Certificate/Diploma/Advanced Diploma in Insurance Accelerating ...

Certificate/Diploma/Advanced Diploma in Insurance Accelerating ...

Certificate/Diploma/Advanced Diploma in Insurance Accelerating ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

4<br />

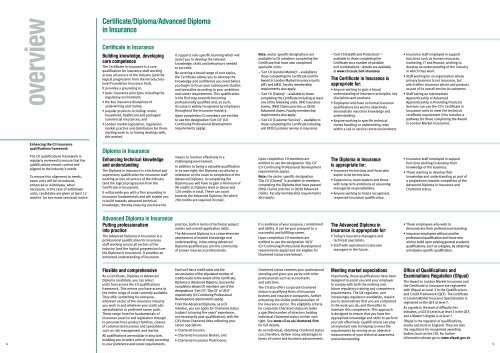

overview<br />

Enhanc<strong>in</strong>g the CII <strong>in</strong>surance<br />

qualifications framework<br />

The CII qualifications framework is<br />

regularly reviewed to ensure that the<br />

qualifications rema<strong>in</strong> current and<br />

aligned to the <strong>in</strong>dustry’s needs.<br />

To ensure this alignment to needs,<br />

exam units will be <strong>in</strong>troduced,<br />

enhanced or withdrawn, when<br />

necessary. In the case of withdrawn<br />

units, candidates are given at least 12<br />

months’ (or two exam sessions) notice.<br />

<strong>Certificate</strong>/<strong>Diploma</strong>/<strong>Advanced</strong> <strong>Diploma</strong><br />

<strong>in</strong> <strong>Insurance</strong><br />

<strong>Certificate</strong> <strong>in</strong> <strong>Insurance</strong><br />

Build<strong>in</strong>g knowledge, develop<strong>in</strong>g<br />

core competence<br />

The <strong>Certificate</strong> <strong>in</strong> <strong>Insurance</strong> is a core<br />

qualification for <strong>in</strong>surance staff work<strong>in</strong>g<br />

across all sectors of the <strong>in</strong>dustry (and the<br />

logical progression from the <strong>in</strong>troductorylevel<br />

Foundation <strong>Insurance</strong> Test).<br />

It provides a ground<strong>in</strong>g <strong>in</strong>:<br />

• basic <strong>in</strong>surance pr<strong>in</strong>ciples <strong>in</strong>clud<strong>in</strong>g the<br />

regulatory environment;<br />

• the key <strong>in</strong>surance discipl<strong>in</strong>es of<br />

underwrit<strong>in</strong>g and claims;<br />

• popular products <strong>in</strong>clud<strong>in</strong>g: motor,<br />

household, healthcare and packaged<br />

commercial <strong>in</strong>surances; and<br />

• London market legislation, regulation,<br />

market practice and distribution for those<br />

start<strong>in</strong>g work <strong>in</strong>, or hav<strong>in</strong>g deal<strong>in</strong>gs with,<br />

this market.<br />

<strong>Diploma</strong> <strong>in</strong> <strong>Insurance</strong><br />

Enhanc<strong>in</strong>g technical knowledge<br />

and understand<strong>in</strong>g<br />

The <strong>Diploma</strong> <strong>in</strong> <strong>Insurance</strong> is a technical and<br />

supervisory qualification for <strong>in</strong>surance staff<br />

work<strong>in</strong>g across all sectors of the <strong>in</strong>dustry<br />

(and the logical progression from the<br />

<strong>Certificate</strong> <strong>in</strong> <strong>Insurance</strong>).<br />

It will provide you with a firm ground<strong>in</strong>g <strong>in</strong><br />

<strong>in</strong>surance fundamentals and will enable you<br />

to build towards advanced technical<br />

knowledge, thereby ensur<strong>in</strong>g you have the<br />

<strong>Advanced</strong> <strong>Diploma</strong> <strong>in</strong> <strong>Insurance</strong><br />

Putt<strong>in</strong>g professionalism<br />

<strong>in</strong>to practice<br />

The <strong>Advanced</strong> <strong>Diploma</strong> <strong>in</strong> <strong>Insurance</strong> is a<br />

professional qualification for <strong>in</strong>surance<br />

staff work<strong>in</strong>g across all sectors of the<br />

<strong>in</strong>dustry (and the logical progression from<br />

the <strong>Diploma</strong> <strong>in</strong> <strong>Insurance</strong>). It provides an<br />

enhanced understand<strong>in</strong>g of <strong>in</strong>surance<br />

Flexible and comprehensive<br />

As a <strong>Certificate</strong>, <strong>Diploma</strong> or <strong>Advanced</strong><br />

