BVCA Private Equity and Venture Capital Performance - BVCA admin

BVCA Private Equity and Venture Capital Performance - BVCA admin

BVCA Private Equity and Venture Capital Performance - BVCA admin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Highlights<br />

Continued<br />

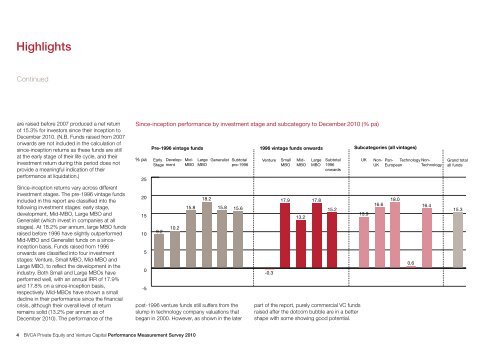

are raised before 2007 produced a net return<br />

of 15.3% for investors since their inception to<br />

December 2010. (N.B. Funds raised from 2007<br />

onwards are not included in the calculation of<br />

since-inception returns as these funds are still<br />

at the early stage of their life cycle, <strong>and</strong> their<br />

investment return during this period does not<br />

provide a meaningful indication of their<br />

performance at liquidation.)<br />

Since-inception returns vary across different<br />

investment stages. The pre-1996 vintage funds<br />

included in this report are classified into the<br />

following investment stages: early stage,<br />

development, Mid-MBO, Large MBO <strong>and</strong><br />

Generalist (which invest in companies at all<br />

stages). At 18.2% per annum, large MBO funds<br />

raised before 1996 have slightly outperformed<br />

Mid-MBO <strong>and</strong> Generalist funds on a sinceinception<br />

basis. Funds raised from 1996<br />

onwards are classified into four investment<br />

stages: <strong>Venture</strong>, Small MBO, Mid-MBO <strong>and</strong><br />

Large MBO, to reflect the development in the<br />

industry. Both Small <strong>and</strong> Large MBOs have<br />

performed well, with an annual IRR of 17.9%<br />

<strong>and</strong> 17.8% on a since-inception basis,<br />

respectively. Mid-MBOs have shown a small<br />

decline in their performance since the financial<br />

crisis, although their overall level of return<br />

remains solid (13.2% per annum as of<br />

December 2010). The performance of the<br />

post-1996 venture funds still suffers from the<br />

slump in technology company valuations that<br />

began in 2000. However, as shown in the later<br />

4 <strong>BVCA</strong> <strong>Private</strong> <strong>Equity</strong> <strong>and</strong> <strong>Venture</strong> <strong>Capital</strong> <strong>Performance</strong> Measurement Survey 2010<br />

Since-inception performance by investment stage <strong>and</strong> subcategory to December 2010 (% pa)<br />

% pa<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

Pre-1996 vintage funds<br />

Early<br />

Stage<br />

9.2<br />

Development<br />

10.2<br />

Mid-<br />

MBO<br />

15.8<br />

Large<br />

MBO<br />

18.2<br />

Generalist<br />

Subtotal<br />

pre-1996<br />

15.8 15.6<br />

1996 vintage funds onwards<br />

<strong>Venture</strong> Small Mid- Large Subtotal<br />

UK Non- Pan- Technology Non- Gr<strong>and</strong> total<br />

MBO MBO MBO 1996<br />

onwards<br />

UK European Technology all funds<br />

-0.3<br />

17.9<br />

13.2<br />

17.8<br />

15.2<br />

part of the report, purely commercial VC funds<br />

raised after the dotcom bubble are in a better<br />

shape with some showing good potential.<br />

Subcategories (all vintages)<br />

13.9<br />

16.6<br />

18.0<br />

0.6<br />

16.4<br />

15.3