finansbank anti-money laundering / know your customer procedure

finansbank anti-money laundering / know your customer procedure

finansbank anti-money laundering / know your customer procedure

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

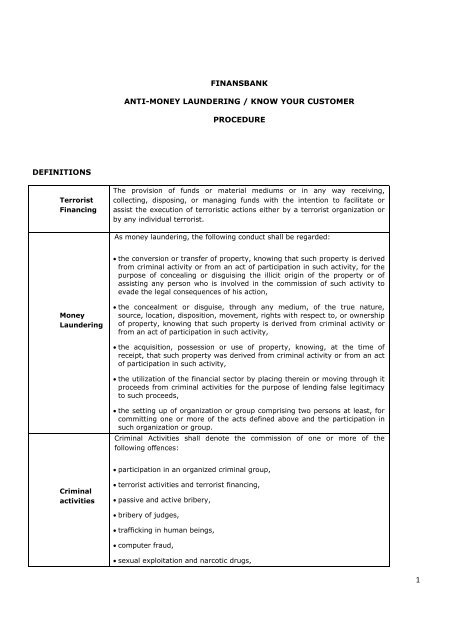

DEFINITIONS<br />

Terrorist<br />

Financing<br />

Money<br />

Laundering<br />

Criminal<br />

activities<br />

FINANSBANK<br />

ANTI-MONEY LAUNDERING / KNOW YOUR CUSTOMER<br />

PROCEDURE<br />

The provision of funds or material mediums or in any way receiving,<br />

collecting, disposing, or managing funds with the intention to facilitate or<br />

assist the execution of terroristic actions either by a terrorist organization or<br />

by any individual terrorist.<br />

As <strong>money</strong> <strong>laundering</strong>, the following conduct shall be regarded:<br />

the conversion or transfer of property, <strong>know</strong>ing that such property is derived<br />

from criminal activity or from an act of participation in such activity, for the<br />

purpose of concealing or disguising the illicit origin of the property or of<br />

assisting any person who is involved in the commission of such activity to<br />

evade the legal consequences of his action,<br />

the concealment or disguise, through any medium, of the true nature,<br />

source, location, disposition, movement, rights with respect to, or ownership<br />

of property, <strong>know</strong>ing that such property is derived from criminal activity or<br />

from an act of participation in such activity,<br />

the acquisition, possession or use of property, <strong>know</strong>ing, at the time of<br />

receipt, that such property was derived from criminal activity or from an act<br />

of participation in such activity,<br />

the utilization of the financial sector by placing therein or moving through it<br />

proceeds from criminal activities for the purpose of lending false legitimacy<br />

to such proceeds,<br />

the setting up of organization or group comprising two persons at least, for<br />

committing one or more of the acts defined above and the participation in<br />

such organization or group.<br />

Criminal Activities shall denote the commission of one or more of the<br />

following offences:<br />

participation in an organized criminal group,<br />

terrorist activities and terrorist financing,<br />

passive and active bribery,<br />

bribery of judges,<br />

trafficking in human beings,<br />

computer fraud,<br />

sexual exploitation and narcotic drugs,<br />

1

Suspicious<br />

transaction<br />

Unusual<br />

transaction<br />

Due<br />

Diligence<br />

P.E.P.s<br />

Immediate<br />

family<br />

members<br />

of P.E.P.s<br />

Persons<br />

<strong>know</strong>n to<br />

be close<br />

associates<br />

bribery of employees<br />

offences regarding weapons, ammunition, explosives, etc,<br />

offences regarding <strong>anti</strong>quities and cultural heritage in general,<br />

any other offence punishable by deprivation of liberty for a minimum of<br />

more than six months and having generated any type of economic benefit<br />

Suspicious transaction is the case where there is an information, suspicion or<br />

reasonable grounds to suspect that the asset, which is subject to the<br />

transactions carried out or attempted to be carried out within or through the<br />

obliged parties, has been acquired through illegal ways or used for illegal<br />

purposes, used for terrorist activities or by terrorist organizations, terrorists or<br />

those who finance terrorism or connected or linked with them.<br />

Transaction or transactions or activities incompatible with the <strong>customer</strong>’s or<br />

beneficial owner’s economic/transacting profile (transactional, professional or<br />

business behaviour, financial condition) or have no apparent purpose or<br />

motive of a financial, professional or personal nature.<br />

Measures for the collection and maintenance of adequate information on a<br />

<strong>customer</strong>, the use of such information for identification purposes and the<br />

assessment of his overall economic/transacting profile on basis of <strong>procedure</strong>s<br />

that are comprised according to the relevant risk that they represent<br />

regarding the use of the financial sector for ML/FT.<br />

Due diligence measures form the basis for AML/CFT <strong>procedure</strong>s and constitute<br />

the most effective protection against negative effects on Bank’s solvency and<br />

reputation.<br />

“Politically exposed persons” are the natural persons who are or have been<br />

entrusted with prominent public functions and immediate family members, or<br />

persons <strong>know</strong>n to be close associates, of such persons Natural persons<br />

