Denver / North Front Range Fuel Supply Costs and Impacts

Denver / North Front Range Fuel Supply Costs and Impacts

Denver / North Front Range Fuel Supply Costs and Impacts

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

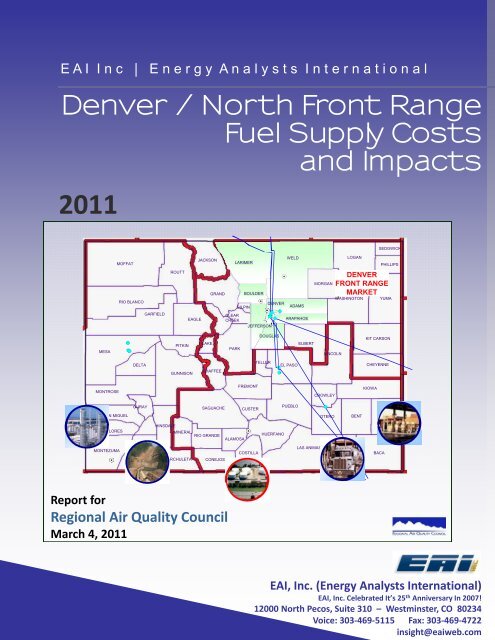

E A I I n c | E n e r g y A n a l y s t s I n t e r n a t i o n a l<br />

<strong>Denver</strong> / <strong>North</strong> <strong>Front</strong> <strong>Range</strong><br />

<strong>Fuel</strong> <strong>Supply</strong> <strong>Costs</strong><br />

<strong>and</strong> <strong>Impacts</strong><br />

2011<br />

MESA<br />

MONTROSE<br />

DOLORES<br />

MOFFAT<br />

SAN MIGUEL<br />

MONTEZUMA<br />

RIO BLANCO<br />

DELTA<br />

OURAY<br />

LA PLATA<br />

GARFIELD<br />

HINSDALE<br />

ROUTT<br />

PITKIN<br />

GUNNISON<br />

ARCHULETA<br />

EAGLE<br />

JACKSON<br />

LAKE<br />

GRAND<br />

CHAFFEE<br />

SAGUACHE<br />

MINERAL<br />

RIO GRANDE<br />

CONEJOS<br />

Report for<br />

Regional Air Quality Council<br />

March 4, 2011<br />

CLEAR<br />

CREEK<br />

PARK<br />

LARIMER<br />

GILPIN<br />

ALAMOSA<br />

BOULDER<br />

JEFFERSON<br />

FREMONT<br />

CUSTER<br />

COSTILLA<br />

DENVER<br />

DOUGLAS<br />

TELLER<br />

HUERFANO<br />

WELD<br />

ADAMS<br />

ARAPAHOE<br />

EL PASO<br />

PUEBLO<br />

ELBERT<br />

LAS ANIMAS<br />

MORGAN<br />

LINCOLN<br />

CROWLEY<br />

OTERO<br />

LOGAN<br />

WASHINGTON<br />

BENT<br />

KIT CARSON<br />

CHEYENNE<br />

KIOWA<br />

SEDGWICK<br />

BACA<br />

PHILLIPS<br />

DENVER<br />

FRONT RANGE<br />

MARKET<br />

YUMA<br />

PROWERS<br />

EAI, Inc. (Energy Analysts International)<br />

EAI, Inc. Celebrated It’s 25 th Anniversary In 2007!<br />

12000 <strong>North</strong> Pecos, Suite 310 – Westminster, CO 80234<br />

Voice: 303‐469‐5115 Fax: 303‐469‐4722<br />

insight@eaiweb.com

TABLE OF CONTENTS<br />

SECTION DESCRIPTION PAGE#<br />

A ES EXECUTIVE SUMMARY<br />

Introduction ES‐ 1<br />

RAQC Mission ES‐ 2<br />

Purpose of Study <strong>and</strong> Task Overview ES‐ 2<br />

Colorado Gasoline Market & RAQC Program Area ES‐ 3<br />

Status & Operation of the Colorado Product <strong>Supply</strong> Network ES‐ 4<br />

Impact of Gasoline Specification Changes ES‐ 7<br />

B OV OVERVIEW OF THE CO & FRONT RANGE FUELS MARKET<br />

Introduction OV‐ 1<br />

Gasoline Dem<strong>and</strong> in Colorado OV‐ 2<br />

Colorado <strong>Front</strong> <strong>Range</strong> Gasoline <strong>Supply</strong> Sturcture OV‐ 6<br />

Summary of Colorado Market <strong>Supply</strong> & Dem<strong>and</strong> OV‐ 11<br />

C REF REFINING AND GASOLINE SUPPLY<br />

Introduction REF‐ 1<br />

Refinery Process Unit & Operation Review REF‐ 1<br />

Major Refineries <strong>Supply</strong>ing The Colorado/<strong>Front</strong> <strong>Range</strong> Markets REF‐ 4<br />

Overview of the Colorado <strong>Front</strong> <strong>Range</strong> Refinery <strong>Supply</strong> Network REF‐ 4<br />

Suncor Commerce City Refinery REF‐ 5<br />

<strong>Front</strong>ier Cheyenne Refinery REF‐ 6<br />

Sinclair Rawlines Refinery REF‐ 6<br />

<strong>Front</strong>ier El Dorado Refinery REF‐ 7<br />

WRB ‐ ConocoPhillips Borger Refinery REF‐ 8<br />

Valero McKee Refinery REF‐ 8<br />

Operations Summary REF‐ 9<br />

Refinery <strong>Supply</strong> <strong>Costs</strong> Impact REF‐ 10<br />

Higher RVP Options: 7 PSI CBOB With Waiver & 7.8 PSI CBOB No Waiver REF‐ 11<br />

Low RVP Options: 7 PSI CBOB No Waiver & Reformulated Gasoline REF‐ 12<br />

Impact Summary REF‐ 13<br />

D DST DISTRIBUTION & NETWORK BALANCE FORECASTS<br />

Introduction DST‐ 1<br />

Market Price <strong>Impacts</strong> ‐ Low RVP & RFG Options DST‐ 2<br />

Distribution System <strong>Impacts</strong> DST‐ 3<br />

E BIO BIOFUEL SUPPLY DEMAND OUTLOOK ETHANOL & BIODIESEL<br />

Introduction BIO‐ 1<br />

Ethanol Overview BIO‐ 1<br />

Ethanol Blended Gasoline BIO‐ 2<br />

Corn Ethanol Economics BIO‐ 3<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUEL SUPPLY COSTS AND IMPACTS 2010<br />

TOC-1

TABLE OF CONTENTS<br />

SECTION DESCRIPTION PAGE#<br />

Ethanol Based Engines BIO‐ 4<br />

Bio<strong>Fuel</strong> M<strong>and</strong>ates BIO‐ 4<br />

Current Ethanol Usage BIO‐ 8<br />

Tax Incentive for Ethanol BIO‐ 9<br />

Cellulosic Ethanol BIO‐ 9<br />

Ethanol Dem<strong>and</strong> Outlook BIO‐ 10<br />

National BIO‐ 10<br />

Ethanol <strong>Supply</strong> Outlook BIO‐ 12<br />

Ethanol Logistics & Pricing BIO‐ 16<br />

Ethanol Logistics BIO‐ 16<br />

Ethanol Pricing BIO‐ 19<br />

Renewable <strong>Fuel</strong>s St<strong>and</strong>ard Overview BIO‐ 23<br />

New RFS Regulations BIO‐ 23<br />

Introduction BIO‐ 23<br />

Greenhouse Gas Reduction Thresholds BIO‐ 23<br />

Treatment of Required Volumes in 2009 BIO‐ 24<br />

Final St<strong>and</strong>ards for 2010 BIO‐ 25<br />

Program Design & Proposed Implementation Approach BIO‐ 25<br />

Overview of Impact of the Rule BIO‐ 26<br />

Greenhouse Gas Emissions BIO‐ 26<br />

Emissions & Air Quality BIO‐ 27<br />

Renewable identification Number (RIN) BIO‐ 27<br />

Colorado Ethanol BioDiesel Outlook BIO‐ 31<br />

F REG PRODUCT REGULATIONS<br />

Introduction REG‐ 1<br />

Ozone Pollution REG‐ 1<br />

Gasoline Regulations REG‐ 4<br />

Overview of Federal Regulations REG‐ 4<br />

Mobile Sources Air Toxics (MSAT) REG‐ 7<br />

Introduction REG‐ 7<br />

Gasoline Benzene Regulations REG‐ 8<br />

Small Refiner Flexibilities REG‐ 8<br />

Benezene Pre‐Compliance Reporting Requirements REG‐ 9<br />

Benezene Pre‐Compliance Reports REG‐ 10<br />

American Recovery & Reinvestment Act of 2009 REG‐ 11<br />

Economic Stimulus Plan REG‐ 11<br />

Greenhouse Gas (GHG) Emissions REG‐ 11<br />

American Clean Energy & Security Act of 2009 REG‐ 12<br />

Introduction REG‐ 12<br />

Cap & Trade Program REG‐ 12<br />

Summary REG‐ 13<br />

APX APPENDIX<br />

Glossary of Terms APX‐ 1<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUEL SUPPLY COSTS AND IMPACTS 2010<br />

TOC-2

LIST OF FIGURES<br />

FIGURE# DESCRIPTION PAGE#<br />

A ES EXECUTIVE SUMMARY<br />

ES‐ 1 <strong>Denver</strong>‐Boulder‐Greeley‐Fort Collins / Eight Hour Ozone Control Area ES‐ 1<br />

ES‐ 2 Gasoline Dem<strong>and</strong> Distribution / CO by Geography & Ozone Attainment ES‐ 3<br />

ES‐ 3 Refined Product Network Status / Rocky Mountain Region ES‐ 4<br />

ES‐ 4 Colorado Light Product <strong>Supply</strong> Chain & Capabilities, 2009 MBPD ES‐ 6<br />

ES‐ 5 Gasoline <strong>Supply</strong> Share by Refiner: Colorado <strong>Front</strong> <strong>Range</strong> ES‐ 6<br />

