Actuarial Science Programme Director: Prof. dr H. Wolthuis

Actuarial Science Programme Director: Prof. dr H. Wolthuis

Actuarial Science Programme Director: Prof. dr H. Wolthuis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Actuarial</strong> <strong>Science</strong> - <strong>Wolthuis</strong> - Quantitative Economics<br />

<strong>Actuarial</strong> <strong>Science</strong><br />

<strong>Programme</strong> <strong>Director</strong>: <strong>Prof</strong>. <strong>dr</strong> H. <strong>Wolthuis</strong><br />

Department: Quantitative Economics (KE)<br />

Ozis-code: uva/fee/ake/act<br />

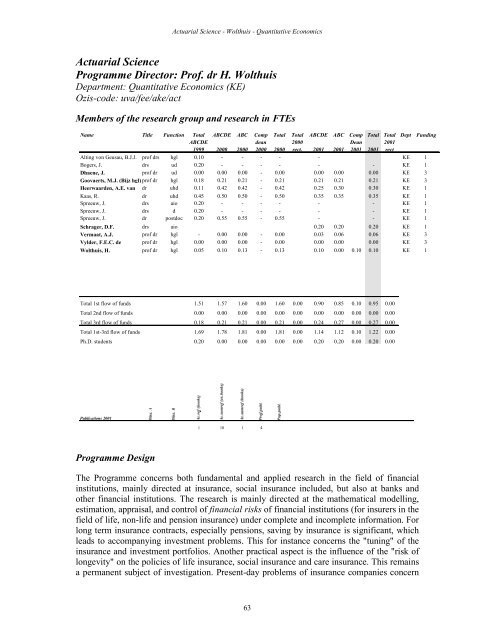

Members of the research group and research in FTEs<br />

Name Title Function Total<br />

ABCDE<br />

1999<br />

<strong>Programme</strong> Design<br />

ABCDE<br />

2000<br />

ABC<br />

2000<br />

The <strong>Programme</strong> concerns both fundamental and applied research in the field of financial<br />

institutions, mainly directed at insurance, social insurance included, but also at banks and<br />

other financial institutions. The research is mainly directed at the mathematical modelling,<br />

estimation, appraisal, and control of financial risks of financial institutions (for insurers in the<br />

field of life, non-life and pension insurance) under complete and incomplete information. For<br />

long term insurance contracts, especially pensions, saving by insurance is significant, which<br />

leads to accompanying investment problems. This for instance concerns the "tuning" of the<br />

insurance and investment portfolios. Another practical aspect is the influence of the "risk of<br />

longevity" on the policies of life insurance, social insurance and care insurance. This remains<br />

a permanent subject of investigation. Present-day problems of insurance companies concern<br />

63<br />

Comp<br />

dean<br />

2000<br />

Total<br />

2000<br />

Total<br />

2000<br />

rect.<br />

ABCDE<br />

2001<br />

ABC<br />

2001<br />

Comp<br />

Dean<br />

2001<br />

Total<br />

2001<br />

Total<br />

2001<br />

rect<br />

Dept Funding<br />

Alting von Geusau, B.J.J. prof <strong>dr</strong>s hgl 0.10 - - - - - KE 1<br />

Bogers, J. <strong>dr</strong>s ud 0.20 - - - - - - KE 1<br />

Dhaene, J. prof <strong>dr</strong> ud 0.00 0.00 0.00 - 0.00 0.00 0.00 0.00 KE 3<br />

Goovaerts, M.J. (Bijz hgl) prof <strong>dr</strong> hgl 0.18 0.21 0.21 - 0.21 0.21 0.21 0.21 KE 3<br />

Heerwaarden, A.E. van <strong>dr</strong> uhd 0.11 0.42 0.42 - 0.42 0.25 0.30 0.30 KE 1<br />

Kaas, R. <strong>dr</strong> uhd 0.45 0.50 0.50 - 0.50 0.35 0.35 0.35 KE 1<br />

Spreeuw, J. <strong>dr</strong>s aio 0.20 - - - - - - KE 1<br />

Spreeuw, J. <strong>dr</strong>s d 0.20 - - - - - - KE 1<br />

Spreeuw, J. <strong>dr</strong> postdoc 0.20 0.55 0.55 - 0.55 - - KE 1<br />

Schrager, D.F. <strong>dr</strong>s aio 0.20 0.20 0.20 KE 1<br />

Vermaat, A.J. prof <strong>dr</strong> hgl - 0.00 0.00 - 0.00 0.03 0.06 0.06 KE 3<br />

Vylder, F.E.C. de prof <strong>dr</strong> hgl 0.00 0.00 0.00 - 0.00 0.00 0.00 0.00 KE 3<br />

