2009 Course Catalogue - ffiec

2009 Course Catalogue - ffiec

2009 Course Catalogue - ffiec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

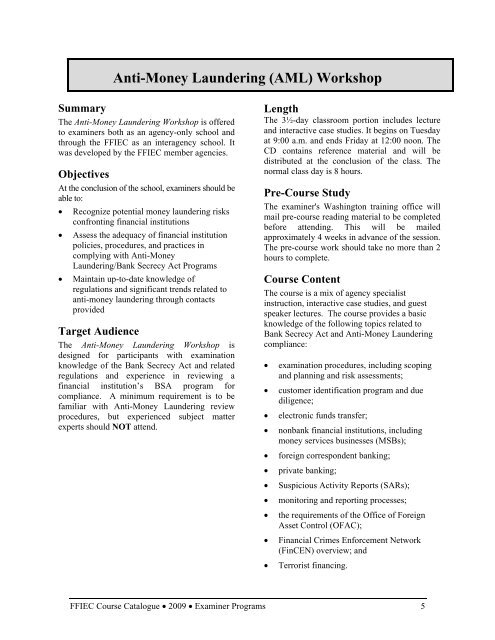

Anti-Money Laundering (AML) Workshop<br />

Summary<br />

The Anti-Money Laundering Workshop is offered<br />

to examiners both as an agency-only school and<br />

through the FFIEC as an interagency school. It<br />

was developed by the FFIEC member agencies.<br />

Objectives<br />

At the conclusion of the school, examiners should be<br />

able to:<br />

• Recognize potential money laundering risks<br />

confronting financial institutions<br />

• Assess the adequacy of financial institution<br />

policies, procedures, and practices in<br />

complying with Anti-Money<br />

Laundering/Bank Secrecy Act Programs<br />

• Maintain up-to-date knowledge of<br />

regulations and significant trends related to<br />

anti-money laundering through contacts<br />

provided<br />

Target Audience<br />

The Anti-Money Laundering Workshop is<br />

designed for participants with examination<br />

knowledge of the Bank Secrecy Act and related<br />

regulations and experience in reviewing a<br />

financial institution’s BSA program for<br />

compliance. A minimum requirement is to be<br />

familiar with Anti-Money Laundering review<br />

procedures, but experienced subject matter<br />

experts should NOT attend.<br />

Length<br />

The 3½-day classroom portion includes lecture<br />

and interactive case studies. It begins on Tuesday<br />

at 9:00 a.m. and ends Friday at 12:00 noon. The<br />

CD contains reference material and will be<br />

distributed at the conclusion of the class. The<br />

normal class day is 8 hours.<br />

Pre-<strong>Course</strong> Study<br />

The examiner's Washington training office will<br />

mail pre-course reading material to be completed<br />

before attending. This will be mailed<br />

approximately 4 weeks in advance of the session.<br />

The pre-course work should take no more than 2<br />

hours to complete.<br />

<strong>Course</strong> Content<br />

The course is a mix of agency specialist<br />

instruction, interactive case studies, and guest<br />

speaker lectures. The course provides a basic<br />

knowledge of the following topics related to<br />

Bank Secrecy Act and Anti-Money Laundering<br />

compliance:<br />

• examination procedures, including scoping<br />

and planning and risk assessments;<br />

• customer identification program and due<br />

diligence;<br />

• electronic funds transfer;<br />

• nonbank financial institutions, including<br />

money services businesses (MSBs);<br />

• foreign correspondent banking;<br />

• private banking;<br />

• Suspicious Activity Reports (SARs);<br />

• monitoring and reporting processes;<br />

• the requirements of the Office of Foreign<br />

Asset Control (OFAC);<br />

• Financial Crimes Enforcement Network<br />

(FinCEN) overview; and<br />

• Terrorist financing.<br />

FFIEC <strong>Course</strong> <strong>Catalogue</strong> • <strong>2009</strong> • Examiner Programs 5