ES‐ 6 Manufacturing Cost Increases Due To <strong>Fuel</strong>s Specification Changes ES‐ 8<br />

ES‐ 7 <strong>Front</strong> <strong>Range</strong> Light End Rejection to Meet RVP & 1 lb Waiver Options ES‐ 9<br />

ES‐ 8 Movement of Gasoline Into Attainment Areas ES‐ 11<br />

B OV OVERVIEW OF THE CO & FRONT RANGE FUELS MARKET<br />

OV‐ 1 <strong>Denver</strong>‐Boulder‐Greeley‐Fort Collins / Eight Hour Ozone Control Area OV‐ 2<br />

OV‐ 2 Gasoline Dem<strong>and</strong> Distribution/CO by Geography & Ozone Attainment OV‐ 3<br />

OV‐ 3 Seasonality of Colorado Gasoline Dem<strong>and</strong> OV‐ 5<br />

OV‐ 4 Annual Colorado Gasoline Dem<strong>and</strong> OV‐ 6<br />

OV‐ 5 U.S. Refined Product <strong>Supply</strong>‐Dem<strong>and</strong> Network OV‐ 7<br />

OV‐ 6 Refined Product <strong>Supply</strong> ‐ Pipelines & Refineries OV‐ 8<br />

OV‐ 7 Current Colorado <strong>Front</strong> <strong>Range</strong> Gasoline <strong>Supply</strong> Envelope OV‐ 9<br />

OV‐ 8 Refined Product Network Status / Rocky Mountain Region OV‐ 10<br />

OV‐ 9 Western Region Refined Product Network/Project Updates & Key Bus. Drivers OV‐ 11<br />

OV‐ 10 Colorado Light Product <strong>Supply</strong> Chain & Capacities, 2009 MBPD OV‐ 12<br />

C REF REFINING AND GASOLINE SUPPLY<br />

REF‐ 1 Generalized Refinery Process Schematic REF‐ 1<br />

REF‐ 2 Aggregate Refinery Representing Primary Plants <strong>Supply</strong>ing Colorado REF‐ 11<br />

REF‐ 3 <strong>Front</strong> <strong>Range</strong> Light End Rejection to Meet RVP & 1LB Waiver Options REF‐ 15<br />

REF‐ 4 <strong>Front</strong> <strong>Range</strong> Gasoline Pool Blending to Meet RVP & 1LB Waiver Options REF‐ 16<br />

REF‐ 5 Potential Gasoline volume Loss & Shift / <strong>Denver</strong> <strong>Front</strong> <strong>Range</strong> Market REF‐ 17<br />

REF‐ 6 Loss of Value Selling <strong>Denver</strong> Gasoline at Conway Natural Gasoline Price REF‐ 18<br />

REF‐ 7 Manufacturing Cost Increases Due to <strong>Fuel</strong>s Specification Changes REF‐ 19<br />

D DST DISTRIBUTION & NETWORK BALANCE FORECASTS<br />

DST‐ 1 Refined Product <strong>Supply</strong> ‐ Pipelines & Refineries DST‐ 1<br />

DST‐ 2 Reformulated Gasoline Market vs Conventional DST‐ 3<br />

DST‐ 3 Colorado <strong>Front</strong> <strong>Range</strong> Gasoline <strong>Supply</strong> Envelope DST‐ 4<br />

DST‐ 4 Movement of Gasoline Into Attainment Areas DST‐ 5<br />

DST‐ 5 Colorado Gasoline Distribution by Ozone Attainment Status & Source DST‐ 6<br />

DST‐ 6 Refined Product <strong>Supply</strong> Network / <strong>Denver</strong> ‐ Colorado <strong>Front</strong> <strong>Range</strong> DST‐ 7<br />

E BIO BIOFUEL SUPPLY DEMAND OUTLOOK ETHANOL & BIODIESEL<br />

BIO‐ 1 Federal M<strong>and</strong>ate for Total Ethanol Use Under EISA 2007 BIO‐ 5<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUEL SUPPLY COSTS AND IMPACTS 2010<br />

TOC-3

LIST OF FIGURES<br />

FIGURE# DESCRIPTION PAGE#<br />

BIO‐ 2 Federal M<strong>and</strong>ate for Corn Ethanol Use ‐ EISA 2007 ‐ Actual for 2008 BIO‐ 6<br />

BIO‐ 3 Federal M<strong>and</strong>ate for Cellulose Ethanol Use EISA ‐ 2007 BIO‐ 6<br />

BIO‐ 4 U.S. Gasoline Consumption Forecast / Reformulated & Oxygenated <strong>Fuel</strong>s BIO‐ 11<br />

BIO‐ 5 U.S. Gasoline Consumption Forecast / Based on Federal Ethanol M<strong>and</strong>ate BIO‐ 11<br />

BIO‐ 6 New Capacity for Corn & Advanced Biofuels BIO‐ 13<br />

BIO‐ 7 U.S. Ethanol Production Outlook / Plant Construction Activity BIO‐ 14<br />

BIO‐ 8 U.S. <strong>Fuel</strong> Ethanol Existing & Under Const./Est. Capacity vs Prj. Dem<strong>and</strong> BIO‐ 15<br />

BIO‐ 9 EAI, Inc. U.S. Ethanol Balances / Jan‐Oct 2009, MBPD BIO‐ 17<br />

BIO‐ 10 Relative Market Terminal Ethanol Saturation BIO‐ 17<br />

BIO‐ 11 Spot Product Price Spreads to Crude/Chicago Spot Gasoline & Diesel to WTI BIO‐ 19<br />

BIO‐ 12 Ethanol Blending Incentive BIO‐ 20<br />

BIO‐ 13 Ethanol Transportation Rates To Major Markets BIO‐ 21<br />

BIO‐ 14 Ethanol Market Margins ‐ Chicago Origin BIO‐ 21<br />

BIO‐ 15 Brazil Ethanol Imports ‐ <strong>North</strong>east Ports BIO‐ 22<br />

BIO‐ 16 Estimated Federal M<strong>and</strong>ate Percent of Total Gasoline for CO Ethanol Use BIO‐ 32<br />

BIO‐ 17 Estimated Federal M<strong>and</strong>ate for Colorado Ethanol Use (EISA 2007) BIO‐ 32<br />

BIO‐ 18 <strong>Denver</strong> <strong>Front</strong> <strong>Range</strong> Ethanol <strong>Supply</strong> Availability by Distance (Miles) BIO‐ 33<br />

BIO‐ 19 Ttl Corn Ethanol Dem<strong>and</strong> for Tri‐State Area vs Current Production Capacity BIO‐ 33<br />

BIO‐ 20 Estimated Federal M<strong>and</strong>ate for CO Biomass Diesel Use Under EISA 2007 BIO‐ 34<br />

BIO‐ 21 <strong>Denver</strong> <strong>Front</strong> <strong>Range</strong> Biodiesel <strong>Supply</strong> Availability by Distance (Miles) BIO‐ 34<br />

F REG PRODUCT REGULATIONS<br />

REG‐ 1 EPA Ozone Non‐Attainment Areas REG‐ 3<br />

REG‐ 2 M<strong>and</strong>ated Reformulated Gasoline Market Areas REG‐ 5<br />

REG‐ 3 Gasoline Environmental Grades By Market Area REG‐ 6<br />

APX APPENDIX<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUEL SUPPLY COSTS AND IMPACTS 2010<br />

TOC-4

LIST OF TABLES<br />

TABLE# DESCRIPTION PAGE#<br />

A ES EXECUTIVE SUMMARY<br />

B OV OVERVIEW OF THE CO & FRONT RANGE FUELS MARKET<br />

OV‐ 1 Colorado State Level Refined Product Balance ‐ 2009 OV‐ 13<br />

C REF REFINING AND GASOLINE SUPPLY<br />

REF‐ 1 Refinery Configuration Matrix/CO <strong>Front</strong> <strong>Range</strong> <strong>Supply</strong> Refineries REF‐ 20<br />

REF‐ 2 Refining Company Operations Summary 2009 REF‐ 21<br />

REF‐ 3 Ozone <strong>Fuel</strong> Scenario Impact Matrix REF‐ 22<br />

D DST DISTRIBUTION & NETWORK BALANCE FORECASTS<br />

E BIO BIOFUEL SUPPLY DEMAND OUTLOOK ETHANOL & BIODIESEL<br />

BIO‐ 1 U.S. <strong>Fuel</strong> Ethanol Production Capacity (Existing & Under Construction) BIO‐ 35<br />

BIO‐ 2 U.S. Cellulosic Ethanol Projects Under Development & Construction BIO‐ 38<br />

BIO‐ 3 Colorado FR Local Ethanol <strong>Supply</strong>/Major Ethanol Plants in 400 Miles BIO‐ 39<br />

BIO‐ 4 Colorado FR Local Biodiesel <strong>Supply</strong>/Major Biodiesel Plants in 400 Miles BIO‐ 40<br />

F REG PRODUCT REGULATIONS<br />

APX APPENDIX<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUEL SUPPLY COSTS AND IMPACTS 2010<br />

TOC-5

ES<br />

EXECUTIVE SUMMARY<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUEL SUPPLY COSTS AND IMPACTS 2011

INTRODUCTION<br />

EXECUTIVE SUMMARY<br />

This report, <strong>Denver</strong>/<strong>North</strong> <strong>Front</strong> <strong>Range</strong> <strong>Fuel</strong> <strong>Supply</strong> <strong>Costs</strong> <strong>and</strong> <strong>Impacts</strong>, was prepared for the<br />

<strong>Denver</strong> Regional Air Quality Council (RAQC) by EAI, Inc. (Energy Analysts International). RAQC has<br />

responsibility for implementing strategies for the air quality attainment in the <strong>Denver</strong> Metropolitan<br />

Area – <strong>North</strong> <strong>Front</strong> <strong>Range</strong> area. This area is shown in Figure ES‐1.<br />