<strong>Diploma</strong> candidate, you can select<br />

units from across the CII qualifications<br />

framework. This means you have access to<br />

the entire range of units currently available.<br />

They offer someth<strong>in</strong>g for everyone,<br />

whatever sector of the <strong>in</strong>surance <strong>in</strong>dustry<br />

you work <strong>in</strong> and whatever your particular<br />

specialisation or preferred career path.<br />

These range from the fundamentals of<br />

<strong>in</strong>surance practice and legislation through<br />

to personal l<strong>in</strong>es product families, classes<br />

of commercial <strong>in</strong>surance and specialisms<br />

such as risk management and mar<strong>in</strong>e.<br />

All qualifications are modular <strong>in</strong> structure,<br />

enabl<strong>in</strong>g you to select units of study accord<strong>in</strong>g<br />

to your preference and career requirements.<br />

It supports role-specific learn<strong>in</strong>g which will<br />

assist you to develop the relevant<br />

knowledge, skills and behaviours needed<br />

to succeed.<br />

By cover<strong>in</strong>g a broad range of core topics,<br />

the <strong>Certificate</strong> allows you to develop the<br />

knowledge and confidence you need before<br />

you beg<strong>in</strong> to focus your subsequent studies<br />

and specialise accord<strong>in</strong>g to your ambitions<br />

and career requirements. This qualification<br />

is the first step towards becom<strong>in</strong>g<br />

professionally qualified and, as such,<br />

its value is widely recognised by employers<br />

throughout the <strong>in</strong>surance <strong>in</strong>dustry.<br />

Upon completion CII members are entitled<br />

to use the designation ‘Cert CII’ (CII<br />

Cont<strong>in</strong>u<strong>in</strong>g Professional Development<br />

requirements apply).<br />

means to function effectively <strong>in</strong> a<br />

challeng<strong>in</strong>g environment.<br />

In addition to be<strong>in</strong>g a valuable qualification<br />

<strong>in</strong> its own right, the <strong>Diploma</strong> can also be a<br />

milestone on the route to completion of the<br />

<strong>Advanced</strong> <strong>Diploma</strong>. In complet<strong>in</strong>g the<br />

<strong>Diploma</strong> you will have to ga<strong>in</strong> a m<strong>in</strong>imum of<br />

90 credits at <strong>Diploma</strong> level or above and<br />

120 credits <strong>in</strong> total. These can count<br />

towards the <strong>Advanced</strong> <strong>Diploma</strong> (for which<br />

290 credits are required <strong>in</strong> total).<br />

practice, both <strong>in</strong> terms of technical subject<br />

matter and overall application skills.<br />

The <strong>Advanced</strong> <strong>Diploma</strong> is a comprehensive<br />

assessment of market knowledge and<br />

understand<strong>in</strong>g. In becom<strong>in</strong>g <strong>Advanced</strong><br />

<strong>Diploma</strong> qualified you jo<strong>in</strong> the community<br />

of proven <strong>in</strong>surance professionals.<br />

Each unit has a credit value and the<br />

accumulation of the stipulated number of<br />

credits leads to the award of the <strong>Certificate</strong>,<br />

<strong>Diploma</strong> or <strong>Advanced</strong> <strong>Diploma</strong>. Successful<br />

completion allows CII members use of the<br />

designations ‘Cert CII’, ‘Dip CII’ or ‘ACII’<br />

respectively (CII Cont<strong>in</strong>u<strong>in</strong>g Professional<br />

Development requirements apply).<br />

From the <strong>Advanced</strong> <strong>Diploma</strong>, as a CII<br />

member, you can apply for Chartered status<br />

(subject to hav<strong>in</strong>g five years’ experience,<br />

not necessarily post-qualification), with the<br />

CII’s three Chartered titles reflect<strong>in</strong>g your<br />

career specialism:<br />

• Chartered Insurer;<br />

• Chartered <strong>Insurance</strong> Broker; and<br />

• Chartered <strong>Insurance</strong> Practitioner.<br />

Note: sector specific designations are<br />

available to CII members complet<strong>in</strong>g the<br />

<strong>Certificate</strong> that have also completed<br />

specialist units:<br />

– ‘Cert CII (London Market)’ – available to<br />

those complet<strong>in</strong>g the <strong>Certificate</strong> and the<br />

Award <strong>in</strong> London Market <strong>Insurance</strong> (units<br />

LM1 and LM2). Faculty membership<br />

requirements also apply.<br />

– ‘Cert CII (Claims)’ – available to those<br />

complet<strong>in</strong>g the <strong>Certificate</strong> <strong>in</strong>clud<strong>in</strong>g at least<br />

