How to invest in private equity - BVCA admin

How to invest in private equity - BVCA admin

How to invest in private equity - BVCA admin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

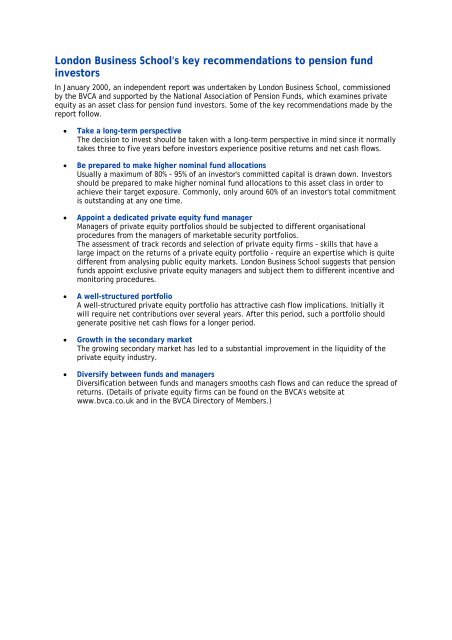

London Bus<strong>in</strong>ess School's key recommendations <strong>to</strong> pension fund<br />

<strong>in</strong>ves<strong>to</strong>rs<br />

In January 2000, an <strong>in</strong>dependent report was undertaken by London Bus<strong>in</strong>ess School, commissioned<br />

by the <strong>BVCA</strong> and supported by the National Association of Pension Funds, which exam<strong>in</strong>es <strong>private</strong><br />

<strong>equity</strong> as an asset class for pension fund <strong>in</strong>ves<strong>to</strong>rs. Some of the key recommendations made by the<br />

report follow.<br />

• Take a long-term perspective<br />

The decision <strong>to</strong> <strong><strong>in</strong>vest</strong> should be taken with a long-term perspective <strong>in</strong> m<strong>in</strong>d s<strong>in</strong>ce it normally<br />

takes three <strong>to</strong> five years before <strong>in</strong>ves<strong>to</strong>rs experience positive returns and net cash flows.<br />

• Be prepared <strong>to</strong> make higher nom<strong>in</strong>al fund allocations<br />

Usually a maximum of 80% - 95% of an <strong>in</strong>ves<strong>to</strong>r's committed capital is drawn down. Inves<strong>to</strong>rs<br />

should be prepared <strong>to</strong> make higher nom<strong>in</strong>al fund allocations <strong>to</strong> this asset class <strong>in</strong> order <strong>to</strong><br />

achieve their target exposure. Commonly, only around 60% of an <strong>in</strong>ves<strong>to</strong>r's <strong>to</strong>tal commitment<br />

is outstand<strong>in</strong>g at any one time.<br />

• Appo<strong>in</strong>t a dedicated <strong>private</strong> <strong>equity</strong> fund manager<br />

Managers of <strong>private</strong> <strong>equity</strong> portfolios should be subjected <strong>to</strong> different organisational<br />

procedures from the managers of marketable security portfolios.<br />

The assessment of track records and selection of <strong>private</strong> <strong>equity</strong> firms - skills that have a<br />

large impact on the returns of a <strong>private</strong> <strong>equity</strong> portfolio - require an expertise which is quite<br />

different from analys<strong>in</strong>g public <strong>equity</strong> markets. London Bus<strong>in</strong>ess School suggests that pension<br />

funds appo<strong>in</strong>t exclusive <strong>private</strong> <strong>equity</strong> managers and subject them <strong>to</strong> different <strong>in</strong>centive and<br />

moni<strong>to</strong>r<strong>in</strong>g procedures.<br />

• A well-structured portfolio<br />

A well-structured <strong>private</strong> <strong>equity</strong> portfolio has attractive cash flow implications. Initially it<br />

will require net contributions over several years. After this period, such a portfolio should<br />

generate positive net cash flows for a longer period.<br />

• Growth <strong>in</strong> the secondary market<br />

The grow<strong>in</strong>g secondary market has led <strong>to</strong> a substantial improvement <strong>in</strong> the liquidity of the<br />

<strong>private</strong> <strong>equity</strong> <strong>in</strong>dustry.<br />

• Diversify between funds and managers<br />

Diversification between funds and managers smooths cash flows and can reduce the spread of<br />

returns. (Details of <strong>private</strong> <strong>equity</strong> firms can be found on the <strong>BVCA</strong>'s website at<br />

www.bvca.co.uk and <strong>in</strong> the <strong>BVCA</strong> Direc<strong>to</strong>ry of Members.)