Figure ES‐1<br />

<strong>Denver</strong>-Boulder-Greeley-Fort Collins<br />

Eight Hour Ozone Control Area<br />

Copyright ©: EAI, Inc., 2011<br />

The defined area includes the highly populated areas extending from Castle Rock in the south,<br />

through <strong>Denver</strong> – Boulder <strong>and</strong> up to Fort Collins. This area is supplied with gasoline from a select<br />

number of refineries located both within the area <strong>and</strong> external to the area with major supply<br />

volumes being transported to the area by product pipelines. A significant amount of gasoline<br />

supply is trucked from product terminals located within the non‐attainment area to peripheral<br />

markets located in the ozone attainment area since there are limited alternative sources of product<br />

to economically supply these areas.<br />

The purpose of conducting this study is to evaluate the impacts of choosing a more stringent<br />

formulation of summertime gasoline for the <strong>Denver</strong>/<strong>North</strong> <strong>Front</strong> <strong>Range</strong> market. These impacts can<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUELS SUPPLY COSTS AND IMPACTS 2011<br />

ES‐1

EXECUTIVE SUMMARY<br />

take a number of forms including additional gasoline supply costs due to increased manufacturing<br />

costs <strong>and</strong> changes in in the sourcing of gasoline supply due to decisions by refiners to not invest in<br />

the equipment needed to produce the more stringent gasoline specifications. Both of these<br />

situations can potentially add significant costs to the consumer price of gasoline.<br />

RAQC MISSION<br />

RAQC is in the process of developing a set of recommended actions to reduce ozone precursor<br />

emissions from mobile sources via changes in motor gasoline specifications. The gasoline<br />

specification options to be considered include the following:<br />

1. Retain the current 7.8 RVP summertime st<strong>and</strong>ard, but eliminate the one psi ethanol waiver<br />

2. Adopt a 7.0 RVP summertime st<strong>and</strong>ard <strong>and</strong> retain the one psi ethanol waiver<br />

3. Adopt a 7.0 RVP summertime st<strong>and</strong>ard <strong>and</strong> eliminate the one psi ethanol waiver<br />

4. Opt‐into the federal Reformulated Gasoline Program (RFG).<br />

The ozone non‐attainment area that these gasoline specification changes are proposed for is the<br />

<strong>Denver</strong> Metropolitan Area – <strong>North</strong> <strong>Front</strong> <strong>Range</strong> Area. An option of applying for a waiver on ethanol<br />

blending was considered but was decided to not be a viable option. Similarly impacts of the<br />

approval of E15 gasoline were not evaluated.<br />

PURPOSE OF STUDY AND TASK OVERVIEW<br />

As noted above, the purpose of this study is to provide an assessment of various fuel strategies for<br />

the <strong>Denver</strong>/<strong>North</strong> <strong>Front</strong> <strong>Range</strong> relative to feasibility, cost impacts <strong>and</strong> likely supply scenarios. This<br />

assessment was achieved through a combination of survey work, analysis <strong>and</strong> modeling by EAI, Inc.<br />

Task 1: Summarize the Colorado <strong>and</strong> <strong>Front</strong> <strong>Range</strong> <strong>Fuel</strong>s Market<br />

Task 2: Describe the capabilities of the refineries<br />

Task 3: Quantify cost impacts<br />

Task 4: Quantify distribution impacts<br />

Task 5: Quantify ethanol <strong>and</strong> biofuel impacts<br />

Task 6: Describe impacts of current <strong>and</strong> proposed Federal rules<br />

The overall goal is to assess the market impacts of the various proposed fuel strategies, the costs<br />

incurred to make the designated fuel (capital <strong>and</strong> operating) <strong>and</strong> how a particular fuel specification<br />

may impact the sourcing <strong>and</strong> availability of summer gasoline for the Colorado‐<strong>Front</strong> <strong>Range</strong> market.<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUELS SUPPLY COSTS AND IMPACTS 2011<br />

ES‐2

COLORADO GASOLINE MARKET AND RAQC PROGRAM AREA<br />

EXECUTIVE SUMMARY<br />

An overview of the state of Colorado <strong>and</strong> the <strong>Denver</strong> <strong>North</strong> <strong>Front</strong> <strong>Range</strong> program area are shown in<br />

Figure ES‐2 with estimates of gasoline consumed in the various sub‐regions.<br />

Figure ES‐2<br />

Gasoline Dem<strong>and</strong> Distribution<br />

Colorado by Geography <strong>and</strong> Ozone Attainment Status, 2009<br />

Total Gasoline Dem<strong>and</strong> at 136.8 MBPD<br />

Western CO<br />

Dem<strong>and</strong> = 16<br />

MBPD<br />

MESA<br />

DELTA<br />

GRAND JUNCTION<br />

MONTROSE<br />

DOLORES<br />

MONTEZUMA<br />

MOFFAT<br />

RIO BLANCO<br />

GARFIELD<br />

MARKET<br />

WESTERN SLOPE<br />

OURAY<br />

SAN MIGUEL<br />

LA PLATA<br />

HINSDALE<br />

ROUTT<br />

PITKIN<br />

GUNNISON<br />

MINERAL<br />

RIO GRANDE<br />

ALAMOSA<br />

ARCHULETA<br />

EAGLE<br />

JACKSON<br />

LAKE<br />

GRAND<br />

CHAFFEE<br />

SAGUACHE<br />

CONEJOS<br />

LARIMER<br />

GILPIN<br />

BOULDER<br />

CLEAR CREEK<br />

PARK<br />

JEFFERSON<br />

FREMONT<br />

CUSTER<br />

COSTILLA<br />

Copyright ©: EAI, Inc., 2011<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUELS SUPPLY COSTS AND IMPACTS 2011<br />

ES‐3<br />

DENVER<br />

ADAMS<br />

DOUGLAS<br />

TELLER<br />

HUERFANO<br />

WELD<br />

ARAPAHOE<br />

EL PASO<br />

PUEBLO<br />

COLO SPR – PBLO<br />

MARKET<br />

ELBERT<br />

LAS ANIMAS<br />

MORGAN<br />

LINCOLN<br />

CROWLEY<br />

OTERO<br />

LOGAN<br />

DENVER<br />

FRONT RANGE<br />

MARKET<br />

WASHINGTON<br />

BENT<br />

KIT CARSON<br />

CHEYENNE<br />

KIOWA<br />

SEDGWICK<br />

BACA<br />

PHILLIPS<br />

YUMA<br />

<strong>Denver</strong>-<strong>Front</strong> <strong>Range</strong><br />

Dem<strong>and</strong><br />

Ozone NA = 78 MBPD<br />

Ozone ATN = 18 MBPD<br />

Southeast CO<br />

Dem<strong>and</strong> = 24<br />

PROWERS<br />

MBPD<br />

Total Colorado gasoline dem<strong>and</strong> was 136.8 MBPD (1000 BPD) in 2009. EAI, Inc.’s forecast for<br />

gasoline consumption in Colorado is for gasoline dem<strong>and</strong> to recover in 2010, remain basically flat<br />

until 2013 <strong>and</strong> then undergo a long period of slow decline with forecasted dem<strong>and</strong> levels of 135<br />

MBPD in 2020 <strong>and</strong> 123 MBPD in 2030.<br />

Based on EAI, Inc.’s latest Micro‐Market Dem<strong>and</strong> analysis, the total gasoline dem<strong>and</strong> in the <strong>Front</strong><br />

<strong>Range</strong> non‐attainment area is 78.1 MBPD. The total Colorado dem<strong>and</strong> for gasoline outside the<br />

non‐attainment area is 61.4 MBPD. The overall Eastern Central <strong>and</strong> <strong>North</strong>east Colorado area<br />

dem<strong>and</strong> from Douglas country north to the state border <strong>and</strong> East to the KS border is 96.0 MBPD<br />

consisting of 78.1 MBPD in the ozone 8 hour non‐attainment (NATN) area <strong>and</strong> 18 MBPD outside of<br />

the non‐attainment area. The total gasoline dem<strong>and</strong> in Western Colorado <strong>and</strong> Southeastern<br />

Colorado is roughly 16 <strong>and</strong> 24 MBPD, respectively.

EXECUTIVE SUMMARY<br />

STATUS AND OPERATION OF THE COLORADO PRODUCT SUPPLY NETWORK<br />

The Colorado <strong>Front</strong> <strong>Range</strong> is primarily supplied by six refineries – one in state (Suncor) <strong>and</strong> five<br />

(ConocoPhillips Borger, <strong>Front</strong>ier El Dorado, <strong>Front</strong>ier Cheyenne, Sinclair Rawlins <strong>and</strong> Valero McKee)<br />

out of state that supply the <strong>Front</strong> <strong>Range</strong> via five refined product pipelines. These refineries <strong>and</strong><br />

product pipelines are shown in Figure ES‐3.<br />

ID<br />

Salt Lake<br />

City<br />

UT<br />

Figure ES‐3<br />

Refined Product <strong>Supply</strong> – Pipelines <strong>and</strong> Refineries<br />

Rocky Mountain Region <strong>and</strong> Colorado <strong>Front</strong> <strong>Range</strong><br />

Major Terminals<br />

Refineries<br />

(xx) Pipeline Capacity MBPCD<br />

*<br />

Boise<br />

Primary Colorado <strong>Front</strong> <strong>Range</strong> <strong>Supply</strong> Refineries<br />

Suncor Commerce City, CO<br />

<strong>Front</strong>ier Cheyenne, WY<br />

•Sinclair Rawlins, WY<br />

•<strong>Front</strong>ier El Dorado, KS<br />

•ConocoPhillips Borger, TX<br />

•Valero McKee, TX<br />

Missoula<br />

Twin Falls Pocatello<br />

Great Falls<br />

Billings<br />

WY<br />

Copyright ©: EAI, Inc., 2011<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUELS SUPPLY COSTS AND IMPACTS 2011<br />

