financial aid;<br />

however, eligibility for state funds is<br />

based on the youth and adoptive<br />

family’s income.<br />

Eligibility for Federal funds takes<br />

only the youth’s income into<br />

consideration if the youth was<br />

adopted after age 13. Youth should<br />

consult with school’s financial aid<br />

<strong>of</strong>fice.<br />

Visit:<br />

http://www.ecampustours.come/payi<br />

ngforcollege/financialaidandfafsa/fos<br />

teryouthtipsfafsa.htm for tips on<br />

completing the FAFSA.<br />

In 2011, the tax credit allowed is<br />

$13,360i n the year <strong>of</strong> adoption. If<br />

credit is more than tax liability limit,<br />

unused credit can be carried forward<br />

to the next 5 years. 44 Families<br />

should consult with their tax<br />

consultant for direction.<br />

RELATIVE<br />

GUARDIANSHIP<br />

(supported by Enhanced Kin-<br />

GAP)<br />

Kin GAP Legal Guardianship youth<br />

may be eligible for federal and state<br />

financial aid. The Legal Guardian’s<br />

income is not considered. Eligibility is<br />

based on the youth’s income, and, if<br />

the biological parents have claimed<br />

the youth as a dependent on the past<br />

two years’ income tax reports, their<br />

income is also considered. The youth<br />

may file an appeal with the financial<br />

aid <strong>of</strong>fice if pro<strong>of</strong> <strong>of</strong> birth parent nonsupport<br />

can be shown. Youth should<br />

consult with school’s financial aid<br />

<strong>of</strong>fice. 43<br />

www.ed.gov/<strong>of</strong>fices/OSFAP/<br />

A child under Kin-Gap may be an<br />

allowable tax dependent <strong>of</strong> the relative<br />

guardian. Families should consult<br />

with their tax consultant for direction.<br />

LEGAL GUARDIANSHIP<br />

NON-RELATIVE/<br />

RELATIVE<br />

GUARDIANSHIP<br />

(supported by foster care funds)<br />

Legal Guardianship youth may be<br />

eligible for federal and state financial<br />

aid. The Legal Guardian’s income is<br />

not considered. Eligibility is based on<br />

the youth’s income, and, if the<br />

biological parents have claimed the<br />

youth as a dependent on the past two<br />

years’ income tax reports, their income<br />

is also considered. The youth may file<br />

an appeal with the financial aid <strong>of</strong>fice if<br />

pro<strong>of</strong> <strong>of</strong> birth parent non-support can<br />

be shown. Youth should consult with<br />

school’s financial aid <strong>of</strong>fice. 43<br />

A child under Kin-Gap may be an<br />

allowable tax dependent <strong>of</strong> the relative<br />

guardian. Families should consult with<br />

their tax consultant for direction.<br />

PLANNED PERMANENT<br />

LIVING ARRANGEMENT<br />

(Long Term Foster Care)<br />

Youth who remain in foster care through<br />

their 18 th birthday are eligible for federal<br />

and state financial aid. Only the youth’s<br />

income is considered. These youth may<br />

also be eligible for other funding<br />

designated specifically for foster youth.<br />

Youth should consult with school’s<br />

financial aid <strong>of</strong>fice.<br />

A child under Kin-Gap may be an<br />

allowable tax dependent <strong>of</strong> the relative<br />

guardian. Families should consult with<br />

their tax consultant for direction.