View Presentation

View Presentation

View Presentation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

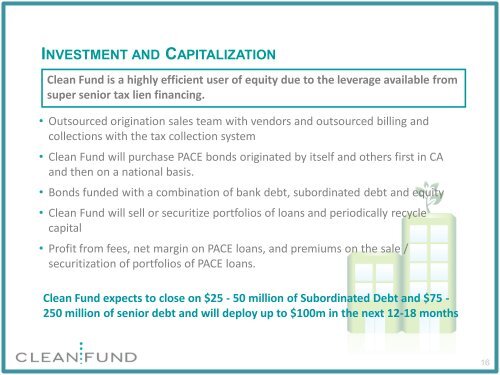

INVESTMENT AND CAPITALIZATION<br />

Clean Fund is a highly efficient user of equity due to the leverage available from<br />

super senior tax lien financing.<br />

• Outsourced origination sales team with vendors and outsourced billing and<br />

collections with the tax collection system<br />

• Clean Fund will purchase PACE bonds originated by itself and others first in CA<br />

and then on a national basis.<br />

• Bonds funded with a combination of bank debt, subordinated debt and equity<br />

• Clean Fund will sell or securitize portfolios of loans and periodically recycle<br />

capital<br />

• Profit from fees, net margin on PACE loans, and premiums on the sale /<br />

securitization of portfolios of PACE loans.<br />

Clean Fund expects to close on $25 - 50 million of Subordinated Debt and $75 -<br />

250 million of senior debt and will deploy up to $100m in the next 12-18 months<br />

16