ES‐4<br />

MT<br />

Rock Springs<br />

CO<br />

Sheridan<br />

Casper<br />

*<br />

<strong>Denver</strong><br />

*<br />

Fountain<br />

Glendive<br />

DS**<br />

Valero McKee<br />

*<br />

*<br />

La Junta<br />

Sidney<br />

*<br />

WRB Borger<br />

<strong>North</strong><br />

Platte<br />

Kaneb (21)<br />

With the exception of small truck movements of gasoline into the state from surrounding states,<br />

almost all of the gasoline supplied to the Colorado market is delivered to the <strong>Front</strong> <strong>Range</strong> product<br />

terminals <strong>and</strong> distributed from there to outlying areas. Ethanol supply for the Colorado market is<br />

trucked or railed into the <strong>Denver</strong> area terminals <strong>and</strong> then blended into gasoline product. A<br />

summary of gasoline <strong>and</strong> total product supply sources to the Colorado/<strong>Front</strong> <strong>Range</strong> market along<br />

with pipeline capabilities is provided in the following table.<br />

*

EXECUTIVE SUMMARY<br />

COLORADO FRONT RANGE SUPPLY, DEMAND AND LOGISTICS<br />

REFINED PRODUCT BALANCE<br />

DEMAND COMPONENTS GASOLINE<br />

TOTAL<br />

PRODUCT<br />

EST SEASONAL<br />

VOLUME<br />

PIPELINE<br />

CAPACITIES<br />

OPEN CAPACITY COMMENTS<br />

Consumption 139516 212286<br />

Truck Exports 750 750 Estimated<br />

TOTAL DEMAND<br />

SUPPLY COMPONENTS<br />

140266 213036<br />

Refinery Production 46100 77600 Suncor Refinery‐‐EAI, Inc,. Model Output<br />

Ethanol 9533 9533 Local Truck plus rail from MW/MC<br />

Chase Pipeline from KS 14900 36100 41154 60000 18846 One Main Source/Jet Growing<br />

ConocoPhillips PL from Borger 18000 27200 31008 42000 10992 WRB can shift from oth mrkts<br />

NuStar PL from Sunray ‐ Note 1 15600 22310 25433 38000 12567 Valero can shift from oth mrkts<br />

<strong>Denver</strong> Products PL from Rawlins 11900 14000 15960 20000 4040 Potential to shift vlm to LV/SLC<br />

Plains PL from Cheyenne 19600 20600 23484 54000 30516 Incremental supply limited<br />

Other 3125 4032<br />

TOTAL SUPPLY 138758 212875 137039 214000 76961 Effective Capacity in range of 40‐45 MBD<br />

%BALANCE CLOSURE 98.92% 99.92%<br />

The Suncor refinery is the largest source of supply to the Colorado market <strong>and</strong> two refineries,<br />

<strong>Front</strong>ier Cheyenne <strong>and</strong> Sinclair Rawlins, place a large portion of their gasoline product into the<br />

<strong>Front</strong> <strong>Range</strong>. The other refineries supply a smaller fraction of their total gasoline production to<br />

Colorado, i.e. produce significant volumes of gasoline <strong>and</strong> supply these volumes to other markets.<br />

Product pipelines also figure prominently into the Colorado <strong>Front</strong> <strong>Range</strong> gasoline supply. Besides<br />

gasoline, these pipelines also provide a significant fraction of the state’s jet fuel <strong>and</strong> distillate fuel<br />

supply, 77 percent <strong>and</strong> 43 percent respectively. Total capacity of the product pipelines into<br />

Colorado is 214 MBPD <strong>and</strong> on an annual average basis 90 MBPD of open capacity existed in 2009 or<br />

77 MBPD on a peak seasonal basis. It is important to note that several product pipelines are<br />

connected to upstream refineries that have limited excess or swing capability generally <strong>and</strong> most<br />

likely will have even less excess capability to make the more stringent specification product. The<br />

effective capacity of the pipeline network to supply <strong>Denver</strong> area non‐attainment grade gasoline is<br />

in the range of 40 to 45 MBPD. The status of the combined portions of the product supply network<br />

for Colorado is summarized in Figure ES‐4 <strong>and</strong> the market share position of refiners in the <strong>Denver</strong><br />

<strong>Front</strong> <strong>Range</strong> market is shown in Figure ES‐5. As shown, the six primary supply refineries have a 92<br />

percent share or the gasoline market. Those with the highest market share position <strong>and</strong> least<br />

alternative market options will have the greatest probability to product gasoline to satisfy the<br />

<strong>Denver</strong> <strong>Front</strong> <strong>Range</strong> ozone fuel specification. This would include the Suncor‐Commerce City <strong>and</strong><br />

<strong>Front</strong>ier‐Cheyenne refineries which have the highest market shares <strong>and</strong> the least alternative<br />

markets options. Together they represent at least 50 percent of the market plus additional share<br />

to account for the ethanol they use in the market.<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUELS SUPPLY COSTS AND IMPACTS 2011<br />

ES‐5

EXECUTIVE SUMMARY<br />

Colorado Light Product <strong>Supply</strong> Chain<br />

<strong>and</strong> Capacities, 2009 MBPD<br />

The refining, light product transport <strong>and</strong> terminaling supply chain servicing the<br />

Colorado market is a relatively tight system. Loss of product such as gasoline is not<br />

easy to replace currently <strong>and</strong> will be even more difficult as the <strong>Front</strong> <strong>Range</strong> diverges<br />

from other nearby market specifications.<br />

Refining Access & Capacities<br />

CHS Laurel, MT<br />

ConocoPhillips Billings, MT<br />

Little America Casper, WY<br />

<strong>Front</strong>ier Cheyenne, WY*<br />

<strong>Front</strong>ier El Dorado, KS*<br />

Sinclair Rawlins, WY*<br />

Sinclair <strong>Denver</strong>, CO*<br />

Valero McKee, TX*<br />

WRB Borger, TX*<br />

9 Refineries can <strong>and</strong> have<br />

accessed the <strong>Denver</strong> market <strong>and</strong><br />

*6 on a regular basis<br />

Total Capacity 775 MBPD<br />

Effective Refining Capacity<br />

accessing the Colorado <strong>Front</strong><br />

<strong>Range</strong> Market = 673<br />

MBPD<br />

Refining Capacity Serves Other Markets in<br />

other Rocky Mountain states, Midcontinent,<br />

Texas <strong>and</strong> Midwest markets.<br />

Figure ES‐4<br />

Pipeline <strong>and</strong> Terminal Network has<br />

Limited Excess Capacity ‐<br />

Chase, COP, NuStar, Plains, Sinclair<br />

Total Pipeline Capacity =<br />

214 MBPD; 58% Utilized<br />

Effective Pipeline Open<br />

Capacity Long Term Basis<br />

Avg. Annual = 90 MBPD<br />

Summer = 77 MBPD<br />

Effective Pipeline Open<br />

Capacity Short Term Basis<br />

Avg. Annual = 45 MBPD<br />

Summer = 40 MBPD<br />

Upstream pipeline bottlenecks<br />

Seminoe pipeline from Billings to Casper<br />

Magellan Chase –El Dorado tankage<br />

Copyright ©: EAI, Inc., 2011<br />

Copyright ©: EAI, Inc., 2011<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUELS SUPPLY COSTS AND IMPACTS 2011<br />

ES‐6<br />

Colorado<br />

Consumption<br />

Total Light Product = 211 MBPD<br />

Total Gasoline = 137 MBPD<br />

Limited amount of effective refining<br />

capacity that can access the <strong>Denver</strong><br />

<strong>Front</strong> <strong>Range</strong> Market directly via<br />

pipeline; on the order of 100 MBPD<br />

total product or 50 MBPD of<br />

gasoline<br />

Figure ES‐5<br />

Gasoline <strong>Supply</strong> Share By Refiner: Colorado <strong>Front</strong> <strong>Range</strong><br />

Suncor has the largest <strong>Front</strong> <strong>Range</strong> market share with its local refinery presence followed by <strong>Front</strong>ier, WRB<br />

(ConocoPhillips-Cenovus), Valero <strong>and</strong> Sinclair.<br />

<strong>Front</strong>ier_Chyn,<br />

15.8%<br />

Sinclair, 7.2%<br />

<strong>Front</strong>ier_Eldr,<br />

11.1%<br />

Others, 1.3%<br />

Valero, 10.9%<br />

Ethanol Plants,<br />

6.9%<br />

Suncor , 34.1%<br />

WRB, 12.9%

IMPACT OF GASOLINE SPECIFICATION CHANGES<br />

EXECUTIVE SUMMARY<br />

EAI, Inc. via refinery modeling of the primary refineries involved in supplying the Colorado <strong>Front</strong><br />

<strong>Range</strong> market evaluated the changes in production costs associated with the four prospective<br />

summer gasoline specifications. As input to this process, EAI, Inc. also surveyed a limited number<br />

of refiners as to specifics of their capabilities. The results are summarized in the following.<br />

Refinery <strong>Impacts</strong>: Refiners will realize ozone fuel attainment program impacts in two major ways;<br />

1) most refiners will have to modify their refineries to make the various fuels being considered, <strong>and</strong><br />

2) most refiners will incur reductions of gasoline available for the <strong>Front</strong> <strong>Range</strong> market through light<br />

ends rejection <strong>and</strong>/or shift of gasoline to other markets.<br />

Modification/Implementation Schedule: Refiners will require 36 to 48 months to implement<br />

capabilities to produce 7.8 no waiver <strong>and</strong> 7.0 psi‐with waiver CBOB gasoline <strong>and</strong> 60 months for the<br />

