ANNUAL rEport 2008 - Tivoli

ANNUAL rEport 2008 - Tivoli

ANNUAL rEport 2008 - Tivoli

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ANNUAL</strong> <strong>rEport</strong> <strong>2008</strong><br />

In <strong>2008</strong> the Company has raised a 20-year floating-rate mortgage loan of DKK 100 million for financing the Nimb reconstruction.<br />

At the same time, an interest rate swap with a fixed interest rate of 4.97% was entered into for the full term of the loan.<br />

Changes in the market value of the interest rate swap are recognised directly in equity.<br />

If the floating interest rate is 1% above the fixed interest rate, the interest rate swap will have an annual positive effect on consolidated profit of<br />

DKK 1.0 million. If, however, the floating interest rate is 1% below the fixed interest rate, the interest rate swap will have an annual negative effect<br />

on consolidated profit of DKK 1.0 million.<br />

Credit risks<br />

In consequence of the Company’s activities, receivables only arise to a minor extent. Furthermore, cash funds are utilised to a large extent to reduce<br />

drawing on the cash pool arrangement of Scandinavian Tobacco Group A/S. Therefore, the Group is not materially exposed to credit risks.<br />

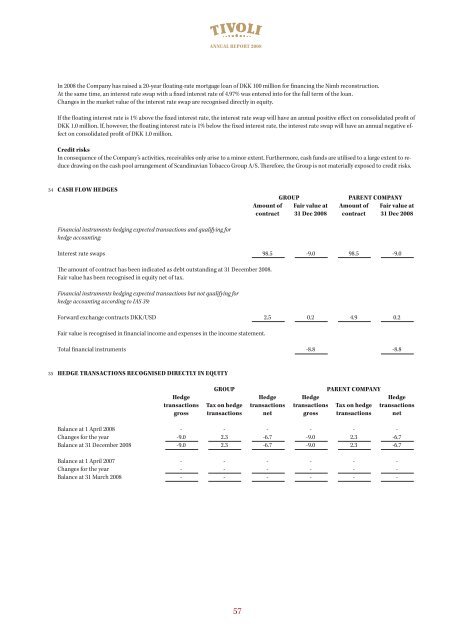

34 CASH FLoW HEDGES<br />

Financial instruments hedging expected transactions and qualifying for<br />

hedge accounting:<br />

57<br />

Amount of<br />

contract<br />

GroUp pArENt CoMpANY<br />

Fair value at<br />

31 Dec <strong>2008</strong><br />

Amount of<br />

contract<br />

Fair value at<br />

31 Dec <strong>2008</strong><br />

Interest rate swaps 98.5 -9.0 98.5 -9.0<br />

The amount of contract has been indicated as debt outstanding at 31 December <strong>2008</strong>.<br />

Fair value has been recognised in equity net of tax.<br />

Financial instruments hedging expected transactions but not qualifying for<br />

hedge accounting according to IAS 39:<br />

Forward exchange contracts DKK/USD 2.5 0.2 4.9 0.2<br />

Fair value is recognised in financial income and expenses in the income statement.<br />

Total financial instruments -8.8 -8.8<br />

35 HEDGE trANSACtIoNS rECoGNISED DIrECtLY IN EQUItY<br />

Hedge<br />

transactions<br />

gross<br />

GroUp pArENt CoMpANY<br />

tax on hedge<br />

transactions<br />

Hedge<br />

transactions<br />

net<br />

Hedge<br />

transactions<br />

gross<br />

tax on hedge<br />

transactions<br />

Hedge<br />

transactions<br />

net<br />

Balance at 1 April <strong>2008</strong> - - - - - -<br />

Changes for the year -9.0 2.3 -6.7 -9.0 2.3 -6.7<br />

Balance at 31 December <strong>2008</strong> -9.0 2.3 -6.7 -9.0 2.3 -6.7<br />

Balance at 1 April 2007 - - - - - -<br />

Changes for the year - - - - - -<br />

Balance at 31 March <strong>2008</strong> - - - - - -