latin american hedge fund directory 2004/2005 - Eurekahedge

latin american hedge fund directory 2004/2005 - Eurekahedge

latin american hedge fund directory 2004/2005 - Eurekahedge

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Key Trends in Latin American Hedge Funds<br />

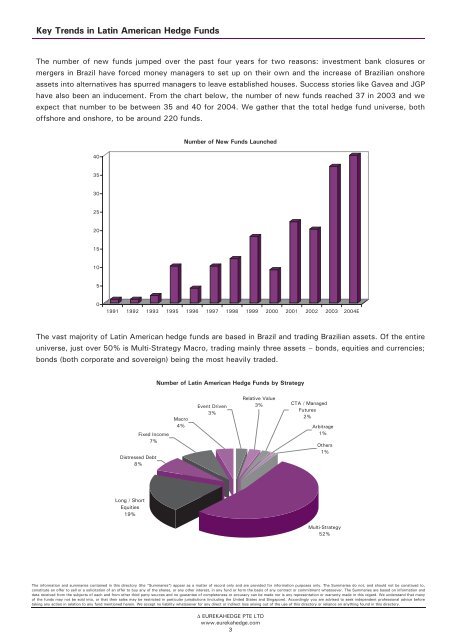

The number of new <strong>fund</strong>s jumped over the past four years for two reasons: investment bank closures or<br />

mergers in Brazil have forced money managers to set up on their own and the increase of Brazilian onshore<br />

assets into alternatives has spurred managers to leave established houses. Success stories like Gavea and JGP<br />

have also been an inducement. From the chart below, the number of new <strong>fund</strong>s reached 37 in 2003 and we<br />

expect that number to be between 35 and 40 for <strong>2004</strong>. We gather that the total <strong>hedge</strong> <strong>fund</strong> universe, both<br />

offshore and onshore, to be around 220 <strong>fund</strong>s.<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Number of New Funds Launched<br />

1991 1992 1993 1995 1996 1997 1998 1999 2000 2001 2002 2003 <strong>2004</strong>E<br />

The vast majority of Latin American <strong>hedge</strong> <strong>fund</strong>s are based in Brazil and trading Brazilian assets. Of the entire<br />

universe, just over 50% is Multi-Strategy Macro, trading mainly three assets – bonds, equities and currencies;<br />

bonds (both corporate and sovereign) being the most heavily traded.<br />

Fixed Income<br />

7%<br />

Distressed Debt<br />

8%<br />

Long / Short<br />

Equities<br />

19%<br />

Number of Latin American Hedge Funds by Strategy<br />

Macro<br />

4%<br />

Event Driven<br />

3%<br />

Relative Value<br />

3%<br />

The information and summaries contained in this <strong>directory</strong> (the “Summaries”) appear as a matter of record only and are provided for information purposes only. The Summaries do not, and should not be construed to,<br />

constitute an offer to sell or a solicitation of an offer to buy any of the shares, or any other interest, in any <strong>fund</strong> or form the basis of any contract or commitment whatsoever. The Summaries are based on information and<br />

data received from the subjects of each and from other third party sources and no guarantee of completeness or accuracy can be made nor is any representation or warranty made in this regard. We understand that many<br />

of the <strong>fund</strong>s may not be sold into, or that their sales may be restricted in particular jurisdictions (including the United States and Singapore). Accordingly you are advised to seek independent professional advice before<br />

taking any action in relation to any <strong>fund</strong> mentioned herein. We accept no liability whatsoever for any direct or indirect loss arising out of the use of this <strong>directory</strong> or reliance on anything found in this <strong>directory</strong>.<br />

∆ EUREKAHEDGE PTE LTD<br />

www.eureka<strong>hedge</strong>.com<br />

3<br />

CTA / Managed<br />

Futures<br />

2%<br />

Arbitrage<br />

1%<br />

Others<br />

1%<br />

Multi-Strategy<br />

52%