7 psi‐no waiver or RFG gasoline grades.<br />

Basis for Total Incremental Production <strong>Costs</strong>: The average program costs per gallon include<br />

estimates of incremental operating costs, incremental capital costs <strong>and</strong> lost value for shifting<br />

refinery light ends from a higher value gasoline market option to a lower value Conway natural<br />

gasoline market.<br />

Total Cost Impact: Total average weighted incremental production costs range from 11 to 19 CPG<br />

with the summer RFG case being the highest <strong>and</strong> the 7.0 psi with waiver <strong>and</strong> the 7.8 psi with no<br />

waiver the lowest at 11.4 <strong>and</strong> 12.3 CPG respectively.<br />

The range of costs for the most realistic representation of refinery response was as follows:<br />

o 7 psi with Waiver: The costs representing the majority of the non‐attainment area<br />

gasoline volume was in the range of 9 to 13 CPG. This includes a high of 2 CPG for<br />

incremental operating costs, 8 to 14 CPG for light‐end rejection <strong>and</strong> capital costs<br />

ranging from 0.7 to 2.2 CPG of output (based on amortizing capital costs over 20<br />

years).<br />

o 7.8 psi with No Waiver: At 12.3 CPG total weighted manufacturing cost, this fuel<br />

scenario was very close to the 7 psi case with waiver since the required gasoline psi<br />

level is fairly close. Most of the additional cost for the 7.8 case was for additional<br />

light ends rejection.<br />

o 7 psi – No Waiver: The costs representing the majority of the non‐attainment area<br />

gasoline volume was in the range of 2 to 24 CPG. This includes a high of 2.8 CPG for<br />

incremental operating costs, 1 to 18 CPG for light‐end rejection <strong>and</strong> capital costs<br />

ranging from 1 to 4.4 CPG of output (based on amortizing capital costs over 20<br />

years). It should be noted that the total capital costs for this case were relatively<br />

high but the investment increased the usage of light ends thus lowering the light<br />

end rejection penalty.<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUELS SUPPLY COSTS AND IMPACTS 2011<br />

ES‐7

EXECUTIVE SUMMARY<br />

o RFG Case: This was the highest cost case in terms of capital expenditures, light end<br />

rejections <strong>and</strong> incremental operating costs with a range of 13 to 26 CPG for the<br />

largest volume suppliers. Some of the refiners having much smaller presence in the<br />

non‐attainment area had costs in the 1 to 1.5 CPG range.<br />

A comparison of the manufacturing costs for the prospective gasoline grades is shown in Figure<br />

ES‐6.<br />

Cost, CPG<br />

Figure REF‐6<br />

Manufacturing Cost Increases Due To <strong>Fuel</strong>s Specification<br />

Changes: Production Weighted Cost Composite for Primary<br />

Refineries <strong>Supply</strong>ing <strong>Denver</strong>‐<strong>Front</strong> <strong>Range</strong><br />

20.00<br />

18.00<br />

16.00<br />

14.00<br />

12.00<br />

10.00<br />

8.00<br />

6.00<br />

4.00<br />

2.00<br />

0.00<br />

Capital <strong>Costs</strong> Operating <strong>Costs</strong> C5/C6 Reject<br />

Copyright ©: EAI, Inc., 2011<br />

Capital Cost <strong>Impacts</strong>: Total industry capital costs to comply with the various gasoline grades being<br />

considered is in the range of $250 million for the CBOB 7 psi with waiver <strong>and</strong> CBOB 7.8 psi no<br />

waiver cases, $560 million dollars for CBOB 7 psi no waiver case <strong>and</strong> $710 million dollars for the<br />

RFG case. No costs for benzene extraction or saturation are included. Capital costs are highly<br />

variable depending on the individual refinery considered. Suncor has the highest capital costs due<br />

to need to construct an olefin aklylation unit to replace current olefin polymerizaton units.<br />

Operating Cost <strong>Impacts</strong>: The lowest average incremental operating costs are for the CBOB 7 psi‐<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUELS SUPPLY COSTS AND IMPACTS 2011<br />

ES‐8

EXECUTIVE SUMMARY<br />

with waiver <strong>and</strong> 7.8‐no waiver cases <strong>and</strong> range from 0.15 <strong>and</strong> 2 cpg <strong>and</strong> the highest were estimated<br />

for the 7 psi‐no waiver <strong>and</strong> RFG cases <strong>and</strong> range from 3 to 4 cpg respectively.<br />

Lost Light End Value: The lost value for rejected light ends was estimated by EAI, Inc. The lost value<br />

ranged from 4 cpg to 11 cpg depending on the gasoline specification being considered. This lost<br />

value estimate is based on separating 8 to 13 MBPD of light ends at the refinery <strong>and</strong> transporting<br />

the material to the Conway natural gasoline market. Figure ES‐7 below:<br />

Figure ES‐7<br />

<strong>Front</strong> <strong>Range</strong> Light End Rejection to Meet RVP & 1 lb Waiver Options<br />

The light end rejection requirements to meet the most stringent RVP option would be on the order of 13 MBPD representing<br />

14 percent of the overall non-attainment pool including spill over volume. This would have to be replaced with other<br />

streams that have lower RVP levels but also can help the overall gasoline pool meet other specifications such as octane<br />

level, drivability index, T50, etc.<br />

Rejected Gasoline, MBPD<br />

14.00<br />

12.00<br />

10.00<br />

8.00<br />

6.00<br />

4.00<br />

2.00<br />

0.00<br />

No Butanes 7.8_w_wvr 7.8_wo_wvr 7.0_w_wvr 7.0_wo_wvr<br />

Lost LSR/Isomerate For NATNM Gasoline Lost LSR/Isomerate For NATNM Plus Spillover Gasoline<br />

Copyright ©: EAI, Inc., 2011<br />

Impact on <strong>Supply</strong> Options: Some of the proposed new fuels in the Colorado <strong>Front</strong> <strong>Range</strong> will most<br />

likely sever supply linkage with refiners north of Cheyenne <strong>and</strong> refiners east <strong>and</strong> south of El<br />

Dorado, Kansas. There appears to be sufficient open pipeline capacity accessing the Texas<br />

Panh<strong>and</strong>le <strong>and</strong> Midcontinent area refiners to bring in supplemental or replacement supply.<br />

However, these potential incremental supply sources have different combinations of RVP <strong>and</strong>/or<br />

octane specifications then the cases being considered for <strong>Denver</strong>. The more stringent fuel<br />

specifications are likely to make the <strong>Denver</strong>/<strong>Front</strong> <strong>Range</strong> somewhat of a market isl<strong>and</strong> during the<br />

early stages of the program with potential for significant pricing upsets. Longer term, with other<br />

markets declining <strong>and</strong> <strong>Denver</strong> retaining a premium value to these alternative markets, it is likely<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUELS SUPPLY COSTS AND IMPACTS 2011<br />

ES‐9<br />

25.0%<br />

20.0%<br />

15.0%<br />

10.0%<br />

5.0%<br />

0.0%

EXECUTIVE SUMMARY<br />

that external sources of supply will target additional volume for the <strong>Denver</strong>‐<strong>Front</strong> <strong>Range</strong> market.<br />

Potential <strong>Supply</strong> Loss: The Colorado <strong>Front</strong> <strong>Range</strong> is likely to experience a decline in available<br />

gasoline supply from current supply sources due to two major factors:<br />

Rejection of light ends (butanes & pentanes plus) to meet gasoline pool RVP limits.<br />

This volume is estimated to be in the range of 11 to 14 MBPD. A portion of this may<br />

be covered by increased ethanol blending either from ethanol blended into gasoline<br />

that is not blended now or via an increase in allowable ethanol blends, e.g. E15,<br />

increasing crude runs <strong>and</strong>/or producing other gasoline blendstocks such as<br />

isomerate <strong>and</strong> alkylate that would allow the use of greater quantities of lighter<br />

blendstocks.<br />

Some refiners have access to other markets <strong>and</strong> may shift gasoline to these markets<br />

to avoid the required capital investments in manufacturing some of the more<br />

stringent gasoline specs being considered for the Colorado <strong>Front</strong> <strong>Range</strong> market.<br />

The range of potential gasoline loss due to market shift is 10 to 17 MBPD with the<br />

higher end of the range representing the RFG <strong>and</strong> 7 psi‐no waiver cases.<br />

The combined potential loss of 20 to 30 MBPD of gasoline supply for the <strong>Front</strong> <strong>Range</strong> market may<br />

be difficult to replace from current sources. The likely risk volume to be lost during the early stages<br />

of the program is in the range of 10 to 15 MBPD.<br />

<strong>Supply</strong> Availability <strong>and</strong> Impact on Market Prices: EAI, Inc.’s analysis indicates that there have often<br />

been 2 to 21 CPG market premiums paid for 7.0 low RVP fuels (Detroit <strong>and</strong> Kansas City) relative to<br />

conventional fuels without imposing the “1 psi no‐waiver” restriction. The <strong>Front</strong> <strong>Range</strong> market<br />

already experiences short term, summer price increases (relative to Gulf Coast spot) <strong>and</strong> these are<br />

likely to increase. The <strong>Denver</strong> <strong>Front</strong> <strong>Range</strong> market is more isolated than these other markets <strong>and</strong> is<br />

likely to experience at least these levels of price increases related to the incremental cost of<br />

gasoline meeting the new specifications. Generally the highest cost source of incremental volume<br />

required by the market sets the market clearing price. If there is considerably more supply than<br />

what the market can consume, prices will gravitate downward driven by surplus product spilling<br />

over into the attainment markets.<br />

Retail Pricing Response to Increasing Wholesale Prices: With supply being generally tight during<br />

the early stages of the program (first two to three years), it is likely that the incremental wholesale<br />

gasoline costs will be supported by the retail sector <strong>and</strong> passed on to the consumer. Some of the<br />

wholesale price increase could be mitigated somewhat by competing forces at the retail level as<br />

operators stay competitive to maintain store traffic <strong>and</strong> in‐store sales. This is especially true in<br />

markets that have a relatively high population of hypermart stores selling gasoline as does the<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUELS SUPPLY COSTS AND IMPACTS 2011<br />

ES‐10

<strong>Denver</strong> market.<br />

EXECUTIVE SUMMARY<br />

<strong>Supply</strong> Response to Higher Prices: Preliminary estimates indicate that the current <strong>Denver</strong> – NFR<br />

market is oversupplied with 7.8 psi gasoline with overflow occurring to the nearby attainment<br />

market areas. With the higher cost product relative to 9.0 psi gasoline, i.e. 7.0 psi <strong>and</strong> RFG<br />

gasolines, refiners will seek to minimize C5/C6 losses <strong>and</strong> supply only the required amount of<br />

nonattainment area gasoline, i.e. gasoline produced for the non‐attainment areas will only be<br />

supplied in the non‐attainment areas <strong>and</strong> conventional gasoline will be supplied in the attainment<br />

areas, e.g. see Figure ES‐8. This will require construction of tankage at pipeline terminals to<br />

accommodate both 9 psi gasoline <strong>and</strong> the new lower RVP products.<br />

