The Impact of Microfinance on Household Welfare ... - X-Eye Design

The Impact of Microfinance on Household Welfare ... - X-Eye Design

The Impact of Microfinance on Household Welfare ... - X-Eye Design

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<str<strong>on</strong>g>The</str<strong>on</strong>g> <str<strong>on</strong>g>Impact</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> Micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance <strong>on</strong> <strong>Household</strong> <strong>Welfare</strong>:<br />

Case Study <str<strong>on</strong>g>of</str<strong>on</strong>g> a Savings Group in Lao PDR<br />

by<br />

K<strong>on</strong>gpasa Sengsouriv<strong>on</strong>g<br />

Master <str<strong>on</strong>g>The</str<strong>on</strong>g>sis<br />

Department <str<strong>on</strong>g>of</str<strong>on</strong>g> Regi<strong>on</strong>al Cooperati<strong>on</strong> Policy Studies<br />

Graduate School <str<strong>on</strong>g>of</str<strong>on</strong>g> Internati<strong>on</strong>al Cooperati<strong>on</strong> Studies<br />

Kobe University<br />

Filed July 2006

<str<strong>on</strong>g>The</str<strong>on</strong>g> <str<strong>on</strong>g>Impact</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> Micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance <strong>on</strong> <strong>Household</strong> <strong>Welfare</strong>:<br />

Case Study <str<strong>on</strong>g>of</str<strong>on</strong>g> a Savings Group in Lao PDR ∗<br />

K<strong>on</strong>gpasa Sengsouriv<strong>on</strong>g<br />

July 2006<br />

∗ Copyright © 2006, Master <str<strong>on</strong>g>The</str<strong>on</strong>g>sis submitted to the Department <str<strong>on</strong>g>of</str<strong>on</strong>g> Regi<strong>on</strong>al Cooperati<strong>on</strong> Policy Studies,<br />

Graduate School <str<strong>on</strong>g>of</str<strong>on</strong>g> Internati<strong>on</strong>al Cooperati<strong>on</strong> Studies, Kobe University, Japan .<str<strong>on</strong>g>The</str<strong>on</strong>g> views and<br />

interpretati<strong>on</strong>s in this paper are those <str<strong>on</strong>g>of</str<strong>on</strong>g> the author and do not necessarily reflect the positi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> Kobe<br />

University. E-mail: s_k<strong>on</strong>gpasa@yahoo.com.

ACKNOWEDGEMENTS<br />

I am indeed indebted to my academic adviser, Associate Pr<str<strong>on</strong>g>of</str<strong>on</strong>g>essor Koji KAWABATA<br />

for his insightful comments and support. I also would like to sincerely thank my two<br />

former academic advisers, Associate Pr<str<strong>on</strong>g>of</str<strong>on</strong>g>essor Fumiharu MIENO who provided me with<br />

valued guidance, feedback and financial support for the follow-up survey in Laos, and<br />

Pr<str<strong>on</strong>g>of</str<strong>on</strong>g>essor Hiroshi UENO who provided me <str<strong>on</strong>g>of</str<strong>on</strong>g> tremendous support during my first<br />

semester at the Graduate School <str<strong>on</strong>g>of</str<strong>on</strong>g> Internati<strong>on</strong>al Cooperati<strong>on</strong> Studies. I am very grateful<br />

to the critical questi<strong>on</strong>s and invaluable comments from both Pr<str<strong>on</strong>g>of</str<strong>on</strong>g>essor Seiichi FUKUI<br />

and Pr<str<strong>on</strong>g>of</str<strong>on</strong>g>essor CHEN Kuang-hui during the time <str<strong>on</strong>g>of</str<strong>on</strong>g> being examinati<strong>on</strong> committee.<br />

C<strong>on</strong>tributi<strong>on</strong> from Pr<str<strong>on</strong>g>of</str<strong>on</strong>g>essor TAKAHASHI Motoki is gratefully acknowledged. I also<br />

wish to thank Dr. Shalini MATHUR for her assistance in editing and structuring my<br />

thesis.<br />

In additi<strong>on</strong>, I would like to express my gratitude to the Lao Women’s Uni<strong>on</strong>,<br />

especially Ms. Sysay LEUDEDMOUNSONE (<str<strong>on</strong>g>The</str<strong>on</strong>g> President <str<strong>on</strong>g>of</str<strong>on</strong>g> Lao Women’s Uni<strong>on</strong>),<br />

Ms. Boual<strong>on</strong>e VONGDALASENE (the President <str<strong>on</strong>g>of</str<strong>on</strong>g> Lao Women’s Uni<strong>on</strong> at the<br />

Vientiane Capital), Ms. Saikham SENGKA (the President <str<strong>on</strong>g>of</str<strong>on</strong>g> Lao Women’s Uni<strong>on</strong> at<br />

Naxaith<strong>on</strong>g city), and Ms. Khampane NAOVALARD (the Vice President <str<strong>on</strong>g>of</str<strong>on</strong>g> Lao<br />

Women’s Uni<strong>on</strong> at Naxaith<strong>on</strong>g city) for their advice and support throughout the surveys.<br />

Thanks also to the Women and Community’s Empowering Project, particularly Mr.<br />

Khanth<strong>on</strong>e PHAMUANG (the Manager <str<strong>on</strong>g>of</str<strong>on</strong>g> the Women and Community’s Empowering<br />

Project), and the other staff <str<strong>on</strong>g>of</str<strong>on</strong>g> the project for their support and cooperati<strong>on</strong> during the<br />

survey and for providing me with data <strong>on</strong> savings groups.<br />

ii

Furthermore, I am obliged to my former boss, Mr. Huw LESTER, Senior<br />

Manager <str<strong>on</strong>g>of</str<strong>on</strong>g> PricewaterhouseCoopers (Laos) Ltd, and Mrs. Rae DUNSTAN who edited<br />

and pro<str<strong>on</strong>g>of</str<strong>on</strong>g> read my paper. Special thanks to my beloved sister and brother, Ms.<br />

F<strong>on</strong>gchinda SENGSOURIVONG and Mr. Apisid SENGSOURIVONG, for their<br />

invaluable support and comments; and to my friends, Ms. Chanmany VONGLOKHAM,<br />

Mr. Paliph<strong>on</strong>epheth BOUARAVONG, Ms. Phoummaly SIRIPHOLDEJ, Ms. Visany<br />

PHOMSOMBATH, and the students <str<strong>on</strong>g>of</str<strong>on</strong>g> the faculty <str<strong>on</strong>g>of</str<strong>on</strong>g> ec<strong>on</strong>omics and business<br />

management (FEBM) from the Nati<strong>on</strong>al University <str<strong>on</strong>g>of</str<strong>on</strong>g> Laos, for kindly helping me to<br />

c<strong>on</strong>duct surveys. I would also like to thank my friend, Mr. Bounth<strong>on</strong>e SOUKAVONG,<br />

Ec<strong>on</strong>omic Lecturer at FEBM, for kindly providing the students to help me c<strong>on</strong>duct my<br />

survey. My gratitude to my friends, Mr. Santisouk PHOUNESAVATH and Mr. Buavanh<br />

VILAVONG for their invaluable comments; to Ms. Chansathith CHALEUNSHINH,<br />

Research Officer <str<strong>on</strong>g>of</str<strong>on</strong>g> Nati<strong>on</strong>al Ec<strong>on</strong>omic Research Institute, for providing me relevant data<br />

and arranging <str<strong>on</strong>g>of</str<strong>on</strong>g> the surveys and to Ms. Daravanh VONGVIGIT, for kindly helping me<br />

<strong>on</strong> data processing. Many thanks to my Vietnamese friend, Ms. Nguyen Thi Thuy Vinh,<br />

for her helpful support <strong>on</strong> data processing and technical aspects <str<strong>on</strong>g>of</str<strong>on</strong>g> the ec<strong>on</strong>ometric<br />

s<str<strong>on</strong>g>of</str<strong>on</strong>g>tware. In working through this research, I also have leant to appreciate positive<br />

externalities through discussi<strong>on</strong>s with my colleagues. I am thankful to them.<br />

