DEREGULATED WHOLESALE ELECTRICITY PRICES IN EUROPE

DEREGULATED WHOLESALE ELECTRICITY PRICES IN EUROPE

DEREGULATED WHOLESALE ELECTRICITY PRICES IN EUROPE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

0.04<br />

0.03<br />

0.02<br />

<strong>DEREGULATED</strong> <strong>WHOLESALE</strong> <strong>ELECTRICITY</strong> <strong>PRICES</strong> <strong>IN</strong> <strong>EUROPE</strong> 23<br />

APX<br />

EXAA<br />

EEX<br />

Powernext<br />

0 5 10 15 20 25 30<br />

Weeks<br />

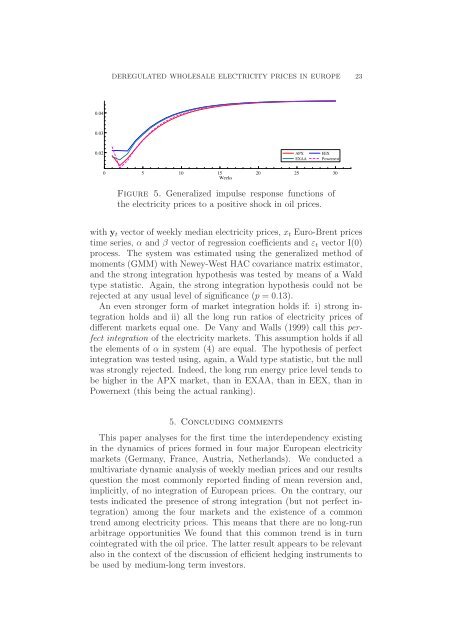

Figure 5. Generalized impulse response functions of<br />

the electricity prices to a positive shock in oil prices.<br />

with yt vector of weekly median electricity prices, xt Euro-Brent prices<br />

time series, α and β vector of regression coefficients and εt vector I(0)<br />

process. The system was estimated using the generalized method of<br />

moments (GMM) with Newey-West HAC covariance matrix estimator,<br />

and the strong integration hypothesis was tested by means of a Wald<br />

type statistic. Again, the strong integration hypothesis could not be<br />

rejected at any usual level of significance (p =0.13).<br />

An even stronger form of market integration holds if: i) strong integration<br />

holds and ii) all the long run ratios of electricity prices of<br />

different markets equal one. De Vany and Walls (1999) call this perfect<br />

integration of the electricity markets. This assumption holds if all<br />

the elements of α in system (4) are equal. The hypothesis of perfect<br />

integration was tested using, again, a Wald type statistic, but the null<br />

was strongly rejected. Indeed, the long run energy price level tends to<br />

be higher in the APX market, than in EXAA, than in EEX, than in<br />

Powernext (this being the actual ranking).<br />

5. Concluding comments<br />

This paper analyses for the first time the interdependency existing<br />

in the dynamics of prices formed in four major European electricity<br />

markets (Germany, France, Austria, Netherlands). We conducted a<br />

multivariate dynamic analysis of weekly median prices and our results<br />

question the most commonly reported finding of mean reversion and,<br />

implicitly, of no integration of European prices. On the contrary, our<br />

tests indicated the presence of strong integration (but not perfect integration)<br />

among the four markets and the existence of a common<br />

trend among electricity prices. This means that there are no long-run<br />

arbitrage opportunities We found that this common trend is in turn<br />

cointegrated with the oil price. The latter result appears to be relevant<br />

also in the context of the discussion of efficient hedging instruments to<br />

be used by medium-long term investors.