Figure ES‐8<br />

Movement of Gasoline Into Attainment Areas<br />

Lower RVP gasoline, 7 psi CBOB no waiver <strong>and</strong> RFG, will cause retraction of<br />

non-attainment gasoline that currently moves into attainment areas.<br />

SUPPLY ENVELOPE<br />

NE_FRNGE<br />

NE_REMOTE<br />

NNATNM<br />

NW_WY_SRCE<br />

SE_FRNGE<br />

SE_REMOTE<br />

SOTHN_ACCESS<br />

WSTR_REMOTE<br />

WSTR_TRNS<br />

17.6 WSTR_REMOTE<br />

1.1 NW_WY_SRCE<br />

9.9 WSTR_TRNS<br />

Copyright ©: EAI, Inc., 2011<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUELS SUPPLY COSTS AND IMPACTS 2011<br />

ES‐11<br />

78.1 NNATNM<br />

3.0 NE_FRNGE<br />

0.8 SE_FRINGE<br />

1.0 NE REMOTE<br />

1.2 SE_REMOTE<br />

Ethanol Blending: Due to the Federal m<strong>and</strong>ated Renewable <strong>Fuel</strong>s St<strong>and</strong>ards, m<strong>and</strong>ated blending of<br />

biofuels is on a course of constantly increasing requirements for ethanol blending. While there has<br />

been some relief from blending due to small refiner exemptions, these end in 2011 with the<br />

expected impact of requiring that the Colorado market become 100 percent ethanol blended fuels<br />

– up from 68 percent in 2009. RINS values are expected to increase substantially when this occurs.<br />

Since bottoming out in 2009, crude prices have recovered to the 80 – 90 $/Bbl range. At this crude

EXECUTIVE SUMMARY<br />

price level, Gulf Coast spot market clear gasoline has ranged from 195 to 222 cents per gallon while<br />

spot ethanol prices have been in the 168 to 245 cents per gallon range. At these pricing levels<br />

combined with the ethanol blenders tax credit, ethanol blending can act to lower gasoline<br />

production costs <strong>and</strong> these savings may be passed on to the consumer.<br />

Boutique Gasoline Products <strong>and</strong> Fungability: In the near term, more ozone non‐attainment<br />

markets are expected to adopt low RVP gasoline “st<strong>and</strong>ards”, this product will be in greater supply<br />

<strong>and</strong> accessible to markets from more refinery options. In the last two years, the number of<br />

metropolitan areas requiring 7.8 RVP gasoline has increased to 19 while the number of<br />

metropolitan areas that require 7.0 RVP gasoline has stayed constant at 5 (Atlanta, Birmingham, El<br />

Paso, Kansas City <strong>and</strong> Detroit). Similarly, no new RFG m<strong>and</strong>ated areas have been added. It is<br />

important for states <strong>and</strong> local governments to work in t<strong>and</strong>em to adopt common st<strong>and</strong>ards that<br />

recognize not only the localized market but the overall capability of the fuel supply chain. Other<br />

near term potential ozone non‐attainment markets are Salt Lake City, Tulsa, Oklahoma City <strong>and</strong><br />

Wichita.<br />

Further Federal Environmental M<strong>and</strong>ates: In the near term (beginning in 2011 <strong>and</strong> becoming<br />

more stringent in 2012), refiners have to meet more strict limitations on benzene levels in gasoline<br />

under MSAT. Most of the major suppliers of gasoline to the Colorado <strong>Front</strong> <strong>Range</strong> can either meet<br />

these specifications or are in the process of installing equipment/changing operations to meet the<br />

new regulations. With the required benzene reductions coupled with lower gasoline RVP<br />

requirements, there is some convergence of the lower RVP gasoline option <strong>and</strong> RFG <strong>and</strong> their<br />

respective properties.<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUELS SUPPLY COSTS AND IMPACTS 2011<br />

ES‐12

OV<br />

OVERVIEW OF THE COLORADO AND<br />

FRONT RANGE FUELS MARKET<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUEL SUPPLY COSTS – IMPACTS 2011

OVERVIEW OF THE COLORADO AND FRONT RANGE FUELS MARKET<br />

INTRODUCTION<br />

The Colorado <strong>and</strong> the <strong>Front</strong> <strong>Range</strong> fuel markets are dynamic, complex, <strong>and</strong> interlocked markets<br />

that form a distinct market in the Midcontinent ‐ Rocky Mountain area. They are isolated markets,<br />

physically separated from other surrounding major markets, such as Kansas City <strong>and</strong> Salt Lake City,<br />

<strong>and</strong> especially the large Gulf Coast refinery distribution system. Like other isolated central U.S.<br />

markets, the Colorado <strong>and</strong> <strong>Front</strong> <strong>Range</strong> fuel markets depend on outside suppliers to provide a<br />

substantial portion of the required fuel products consumed in the area.<br />

Six major refineries <strong>and</strong> five major product pipelines supply this area. Other swing refineries <strong>and</strong><br />

ancillary pipelines are capable of providing some additional product. Five of these refineries are<br />

located out‐of‐state, with the sixth, the Suncor refinery, is located in Commerce City. The local<br />

Commerce City refinery is the largest single supplier to the Colorado <strong>and</strong> <strong>Front</strong> <strong>Range</strong> Markets,<br />

supplying roughly one‐third of the <strong>Front</strong> <strong>Range</strong> area’s product. Of the other five refineries, two,<br />

both in Wyoming are also primarily oriented to supplying the <strong>Front</strong> <strong>Range</strong> market. The other three,<br />

two in Texas, <strong>and</strong> one in Kansas supply products to multiple markets, with the Colorado/<strong>Front</strong><br />

<strong>Range</strong> markets being only one of their major markets. These refineries have the ability to move<br />

product to the markets that are most attractive business‐wise.<br />

Because of past ozone violations, the <strong>Denver</strong> area has been designated as a low summertime<br />

gasoline volatility area, with base gasoline having a maximum Reid Vapor Pressure (RVP) of 7.8<br />

pounds per square inch (psi). With the adoption of the current eight‐hour ozone State<br />

Implementation Plan (SIP), this area was recently exp<strong>and</strong>ed to include the entire seven county<br />

<strong>Denver</strong> metropolitan area, as well as to parts of Larimer <strong>and</strong> Weld counties that are contained in<br />

the ozone nonattainment area. Outside of the <strong>Denver</strong>/<strong>North</strong> <strong>Front</strong> <strong>Range</strong> areas, a more volatile<br />

summertime gasoline of up to 9.0 lbs. RVP is permitted.<br />

The <strong>Denver</strong> – Boulder – Greeley – Fort Collins eight hour ozone control area (ozone non‐<br />

attainment) is shown in Figure OV‐1. This area encompasses major portions of the Colorado <strong>Front</strong><br />

<strong>Range</strong> <strong>and</strong> includes both major populated areas (<strong>Denver</strong>, Boulder, Fort Collins, Castle Rock <strong>and</strong><br />

Greeley) <strong>and</strong> also a larger control area that includes areas of eastern, northeastern <strong>and</strong> northern<br />

Colorado. Counties included in this area are Adams, Arapahoe, Boulder, Broomfield, <strong>Denver</strong>,<br />

Douglas, Jefferson, Larimer <strong>and</strong> Weld.<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUEL SUPPLY COSTS – IMPACTS 2011<br />

OV‐1

OVERVIEW OF THE COLORADO AND FRONT RANGE FUELS MARKET<br />

Figure OV‐1<br />

<strong>Denver</strong>-Boulder-Greeley-Fort Collins<br />

Eight Hour Ozone Control Area<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUEL SUPPLY COSTS – IMPACTS 2011<br />

OV‐2<br />

Copyright ©: EAI, Inc., 2011<br />

Location of this nine county area within the existing gasoline distribution areas of Colorado is<br />

shown in Figure OV‐2. As shown, the nine county ozone non‐attainment area is entirely located<br />

within EAI, Inc.’s defined <strong>Denver</strong> <strong>Front</strong> <strong>Range</strong> market area. Other gasoline market areas in<br />

Colorado include the Colorado Springs – Pueblo market area to the south <strong>and</strong> the Gr<strong>and</strong> Junction –<br />

Western Slope market area to the west.<br />

GASOLINE DEMAND IN COLORADO<br />

Gasoline dem<strong>and</strong> in Colorado in 2009 was estimated to have been 136.8 thous<strong>and</strong> barrels per day<br />

(MBPD). This overall dem<strong>and</strong> may be further split into different regions of Colorado to represent<br />

local markets.<br />

In the <strong>Denver</strong> <strong>Front</strong> <strong>Range</strong> area, gasoline dem<strong>and</strong> was estimated to be 96.0 MBPD in 2009. This<br />

includes gasoline dem<strong>and</strong> within the <strong>Denver</strong> <strong>Front</strong> <strong>Range</strong> area from areas outside of the eight‐hour<br />

ozone nonattainment area. Within the ozone nonattainment area proper, gasoline dem<strong>and</strong> is<br />

estimated to be 78.1 MBPD.<br />

Outside of the <strong>Denver</strong> <strong>Front</strong> <strong>Range</strong> market area, EAI estimates that there is a total fuel dem<strong>and</strong> of<br />

40.8 MBPD. This split between southern <strong>and</strong> southeastern Colorado markets <strong>and</strong> Western Slope<br />

markets. Including the 17.9 MBPD of 9.0 lb RVP conventional gasoline that can be sold in the<br />

<strong>Denver</strong> <strong>Front</strong> <strong>Range</strong> area, <strong>and</strong> the 40.8 MBPD of 9.0 lb. RVP conventional gasoline that may be sold

OVERVIEW OF THE COLORADO AND FRONT RANGE FUELS MARKET<br />

in Colorado areas outside of the <strong>Denver</strong> <strong>Front</strong> <strong>Range</strong> area, a total market dem<strong>and</strong> of 58.6PD of 9.0<br />

lb. RVP conventional gasoline may is estimated. This compares to the estimated 78.1 MBPD market<br />

dem<strong>and</strong> for 7.8 lb RVP low volatility gasoline that is required in the eight‐hour ozone<br />

nonattainment area. However, fuel sampling by the Colorado Department of Public Health <strong>and</strong><br />