Moreover, I would like to thank Japan Internati<strong>on</strong>al Cooperati<strong>on</strong> Agency (JICA)<br />

and Japan Internati<strong>on</strong>al Cooperati<strong>on</strong> Center (JICE) for the financial support during study<br />

in Japan. Finally, I would like to truly thank my beloved parents, my dear wife and my<br />

cute daughter for always supporting me.<br />

SENGSOURIVONG, K<strong>on</strong>gpasa. Kobe, Japan, July 2006.<br />

iii

EXECUTIVE SUMMARY<br />

Many countries recognize that micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance can play an important role in<br />

ec<strong>on</strong>omic development as <strong>on</strong>e <str<strong>on</strong>g>of</str<strong>on</strong>g> the tools for poverty reducti<strong>on</strong>. Access to financial<br />

services is a major issue for both rural and urban areas <str<strong>on</strong>g>of</str<strong>on</strong>g> Laos. C<strong>on</strong>sequently, the<br />

government <str<strong>on</strong>g>of</str<strong>on</strong>g> Laos recognizes that access to rural finance and micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance could be<br />

<strong>on</strong>e <str<strong>on</strong>g>of</str<strong>on</strong>g> the major tools for poverty alleviati<strong>on</strong> and places micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance activities as <strong>on</strong>e <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

the priority programs for the agriculture and forestry sector in order to promote<br />

sustainable growth and poverty eradicati<strong>on</strong> under the Nati<strong>on</strong>al Growth and Poverty<br />

Eradicati<strong>on</strong> Strategy. Many studies have examined the relati<strong>on</strong>ship between micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance<br />

and ec<strong>on</strong>omic development, but until now, <strong>on</strong>ly two key studies were undertaken in Laos.<br />

While these two studies made an important c<strong>on</strong>tributi<strong>on</strong> to this subject, they had some<br />

shortcomings as they did not correct for problems <str<strong>on</strong>g>of</str<strong>on</strong>g> the self-selecti<strong>on</strong> and endogenous<br />

program placement.<br />

This paper surmounts these issues by adopting the methods used by Coleman<br />

(1999) to estimate the effects <strong>on</strong> household welfare or outcomes by the participati<strong>on</strong> in<br />

the savings group. <str<strong>on</strong>g>The</str<strong>on</strong>g> survey was c<strong>on</strong>ducted in six villages in 2005 - 2006, in a semi-<br />

urban area <str<strong>on</strong>g>of</str<strong>on</strong>g> Laos. All these villages had savings groups which were in operati<strong>on</strong> for<br />

various lengths <str<strong>on</strong>g>of</str<strong>on</strong>g> time. Of these, three villages had savings groups operating for more<br />

than a year, and are called “old” savings groups. <str<strong>on</strong>g>The</str<strong>on</strong>g> remaining three villages also started<br />

operating savings groups but these were in operati<strong>on</strong> for less than a year. <str<strong>on</strong>g>The</str<strong>on</strong>g>se are called<br />

“new” savings groups. In the six villages, villagers were allowed to self-select to be<br />

iv

savings group members or n<strong>on</strong>members. <str<strong>on</strong>g>The</str<strong>on</strong>g> survey sample included members and<br />

n<strong>on</strong>members in the six villages. Members who experienced benefits from joining the<br />

savings group by either obtaining a credit or receiving a dividend are called the<br />

“treatment” group, and those who have not benefited from the groups are called the<br />

“c<strong>on</strong>trol” group. All members <str<strong>on</strong>g>of</str<strong>on</strong>g> the “c<strong>on</strong>trol” group were relatively new members with<br />

an average membership <str<strong>on</strong>g>of</str<strong>on</strong>g> 2.2 m<strong>on</strong>ths. Hence, the effects <strong>on</strong> savings group members in<br />

the treatment group can be compared with the savings group members in the c<strong>on</strong>trol<br />

group. In additi<strong>on</strong>, differences in the length <str<strong>on</strong>g>of</str<strong>on</strong>g> time that savings group program has been<br />

available to members in both treatment and c<strong>on</strong>trol groups is taken into account to obtain<br />

more precise impact estimates. Inclusi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> n<strong>on</strong>members in all six villages allowed for<br />

the use <str<strong>on</strong>g>of</str<strong>on</strong>g> village fixed effect estimati<strong>on</strong> to c<strong>on</strong>trol the possibility that the order in which<br />

these six villages had savings group program placement is endogenous.<br />

With this kind <str<strong>on</strong>g>of</str<strong>on</strong>g> survey design, the impact <str<strong>on</strong>g>of</str<strong>on</strong>g> savings group program <strong>on</strong><br />

household outcomes can be straightforwardly estimated. <str<strong>on</strong>g>The</str<strong>on</strong>g>se positive outcomes include<br />

increase in household house value, household livestock producti<strong>on</strong> income, household<br />

agriculture producti<strong>on</strong> income, household rental expenses, and household educati<strong>on</strong><br />

expenses. <str<strong>on</strong>g>The</str<strong>on</strong>g> results illustrate that the savings group participati<strong>on</strong> has large positive and<br />

significant effects <strong>on</strong> all <str<strong>on</strong>g>of</str<strong>on</strong>g> these outcomes, except household yearly income from<br />

agriculture. However, this can largely be explained by issues relating to the robustness <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

the data for this indicator. In short, the participati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> savings group can increase<br />

household asset, household income from self-employment activities and support the<br />

educati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> children.<br />

v

C<strong>on</strong>sequently, this paper’s findings have several important implicati<strong>on</strong>s. Firstly,<br />

the large positive impact savings group has <strong>on</strong> household asset suggest that micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance<br />

programs may improve household status in terms <str<strong>on</strong>g>of</str<strong>on</strong>g> wealth. Sec<strong>on</strong>dly, the positive<br />

significant effects <str<strong>on</strong>g>of</str<strong>on</strong>g> the savings group <strong>on</strong> productivity, particularly livestock and<br />

agriculture in terms <str<strong>on</strong>g>of</str<strong>on</strong>g> rental <strong>on</strong> rice fields, suggest that the savings group program may<br />

be a viable strategy for the poverty eradicati<strong>on</strong>. This is c<strong>on</strong>sistent with the Nati<strong>on</strong>al<br />

Growth and Poverty Eradicati<strong>on</strong> Strategy (NGPES) (2004: 65) <str<strong>on</strong>g>of</str<strong>on</strong>g> the Government <str<strong>on</strong>g>of</str<strong>on</strong>g> Lao<br />

PDR which recognizes the importance <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance and has placed it as the <strong>on</strong>e <str<strong>on</strong>g>of</str<strong>on</strong>g> the<br />

high priority projects for the agriculture and forestry development plan. Thirdly, the great<br />

positive influence <str<strong>on</strong>g>of</str<strong>on</strong>g> the savings group program <strong>on</strong> household educati<strong>on</strong> expenses<br />

suggests that micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance program may be <strong>on</strong>e viable strategy to reach the millennium<br />

development goals in terms <str<strong>on</strong>g>of</str<strong>on</strong>g> educati<strong>on</strong>.<br />

vi

CHAPTER TITLE<br />

TABLE OF CONTENTS<br />

vii<br />

PAGE<br />

Title Page i<br />

Acknowledgements ii<br />

Executive Summary iv<br />

Table <str<strong>on</strong>g>of</str<strong>on</strong>g> C<strong>on</strong>tents vii<br />

List <str<strong>on</strong>g>of</str<strong>on</strong>g> Tables ix<br />

1 INTRODUCTION 1<br />

1.1 Issues 1<br />

1.2 Research Topic and Objective 5<br />

1.3 Hypothesis 5<br />

1.4 Methodology 6<br />

1.5 Structure <str<strong>on</strong>g>of</str<strong>on</strong>g> the Paper 7<br />

2 MICROFINANCE IN LAOS 8<br />

2.1 Country Brief 8<br />

2.2 Micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance in Laos 9<br />

3 LITERATURE REVIEW 19<br />

3.1 <str<strong>on</strong>g>Impact</str<strong>on</strong>g> Studies <str<strong>on</strong>g>of</str<strong>on</strong>g> Micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance <strong>on</strong> Different Ec<strong>on</strong>omic and Social<br />

Indicators<br />

19<br />

3.2 Methodology 26<br />

4 ANALYTICAL FRAMEWORK 31<br />

4.1 <str<strong>on</strong>g>The</str<strong>on</strong>g>oretical Framework 31<br />

4.2 Model Specificati<strong>on</strong> and Methodology 36<br />

5 SURVEY DESIGN 46

5.1 Survey <strong>Design</strong> 47<br />

5.2 Data Descripti<strong>on</strong> 51<br />

6 EMPIRICAL RESULTS 52<br />

6.1 <str<strong>on</strong>g>Impact</str<strong>on</strong>g> <strong>on</strong> <strong>Household</strong> House Asset 55<br />

