2007 annual report aveiro investment corp. - First West Properties

2007 annual report aveiro investment corp. - First West Properties

2007 annual report aveiro investment corp. - First West Properties

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Land and Lethbridge Land acquisitions for an aggregate of<br />

$9,321,561 and equipment of $54,143. The cash infl ows from<br />

investing activities were also used to fund the cash outfl ows<br />

from the operations of the business totaling $552,726. The net<br />

increase in cash from all activities was $1,930,423. For the prior<br />

year ended June 30, 2006, there was no net change in the cash of<br />

the business.<br />

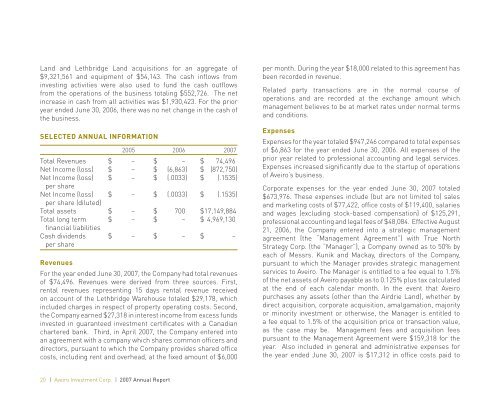

SELECTED ANNUAL INFORMATION<br />

2005 2006 <strong>2007</strong><br />

Total Revenues $ – $ – $ 74,496<br />

Net Income (loss) $ – $ (6,863 ) $ (872,750 )<br />

Net Income (loss)<br />

per share<br />

$ – $ (.0033 ) $ (.1535 )<br />

Net Income (loss)<br />

per share (diluted)<br />

$ – $ (.0033 ) $ (.1535 )<br />

Total assets $ – $ 700 $ 17,149,884<br />

Total long term<br />

fi nancial liabilities<br />

$ – $ – $ 4,969,130<br />

Cash dividends<br />

per share<br />

$ – $ – $ –<br />

Revenues<br />

For the year ended June 30, <strong>2007</strong>, the Company had total revenues<br />

of $74,496. Revenues were derived from three sources. <strong>First</strong>,<br />

rental revenues representing 15 days rental revenue received<br />

on account of the Lethbridge Warehouse totaled $29,178, which<br />

included charges in respect of property operating costs. Second,<br />

the Company earned $27,318 in interest income from excess funds<br />

invested in guaranteed <strong>investment</strong> certifi cates with a Canadian<br />

chartered bank. Third, in April <strong>2007</strong>, the Company entered into<br />

an agreement with a company which shares common offi cers and<br />

directors, pursuant to which the Company provides shared offi ce<br />

costs, including rent and overhead, at the fi xed amount of $6,000<br />

20 | Aveiro Investment Corp. | <strong>2007</strong> Annual Report<br />

per month. During the year $18,000 related to this agreement has<br />

been recorded in revenue.<br />

Related party transactions are in the normal course of<br />

operations and are recorded at the exchange amount which<br />

management believes to be at market rates under normal terms<br />

and conditions.<br />

Expenses<br />

Expenses for the year totaled $947,246 compared to total expenses<br />

of $6,863 for the year ended June 30, 2006. All expenses of the<br />

prior year related to professional accounting and legal services.<br />

Expenses increased signifi cantly due to the startup of operations<br />

of Aveiro’s business.<br />

Corporate expenses for the year ended June 30, <strong>2007</strong> totaled<br />

$673,976. These expenses include (but are not limited to) sales<br />

and marketing costs of $77,422, offi ce costs of $119,400, salaries<br />

and wages (excluding stock-based compensation) of $125,291,<br />

professional accounting and legal fees of $48,084. Effective August<br />

21, 2006, the Company entered into a strategic management<br />

agreement (the “Management Agreement”) with True North<br />

Strategy Corp. (the “Manager”), a Company owned as to 50% by<br />

each of Messrs. Kunik and Mackay, directors of the Company,<br />

pursuant to which the Manager provides strategic management<br />

services to Aveiro. The Manager is entitled to a fee equal to 1.5%<br />

of the net assets of Aveiro payable as to 0.125% plus tax calculated<br />

at the end of each calendar month. In the event that Aveiro<br />

purchases any assets (other than the Airdrie Land), whether by<br />

direct acquisition, <strong>corp</strong>orate acquisition, amalgamation, majority<br />

or minority <strong>investment</strong> or otherwise, the Manager is entitled to<br />

a fee equal to 1.5% of the acquisition price or transaction value,<br />

as the case may be. Management fees and acquisition fees<br />

pursuant to the Management Agreement were $159,318 for the<br />

year. Also included in general and administrative expenses for<br />

the year ended June 30, <strong>2007</strong> is $17,312 in offi ce costs paid to