latin american hedge fund directory 2004/2005 - Eurekahedge

latin american hedge fund directory 2004/2005 - Eurekahedge

latin american hedge fund directory 2004/2005 - Eurekahedge

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

POBT Equities Fund SPC – Total Return Equities Class<br />

Manager Profile Strategy<br />

• Patrick O’Grady acts as advisor to the <strong>fund</strong>.<br />

• O’Grady is the head of Pactual Asset Management equities team;<br />

he has headed the team since November 1998. He previously<br />

worked in the emerging markets investment group and the<br />

research department for two years. In 1996, he moved to the<br />

international equity distribution area, taking over the management<br />

of this area in 1998.<br />

• O’Grady majored in economics at the Federal University of Rio de<br />

Janeiro and earned an MBA in finance from the Brazilian Capital<br />

Markets Institute (IBMEC) and a CFA certificate in 1998. He<br />

became a partner of Pactual in 1998.<br />

• POBT is the offshore arm of Pactual Asset Management.<br />

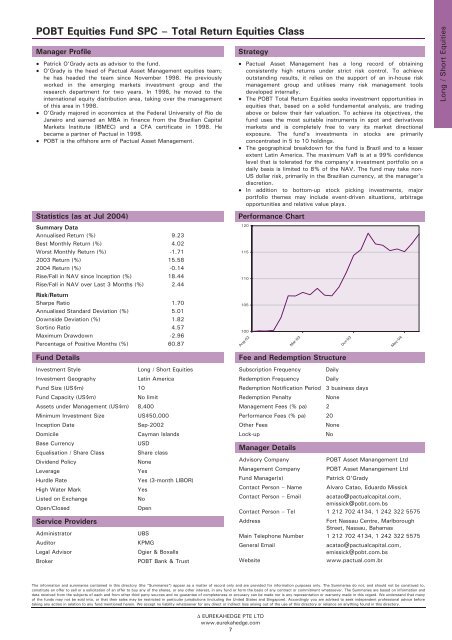

Statistics (as at Jul <strong>2004</strong>) Performance Chart<br />

Summary Data<br />

Annualised Return (%) 9.23<br />

Best Monthly Return (%) 4.02<br />

Worst Monthly Return (%) -1.71<br />

2003 Return (%) 15.58<br />

<strong>2004</strong> Return (%) -0.14<br />

Rise/Fall in NAV since Inception (%) 18.44<br />

Rise/Fall in NAV over Last 3 Months (%)<br />

Risk/Return<br />

2.44<br />

Sharpe Ratio 1.70<br />

Annualised Standard Deviation (%) 5.01<br />

Downside Deviation (%) 1.82<br />

Sortino Ratio 4.57<br />

Maximum Drawdown -2.96<br />

Percentage of Positive Months (%) 60.87<br />

Fund Details<br />

Investment Style Long / Short Equities<br />

Investment Geography Latin America<br />

Fund Size (US$m) 10<br />

Fund Capacity (US$m) No limit<br />

Assets under Management (US$m) 8,400<br />

Minimum Investment Size US$50,000<br />

Inception Date Sep-2002<br />

Domicile Cayman Islands<br />

Base Currency USD<br />

Equalisation / Share Class Share class<br />

Dividend Policy None<br />

Leverage Yes<br />

Hurdle Rate Yes (3-month LIBOR)<br />

High Water Mark Yes<br />

Listed on Exchange No<br />

Open/Closed Open<br />

Service Providers<br />

Administrator UBS<br />

Auditor KPMG<br />

Legal Advisor Ogier & Boxalls<br />

Broker POBT Bank & Trust<br />

The information and summaries contained in this <strong>directory</strong> (the “Summaries”) appear as a matter of record only and are provided for information purposes only. The Summaries do not, and should not be construed to,<br />

constitute an offer to sell or a solicitation of an offer to buy any of the shares, or any other interest, in any <strong>fund</strong> or form the basis of any contract or commitment whatsoever. The Summaries are based on information and<br />

data received from the subjects of each and from other third party sources and no guarantee of completeness or accuracy can be made nor is any representation or warranty made in this regard. We understand that many<br />

of the <strong>fund</strong>s may not be sold into, or that their sales may be restricted in particular jurisdictions (including the United States and Singapore). Accordingly you are advised to seek independent professional advice before<br />

taking any action in relation to any <strong>fund</strong> mentioned herein. We accept no liability whatsoever for any direct or indirect loss arising out of the use of this <strong>directory</strong> or reliance on anything found in this <strong>directory</strong>.<br />

∆ EUREKAHEDGE PTE LTD<br />

www.eureka<strong>hedge</strong>.com<br />

7<br />

• Pactual Asset Management has a long record of obtaining<br />

consistently high returns under strict risk control. To achieve<br />

outstanding results, it relies on the support of an in-house risk<br />

management group and utilises many risk management tools<br />

developed internally.<br />

• The POBT Total Return Equities seeks investment opportunities in<br />

equities that, based on a solid <strong>fund</strong>amental analysis, are trading<br />

above or below their fair valuation. To achieve its objectives, the<br />

<strong>fund</strong> uses the most suitable instruments in spot and derivatives<br />

markets and is completely free to vary its market directional<br />

exposure. The <strong>fund</strong>’s investments in stocks are primarily<br />

concentrated in 5 to 10 holdings.<br />

• The geographical breakdown for the <strong>fund</strong> is Brazil and to a lesser<br />

extent Latin America. The maximum VaR is at a 99% confidence<br />

level that is tolerated for the company’s investment portfolio on a<br />

daily basis is limited to 8% of the NAV. The <strong>fund</strong> may take non-<br />

US dollar risk, primarily in the Brazilian currency, at the manager’s<br />

discretion.<br />

• In addition to bottom-up stock picking investments, major<br />

portfolio themes may include event-driven situations, arbitrage<br />

opportunities and relative value plays.<br />

120<br />

115<br />

110<br />

105<br />

100<br />

Aug-02<br />

Mar-03<br />

Fee and Redemption Structure<br />

Oct-03<br />

Subscription Frequency Daily<br />

Redemption Frequency Daily<br />

Redemption Notification Period 3 business days<br />

Redemption Penalty None<br />

Management Fees (% pa) 2<br />

Performance Fees (% pa) 20<br />

Other Fees None<br />

Lock-up No<br />

Manager Details<br />

May-04<br />

Advisory Company POBT Asset Manangement Ltd<br />

Management Company POBT Asset Manangement Ltd<br />

Fund Manager(s) Patrick O’Grady<br />

Contact Person – Name Alvaro Catao, Eduardo Missick<br />

Contact Person – Email acatao@pactualcapital.com,<br />

emissick@pobt.com.bs<br />

Contact Person – Tel 1 212 702 4134, 1 242 322 5575<br />

Address Fort Nassau Centre, Marlborough<br />

Street, Nassau, Bahamas<br />

Main Telephone Number 1 212 702 4134, 1 242 322 5575<br />

General Email acatao@pactualcapital.com,<br />

emissick@pobt.com.bs<br />

Website www.pactual.com.br<br />

Long / Short Equities