<strong>Wolthuis</strong>, H. prof <strong>dr</strong> hgl 0.05 0.10 0.13 - 0.13 0.10 0.00 0.10 0.10 KE 1<br />

Total 1st flow of funds 1.51 1.57 1.60 0.00 1.60 0.00 0.90 0.85 0.10 0.95 0.00<br />

Total 2nd flow of funds 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00<br />

Total 3rd flow of funds 0.18 0.21 0.21 0.00 0.21 0.00 0.24 0.27 0.00 0.27 0.00<br />

Total 1st-3rd flow of funds 1.69 1.78 1.81 0.00 1.81 0.00 1.14 1.12 0.10 1.22 0.00<br />

Ph.D. students 0.20 0.00 0.00 0.00 0.00 0.00 0.20 0.20 0.00 0.20 0.00<br />

Publications 2001<br />

1 10 1 4

<strong>Actuarial</strong> <strong>Science</strong> - <strong>Wolthuis</strong> - Quantitative Economics<br />

decreasing profit margins, increasing competition and selective behaviour of the insured and<br />

of insurance companies. Up to now limited attention has been given to problems that emerge<br />

from the privatisation of social insurance. The research partly deals with problems related to<br />

the supervision of insurance companies.<br />

An important subject of investigation is the further development of actuarial risk theory, in<br />

particular the development of new mathematical and economic models in the fields of<br />

mathematical reserves, equalisation reserves and solvency margins for insurance portfolios.<br />

Other significant fields of research are the interaction between credibility theory, models for<br />

the estimation of unreported claims (IBNR) and actuarial ordering of risks, and the<br />

consequences for the determination of insurance and tariff premiums. In the premium<br />

calculation and tarification of insurance, the determination of the factors that are relevant for<br />

the risk (risk classification) is a significant aspect. Other aspects for the premium calculation<br />

are the homogeneity and heterogeneity of the insurance portfolios, the solidarity between the<br />

insured, the voluntary or compulsory character of the insurance, and the auto selection and<br />

anti-selection of those insured. Another theoretical research subject concerns the unification<br />

of several distinct actuarial theories in the field of non-life, life and pension insurance, partly<br />

in connection with stochastic financial mathematics. A new research project deals with the<br />

valuation of interest rate guarantees in insurance and financial products.<br />

<strong>Programme</strong> Evaluation<br />

The main focus of the research of the <strong>Actuarial</strong> <strong>Science</strong> group presently is on the subject of<br />

ordering of risks and dependence of risks, as can be seen from the lists of refereed and nonrefereed<br />

publications. In the future, research in this field will continue, but there will be also<br />

be a shift to the field of financial modelling: In co-operation with the professors of financial<br />

economics and financial econometrics of our faculty a new Ph.D. research project has started<br />

this year, called “Valuation of Interest Guarantees in Insurance Projects”, which<br />

demonstrates the integration of actuarial and financial modelling. A second Ph.D. project will<br />

start in May 2002, called “Reinsurance and Insurance Linked Derivatives”, hence, also a<br />

project that combines insurance and financial market elements. Also in May 2002 a Postdoc,<br />

financed by NWO will start working on a project called “The Theory of Dependencies of<br />

risks applied to asset-liability models”. Altogether this means that the annual research input<br />

of the actuarial research group will more than double in the near future. Finally we intend to<br />

work together more closely with our Belgian colleagues in Leuven, who have started a large<br />

GOA Project (to be compared with NWO) called: <strong>Actuarial</strong>, financial and statistical aspects<br />

of dependencies in insurance and financial mathematics.<br />

Key publications<br />

Dhaene, J. & Sundt, B. (1998). On approximating distributions by approximating their De<br />

Pril transforms. Scandinavian <strong>Actuarial</strong> Journal, 1-23.<br />

Vylder, F. de, Goovaerts, M.J. & Marceau, E. (1997). The Bi-atomic uniform extremal<br />

solution of Schmitters's problem. Insurance: Mathematics & Economics, 20, 59-78.<br />

Goovaerts, M.J. & Schepper, A. de (1997). IBNR reserves under stochastic interest rates.<br />

Insurance: Mathematics & Economics, 21, 225-244.<br />

Kaas, R., Dhaene, J. & Goovaerts, M.J. (2000). Upper and lower bounds or sums of random<br />

variables. Insurance: Mathematics & Economics, 27, 151-168.<br />

64

<strong>Actuarial</strong> <strong>Science</strong> - <strong>Wolthuis</strong> - Quantitative Economics<br />

