latin american hedge fund directory 2004/2005 - Eurekahedge

latin american hedge fund directory 2004/2005 - Eurekahedge

latin american hedge fund directory 2004/2005 - Eurekahedge

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Key Trends in Latin American Hedge Funds<br />

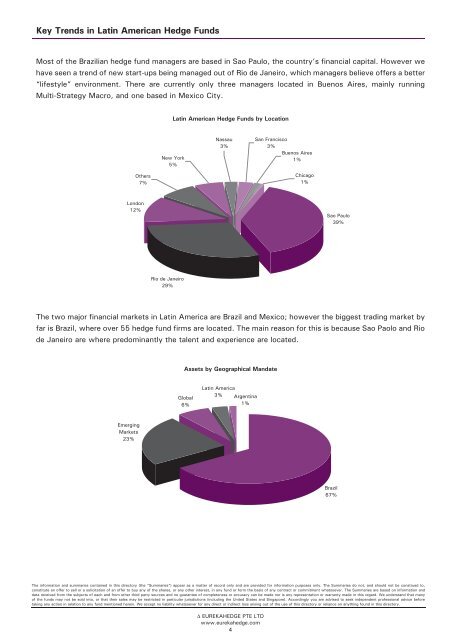

Most of the Brazilian <strong>hedge</strong> <strong>fund</strong> managers are based in Sao Paulo, the country’s financial capital. However we<br />

have seen a trend of new start-ups being managed out of Rio de Janeiro, which managers believe offers a better<br />

“lifestyle” environment. There are currently only three managers located in Buenos Aires, mainly running<br />

Multi-Strategy Macro, and one based in Mexico City.<br />

Others<br />

7%<br />

London<br />

12%<br />

Emerging<br />

Markets<br />

23%<br />

Rio de Janeiro<br />

29%<br />

Latin American Hedge Funds by Location<br />

New York<br />

5%<br />

Nassau<br />

3%<br />

Assets by Geographical Mandate<br />

Global<br />

6%<br />

Latin America<br />

3% Argentina<br />

1%<br />

The information and summaries contained in this <strong>directory</strong> (the “Summaries”) appear as a matter of record only and are provided for information purposes only. The Summaries do not, and should not be construed to,<br />

constitute an offer to sell or a solicitation of an offer to buy any of the shares, or any other interest, in any <strong>fund</strong> or form the basis of any contract or commitment whatsoever. The Summaries are based on information and<br />

data received from the subjects of each and from other third party sources and no guarantee of completeness or accuracy can be made nor is any representation or warranty made in this regard. We understand that many<br />

of the <strong>fund</strong>s may not be sold into, or that their sales may be restricted in particular jurisdictions (including the United States and Singapore). Accordingly you are advised to seek independent professional advice before<br />

taking any action in relation to any <strong>fund</strong> mentioned herein. We accept no liability whatsoever for any direct or indirect loss arising out of the use of this <strong>directory</strong> or reliance on anything found in this <strong>directory</strong>.<br />

∆ EUREKAHEDGE PTE LTD<br />

www.eureka<strong>hedge</strong>.com<br />

4<br />

San Francisco<br />

3%<br />

Buenos Aires<br />

1%<br />

Chicago<br />

1%<br />

Sao Paulo<br />

39%<br />

The two major financial markets in Latin America are Brazil and Mexico; however the biggest trading market by<br />

far is Brazil, where over 55 <strong>hedge</strong> <strong>fund</strong> firms are located. The main reason for this is because Sao Paolo and Rio<br />

de Janeiro are where predominantly the talent and experience are located.<br />

Brazil<br />

67%