What's inside - BVCA admin

What's inside - BVCA admin

What's inside - BVCA admin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

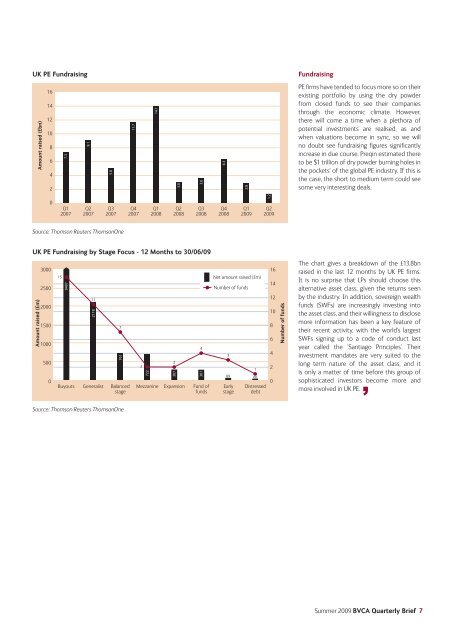

UK PE Fundraising<br />

Amount raised (£bn)<br />

Amount raised (£m)<br />

16<br />

14<br />

12<br />

10<br />

3000<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

0<br />

8<br />

6<br />

4<br />

2<br />

0<br />

15<br />

7.3<br />

Q1<br />

2007<br />

9497<br />

9.1<br />

Q2<br />

2007<br />

11<br />

2118<br />

5.0<br />

Q3<br />

2007<br />

Source: Thomson Reuters ThomsonOne<br />

UK PE Fundraising by Stage Focus - 12 Months to 30/06/09<br />

Buyouts Generalist Balanced<br />

stage<br />

7<br />

761<br />

Source: Thomson Reuters ThomsonOne<br />

11.7<br />

Q4<br />

2007<br />

2<br />

722<br />

14.1<br />

Q1<br />

2008<br />

Mezzanine<br />

2<br />

307<br />

3.0<br />

Q2<br />

2008<br />

Expansion<br />

3.6<br />

Q3<br />

2008<br />

4<br />

301<br />

Fund of<br />

funds<br />

6.3<br />

Q4<br />

2008<br />

Net amount raised (£m)<br />

Number of funds<br />

3<br />

Early<br />

stage<br />

2.8<br />

Q1<br />

2009<br />

1<br />

69 60<br />

Distressed<br />

debt<br />

1.2<br />

Q2<br />

2009<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Number of funds<br />

Fundraising<br />

PE firms have tended to focus more so on their<br />

existing portfolio by using the dry powder<br />

from closed funds to see their companies<br />

through the economic climate. However,<br />

there will come a time when a plethora of<br />

potential investments are realised, as and<br />

when valuations become in sync, so we will<br />

no doubt see fundraising figures significantly<br />

increase in due course. Preqin estimated there<br />

to be $1 trillion of dry powder burning holes in<br />

the pockets’ of the global PE industry. If this is<br />

the case, the short to medium term could see<br />

some very interesting deals.<br />

The chart gives a breakdown of the £13.8bn<br />

raised in the last 12 months by UK PE firms.<br />

It is no surprise that LPs should choose this<br />

alternative asset class, given the returns seen<br />

by the industry. In addition, sovereign wealth<br />

funds (SWFs) are increasingly investing into<br />

the asset class, and their willingness to disclose<br />

more information has been a key feature of<br />

their recent activity, with the world’s largest<br />

SWFs signing up to a code of conduct last<br />

year called the ‘Santiago Principles’. Their<br />

investment mandates are very suited to the<br />

long term nature of the asset class, and it<br />

is only a matter of time before this group of<br />

sophisticated investors become more and<br />

more involved in UK PE.<br />

Summer 2009 <strong>BVCA</strong> Quarterly Brief 7