Kaas, R., Goovaerts, M.J., Dhaene, J. & Denuit, M. (2001). Modern actuarial risk theory.<br />

Kluwer Academic Publishers. 328 pages.<br />

Academic publications (excluding publications in/of books) – refereed<br />

Cossette, H., Denuit, M., Dhaene, J. & Marceau, E. (2001). Stochastic approximations of present<br />

value functions. Mitteilungen der Schweiz. Actuarvereinigung, 15-28. [C].<br />

Denuit, M., Dhaene, J. & Ribas, C. (2001). Does positive dependence between individual risks<br />

increase stop-loss premiums? Insurance: Mathematics & Economics, 28, 305-308. [A].<br />

Denuit, M., Dhaene, J., Le Bailly De Tilleghem, C. & Teghem, S. (2001). Measuring the impact of a<br />

dependence among insured life lengths. Belgian <strong>Actuarial</strong> Bulletin, 18-39. [C].<br />

Dhaene, J., Wang, S., Young, V. & Goovaerts, M.J. (2000). Comonotonicity and maximal stop-loss<br />

premiums. Mitteilungen der Schweiz. Actuarvereinigung, 99-113. [C].<br />

Goovaerts, M.J., Dhaene, J., Borre, E. van den & Redant, R. (2001). Some remarks on IBNR<br />

evaluation techniques. Belgian <strong>Actuarial</strong> Bulletin, 58-60. [C].<br />

Vyncke, D., Goovaerts, M.J. & Dhaene, J. (2001). Convex upper and lower bounds for present value<br />

functions. Applied Stochastic Models in Business and Industry, 17, 149-164. [B].<br />

Academic publications (in/of books) - refereed<br />

Kaas, R., Goovaerts, M.J., Dhaene, J. & Denuit, M. (2001). Modern actuarial risk theory. Kluwer<br />

Academic Publishers. pp. 328. [B].<br />

Academic publications (excluding publications in/of books) - non-refereed<br />

DeSchepper, A., Goovaerts, M.J., Dhaene, J., Vyncke, D. & Kaas, R. (2001). The valuation of cash<br />

flows for dividend paying securities. In Proceedings Astin Colloquium. Washington.<br />

DeSchepper, A., Goovaerts, M.J., Dhaene, J., Kaas, R. & Vyncke, D. (2001). Bounds for present<br />

value functions with stochastic interest rates and stochastic volatility. In Proceedings of the<br />

fifth International Congress on Insurance: Mathematics and Economics, State College.<br />

Denuit, M. & Dhaene, J. (2001). Bonus-malus scales using exponential loss functions. Blätter der<br />

Deutsche Gesellschaft für Versicherungsmathematik, 25, 13-27.<br />

Dhaene, J., Denuit, M., Goovaerts, M.J., Kaas, R. & Vyncke, D. (2001). The concept of<br />

comonotonicity in <strong>Actuarial</strong> <strong>Science</strong> and Finance: Theory. In Proceedings of the fifth<br />

International Congress on Insurance: Mathematics and Economics, State College.<br />

Goovaerts, M.J., DeSchepper, A., Vyncke, D., Dhaene, J. & Kaas, R. (2001). Stable laws and the<br />

distribution of cash-flows. In Proceedings AFIR colloquium. Toronto.<br />

Kaas, R., Dhaene, J., Vyncke, D., Goovaerts, M.J. & Denuit, M. (2001). A simple geometric proof<br />

that comonotonic risks have a convex largest sum. In Proceedings of the fifth International<br />

Congress on Insurance: Mathematics and Economics. State College.<br />

Schrager, D.F. (2001). Market based valuation of interest rate guarantees in Unit linked life<br />

insurance with stochastic volatility. Universiteit van Amsterdam: Masters thesis.<br />

Schrager, D.F. (2001). Properties of stock returns, time varying volatility. AENORM, 33, 4-6.<br />

Schrager, D.F. (2001). Waardering van rendementsgaranties binnen beleggingsverzekeringen. De<br />

Actuaris, May, 24-27.<br />

Vyncke, D., Goovaerts, M.J., DeSchepper, A., Kaas, R. & Dhaene, J. (2001). On the distribution of<br />

cash-flows using Esscher transforms. In Proceedings of the Fifth International Congress on<br />

Insurance: Mathematics and Economics. State college.<br />

65

<strong>Actuarial</strong> <strong>Science</strong> - <strong>Wolthuis</strong> - Quantitative Economics<br />

Academic publications (in/of books) - non-refereed<br />

Smid, C.L. & <strong>Wolthuis</strong>, H. (2001). Be<strong>dr</strong>ijfsanalyse en embedded value. Amsterdam: IAE. pp. 291.<br />

