View Presentation

View Presentation

View Presentation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

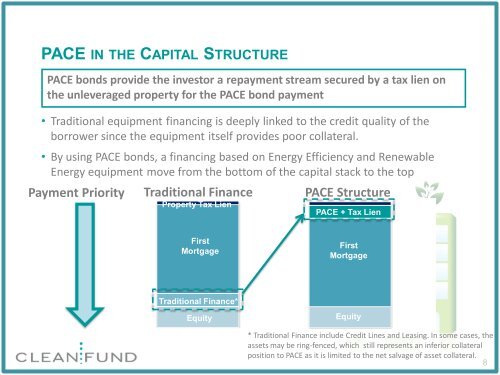

PACE IN THE CAPITAL STRUCTURE<br />

PACE bonds provide the investor a repayment stream secured by a tax lien on<br />

the unleveraged property for the PACE bond payment<br />

• Traditional equipment financing is deeply linked to the credit quality of the<br />

borrower since the equipment itself provides poor collateral.<br />

• By using PACE bonds, a financing based on Energy Efficiency and Renewable<br />

Energy equipment move from the bottom of the capital stack to the top<br />

Payment Priority<br />

Traditional Finance<br />

Property Tax Lien<br />

First<br />

Mortgage<br />

Traditional Finance*<br />

Equity<br />

PACE Structure<br />

PACE + Tax Lien<br />

First<br />

Mortgage<br />

Equity<br />

* Traditional Finance include Credit Lines and Leasing. In some cases, the<br />

assets may be ring-fenced, which still represents an inferior collateral<br />

position to PACE as it is limited to the net salvage of asset collateral.<br />

8