European mortgage markets: what can we learn? - Hypsotech ...

European mortgage markets: what can we learn? - Hypsotech ...

European mortgage markets: what can we learn? - Hypsotech ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The UK<br />

<strong>mortgage</strong> market<br />

In Europe, the UK <strong>mortgage</strong> market is often used as a reference because of the<br />

sheer size and maturity of this market, reflected by a large variety of products<br />

available. With a total value of residential loans of €1,243bn in 2004 the UK<br />

<strong>mortgage</strong> market is the largest in Europe. Further, the number of competitors in<br />

this market is large, albeit the concentration is fairly high: in 2001 the level of<br />

concentration in the UK market was around 60%.<br />

Nevertheless, the level of competition is raised in the UK by the signifi<strong>can</strong>t pressure that is executed<br />

by the smaller players. Therefore, the players in this market adopt various different strategies<br />

in order to compete more effectively; some choose to grow bigger by merging or entering<br />

joint ventures whilst other players opt for specializing in some activities and outsourcing noncore<br />

activities. The level of competition in the UK has not only led the <strong>mortgage</strong> interest rates<br />

to decrease but also it has increased the availability of <strong>mortgage</strong> products: in the UK there are<br />

specialist lenders that supply <strong>mortgage</strong> loans to the non-conforming and sub-prime market segment<br />

as <strong>we</strong>ll. In general it <strong>can</strong> be stated that high risk <strong>mortgage</strong> products are widely available in<br />

the UK. Besides specialist lenders, high street lenders, building societies and retail banks are<br />

important players in this market.<br />

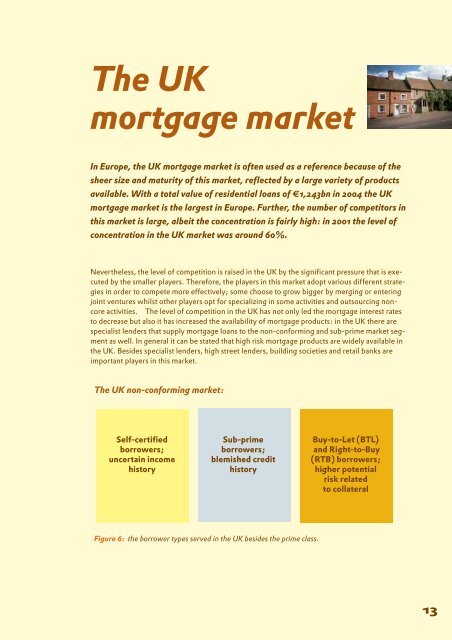

The UK non-conforming market:<br />

Self-certified<br />

borro<strong>we</strong>rs;<br />

uncertain income<br />

history<br />

Sub-prime<br />

borro<strong>we</strong>rs;<br />

blemished credit<br />

history<br />

Figure 6: the borro<strong>we</strong>r types served in the UK besides the prime class.<br />

Buy-to-Let (BTL)<br />

and Right-to-Buy<br />

(RTB) borro<strong>we</strong>rs;<br />

higher potential<br />

risk related<br />

to collateral<br />

13