<strong>Prof</strong>essional publications<br />

Bauwelinckx, T. & Goovaerts, M.J. (eds) (2001). Aanvullende Be<strong>dr</strong>ijfspensioenen. Kluwer. 1-782.<br />

Heerwaarden, A.E. van (ed.) (2001). Column `Nieuws van de Universiteit van Amsterdam'. De<br />

Actuaris. (Bi-monthly).<br />

Heerwaarden, A.E. van (2001). Toepassing van kennistechnologie in het actuariaat. Report on<br />

Symposium Practis. De Actuaris, juli, 9-10.<br />

Heerwaarden, A.E. van (2001). Computational intelligence: mortality models for the actuary. De<br />

Actuaris, July, 11-12. (Bookreview).<br />

Other activities<br />

Contributions (lectures) to conferences, workshops and seminars<br />

Dhaene, J. (2001, 1 February). Modelling Dependencies: Theory. Colloquium The Insurancial<br />

Approach – Linking Insurance and Financial Concepts, K.U. Leuven.<br />

Dhaene, J. (2001, 14 February). Risk and Savings Contracts in Life Insurance, Workshop Selective<br />

<strong>Actuarial</strong> Topics in the World of Insurance, Finance and Risk, University of the Free State,<br />

Department of Mathematical Statistics and Statistics, Bloemfontein, South Africa.<br />

Dhaene, J. (2001, 15 February). Insurancial Mathematics. Workshop Selective <strong>Actuarial</strong> Topics in the<br />

World of Insurance, Finance and Risk. University of the Free State, Department of<br />

Mathematical Statistics and Statistics, Bloemfontein, South Africa.<br />

Dhaene, J. (2001, 1 August). Comonotonicity in <strong>Actuarial</strong> <strong>Science</strong>s. Evening Seminar, University of<br />

Warsaw, Faculty of Economics.<br />

Dhaene, J. (2001, 4 October). Comonotonic Risks. The University of Hong Kong, Department of<br />

Statistics and <strong>Actuarial</strong> <strong>Science</strong>, Faculty of Social <strong>Science</strong>.<br />

Dhaene, J. (2001, 4-8 October). The Education Project of ARAB-KVBA, International <strong>Actuarial</strong><br />

Association Meeting, Hong Kong.<br />

Goovaerts, M.J. (2001, 25 January). The distribution of annuities with random interest rates, Lausanne<br />

3L-seminar.<br />

Goovaerts, M.J. (2001, 1 February). Academische session on the occasion of 60 years of <strong>Actuarial</strong><br />

Education. Actuarieel Onderzoek, K.U. Leuven, Leuven.<br />

Goovaerts, M.J. (2001, 1 February). Insurancial Mathematics, The distribution of present values of a<br />

cash-flow. K.U. Leuven, Leuven.<br />

Goovaerts, M.J. (2001, 2 February). Laudatio prof. <strong>dr</strong>. H.U. Gerber, eredoctor K.U. Leuven, K.U.<br />

Leuven.<br />

Goovaerts, M.J. (2001, 13-14 February). Dependencies in Insurance: Financial Applications,<br />

Bloemfontein, South Africa.<br />

Goovaerts, M.J. (2001, 9 July). The valuation of cash flows for divident paying Securities. Astin<br />

Colloquium, Washington.<br />

Goovaerts, M.J. (2001, 23 July). Applications of comonotonic risks: Theory. Fifth IME-conference,<br />

State College, USA. Invited lecture.<br />

Goovaerts, M.J. (2001, 5 September). Applications of comonotone risks in financial cash flows.<br />

Schulich School of Business, Finance Seminar Series, USA.<br />

Goovaerts, M.J. (2001, 6-7 September). Stable Laws and the distribution of cash flows, AFIRcolloquium<br />

Toronto.<br />

Heerwaarden, A.E. van (2001, 1 October). The risky thing about dependent mortality. AE lunch<br />

seminar, Amsterdam.<br />

66

<strong>Actuarial</strong> <strong>Science</strong> - <strong>Wolthuis</strong> - Quantitative Economics<br />

Heerwaarden, A.E. van & Schrager, D.F. (2001, 10 January). Present values with a lognormal<br />

discount process. Workshop Financial applications of risk ordering, Actuarieel Genootschap,<br />

Zeist.<br />

Heerwaarden, A.E. van & Schrager, D.F. (2001, 10 January). Positive dependence between individual<br />

risks. Workshop Financial applications of risk ordering, Actuarieel Genootschap, Zeist.<br />