Environment shows that the overwhelming majority of <strong>Front</strong> <strong>Range</strong> gasoline from Pueblo to the<br />

Wyoming border is blended at the 7.8 lb. RVP level, regardless of whether the area is located in a<br />

conventional 9.0 lb RVP area, or the 7.8 lb. Low RVP area. It is thought that fuel storage tank<br />

constraints <strong>and</strong> the ability to provide excess 7.8 lb. RVP product is responsible for this situation.<br />

Under different marketing conditions <strong>and</strong> fuel requirements this situation could change. EAI, Inc.<br />

has used its own proprietary models in estimating market dem<strong>and</strong>s in this Micro‐Market Dem<strong>and</strong><br />

analysis.<br />

Figure OV‐2 diagrams this fuel market dem<strong>and</strong>, with the nine county <strong>Denver</strong> <strong>Front</strong> <strong>Range</strong> market<br />

area shown in green. Red boundaries indicate the boundaries of the principal fuel market areas in<br />

Colorado as used by EAI, Inc. in their fuel dem<strong>and</strong> analysis. The 96.0 MBPD <strong>Denver</strong> <strong>Front</strong> <strong>Range</strong><br />

market area is primarily supplied by the local Commerce City refinery <strong>and</strong> the major product<br />

pipeline terminals in the <strong>Denver</strong> area. There are also minor truck volumes that enter this area from<br />

Rawlins <strong>and</strong> Cheyenne, Wyoming <strong>and</strong> from Phillipsburg, KS.<br />

MINERAL<br />

RIO GRANDE<br />

ALAMOSA<br />

ARCHULETA<br />

CHAFFEE<br />

Figure OV‐2<br />

Gasoline Dem<strong>and</strong> Distribution<br />

Colorado by Geography <strong>and</strong> Ozone Attainment Status, 2009<br />

Total Gasoline Dem<strong>and</strong> at 136.8 MBPD<br />

Western CO<br />

Dem<strong>and</strong> = 16<br />

MBPD<br />

MESA<br />

DELTA<br />

GRAND JUNCTION<br />

MONTROSE<br />

DOLORES<br />

MONTEZUMA<br />

MOFFAT<br />

RIO BLANCO<br />

GARFIELD<br />

MARKET<br />

WESTERN SLOPE<br />

OURAY<br />

SAN MIGUEL<br />

LA PLATA<br />

HINSDALE<br />

ROUTT<br />

PITKIN<br />

GUNNISON<br />

EAGLE<br />

JACKSON<br />

LAKE<br />

GRAND<br />

SAGUACHE<br />

CONEJOS<br />

LARIMER<br />

GILPIN<br />

BOULDER<br />

CLEAR CREEK<br />

PARK<br />

JEFFERSON<br />

FREMONT<br />

CUSTER<br />

COSTILLA<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUEL SUPPLY COSTS – IMPACTS 2011<br />

OV‐3<br />

DENVER<br />

ADAMS<br />

DOUGLAS<br />

TELLER<br />

HUERFANO<br />

WELD<br />

ARAPAHOE<br />

EL PASO<br />

PUEBLO<br />

COLO SPR – PBLO<br />

MARKET<br />

ELBERT<br />

LAS ANIMAS<br />

MORGAN<br />

LINCOLN<br />

CROWLEY<br />

OTERO<br />

LOGAN<br />

DENVER<br />

FRONT RANGE<br />

MARKET<br />

WASHINGTON<br />

BENT<br />

KIT CARSON<br />

CHEYENNE<br />

KIOWA<br />

SEDGWICK<br />

BACA<br />

PHILLIPS<br />

YUMA<br />

<strong>Denver</strong>-<strong>Front</strong> <strong>Range</strong><br />

Dem<strong>and</strong><br />

Ozone NA = 78 MBPD<br />

Ozone ATN = 18 MBPD<br />

Southeast CO<br />

Dem<strong>and</strong> = 24<br />

PROWERS<br />

MBPD<br />

Copyright ©: EAI, Inc., 2011

OVERVIEW OF THE COLORADO AND FRONT RANGE FUELS MARKET<br />

The <strong>Denver</strong> <strong>Front</strong> <strong>Range</strong> area dominates the entire Colorado market, with less of a gasoline<br />

dem<strong>and</strong> in the rest of the state. EAI, Inc. estimates that the Gr<strong>and</strong> Junction – Western Slope<br />

market area <strong>and</strong> the Colorado Springs – Pueblo market areas is roughly 16.5 <strong>and</strong> 24.3 MBPD,<br />

respectively. The southern Colorado market is supplied from the Fountain <strong>and</strong> La Junta product<br />

terminals, as well as from <strong>Denver</strong> (especially Colorado Springs). The Gr<strong>and</strong> Junction – Western<br />

Slope area is generally supplied by rail <strong>and</strong> truck from <strong>Denver</strong>, as well as some product from<br />

western Wyoming <strong>and</strong> Utah. The four corners area is supplied to a large extent from New Mexico.<br />

Jackson County is generally supplied from sources in Wyoming. Figure OV‐2 shows these areas.<br />

Overall gasoline dem<strong>and</strong> has been relatively flat over the last five years with some indications of a<br />

dem<strong>and</strong> slump in 2008 <strong>and</strong> 2009. This is despite a significant increase in vehicle miles traveled<br />

(VMT) over the early part of this period.<br />

The Colorado Department of Revenue tracks the use of fuel ethanol in the state of Colorado.<br />

According to their figures, the percentage of ethanol blended gasoline utilized for 2009 is 68<br />

percent of total gasoline distributed. This figure is disputed by the Colorado Department of Public<br />

Health <strong>and</strong> Environment which conducts a biannual fuel survey in the <strong>Front</strong> <strong>Range</strong> area. CDPHE<br />

believes that based on their fuel surveys, the total amount of ethanol blended gasoline is<br />

underreported by industry, with much of the ethanol blended gasoline reported as non‐blended<br />

gasoline to the Department of Revenue. For Colorado tax purposes, it does not matter if gasoline is<br />

reported as ethanol blended or non‐blended gasoline.<br />

Using the CDOR figures, total year 2009 estimated ethanol blended into gasoline is 9.53 MBPD<br />

assuming a ten percent blend. A 2009 summer survey of retail gasoline samples performed by the<br />

Colorado Department of Public Heath <strong>and</strong> Environment, indicates that ethanol blended gasoline<br />

comprised 95 – 98 percent of the Colorado <strong>Front</strong> <strong>Range</strong> gasoline that summer. This would<br />

indicate that if the ethanol blended gasoline market share were applied statewide, up to 13.95<br />

MBPD of fuel ethanol was used.<br />

A five year history of gasoline consumption in the state of Colorado is presented in the table below.<br />

Colorado Gasoline Consumption Trends<br />

Units: BPD 2005 2006 2007 2008 2009<br />

Gasoline 75367 84995 74495 52143 44186<br />

Gasohol 65848 55706 66899 86588 95330<br />

Total 141215 140701 141395 138731 139516<br />

Ethanol Blended Calculated * 6585 5571 6690 8659 9533<br />

Percent Ethanol Blended Gasoline * 46.60% 39.60% 47.30% 62.40% 68.30%<br />

Source: Colorado Dept of Revenue ‐ Gross Gallons<br />

* Colorado Dept of Revenue figures generally low, see following text<br />

Gasoline dem<strong>and</strong> in Colorado is seasonal. As shown in Figure OV‐3, gasoline dem<strong>and</strong> peaks in the<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUEL SUPPLY COSTS – IMPACTS 2011<br />

OV‐4

OVERVIEW OF THE COLORADO AND FRONT RANGE FUELS MARKET<br />

summer, when gasoline dem<strong>and</strong> is greatest, <strong>and</strong> lowest during the winter months, when gasoline<br />

dem<strong>and</strong> is least. Summer months register gasoline dem<strong>and</strong> that is typically 107 to 110 percent of<br />

the yearly average. This compares to the winter months when gasoline dem<strong>and</strong> at its lowest, of<br />

around 93 percent of the annual average volume.<br />

Summer peak gasoline dem<strong>and</strong> in 2009 was about 152.9 MBPD. This compares to the average<br />

annual dem<strong>and</strong> of 139.5 MBPD from the Department of Revenue. The fuel distribution network in<br />

Colorado is thus most highly utilized during the summer months when gasoline most in dem<strong>and</strong>.<br />

Fortunately, Colorado has experienced few fuel disruptions that have affected the motoring public,<br />

though events such as the shutdown of the Valero McKee Texas plant closure in February 16, 2007,<br />

due to a catastrophic fire starting in the propane de‐asphalting unit, came close to producing a<br />

major dislocation of the Colorado fuel market with localized fuel shortages through the spring <strong>and</strong><br />

summer of 2007. There was some fuel rationing to service stations that resulted in certain fuel<br />

dispensing units running out of product. Figure OV‐3 shows the monthly fuel dem<strong>and</strong> in Colorado<br />

as compiled by the Colorado Department of Revenue.<br />

Figure OV‐3<br />

Seasonality of Colorado Gasoline Dem<strong>and</strong><br />

Calculated as monthly gasoline dem<strong>and</strong> BPD divided by annual average gasoline<br />

dem<strong>and</strong> BPD. Seasonal maximum in summer at 1.07 to 1.1 times annual average.<br />

Seasonal low generally in January at 0.93 times annual average.<br />

Monthly Volume/Annual Average<br />

1.15<br />

1.1<br />

1.05<br />

1<br />

0.95<br />

0.9<br />

0.85<br />

0.8<br />

JANUARY<br />

FEBRUARY<br />

2005 2006 2007 2008 2009<br />

MARCH<br />

APRIL<br />

MAY<br />

JUNE<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUEL SUPPLY COSTS – IMPACTS 2011<br />