one of the follow<strong>in</strong>g units: (IF4) <strong>Insurance</strong><br />

claims, (P85) Claims practice, or (820)<br />

<strong>Advanced</strong> claims. Faculty membership<br />

requirements also apply.<br />

– ‘Cert CII (Customer Service)’ – available to<br />

those complet<strong>in</strong>g the <strong>Certificate</strong> <strong>in</strong>clud<strong>in</strong>g<br />

unit (IF9) Customer service <strong>in</strong> <strong>in</strong>surance.<br />

Upon completion CII members are<br />

entitled to use the designation ‘Dip CII’<br />

(CII Cont<strong>in</strong>u<strong>in</strong>g Professional Development<br />

requirements apply).<br />

Note: the sector specific designation<br />

‘Dip CII (Claims)’ is available to members<br />

complet<strong>in</strong>g the <strong>Diploma</strong> that have passed<br />

(P85) Claims practice or (820) <strong>Advanced</strong><br />

claims. Faculty membership requirements<br />

also apply.<br />

It is evidence of your purpose, commitment<br />

and ability. It can be your passport to a<br />

successful and fulfill<strong>in</strong>g career.<br />

Upon completion CII members are<br />

entitled to use the designation ‘ACII’<br />

(CII Cont<strong>in</strong>u<strong>in</strong>g Professional Development<br />

requirements apply) and are eligible for<br />

Chartered status (see below).<br />

Chartered status cements your professional<br />

stand<strong>in</strong>g and gives you parity with other<br />

professionals such as accountants<br />

and solicitors.<br />

The CII also offers corporate Chartered<br />

status to qualify<strong>in</strong>g firms of <strong>in</strong>surance<br />

brokers and <strong>in</strong>surance companies, further<br />

enhanc<strong>in</strong>g the visible professionalism of<br />

the <strong>in</strong>surance sector. The eligibility criteria<br />

for corporate Chartered status <strong>in</strong>cludes<br />

a specified number of directors hold<strong>in</strong>g<br />

<strong>in</strong>dividual Chartered status <strong>in</strong> their own<br />

right. See www.cii.co.uk/chartered-firm<br />

for full details.<br />

As an <strong>in</strong>dividual, obta<strong>in</strong><strong>in</strong>g Chartered status<br />

can, therefore, deliver many advantages <strong>in</strong><br />

terms of career and bus<strong>in</strong>ess advancement.<br />

– ‘Cert CII (Health and Protection)’ –<br />

available to those complet<strong>in</strong>g the<br />

<strong>Certificate</strong> via a number of possible<br />

unit comb<strong>in</strong>ations – details are available<br />

at www.cii.co.uk/cert-<strong>in</strong>surance<br />

The <strong>Certificate</strong> <strong>in</strong> <strong>Insurance</strong> is<br />

appropriate for:<br />

• Anyone wish<strong>in</strong>g to ga<strong>in</strong> a broad<br />

understand<strong>in</strong>g of <strong>in</strong>surance pr<strong>in</strong>ciples, key<br />

discipl<strong>in</strong>es and products.<br />

• Employees who have no formal <strong>in</strong>surance<br />

qualifications but wish to objectively<br />

demonstrate <strong>in</strong>surance knowledge and<br />

understand<strong>in</strong>g.<br />

• Anyone work<strong>in</strong>g <strong>in</strong> specific technical<br />

claims handl<strong>in</strong>g or underwrit<strong>in</strong>g roles<br />

with<strong>in</strong> a call or service centre environment.<br />

The <strong>Diploma</strong> <strong>in</strong> <strong>Insurance</strong><br />