6.2 <str<strong>on</strong>g>Impact</str<strong>on</strong>g> <strong>on</strong> Self-Employment Activities 59<br />

6.3 <str<strong>on</strong>g>Impact</str<strong>on</strong>g> <strong>on</strong> Educati<strong>on</strong> 64<br />

7 CONCLUSION 67<br />

REFERENCES 71<br />

APPENDIX A 80<br />

Table 1: Descriptive Statistics for Variables <str<strong>on</strong>g>of</str<strong>on</strong>g> Whole Sample Size 80<br />

Table 2: Descriptive Statistics for Variables by Treatment Group 84<br />

Table 3: Descriptive Statistics for Variables by C<strong>on</strong>trol Group 88<br />

Table 4: Descriptive Statistics for Variables by N<strong>on</strong>member 92<br />

Table 5: <str<strong>on</strong>g>Impact</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> Savings Group <strong>on</strong> <strong>Household</strong> House Value - GLS 96<br />

Table 6: <str<strong>on</strong>g>Impact</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> Savings Group <strong>on</strong> Yearly Self-Employment Income<br />

from Livestock – GLS<br />

100<br />

Table 7: <str<strong>on</strong>g>Impact</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> Savings Group <strong>on</strong> <strong>Household</strong> Yearly Self-<br />

Employment Income from Agriculture – GLS<br />

103<br />

Table 8: <str<strong>on</strong>g>Impact</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> Savings Group <strong>on</strong> <strong>Household</strong> M<strong>on</strong>thly Rental<br />

Expenditure – GLS<br />

106<br />

Table 9: <str<strong>on</strong>g>Impact</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> Savings Group <strong>on</strong> <strong>Household</strong> M<strong>on</strong>thly Educati<strong>on</strong>al<br />

Expenditure – GLS<br />

109<br />

APPENDIX B 112<br />

Case study: Savings Groups in Naxaith<strong>on</strong>g City 112<br />

viii

TABLE TITLE<br />

LIST OF TABLES<br />

ix<br />

PAGE<br />

2.1 Current Practices in Laos 16<br />

5.1 Sample Size 49

1.1 Issues<br />

CHAPTER 1<br />

INTRODUCTION<br />

Micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance is significant source <str<strong>on</strong>g>of</str<strong>on</strong>g> finance for poor, lower income people in<br />

developing countries. It provides the funding for these people to run their micro-business<br />

and to smooth their household’s c<strong>on</strong>sumpti<strong>on</strong>. Poor, lower income people have<br />

difficulties in obtaining finance from formal financial instituti<strong>on</strong>s such as commercial<br />

banks, due to barriers such as high collateral requirements and complicated applicati<strong>on</strong><br />

procedures (Yunus, 2001; and Hulme &Mosley, 1996). However, there is str<strong>on</strong>g demand<br />

for small-scale commercial financial services (for both credit and savings) am<strong>on</strong>g the<br />

ec<strong>on</strong>omically active poor in developing countries. <str<strong>on</strong>g>The</str<strong>on</strong>g>se and other financial services help<br />

low-income people improve household and enterprise management, increase productivity,<br />

smooth income flows, enlarge and diversify their microenterprises, and increase their<br />

incomes (Robins<strong>on</strong>, 2001). <str<strong>on</strong>g>The</str<strong>on</strong>g>se effects were evident from a number <str<strong>on</strong>g>of</str<strong>on</strong>g> impact studies<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance. Based <strong>on</strong> the recent studies <strong>on</strong> this subject, micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance has significant<br />

impact <strong>on</strong> income, expenditure, assets, educati<strong>on</strong>al status, health as well as gender<br />

empowerment.<br />

This positive impact <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance <strong>on</strong> income was c<strong>on</strong>firmed in studies<br />

undertaken by Hulme and Mosley (1996); Mckernan (2002); Khandker et al. (1998);<br />

Copestake et al. (2001); Sichanth<strong>on</strong>gthip (2004); Shaw (2000); Mosley (2001); and<br />

Copestake (2002).<br />

1

Research by Pitt and Khander (1996 and 1998); and Khandker (2003) found that<br />

micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance could increase household expenditure. Morduch (1998), however, argued<br />

that the eligible households that participated in the micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance programs have strikingly<br />

less c<strong>on</strong>sumpti<strong>on</strong> levels than the eligible households living in villages without the<br />

programs.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> positive impact <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance <strong>on</strong> household assets was c<strong>on</strong>firmed in studies<br />

by M<strong>on</strong>tgomery et al. (1996); Pitt and Khandker (19996 and 1998); Mosley (2001); and<br />

Coleman (1999 and 2002). However, Mckernan (2002) found an inverse relati<strong>on</strong>ship<br />

between participati<strong>on</strong> in program and household assets. Mckernan also found that<br />

households with fewest assets benefit most from participating in a program.<br />

Research by Chowdhury and Bhuiya (2004); Holvoet (2004); and Pitt and<br />

Khandker (1996 and d1998) found that micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance has a positive effect <strong>on</strong> educati<strong>on</strong>.<br />

Similarly, Chowdhury and Bhuiya (2004); Pitt and Khandker (1996); and Pitt et al.<br />

(1999) revealed that micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance has a positive impact <strong>on</strong> health. Furthermore, Hashemi<br />

et al. (1996); and Pitt and Khandker (1998) noted that micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance has positive effect <strong>on</strong><br />

women empowerment. However, there exists a counter argument that microcredit<br />

programs inflicted extreme pressure <strong>on</strong> women by forcing them down to meet difficult<br />

loan repayment schedules (Goetz and Gupta, 1996).<br />

Beside the micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance impact <strong>on</strong> the indicators menti<strong>on</strong>ed above, Kyophilav<strong>on</strong>g<br />

and Chaleunsinh, (2005), found that the behavior <str<strong>on</strong>g>of</str<strong>on</strong>g> the village savings group members<br />

was changed as a result <str<strong>on</strong>g>of</str<strong>on</strong>g> participating in a program. While previously savings were kept<br />

in the form <str<strong>on</strong>g>of</str<strong>on</strong>g> gold, livestock, jewelry, deposits in the bank and savings at home,<br />

members now saved in the savings group.<br />

2

<str<strong>on</strong>g>The</str<strong>on</strong>g> Lao People’s Democratic Republic (Lao PDR) is <strong>on</strong>e <str<strong>on</strong>g>of</str<strong>on</strong>g> the poorest countries<br />

in East Asia in terms <str<strong>on</strong>g>of</str<strong>on</strong>g> an estimated per capita income <str<strong>on</strong>g>of</str<strong>on</strong>g> US$ 390 in 2004 (World Bank<br />

Vientiane Office, 2006). Laos is classified by the United Nati<strong>on</strong> as a Least Developed<br />

Country (LDC). According to the World Bank Vientiane Office (2006), 71 per cent <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

Lao populati<strong>on</strong> lived <strong>on</strong> less than US$2 a day, and 23 per cent <strong>on</strong> less than US$1 a day in<br />

2004. In the same year, 34 per cent <str<strong>on</strong>g>of</str<strong>on</strong>g> the populati<strong>on</strong> lived under the nati<strong>on</strong>al poverty<br />

line; infant mortality was 82 per 1,000 live births; and life expectancy was approximately<br />

55 years.<br />

C<strong>on</strong>sequently, the government <str<strong>on</strong>g>of</str<strong>on</strong>g> Laos recognizes that access to rural finance and<br />

micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance could be <strong>on</strong>e <str<strong>on</strong>g>of</str<strong>on</strong>g> the major tools for poverty alleviati<strong>on</strong> and places<br />

micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance activities as <strong>on</strong>e <str<strong>on</strong>g>of</str<strong>on</strong>g> the priority programs for the agriculture and forestry<br />

sector in order to promote sustainable growth and poverty eradicati<strong>on</strong> under the Nati<strong>on</strong>al<br />

Growth and Poverty Eradicati<strong>on</strong> Strategy (NGPES) (2004). Since 1987, the broad<br />

approach <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance, including in kind and in cash revolving role fund, has been<br />

implemented by numerous development projects which includes those <str<strong>on</strong>g>of</str<strong>on</strong>g> government.<br />

However, the micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance sector is still relatively new in Laos. Although d<strong>on</strong>ors have<br />

made a significant investment in the last few years in micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance programs, the sector<br />

is developing very slowly. About <strong>on</strong>e milli<strong>on</strong> ec<strong>on</strong>omically active people potentially<br />

require access to formal or semi-formal micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance services. However, almost three<br />

quarters can not reach them. Approximately 300,000 people recently accessed loan and<br />

savings services. Only 21 per cent have access to microcredit from the formal sector. 33<br />

per cent are dependant <strong>on</strong> the semi-formal sector and project initiatives and the rest 46<br />

