European mortgage markets: what can we learn? - Hypsotech ...

European mortgage markets: what can we learn? - Hypsotech ...

European mortgage markets: what can we learn? - Hypsotech ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

22<br />

Products<br />

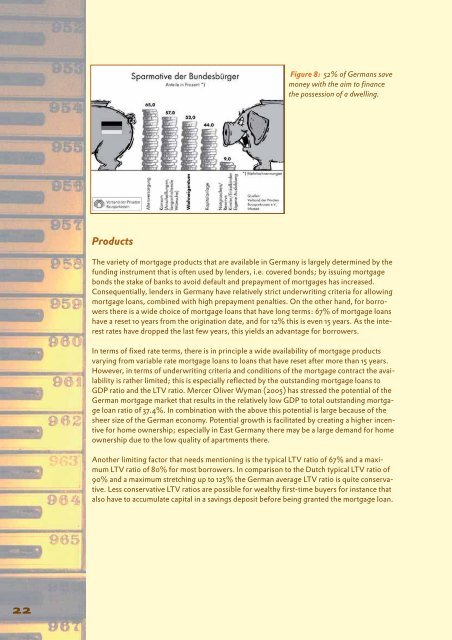

Figure 8: 52% of Germans save<br />

money with the aim to finance<br />

the possession of a d<strong>we</strong>lling.<br />

The variety of <strong>mortgage</strong> products that are available in Germany is largely determined by the<br />

funding instrument that is often used by lenders, i.e. covered bonds; by issuing <strong>mortgage</strong><br />

bonds the stake of banks to avoid default and prepayment of <strong>mortgage</strong>s has increased.<br />

Consequentially, lenders in Germany have relatively strict underwriting criteria for allowing<br />

<strong>mortgage</strong> loans, combined with high prepayment penalties. On the other hand, for borro<strong>we</strong>rs<br />

there is a wide choice of <strong>mortgage</strong> loans that have long terms: 67% of <strong>mortgage</strong> loans<br />

have a reset 10 years from the origination date, and for 12% this is even 15 years. As the interest<br />

rates have dropped the last few years, this yields an advantage for borro<strong>we</strong>rs.<br />

In terms of fixed rate terms, there is in principle a wide availability of <strong>mortgage</strong> products<br />

varying from variable rate <strong>mortgage</strong> loans to loans that have reset after more than 15 years.<br />

Ho<strong>we</strong>ver, in terms of underwriting criteria and conditions of the <strong>mortgage</strong> contract the availability<br />

is rather limited; this is especially reflected by the outstanding <strong>mortgage</strong> loans to<br />

GDP ratio and the LTV ratio. Mercer Oliver Wyman (2005) has stressed the potential of the<br />

German <strong>mortgage</strong> market that results in the relatively low GDP to total outstanding <strong>mortgage</strong><br />

loan ratio of 37.4%. In combination with the above this potential is large because of the<br />

sheer size of the German economy. Potential growth is facilitated by creating a higher incentive<br />

for home ownership; especially in East Germany there may be a large demand for home<br />

ownership due to the low quality of apartments there.<br />

Another limiting factor that needs mentioning is the typical LTV ratio of 67% and a maximum<br />

LTV ratio of 80% for most borro<strong>we</strong>rs. In comparison to the Dutch typical LTV ratio of<br />

90% and a maximum stretching up to 125% the German average LTV ratio is quite conservative.<br />

Less conservative LTV ratios are possible for <strong>we</strong>althy first-time buyers for instance that<br />

also have to accumulate capital in a savings deposit before being granted the <strong>mortgage</strong> loan.