OV‐5<br />

JULY<br />

AUGUST<br />

SEPTEMBER<br />

OCTOBER<br />

NOVEMBER<br />

DECEMBER<br />

Copyright ©: EAI, Inc., 2011<br />

EAI, Inc.’s forecast for gasoline consumption in Colorado is for gasoline dem<strong>and</strong>, shown in Figure<br />

OV‐4, to recover in 2010, remain basically flat until 2013 <strong>and</strong> then undergo a long period of slow

OVERVIEW OF THE COLORADO AND FRONT RANGE FUELS MARKET<br />

decline with forecasted dem<strong>and</strong> levels of 135 MBPD in 2020 <strong>and</strong> 123 MBPD in 2030. The primary<br />

driver for the decline in gasoline is the m<strong>and</strong>ated increase in new vehicle miles per gallon rating<br />

which will start showing a large impact after 2020. Another important driver of the gasoline<br />

dem<strong>and</strong> forecast is a decline in the driving age population associated with aging of the population.<br />

150<br />

140<br />

130<br />

120<br />

110<br />

100<br />

Figure OV‐4<br />

Annual Colorado Gasoline Dem<strong>and</strong><br />

Actual <strong>and</strong> Forecast through 2030 (in MBPD)<br />

2009<br />

2008<br />

2011<br />

2014<br />

2017<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUEL SUPPLY COSTS – IMPACTS 2011<br />

OV‐6<br />

2020<br />

COLORADO FRONT RANGE GASOLINE SUPPLY STRUCTURE<br />

2023<br />

2026<br />

2029<br />

Copyright ©: EAI, Inc., 2011<br />

Colorado is part of the Rocky Mountain supply network. As shown in Figure OV‐5 the Rockies are<br />

relatively isolated in terms of multiplicity of supply sources compared to other regions of the<br />

country. This isolation takes a number of forms – limited number, capacity <strong>and</strong> capability of<br />

refineries that actually can supply the market, limited number <strong>and</strong> capacity of product pipelines<br />

that supply the market, <strong>and</strong> differences in gasoline product supply specifications of the Colorado<br />

<strong>Front</strong> <strong>Range</strong> market versus outlying markets. As implied by Figure OV‐5, it is possible for refined<br />

products sourced in the Gulf Coast (Houston‐Beaumont‐ Port Arthur area) to be transported via<br />

pipeline to the Colorado <strong>Front</strong> <strong>Range</strong> but this is generally not the case as supply can be provided by<br />

more closely located refineries. However, if needed <strong>and</strong> the pipeline capacity is available, this can

OVERVIEW OF THE COLORADO AND FRONT RANGE FUELS MARKET<br />

be accomplished via shipping on Explorer or Magellan pipelines to the Tulsa area, then on Magellan<br />

pipeline from Tulsa to Wichita – El Dorado, KS <strong>and</strong> then on Magellan Chase pipeline from El Dorado<br />

to Aurora, CO.<br />

Figure OV‐5<br />

U.S. Refined Product <strong>Supply</strong>-Dem<strong>and</strong> Network<br />

Definition of EAI, Inc. U.S. Product Distribution Hubs <strong>and</strong> Regions<br />

The Rocky Mountain petroleum market is one of the most isolated areas in the U.S.<br />

Pacific<br />

Southwest<br />

Refining center<br />

Primary pipeline<br />

Product import<br />

Vessel movement<br />

Rocky<br />

Mountain<br />

Gulf Coast<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUEL SUPPLY COSTS – IMPACTS 2011<br />

OV‐7<br />

<strong>North</strong>ern<br />

Tier<br />

Midcontinent<br />

Midwest<br />

Southeast<br />

Seaboard<br />

Copyright ©: EAI, Inc., 2011<br />

Historically, shipments of product from the Gulf Coast – Midcontinent to Colorado have been<br />

limited to jet fuel due to the pipeline bottlenecks or because the existing sources have been able to<br />

supply the required gasoline <strong>and</strong> distillate products. As a generality, the Colorado <strong>and</strong> the Rocky<br />

Mountain region market may use lower octane gasoline than outside markets due to the higher<br />

altitude, i.e. supplying Gulf Coast or Midcontinent grade gasoline would result in octane giveaway.<br />

Suppliers generally get around this problem by exchanging Gulf Coast or Midcontinent grade<br />

gasoline for <strong>Denver</strong> grade gasoline with <strong>Front</strong>ier El Dorado refinery.<br />

A more detailed view of the refined product supply network for the Rocky Mountains <strong>and</strong> the<br />

Colorado <strong>Front</strong> <strong>Range</strong> is shown in Figure OV‐6. There are six primary refineries supplying the<br />

Colorado <strong>Front</strong> <strong>Range</strong> market. The Suncor refinery at Commerce City CO is the only refinery<br />

directly located in the <strong>Front</strong> <strong>Range</strong>. The WRB (Cenovus‐ConocoPhillips) refinery at Borger TX<br />

supplies the market via its 42 MBPD capacity ConocoPhillips pipeline. The Valero refinery at McKee<br />

TX supplies the market through the 38 MBPD NuStar product pipeline, as well as supplying<br />

Colorado Springs <strong>and</strong> southern Colorado. The <strong>Front</strong>ier refinery at El Dorado KS supplies the market<br />

via the 60 MBPD capacity Chase pipeline owned by Magellan. The <strong>Front</strong>ier refinery at Cheyenne

OVERVIEW OF THE COLORADO AND FRONT RANGE FUELS MARKET<br />

WY supplies the <strong>Front</strong> <strong>Range</strong> via the 54 MBPD capacity Plains Kaneb pipeline. Finally, the Sinclair<br />

refinery at Rawlins, WY supplies the <strong>Front</strong> <strong>Range</strong> via its <strong>Denver</strong> Product pipeline which has a<br />

capacity of 20 MBPD.<br />

Salt Lake<br />

City<br />

Figure OV‐6<br />

Refined Product <strong>Supply</strong> – Pipelines <strong>and</strong> Refineries<br />

Rocky Mountain Region <strong>and</strong> Colorado <strong>Front</strong> <strong>Range</strong><br />

Major Terminals<br />

Refineries<br />

(xx) Pipeline Capacity MBPCD<br />

*<br />

ID<br />

Boise<br />

Primary Colorado <strong>Front</strong> <strong>Range</strong> <strong>Supply</strong> Refineries<br />

Suncor Commerce City, CO<br />

<strong>Front</strong>ier Cheyenne, WY<br />

•Sinclair Rawlins, WY<br />

•<strong>Front</strong>ier El Dorado, KS<br />

•ConocoPhillips Borger, TX<br />

•Valero McKee, TX<br />

Missoula<br />

Twin Falls Pocatello<br />

UT<br />

Great Falls<br />

Billings<br />

WY<br />

EAI, INC. (ENERGY ANALYSTS INTERNATIONAL) EAI, INC.<br />

DENVER NFR FUEL SUPPLY COSTS – IMPACTS 2011<br />

OV‐8<br />

MT<br />

CO<br />

Sheridan<br />

Rock Springs<br />

Casper<br />

*<br />

<strong>Denver</strong><br />

*<br />

Fountain<br />

Glendive<br />

DS**<br />

Valero McKee<br />

*<br />

*<br />

La Junta<br />

Sidney<br />

<strong>North</strong><br />

Platte<br />

Kaneb (21)<br />

*<br />

WRB - ConocoPhillips Borger<br />

*<br />

Copyright ©: EAI, Inc., 2011<br />

It is possible for the Sinclair Little America refinery at Casper WY <strong>and</strong> the three Billings area<br />

refineries (CENEX, ConocoPhillips, ExxonMobil) to supply product to <strong>Denver</strong> via pipeline but in the<br />

recent past relatively little of this supply interaction has taken place (around one percent of total<br />

Colorado gasoline supply). This has been partially due to the difficulty of making <strong>Denver</strong> area<br />

summertime specification gasoline but mostly due to tightness of product supply (<strong>and</strong> associated<br />

higher value) in the other Rocky Mountain markets north of Colorado.<br />

<strong>Supply</strong> volumes of the major refined products (gasoline, jet, <strong>and</strong> distillate) for the state of Colorado<br />

are presented in Table OV‐1, presented at the end of the chapter, which is in the form of a supply –<br />

dem<strong>and</strong> balance. As shown, Suncor refinery is the primary source of gasoline in the Colorado <strong>Front</strong><br />

<strong>Range</strong> representing about 33 percent of gasoline supply. Other major sources of gasoline are<br />

product pipelines, in supply share descending order, Magellan Chase pipeline from Wichita/El<br />

Dorado, KS; ConocoPhillips pipeline from Borger, TX; Plains Kaneb pipeline from Cheyenne WY;<br />

NuStar pipeline from McKee, TX; <strong>and</strong> <strong>Denver</strong> Products pipeline from Rawlins, WY. With the<br />

exception of ConocoPhillips pipeline <strong>and</strong> Plains Kaneb pipeline, all of the product moving through<br />

the product pipelines represent product manufactured at the respective upstream refinery. In the<br />

case of ConocoPhillips pipeline from Borger, NuStar is also a 33 percent undivided interest owner in<br />

this product pipeline <strong>and</strong> Valero McKee refinery also ships product on the ConocoPhillips pipeline.

OVERVIEW OF THE COLORADO AND FRONT RANGE FUELS MARKET<br />

As noted above, the Plains Kaneb product pipeline has connections into product supply from the<br />

Billings refineries <strong>and</strong> the <strong>Front</strong>ier Cheyenne refinery. Roughly 85 percent of the volumes to the<br />

<strong>Front</strong> <strong>Range</strong> on this pipeline originate at the <strong>Front</strong>ier Cheyenne refinery. An overview of the supply<br />

sourcing for the Colorado <strong>Front</strong> <strong>Range</strong> market is shown in Figure OV‐7.<br />

CHEVRON<br />

POCATELLO<br />

RVP 7.8<br />

PHOENIX<br />

AZ-CBG<br />

EVANSTON<br />

ROCK SPRINGS<br />

SINCLAIR<br />

GILLETTE<br />

CASPER<br />

Figure OV‐7<br />