European mortgage markets: what can we learn? - Hypsotech ...

European mortgage markets: what can we learn? - Hypsotech ...

European mortgage markets: what can we learn? - Hypsotech ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

10<br />

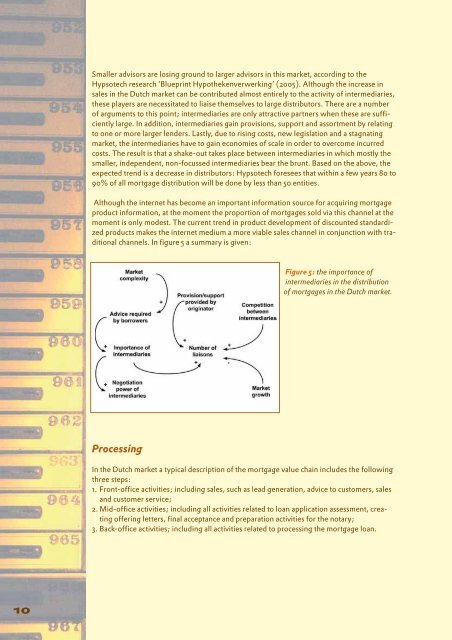

Smaller advisors are losing ground to larger advisors in this market, according to the<br />

<strong>Hypsotech</strong> research ‘Blueprint Hypothekenver<strong>we</strong>rking’ (2005). Although the increase in<br />

sales in the Dutch market <strong>can</strong> be contributed almost entirely to the activity of intermediaries,<br />

these players are necessitated to liaise themselves to large distributors. There are a number<br />

of arguments to this point; intermediaries are only attractive partners when these are sufficiently<br />

large. In addition, intermediaries gain provisions, support and assortment by relating<br />

to one or more larger lenders. Lastly, due to rising costs, new legislation and a stagnating<br />

market, the intermediaries have to gain economies of scale in order to overcome incurred<br />

costs. The result is that a shake-out takes place bet<strong>we</strong>en intermediaries in which mostly the<br />

smaller, independent, non-focussed intermediaries bear the brunt. Based on the above, the<br />

expected trend is a decrease in distributors: <strong>Hypsotech</strong> foresees that within a few years 80 to<br />

90% of all <strong>mortgage</strong> distribution will be done by less than 50 entities.<br />

Although the internet has become an important information source for acquiring <strong>mortgage</strong><br />

product information, at the moment the proportion of <strong>mortgage</strong>s sold via this channel at the<br />

moment is only modest. The current trend in product development of discounted standardized<br />

products makes the internet medium a more viable sales channel in conjunction with traditional<br />

channels. In figure 5 a summary is given:<br />

Processing<br />

Figure 5: the importance of<br />

intermediaries in the distribution<br />

of <strong>mortgage</strong>s in the Dutch market.<br />

In the Dutch market a typical description of the <strong>mortgage</strong> value chain includes the following<br />

three steps:<br />

1. Front-office activities; including sales, such as lead generation, advice to customers, sales<br />

and customer service;<br />

2. Mid-office activities; including all activities related to loan application assessment, creating<br />

offering letters, final acceptance and preparation activities for the notary;<br />

3. Back-office activities; including all activities related to processing the <strong>mortgage</strong> loan.