3

per cent are obtaining financial service from the informal sector (Micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance Capacity<br />

Building and Research Programme, 2005).<br />

Very few empirical studies have c<strong>on</strong>ducted to examine the effect <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance<br />

<strong>on</strong> individual, household, community, or instituti<strong>on</strong>al levels in Laos and to test whether<br />

or not micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance is <strong>on</strong>e <str<strong>on</strong>g>of</str<strong>on</strong>g> tools for poverty reducti<strong>on</strong>. One empirical study <str<strong>on</strong>g>of</str<strong>on</strong>g> Lao<br />

micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance <strong>on</strong> Saithani case 1 by Sichanth<strong>on</strong>gthip (2004) showed a positive impact <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

microcredit <strong>on</strong> income level <str<strong>on</strong>g>of</str<strong>on</strong>g> individual borrower. <str<strong>on</strong>g>The</str<strong>on</strong>g> study involved evaluating the<br />

impact <str<strong>on</strong>g>of</str<strong>on</strong>g> a micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance program (village savings group) in a semi-urban area <str<strong>on</strong>g>of</str<strong>on</strong>g> Laos<br />

using a questi<strong>on</strong>naire to collect primary household data from members <str<strong>on</strong>g>of</str<strong>on</strong>g> the<br />

micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance program at two points <str<strong>on</strong>g>of</str<strong>on</strong>g> time (before and after borrowing) 2 .<br />

Sichanth<strong>on</strong>gthip reported the results <str<strong>on</strong>g>of</str<strong>on</strong>g> the impact <strong>on</strong> income by applying ec<strong>on</strong>ometric<br />

analysis. However, he did not c<strong>on</strong>trol for selecti<strong>on</strong> bias in the sample. Another study<br />

which was not aware with such bias is the study by Kyophilav<strong>on</strong>g and Chaleunsinh<br />

(2005) who estimated the impact <str<strong>on</strong>g>of</str<strong>on</strong>g> a village savings group in a semi-urban area <str<strong>on</strong>g>of</str<strong>on</strong>g> Laos<br />

by c<strong>on</strong>ducting a survey for both members and n<strong>on</strong>members <str<strong>on</strong>g>of</str<strong>on</strong>g> the village savings group.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g>y presented <strong>on</strong>ly the means comparis<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> many impact indicators for both members<br />

and n<strong>on</strong>members. Without the correcti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the selecti<strong>on</strong> bias problem, the results may<br />

overestimate the impact <str<strong>on</strong>g>of</str<strong>on</strong>g> the program.<br />

This study will attempt to evaluate the impact <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance programs in Laos<br />

by correcting for the bias described above. This study also selected savings groups in<br />

Naxaith<strong>on</strong>g city as a case study. <str<strong>on</strong>g>The</str<strong>on</strong>g> city is located in a semi-urban area <str<strong>on</strong>g>of</str<strong>on</strong>g> Vientiane, the<br />

1 Saithani case is derived from that the Saithani Small and Rural Development Project (Saithani Project)<br />

which was established in 1996. <str<strong>on</strong>g>The</str<strong>on</strong>g> Project is a cooperative management between Lao Women’s Uni<strong>on</strong><br />

and the Foundati<strong>on</strong> for Integrated Agricultural Management (FIAM) (Sichanth<strong>on</strong>gthip, 2004:21).<br />

2 Data before the borrowing was collected by resp<strong>on</strong>dent recall.<br />

4

Capital <str<strong>on</strong>g>of</str<strong>on</strong>g> Laos, and the program established as part <str<strong>on</strong>g>of</str<strong>on</strong>g> the Women and Community’s<br />

Empowering Project. <str<strong>on</strong>g>The</str<strong>on</strong>g> locati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the study was selected because most <str<strong>on</strong>g>of</str<strong>on</strong>g> the savings<br />

groups are located in and around the capital. Results <str<strong>on</strong>g>of</str<strong>on</strong>g> a recent survey found that most <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

the 357 savings groups operating in Laos were located in and around Vientiane<br />

(Micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance Capacity Building and Research Project (2003) cited in Chaleunsinh,<br />

2004:7).<br />

1.2 Research topic and objective<br />

Many studies examining the impact <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance at the household level,<br />

enterprise level and macroec<strong>on</strong>omic level have shown a positive impact <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance<br />

<strong>on</strong> two sets <str<strong>on</strong>g>of</str<strong>on</strong>g> indicators – ec<strong>on</strong>omic and social indicators – in both developing and<br />

developed countries. However, such studies have not been widely c<strong>on</strong>ducted in Lao PDR.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g>refore, this paper will address this gap by examining the impact <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance to<br />

household welfare or outcomes in Lao PDR. More specifically, it will investigate the<br />

impact <str<strong>on</strong>g>of</str<strong>on</strong>g> savings groups at the household level in a semi-urban area <str<strong>on</strong>g>of</str<strong>on</strong>g> Laos.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> primary objective <str<strong>on</strong>g>of</str<strong>on</strong>g> a savings group in Laos is to improve the living status <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

borrowers and their families to bring them out <str<strong>on</strong>g>of</str<strong>on</strong>g> poverty. <str<strong>on</strong>g>The</str<strong>on</strong>g> main purpose <str<strong>on</strong>g>of</str<strong>on</strong>g> this paper<br />

will be to evaluate the success <str<strong>on</strong>g>of</str<strong>on</strong>g> savings group against their primary objective.<br />

1.3 Hypothesis<br />

Most <str<strong>on</strong>g>of</str<strong>on</strong>g> poor people and lower income people join micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance program in Laos<br />

because they can access credit with specified interest rate which is lower than that<br />

obtained from the informal m<strong>on</strong>ey lender. <str<strong>on</strong>g>The</str<strong>on</strong>g>y can, thus, save m<strong>on</strong>ey. <str<strong>on</strong>g>The</str<strong>on</strong>g>refore, it is<br />

5

hypothesized that members with a l<strong>on</strong>g-term participati<strong>on</strong> <strong>on</strong> the savings group may have<br />

better quality <str<strong>on</strong>g>of</str<strong>on</strong>g> life in terms <str<strong>on</strong>g>of</str<strong>on</strong>g> wealth, income and expenses.<br />

1.4 Methodology<br />

To achieve the research objective, the author adopted the survey design and<br />

research methodology <str<strong>on</strong>g>of</str<strong>on</strong>g> Coleman (1999) taking into account bias for self-selecti<strong>on</strong> and<br />

endogenous program placement which was not corrected in the previous studies relating<br />

to Laos. <str<strong>on</strong>g>The</str<strong>on</strong>g> author c<strong>on</strong>ducted a survey <str<strong>on</strong>g>of</str<strong>on</strong>g> 251 households in six villages in a semi-urban<br />

area <str<strong>on</strong>g>of</str<strong>on</strong>g> Laos – Naxaith<strong>on</strong>g district which is located 16 kilometers from Vientiane, the<br />

Capital <str<strong>on</strong>g>of</str<strong>on</strong>g> Laos. Of these, three villages had savings groups operating for more than a<br />

year, and are called “old” savings groups. <str<strong>on</strong>g>The</str<strong>on</strong>g> remaining three villages also started<br />

operating savings groups but these were in operati<strong>on</strong> for less than a year. <str<strong>on</strong>g>The</str<strong>on</strong>g>se are called<br />

“new” savings groups. In the six villages, villagers were allowed to self-select to be<br />

savings group members or n<strong>on</strong>members. <str<strong>on</strong>g>The</str<strong>on</strong>g> survey sample included members and<br />

n<strong>on</strong>members in the six villages. Members who experienced benefits from joining the<br />

savings group by either obtaining a credit or receiving a dividend are called the<br />

“treatment” group, and those who have not benefited from the groups are called the<br />

“c<strong>on</strong>trol” group. All members <str<strong>on</strong>g>of</str<strong>on</strong>g> the “c<strong>on</strong>trol” group were relatively new members with<br />

an average membership <str<strong>on</strong>g>of</str<strong>on</strong>g> 2.2 m<strong>on</strong>ths. Hence, the effects <strong>on</strong> savings group members in<br />

the treatment group can be compared with the savings group members in the c<strong>on</strong>trol<br />

group. In additi<strong>on</strong>, differences in the length <str<strong>on</strong>g>of</str<strong>on</strong>g> time that savings group program has been<br />

available to members in both treatment and c<strong>on</strong>trol groups is taken into account to obtain<br />

more precise impact estimates. Inclusi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> n<strong>on</strong>members in all six villages allowed for<br />