is appropriate for:<br />

• <strong>Insurance</strong> technicians and those who<br />

aspire to be technicians.<br />

• Supervisors, team leaders and those<br />

with long-term ambitions of assum<strong>in</strong>g<br />

managerial responsibilities.<br />

• Anyone wish<strong>in</strong>g to hold a recognised,<br />

respected <strong>in</strong>surance qualification.<br />

The <strong>Advanced</strong> <strong>Diploma</strong> <strong>in</strong><br />

<strong>Insurance</strong> is appropriate for:<br />

• Today’s <strong>in</strong>surance managers and<br />

technical specialists.<br />

• Staff with aspirations to become<br />

managers <strong>in</strong> the future.<br />

Meet<strong>in</strong>g market expectations<br />

Importantly, these qualifications have been<br />

designed to assist you and your employer<br />

to comply with both the exist<strong>in</strong>g and<br />

future regulatory tra<strong>in</strong><strong>in</strong>g and competence<br />

requirements. The UK regulator, and<br />

<strong>in</strong>creas<strong>in</strong>gly regulators worldwide, require<br />

you to demonstrate that you are competent<br />

<strong>in</strong> the work you do, and thereafter to<br />

ma<strong>in</strong>ta<strong>in</strong> this competence. This approach<br />

is designed to ensure that you have the<br />

appropriate knowledge and skills to perform<br />

your job effectively. Qualifications can play<br />

an important role <strong>in</strong> help<strong>in</strong>g to meet the<br />

requirements by serv<strong>in</strong>g as an objective<br />

measurement of your technical awareness<br />

and understand<strong>in</strong>g.<br />

• <strong>Insurance</strong> staff employed <strong>in</strong> support<br />

functions such as human resources,<br />

market<strong>in</strong>g, IT and f<strong>in</strong>ance, wish<strong>in</strong>g to<br />

develop an understand<strong>in</strong>g of the <strong>in</strong>dustry<br />

<strong>in</strong> which they work.<br />

• Staff work<strong>in</strong>g for an organisation whose<br />

primary bus<strong>in</strong>ess is not <strong>in</strong>surance, but<br />

which offers <strong>in</strong>surance advice and products<br />

as part of its overall service to customers.<br />

• Staff tak<strong>in</strong>g an Intermediate<br />

Apprenticeship or <strong>Advanced</strong><br />

Apprenticeship <strong>in</strong> Provid<strong>in</strong>g F<strong>in</strong>ancial<br />

Services can use the CII’s <strong>Certificate</strong> <strong>in</strong><br />

<strong>Insurance</strong> units to meet the technical<br />

certificate requirement (this <strong>in</strong>cludes a<br />

pathway for those complet<strong>in</strong>g the Award<br />

<strong>in</strong> London Market <strong>Insurance</strong>).<br />

• <strong>Insurance</strong> staff employed <strong>in</strong> support<br />

functions wish<strong>in</strong>g to develop their<br />

knowledge of the bus<strong>in</strong>ess.<br />

• Those want<strong>in</strong>g to develop their<br />

knowledge and understand<strong>in</strong>g as part of<br />

a progression towards completion of the<br />

<strong>Advanced</strong> <strong>Diploma</strong> <strong>in</strong> <strong>Insurance</strong> and<br />

Chartered status.<br />

• Those employees who wish to<br />

demonstrate their professional stand<strong>in</strong>g.<br />

• <strong>Insurance</strong> employees without another<br />

professional qualification and those who<br />

wish to build upon exist<strong>in</strong>g general academic<br />

qualifications, such as a degree, by obta<strong>in</strong><strong>in</strong>g<br />

an <strong>in</strong>dustry-specific qualification.<br />

Office of Qualifications and<br />

Exam<strong>in</strong>ations Regulation (Ofqual)<br />

The Award <strong>in</strong> London Market <strong>Insurance</strong> and<br />

the <strong>Certificate</strong> <strong>in</strong> <strong>Insurance</strong> are registered<br />

with Ofqual at Level 3 <strong>in</strong> the Qualifications<br />

and Credit Framework (QCF). The <strong>Certificate</strong><br />

<strong>in</strong> London Market <strong>Insurance</strong> Specialisation is<br />

registered on the QCF at level 7.<br />

As a guide to the level of difficulty this<br />

<strong>in</strong>dicates, a GCE A-Level is at level 3 <strong>in</strong> the QCF,<br />

and a Master’s degree is at level 7.<br />

Ofqual is the regulator of qualifications,<br />

exams and tests <strong>in</strong> England. They are also<br />

the regulators for recognised award<strong>in</strong>g<br />

bodies (such as the CII). For further<br />

<strong>in</strong>formation please go to: www.ofqual.gov.uk<br />

5