Heerwaarden, A.E. van & Willemse, W.J. (2001, 22 November). Werken met continue<br />

sterftemodellen. Workshop “Overleven zonder tafels”, Actuarieel Genootschap, Utrecht.<br />

Heerwaarden, A.E. van & Willemse, W.J. (2001, 22 November). Flexibiliseren van sterftemodellen.<br />

Workshop “Overleven zonder tafels”, Actuarieel Genootschap, Utrecht.<br />

Kaas, R. (2001, 10 January). Introduction to ordering of risks and comonotonicity in financial models.<br />

Workshop Financial applications of risk ordering, Actuarieel Genootschap, Zeist.<br />

Kaas, R. (2001, 29 January). Comonotonic risks and comonotonicity, AE-lunchseminar, Amsterdam.<br />

Kaas, R. (2001, 25 July). A simple geometric proof that comonotonic risks have the convex-largest<br />

sum. Fifth IME conference, Penn State University, State College, USA.<br />

Smid, C.L. (2001, 6 November). Geldstromen en winst in het levensverzekeringbe<strong>dr</strong>ijf. Valedictory<br />

UvA, Amsterdam.<br />

Organisational contributions to conferences, workshops and seminars<br />

Kaas, R. & Goovaerts, M.J. (2001, 23-25 July). Fifth Congress on Insurance: Mathematics &<br />

Economics. Involved in the organising.<br />

Kaas, R. (2001, 25 July). Chairman session on ‘Comonotonic risks”. Fifth IME conference, Penn<br />

State University, State College, USA.<br />

Heerwaarden, A.E. van (2001, 10 January). Workshop “Financial applications of risk ordering”,<br />

Actuarieel Genootschap, Zeist.<br />

Heerwaarden, A.E. van (2001, 22 November). Workshop “Overleven zonder tafels”, Actuarieel<br />

Genootschap, Utrecht.<br />

Participation in academic networks<br />

Goovaerts, M.J. (2001). <strong>Director</strong> ACP-netwerk (Actuarieel Contact Program) of Leuven Research and<br />

Development with various Belgian insurers.<br />

Goovaerts, M.J. (2001). Fellow Tinbergen Instituut (1997, June-date).<br />

Editor or member of editorial board<br />

Dhaene, J. (2001). Associate editor Insurance: Mathematics & Economics (North-Holland) and editor<br />

Belgian <strong>Actuarial</strong> Bulletin.<br />

Goovaerts, M.J. (2001). Editor Insurance: Mathematics and Economics (North-Holland), editor Journal<br />

of Computational and Applied Mathematics (North-Holland) and associate editor ASTIN<br />

Bulletin.<br />

Kaas, R. (2001). Managing editor Insurance: Mathematics and Economics (North-Holland).<br />

<strong>Wolthuis</strong>, H. (2001). Associate editor Insurance: Mathematics & Economics (North-Holland).<br />

Membership of academic committees (including Ph.D. committees inside or outside<br />

the UvA)<br />

Dhaene, J. (2001). Member Ph.D. committee C. Ribas, Universitat de Barcelona, Spain.<br />

Goovaerts, M.J. (2001). Member Ph.D. committee C. Ribas, Universitat de Barcelona, Spain.<br />

67

<strong>Actuarial</strong> <strong>Science</strong> - <strong>Wolthuis</strong> - Quantitative Economics<br />

Goovaerts, M.J. (2001). Member of the working party in the framework of the IAA Insurance<br />

Regulation Committee.<br />

<strong>Wolthuis</strong>, H. (2001). Member of committee Dutch survival tables.<br />

<strong>Wolthuis</strong>, H. (2001). Member of committee on International <strong>Actuarial</strong> Notation AAI.<br />

<strong>Wolthuis</strong>, H. (2001). Member of supervising committee Belgian scientific programme “<strong>Actuarial</strong>,<br />

financial and statistical aspects of dependencies in insurance and financial statistics”,<br />

together with <strong>Prof</strong>. <strong>dr</strong> H. Bühlmann & <strong>Prof</strong>. <strong>dr</strong> H.U. Gerber.<br />

Heerwaarden, A.E. van (2001). Member of committee for continuous professional development<br />

(Permanente Educatie) of Actuarieel Genootschap.<br />

Various activities<br />

Goovaerts, M.J. (2001). NWO Project. The Theory of Dependencies of risks applied to asset-liability<br />

models, Fl 428.000 (€ 195.000).<br />

Goovaerts, M.J. & Dhaene, J. (2001). Belgian GOA Project. <strong>Actuarial</strong>, financial and statistical<br />

aspects of dependencies in insurance and financial mathematics, Fl 3.200.000 (€ 1.450.000).<br />

68