6

the use <str<strong>on</strong>g>of</str<strong>on</strong>g> village fixed effect estimati<strong>on</strong> to c<strong>on</strong>trol the possibility that the order in which<br />

these six villages had savings group program placement is endogenous.<br />

1.5 Structure <str<strong>on</strong>g>of</str<strong>on</strong>g> the paper<br />

This paper is organized as follows:<br />

• Chapter 2 presents an overview <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance in Lao PDR.<br />

• Chapter 3 presents a literature review <str<strong>on</strong>g>of</str<strong>on</strong>g> previous studies <strong>on</strong> the impact <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance <strong>on</strong> ec<strong>on</strong>omic and social indicators.<br />

• Chapter 4 discusses the theoretical framework and identifies the empirical<br />

modeling and estimati<strong>on</strong> methods to be used for this study.<br />

• Chapter 5 describes the survey design and data.<br />

• Chapter 6 outlines the results <str<strong>on</strong>g>of</str<strong>on</strong>g> empirical analysis.<br />

• Chapter 7 summarizes the results and draws policy implicati<strong>on</strong>s.<br />

7

CHAPTER 2<br />

MICROFINANCE IN LAOS<br />

Many countries realize that micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance can play an important role in ec<strong>on</strong>omic<br />

development as <strong>on</strong>e <str<strong>on</strong>g>of</str<strong>on</strong>g> the tools for poverty reducti<strong>on</strong>. <str<strong>on</strong>g>The</str<strong>on</strong>g> government <str<strong>on</strong>g>of</str<strong>on</strong>g> Laos also<br />

recognizes that role and has placed micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance activities as <strong>on</strong>e <str<strong>on</strong>g>of</str<strong>on</strong>g> the priority programs<br />

for the agriculture and forestry sector in order to promote sustainable growth and poverty<br />

eradicati<strong>on</strong> under the Nati<strong>on</strong>al Growth and Poverty Eradicati<strong>on</strong> Strategy (NGPES). This<br />

chapter will outline the general background <strong>on</strong> the development <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance in Laos,<br />

provide an overview <str<strong>on</strong>g>of</str<strong>on</strong>g> the current state <str<strong>on</strong>g>of</str<strong>on</strong>g> play in Laos in this area.<br />

2.1 Country Brief<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> Lao People’s Democratic Republic (Lao PDR) is <strong>on</strong>e <str<strong>on</strong>g>of</str<strong>on</strong>g> the poorest countries<br />

in East Asia with an estimated per capita income <str<strong>on</strong>g>of</str<strong>on</strong>g> US$ 390 in 2004 (World Bank<br />

Vientiane Office, 2006). Laos is classified by the United Nati<strong>on</strong> as a Least Developed<br />

Country (LDC). According to the World Bank Vientiane Office (2006), in 2004, 71 per<br />

cent <str<strong>on</strong>g>of</str<strong>on</strong>g> the Lao populati<strong>on</strong> lived <strong>on</strong> less than US$2 a day, and 23 per cent <strong>on</strong> less than<br />

US$1 a day. In the same year, 34 per cent <str<strong>on</strong>g>of</str<strong>on</strong>g> the populati<strong>on</strong> lived under the nati<strong>on</strong>al<br />

poverty line; infant mortality was 82 per 1,000 live births; and life expectancy was<br />

approximately 55 years.<br />

In 2004, Laos had a populati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> around 5.8 milli<strong>on</strong> and a land area <str<strong>on</strong>g>of</str<strong>on</strong>g> 236,800<br />

square kilometers. <str<strong>on</strong>g>The</str<strong>on</strong>g> country is characterized by a high degree <str<strong>on</strong>g>of</str<strong>on</strong>g> geographic, cultural<br />

8

and linguistic diversity with very poor infrastructure. Moreover, villages, particularly<br />

those populated by ethnic minority groups, tend to be extremely isolated and practice<br />

subsistence agriculture. Laos is also a landlocked country which is located in the center<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> the Mek<strong>on</strong>g regi<strong>on</strong>, bordered by Thailand, Vietnam, Southern China, Cambodia and<br />

Myanmar, <str<strong>on</strong>g>of</str<strong>on</strong>g> which, the first three are experiencing rapid ec<strong>on</strong>omic growth. Nevertheless,<br />

Laos has significant ec<strong>on</strong>omic potential because <str<strong>on</strong>g>of</str<strong>on</strong>g> its rich natural resources (such as<br />

forestry, minerals and hydro-electric power) and its proximity to major Asian ec<strong>on</strong>omies.<br />

Agriculture is the major ec<strong>on</strong>omic sector c<strong>on</strong>tributing 51 per cent <str<strong>on</strong>g>of</str<strong>on</strong>g> GDP and employing<br />

80 percent <str<strong>on</strong>g>of</str<strong>on</strong>g> the labor force. <str<strong>on</strong>g>The</str<strong>on</strong>g> industry sector accounts for 23 per cent and services<br />

for 26 per cent (World Bank Vientiane Office, 2006).<br />

2.2 Micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance in Laos<br />

Since 1987, the broad approach <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance in Laos (including in kind and in<br />

cash revolving role fund) has been implemented by numerous development projects<br />

which include those initiated by the government. However, the micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance sector is still<br />

relatively new in Laos. Although d<strong>on</strong>ors have made a significant investment in the last<br />

few years in micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance programs, the sector is developing very slowly. About <strong>on</strong>e<br />

milli<strong>on</strong> ec<strong>on</strong>omically active people potentially require access to formal or semi-formal<br />

micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance services. However, almost three quarters cannot reach them. Approximately<br />

300,000 people recently accessed loan and savings services. Only 21 per cent have access<br />

to microcredit from the formal sector, 33 per cent are dependant <strong>on</strong> the semi-formal<br />

sector and project initiatives and the rest 46 per cent are obtaining financial services from<br />

the informal sector (Micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance Capacity Building and Research Programme, 2005).<br />

9

This secti<strong>on</strong> will briefly describe the development <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance in terms <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance providers 3 which c<strong>on</strong>sist <str<strong>on</strong>g>of</str<strong>on</strong>g> the formal, semiformal and informal sectors.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> informati<strong>on</strong> is sourced from Enterplan (2003).<br />

2.2.1 Formal sector<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> formal banking system in Laos c<strong>on</strong>sists <str<strong>on</strong>g>of</str<strong>on</strong>g>:<br />

• <str<strong>on</strong>g>The</str<strong>on</strong>g> Bank <str<strong>on</strong>g>of</str<strong>on</strong>g> Laos (the central bank);<br />

• Three state-owned banks (the Banque pour le Commerce Exterieur Lao<br />

(BCEL), Lao Development Bank (LDB) 4 , and the Agricultural Promoti<strong>on</strong><br />

Bank (APB));<br />

• Three joint venture banks (Joint Development Bank, Lao-Viet Bank and<br />

Vientiane Commercial Bank);<br />

• Six foreign commercial banks with branch <str<strong>on</strong>g>of</str<strong>on</strong>g>fices and <strong>on</strong>e foreign<br />

commercial bank with a representative <str<strong>on</strong>g>of</str<strong>on</strong>g>fice (FCBs) 5 .<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> headquarters <str<strong>on</strong>g>of</str<strong>on</strong>g> each bank are located in Vientiane. APB is the largest bank<br />

in term <str<strong>on</strong>g>of</str<strong>on</strong>g> branch network in Lao PDR. It has <strong>on</strong>e head <str<strong>on</strong>g>of</str<strong>on</strong>g>fice in Vientiane, 18 branches<br />

in the 17 provincial capitals and Vientiane Capital City, and 55 sub-service units at the<br />

district level. <str<strong>on</strong>g>The</str<strong>on</strong>g> head <str<strong>on</strong>g>of</str<strong>on</strong>g>fice <str<strong>on</strong>g>of</str<strong>on</strong>g> LDB is also located in Vientiane and it has 17 branches<br />

(<strong>on</strong>e in each province). BCEL has three branches. Lao-Viet Bank has <strong>on</strong>e branch in<br />

3 This secti<strong>on</strong> borrows extensively from Enterplan (2003).<br />

4 It was merged from two state-owned banks: Lao May Bank and Lane Xang Bank.<br />

5 Public Bank (Malaysia), Bangkok Bank, Bank <str<strong>on</strong>g>of</str<strong>on</strong>g> Ayudhya, Krung Thai Bank, Siam Commercial Bank,<br />

Thai Military Bank (all Thai Bank) all <str<strong>on</strong>g>of</str<strong>on</strong>g> which have branch <str<strong>on</strong>g>of</str<strong>on</strong>g>fices in Vientiane. Standard Chartered Bank<br />

has a representative <str<strong>on</strong>g>of</str<strong>on</strong>g>fice and <strong>on</strong>ly provides <str<strong>on</strong>g>of</str<strong>on</strong>g>fshore guarantee facilities for overseas clients doing<br />

business in Laos.<br />

10

Champasack province. <str<strong>on</strong>g>The</str<strong>on</strong>g> rest (JVBs and FCBs) have no branches and no provincial<br />

outreach, and <strong>on</strong>ly operate in the area around Vientiane municipality.<br />

Practically, <strong>on</strong>ly <strong>on</strong>e formal financial instituti<strong>on</strong>, APB 6 , has a large outreach and a<br />

true track record in rural finance. APB was established by Decree in 1992 (Decree 92/PM<br />

1992) to assist the development <str<strong>on</strong>g>of</str<strong>on</strong>g> the agricultural sector in Laos. Since March 2000,<br />

APB has been largely under the provisi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the Decree <strong>on</strong> Commercial Banks<br />

(Decree02/PR 2000) after operating under that separate mandate. In April 2002, APB had<br />

about 130,000 borrowers. Of these, about 123,000 were in groups (group lending). <str<strong>on</strong>g>The</str<strong>on</strong>g><br />

activities <str<strong>on</strong>g>of</str<strong>on</strong>g> APB have focused <strong>on</strong> the provisi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> subsidized loans which use funds from<br />

the government and d<strong>on</strong>ors.<br />

2.2.2 Semiformal sector<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> semiformal financial sector in Laos is poorly developed. In this sector,<br />

activities may be classified in two categories: micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance initiatives and illustrative<br />

Internati<strong>on</strong>al N<strong>on</strong> Government Organizati<strong>on</strong> (INGO) initiatives.<br />

A. Micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance Initiatives<br />

Many micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance initiatives provide micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance in urban and rural areas <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

Laos through program such as the Micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance Project, Cooperative de Credit de<br />

Soutien aux Producteurs (CCSP), Project de Developpement Rural du District de<br />

Ph<strong>on</strong>gsaly (PDDP), the Rural Development Cooperative (RDC), and Credit Uni<strong>on</strong> Pilot<br />

Project.<br />

6<br />

Lane Xang Bank before merging with Lao May Bank also provided micro lending with a focus <strong>on</strong> microtraders<br />

(Bank <str<strong>on</strong>g>of</str<strong>on</strong>g> the Lao PDR, 2002: 31).<br />

11

(1) <str<strong>on</strong>g>The</str<strong>on</strong>g> Micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance project<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> United Nati<strong>on</strong>s Capital Development Fund (UNCDF) and the United Nati<strong>on</strong>s<br />

Development Programme (UNDP) with cooperati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the Government <str<strong>on</strong>g>of</str<strong>on</strong>g> Laos launched<br />

the micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance project in late 1997. This project ran micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance activities in<br />

Oudomxay and Sayaboury Provinces using the group lending methodology. It also<br />

includes the Sihom Project Savings and Credit Scheme (SIPSACRES) – an urban credit<br />

and savings cooperative founded under UNDP project in 1995. However, the UNDP and<br />

UNCDF did not provide funding for this project after 2002. Now, the Lao government<br />

manages the project 7 . While data for 2002 is unavailable, estimated data for 2000 showed<br />

that the micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance project serves about 3,525 clients in total in October 2000 (United<br />

Nati<strong>on</strong>s Capital Development Fund, 2001).<br />

(2) Cooperative de Credit de Soutien aux Producteurs (CCSP)<br />

CCSP was established in 1996 <strong>on</strong> the initiative <str<strong>on</strong>g>of</str<strong>on</strong>g> a group <str<strong>on</strong>g>of</str<strong>on</strong>g> Lao entrepreneurs. It<br />

c<strong>on</strong>sists <str<strong>on</strong>g>of</str<strong>on</strong>g> nine member-owned cooperatives. Microcredit provided to their clients in the<br />

vicinity <str<strong>on</strong>g>of</str<strong>on</strong>g> Vientiane is for the purposed <str<strong>on</strong>g>of</str<strong>on</strong>g> agriculture, handicraft, small industry and<br />

services. CCSP also accepts savings from member and issues loan to members secured by<br />

group guarantee and compulsory savings. In September 2002, there were about 1,000<br />

active savers and about 650 active borrowers in this initiative.<br />

(3) Project de Developpement Rural du District de Ph<strong>on</strong>gsaly (PDDP)<br />

PDDP was formed in 1997. It runs village banks for farmers in 57 villages in<br />

Ph<strong>on</strong>gsaly city with the support from Agence Francais Developpement (AFD). PDDP<br />

also requires compulsory savings from their members and leverages these with AFD<br />

7 For the <strong>on</strong>es operating in Sayaboury and Oudomxay provinces are recently under the provincial<br />

government authorities. SIPSACRES is currently under the supervisi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> Finance Department, Vientiane<br />

Capital.<br />

12

funds. In March 2003, about 2,350 borrowers received a loan from PDDP. In this<br />

initiative, loans are provided for cash crops, livestock, handicraft and petty trade and it<br />

applies a joint liability system for loan guarantee.<br />

(4) Rural Development Cooperative(RDC)<br />

RDC began running its activities in August 2001 when it received the funds from<br />

the Vientiane Municipal Development Fund. Its operati<strong>on</strong> is implemented in thirty<br />

villages in Vientiane Capital City. Its services include both credit and savings. Loans are<br />

issued for different kinds <str<strong>on</strong>g>of</str<strong>on</strong>g> ec<strong>on</strong>omic activities such as agriculture, handicraft and trade.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g>se loans require physical collateral and a 20 per cent savings deposit for guarantee.<br />

RDC had between 400 and 500 borrowers in 2003.<br />

(5) Credit Uni<strong>on</strong> Pilot Project<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> Credit Uni<strong>on</strong> Pilot Project is <strong>on</strong>e <str<strong>on</strong>g>of</str<strong>on</strong>g> the subprojects <str<strong>on</strong>g>of</str<strong>on</strong>g> Asian Development<br />

Bank TA cluster 3413 – LAO: Rural Finance Development. In March 2003, the savings<br />

and credit uni<strong>on</strong>s (SCUs) were established in Vientiane, Savanakhet and Luang Prabang<br />

Provinces. <str<strong>on</strong>g>The</str<strong>on</strong>g> three pilot credit uni<strong>on</strong>s have licensing as a c<strong>on</strong>diti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the ADB<br />

Banking Sector Reform Programme Loan (BSRPL).<br />

B. Illustrative INGO initiatives<br />

In additi<strong>on</strong> to the micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance initiatives, there are about 1,600 village revolving<br />

funds (VRFs) that have been supported by d<strong>on</strong>ors and NGOs (Bank <str<strong>on</strong>g>of</str<strong>on</strong>g> the Lao PDR,<br />

2002: 31).<br />

Internati<strong>on</strong>al N<strong>on</strong> Government Organizati<strong>on</strong>s (INGOs) use village revolving<br />

funds (VRFs) to widely provide financial services in the rural areas. <str<strong>on</strong>g>The</str<strong>on</strong>g>se organizati<strong>on</strong>s<br />

13

tend to focus <strong>on</strong> the operati<strong>on</strong> in the areas which are not covered by banks including the<br />

APB. In these areas, villagers can <strong>on</strong>ly access to credit from friends, family members,<br />

and m<strong>on</strong>eylenders. Around 35 INGOs and a few bilateral and multilateral agencies are<br />

supporting rural development projects in Laos. <str<strong>on</strong>g>The</str<strong>on</strong>g>se projects have set up cash or in-kind<br />

funds for villagers as part <str<strong>on</strong>g>of</str<strong>on</strong>g> their integrated programmes. Assistance is provided for<br />

agricultural equipment, gravity water and irrigati<strong>on</strong> supplies, seeds, rice banks for food<br />

security, animal banks, and medicinal drug fund. <str<strong>on</strong>g>The</str<strong>on</strong>g> projects depend <strong>on</strong> subsidized<br />

credit and when this credit finishes when the project ends. <str<strong>on</strong>g>The</str<strong>on</strong>g>re is rarely any local<br />

resource mobilizati<strong>on</strong>. As a result <str<strong>on</strong>g>of</str<strong>on</strong>g> the above, a substantial number <str<strong>on</strong>g>of</str<strong>on</strong>g> projects are not<br />

sustainable.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> Lao Women’s Uni<strong>on</strong> (LWU) is a key intermediary for INGOs rural financial<br />

projects. LWU was established in 1955 and is a mass organizati<strong>on</strong> which has been<br />

implemented at three levels – district, provincial and nati<strong>on</strong>al. LWU operates in every<br />

village through the country. It is active in a significant share <str<strong>on</strong>g>of</str<strong>on</strong>g> INGOs projects as an<br />

intermediary, an organizer, and as the Lao Government partner. Due to its reach into the<br />

villages, LWU has frequently been the implementing agent or partner for INGO-<br />

supported projects.<br />

In additi<strong>on</strong> to LWU, there are three more mass organizati<strong>on</strong>s 8 and five<br />

government <str<strong>on</strong>g>of</str<strong>on</strong>g>fices 9 at district and provincial level to run micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance programs<br />

throughout the country (Micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance Capacity Building and Research Programme,<br />

2005).<br />

8<br />

Lao Youth Uni<strong>on</strong>, Lao Fr<strong>on</strong>t for Nati<strong>on</strong>al C<strong>on</strong>structi<strong>on</strong> Office and Federati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> Trade Uni<strong>on</strong>.<br />

9<br />

Agriculture Office, Planning and Investment Office, Health Office, Labour and Social <strong>Welfare</strong> Office,<br />

and Finance Office.<br />

14

In additi<strong>on</strong>, there are many NGOs running micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance initiatives in Laos<br />

including CARE, CONSORTIUM, CUSO, Menn<strong>on</strong>ite Central Committee (MCC), Save<br />

the Children Australia (SCA).<br />

2.2.3 Informal sector<br />

This sector comprises m<strong>on</strong>eylenders, rotating savings and credit schemes which<br />

locally known as Houai (daily, weekly, and m<strong>on</strong>thly), traders and rich farmers.<br />

According to Bagchi et al. (2002), inter-household loans are important am<strong>on</strong>g rural<br />

households and most <str<strong>on</strong>g>of</str<strong>on</strong>g> these loans are made in-kind. Nevertheless, rotating savings and<br />

credit (Houai) is a significant source <str<strong>on</strong>g>of</str<strong>on</strong>g> loan m<strong>on</strong>ey for investment or emergency needs in<br />

the urban or semi-urban areas.<br />

M<strong>on</strong>eylender<br />

According to the Bank <str<strong>on</strong>g>of</str<strong>on</strong>g> the Lao PDR (2002), the role <str<strong>on</strong>g>of</str<strong>on</strong>g> m<strong>on</strong>eylenders in both<br />

urban and rural areas is estimated to be quite important – approximately 50 per cent <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

rural villages appear to have access to m<strong>on</strong>ey lender services. Most pr<str<strong>on</strong>g>of</str<strong>on</strong>g>essi<strong>on</strong>al<br />

m<strong>on</strong>eylenders operate close to the markets and lend for quick turnover activities.<br />

According to pr<str<strong>on</strong>g>of</str<strong>on</strong>g>essi<strong>on</strong>al observati<strong>on</strong>, rates have been stable for the last few years<br />

ranging from 10 and 30 per cent per m<strong>on</strong>th with lower interest rates in urban areas due to<br />

competiti<strong>on</strong>. Supplier credit for agricultural inputs is rare. Some foreign suppliers across<br />

the Mek<strong>on</strong>g River accept precious metals as collateral for merchandise purchases.<br />

As described above, there are many different approaches to micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance in Laos.<br />

Bagchi et al. (2002) analyzed each micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance practice in Laos and provide<br />

commentary <strong>on</strong> each type <str<strong>on</strong>g>of</str<strong>on</strong>g> initiative. <str<strong>on</strong>g>The</str<strong>on</strong>g>se comments are summarized in Table 2.1.<br />

15

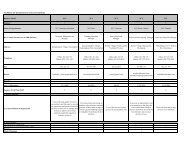

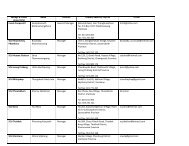

Table 2.1: Current practices in Laos 10<br />

No. Approach/<br />

Implementing agencies<br />

Limitati<strong>on</strong>s/ Challenges<br />

Models GoL/Ministry/ Bank INGOs Bi and or<br />

Provincial<br />

Multilateral<br />

Authority/<br />

Mass<br />

organizati<strong>on</strong><br />

agency<br />

1 Instituti<strong>on</strong>al √ √ • Not targeting poor people<br />

methodology<br />

• Not flexible enough<br />

(solidarity<br />

methodology<br />

focused <strong>on</strong><br />

instituti<strong>on</strong>al<br />

sustainability)<br />

• Limited outreach<br />

• Rural households do not have<br />

access to financial services<br />

2 Credit uni<strong>on</strong> √ √ • Lack <str<strong>on</strong>g>of</str<strong>on</strong>g> c<strong>on</strong>fidence <str<strong>on</strong>g>of</str<strong>on</strong>g> people<br />

as a depositor<br />

• Limited outreach<br />

• Rural households do not have<br />

access to financial services<br />

• Lack <str<strong>on</strong>g>of</str<strong>on</strong>g> skilled human<br />

resources<br />

3 Direct bank<br />

√ • Accessibility is difficult<br />

operati<strong>on</strong><br />

because <str<strong>on</strong>g>of</str<strong>on</strong>g> lots <str<strong>on</strong>g>of</str<strong>on</strong>g> paper work<br />

and formality<br />

• Lack <str<strong>on</strong>g>of</str<strong>on</strong>g> c<strong>on</strong>fidence <str<strong>on</strong>g>of</str<strong>on</strong>g> people<br />

as a depositor<br />

• Limited outreach<br />

• Rural households do not have<br />

access to financial services<br />

• Lack <str<strong>on</strong>g>of</str<strong>on</strong>g> skilled human<br />

resources<br />

• Does not disclose its<br />

financial informati<strong>on</strong> or audit<br />

results to the public<br />

4 Co-operative √ • Limited outreach<br />

• Rural households do not have<br />

access to financial services<br />

5 Self help group √ √ √ • Not properly designed<br />

• Ownership is big challenge<br />

• Most <str<strong>on</strong>g>of</str<strong>on</strong>g> the time village elite<br />

people have easy access to<br />

funds<br />

• Often poorer people<br />

excluded from the benefits<br />

• Highly subsidized<br />

10 Table 2.1 is sourced from the market research study d<strong>on</strong>e by Bagchi et al. (2002).<br />

16

No. Approach/<br />

Implementing agencies<br />

Limitati<strong>on</strong>s/ Challenges<br />

Models GoL/Ministry/ Bank INGOs Bi and or<br />

Provincial<br />

Multilateral<br />

Authority/<br />

Mass<br />

organizati<strong>on</strong><br />

agency<br />

6 Village or √ √ √ √ • Not properly designed<br />

community<br />

• Ownership is big challenge<br />

bank<br />

• Most <str<strong>on</strong>g>of</str<strong>on</strong>g> the time village elite<br />

people have easy access to the<br />

fund<br />

• Often poorer people excluded<br />

from the benefits<br />

• Emphasis <strong>on</strong> credit rather than<br />

savings<br />

• Sustainability is questi<strong>on</strong>ed<br />

7 Informal kinds √ √ √ • Mainly introduced for food<br />

(cereal and<br />

security<br />

animal bank)<br />

• No cash transacti<strong>on</strong>s made<br />

initiatives<br />

• Not financial services<br />

• Pushing back towards the n<strong>on</strong><br />

cash ec<strong>on</strong>omy<br />

• Highly subsidized<br />

• Very informally organized<br />

• Very limited opti<strong>on</strong> for local<br />

resources mobilizati<strong>on</strong><br />

8 Village √ √ √ • Ownership is a questi<strong>on</strong><br />

Revolving Fund<br />

• Often poorly designed<br />

• Most <str<strong>on</strong>g>of</str<strong>on</strong>g> the time village elite<br />

people have easy access to funds<br />

• Often poorer people excluded<br />

from benefits<br />

• Emphasis <strong>on</strong> credit rather than<br />

savings<br />

• Highly subsidized<br />

• Leadership is a crucial factor<br />

• Sustainability is questi<strong>on</strong>ed<br />

Source: Annex 5 <str<strong>on</strong>g>of</str<strong>on</strong>g> Bagchi et al. (2002).<br />

Although the practice <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance in Laos is still new and at an early stage <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

development, this study aims to examine the influence <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance <strong>on</strong> household’s<br />

outcomes. <str<strong>on</strong>g>The</str<strong>on</strong>g>refore, the rest <str<strong>on</strong>g>of</str<strong>on</strong>g> the paper will c<strong>on</strong>duct an in-depth investigati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the<br />

17

effects <str<strong>on</strong>g>of</str<strong>on</strong>g> savings groups <strong>on</strong> household welfare or outcomes to determine whether or not<br />

the household’s status improves with access to micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance.<br />

18

CHAPTER 3<br />

LITERATURE REVIEW<br />

Most existing studies <strong>on</strong> the impact <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance examine two sets <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

indicators 11 – ec<strong>on</strong>omic and social indicators – at different levels 12 . Despite the variati<strong>on</strong><br />

in the methods used and the results <str<strong>on</strong>g>of</str<strong>on</strong>g> studies c<strong>on</strong>ducted in various countries, the main<br />

impact <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance impact is <strong>on</strong> change in income, expenditure, assets, educati<strong>on</strong>al<br />

status, health as well as gender empowerment. <str<strong>on</strong>g>The</str<strong>on</strong>g> studies that have examined the impact<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance <strong>on</strong> these indicators are discussed below.<br />

3.1 <str<strong>on</strong>g>Impact</str<strong>on</strong>g> studies <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance <strong>on</strong> different ec<strong>on</strong>omic and social indicators<br />

3.1.1 <str<strong>on</strong>g>Impact</str<strong>on</strong>g> studies <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance <strong>on</strong> income<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> effect <strong>on</strong> income has been analyzed at the individual, household and<br />

enterprise levels. Hulme and Mosley (1996), c<strong>on</strong>ducted various studies <strong>on</strong> different<br />

micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance programs in numerous countries, and found str<strong>on</strong>g evidence <str<strong>on</strong>g>of</str<strong>on</strong>g> the positive<br />

relati<strong>on</strong>ship between access to a credit and the borrower’s level <str<strong>on</strong>g>of</str<strong>on</strong>g> income. <str<strong>on</strong>g>The</str<strong>on</strong>g> authors<br />

indicated that the middle and upper poor received more benefits from income-generating<br />

credit initiatives than the poorest. McKernan (2002), moreover, evaluated three<br />

significant microcredit programs in Bangladesh and discovered that the pr<str<strong>on</strong>g>of</str<strong>on</strong>g>it for self-<br />

employed activities <str<strong>on</strong>g>of</str<strong>on</strong>g> households can be increased by program participati<strong>on</strong>. <str<strong>on</strong>g>The</str<strong>on</strong>g>se<br />

11 Ec<strong>on</strong>omic indicators are normally measurements for micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance impact as income, level and patterns<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> expenditure, c<strong>on</strong>sumpti<strong>on</strong> and assets. Social indicators to measure the impact <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance became<br />

popular in the early 1980s as educati<strong>on</strong>al status, access to health services, nutriti<strong>on</strong>al levels, anthropometric<br />

measures and c<strong>on</strong>traceptive use, for example (Hulme, 2000).<br />

12 Hulme (2000) identified levels <str<strong>on</strong>g>of</str<strong>on</strong>g> assessment in different units as individual, enterprise, household,<br />

community, instituti<strong>on</strong>al impacts and household ec<strong>on</strong>omic portfolio such as households, enterprise,<br />

individual and community.<br />

19

programs were also examined at the village-level impacts in the study <str<strong>on</strong>g>of</str<strong>on</strong>g> Khandker et<br />

al.(1998) which showed that they have positive impact <strong>on</strong> average households’ annual<br />

income, especially in the rural n<strong>on</strong>-farm sector. Copestake et al. (2001), estimated the<br />

effect <str<strong>on</strong>g>of</str<strong>on</strong>g> an urban credit programme – a group-based microcredit programme – in Zambia,<br />

and found that microcredit has a significant impact <strong>on</strong> the growth in enterprise pr<str<strong>on</strong>g>of</str<strong>on</strong>g>it and<br />

household income in case <str<strong>on</strong>g>of</str<strong>on</strong>g> the borrowers who have received a sec<strong>on</strong>d loan.<br />

Sichanth<strong>on</strong>gthip’s study (2004) also pointed to a positive impact <str<strong>on</strong>g>of</str<strong>on</strong>g> microcredit <strong>on</strong> the<br />

income level <str<strong>on</strong>g>of</str<strong>on</strong>g> individual borrowers. This can be seen from the higher m<strong>on</strong>thly income<br />

earned after the member accessed credit, in the empirical study <str<strong>on</strong>g>of</str<strong>on</strong>g> Lao micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance <strong>on</strong><br />

Saithani case. Shaw (2000) studied two micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance instituti<strong>on</strong>s (MFIs) in Southeastern<br />

Sri Lanka and showed that the less poor clients’ microbusiness that accessed loans from<br />

micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance programs could earn more income than those <str<strong>on</strong>g>of</str<strong>on</strong>g> the poor do. Mosley (2001)<br />

evaluated the impact <str<strong>on</strong>g>of</str<strong>on</strong>g> loans provided by two urban and two rural MFIs <strong>on</strong> poverty in<br />

Bolivia. He found that the net impact <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance from all instituti<strong>on</strong>s, at the average<br />

level, was positive in relati<strong>on</strong> to borrowers’ income, even though that net impact for<br />

poorer borrowers might be less than the net impact <strong>on</strong> richer borrowers. Copestake<br />

(2002) c<strong>on</strong>ducted the case study <str<strong>on</strong>g>of</str<strong>on</strong>g> the Zambian Copperbelt, applying the village bank<br />

model to investigate the effect <strong>on</strong> income distributi<strong>on</strong> at the household and enterprise<br />

levels. <str<strong>on</strong>g>The</str<strong>on</strong>g> study showed that the impact <strong>on</strong> income distributi<strong>on</strong> depends <strong>on</strong> who obtains<br />

the loan, who move <strong>on</strong> to larger loans and who exits the program: group dynamics was<br />

also an important factor. As he discovered, “Some initial levelling up <str<strong>on</strong>g>of</str<strong>on</strong>g> business<br />

incomes was found, but the more marked overall effect am<strong>on</strong>g borrowers was <str<strong>on</strong>g>of</str<strong>on</strong>g> income<br />

polarizati<strong>on</strong>.”(Copestake, 2002: 743).<br />

20

3.1.2 <str<strong>on</strong>g>Impact</str<strong>on</strong>g> studies <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance <strong>on</strong> expenditure<br />

Expenditure is another indicator to measure the impact <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance. Pitt and<br />

Khandker (1996 and 1998) estimated the effect <str<strong>on</strong>g>of</str<strong>on</strong>g> microcredit obtained by both males<br />

and females for the Grameen Bank and two other group-based microcredit programs in<br />

Bangladesh <strong>on</strong> various indicators. <str<strong>on</strong>g>The</str<strong>on</strong>g>y showed that the clients <str<strong>on</strong>g>of</str<strong>on</strong>g> the programs could<br />

gain from participating micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance programs in many ways. It can be seen that income<br />

per capita c<strong>on</strong>sumpti<strong>on</strong> could be increased by accessing a loan from a microcredit<br />

program such as the Grameen Bank. Khandker (2003) also c<strong>on</strong>ducted research <strong>on</strong> the<br />

l<strong>on</strong>g-run impacts <str<strong>on</strong>g>of</str<strong>on</strong>g> micr<str<strong>on</strong>g>of</str<strong>on</strong>g>inance <strong>on</strong> household c<strong>on</strong>sumpti<strong>on</strong> and poverty in Bangladesh<br />

by identifying types <str<strong>on</strong>g>of</str<strong>on</strong>g> impact in six household’s outcomes as outlined bellow:<br />

• Per capita total expenditure;<br />

• Per capita food expenditure;<br />

• Per capita n<strong>on</strong>-food expenditure;<br />

• <str<strong>on</strong>g>The</str<strong>on</strong>g> incidence <str<strong>on</strong>g>of</str<strong>on</strong>g> moderate and extreme poverty;<br />