entrusted with a prominent public functions include:<br />

heads of state, heads of government, ministers, alternate and deputy<br />

ministers,<br />

members of Parliament (MPs),<br />

judges of supreme courts, constitutional courts or other high-level judicial<br />

bodies,<br />

judges of courts of auditors and members of the boards of central banks,<br />

ambassadors, chargés d’ affaires and high-ranking officers in the armed<br />

forces ,<br />

members of the administrative, management or supervisory bodies of stateowned<br />

enterprises.<br />

the spouse,<br />

any partner considered by national law as equivalent to a spouse,<br />

natural or adopted children and their spouses or partners, and<br />

the parents.<br />

any natural person who is <strong>know</strong>n to have joint beneficial ownership of legal<br />

entities or legal arrangements, or any other close business relationships with<br />

a P.E.P,<br />

any natural person who has sole beneficial ownership of a legal entity or<br />

2

of P.E.P.s legal arrangement which is <strong>know</strong>n to have been established for the benefit of<br />

a P.E.P.<br />

Electronic<br />

funds<br />

transfer<br />

Crossborder<br />

funds<br />

transfer<br />

Shell Bank<br />

Beneficial<br />

Owner<br />

Offshore<br />

Company<br />

Nonprofit<br />

organizatio<br />

ns<br />

AML/CFT<br />

Officer<br />

Inspection<br />

of<br />

Obligations<br />

Any transaction that is carried out on behalf of a payer, through a credit or<br />

financial institution, by electronic means, with a view to making funds<br />

available to a payee in another credit or financial institution. The payer and<br />

payee may be the same person.<br />

A funds transfer where the credit or financial institution receiving the order<br />

from the payer is subject to a different legislation form that of the credit or<br />

financial institution that constitutes the transferred funds at payee disposal.<br />

A credit institution or an institution engaged in equivalent activities,<br />

incorporated in a jurisdiction in which it has no physical presence, involving<br />

meaningful mind and management, and which is unaffiliated with a financial<br />

group that meets the regulatory and supervisory requirements of Community<br />

legislation or at least equivalent requirements.<br />

Beneficial owner means natural persons who carry out a transaction<br />

within an obliged party, and natural person(s) who control(s) the<br />

natural persons, legal persons or unincorporated organizations on<br />

behalf of whom a transaction is conducted within an obliged party or<br />

who is the ultimate owner of the transaction or the account belonging<br />

to them<br />

Company that has no commercial or productive activity in the place of its<br />

establishment, such as:<br />

off-shore companies,<br />

abroad commercial-industrial companies ,<br />

Special purpose vehicle (SPV).<br />

Non-profit or public benefit bodies, agencies, organizations, associations,<br />

societies and other unions as well as silent partnerships.<br />

AML/CFT Officer means the officer who is employed for the purpose of<br />

ensuring the compliance with obligations established through the Law no 5549<br />

on Prevention of Laundering Proceeds of Crime or the legislation issued on the<br />

basis of the Law and who is entrusted with the required authority<br />

Inspection of the obligations introduced by the Law no 5549 on Prevention of<br />

Laundering Proceeds of Crime and relevant legislation is carried out through<br />

Finance Inspectors, Tax Inspectors, Customs Inspectors, Revenue<br />

Comptrollers, Sworn-in Bank Auditors, Treasury Comptrollers and Capital<br />

Markets Board Experts<br />

3

A- RISK MANAGEMENT ACTIVITIES<br />

A-1 KNOW YOUR CUSTOMER AND ASSESSMENT OF CUSTOMERS<br />

A-1-1 CONTROLS PRIOR TO OPENING BASE / ACCOUNTS<br />

A-1-2 INDIVIDUALS AND ORGANIZATIONS NOT ACCEPTABLE AS CUSTOMERS<br />

A-1-3 RISK-BASED ASSESSMENT OF CUSTOMERS AND TRANSACTIONS<br />

A-1-4 TRANSACTIONS WHICH SHALL NOT BE CARRIED OUT FROM CUSTOMER ACCOUNTS<br />

A-2 CUSTOMER IDENTIFICATION<br />

A-2-1 GENERAL EXPLANATIONS ON THE LIABILITY OF IDENTIFICATION<br />

A-2-2 IDENTIFICATION OF REAL PERSONS<br />

A-2-3 IDENTIFICATION OF LEGAL PERSONS REGISTERED TO TRADE REGISTRY<br />

(Incorporated, Limited, Unlimited, Commandite companies and cooperatives)<br />

A-2-4 IDENTIFICATION OF ASSOCIATIONS AND FOUNDATIONS<br />

A-2-5 IDENTIFICATION OF UNIONS AND CONFEDERATIONS<br />

A-2-6 IDENTIFICATION OF POLITICAL PARTIES<br />

A-2-7 IDENTIFICATION OF NON-RESIDENT LEGAL PERSONS<br />

A-2-8 IDENTIFICATION OF ENTERPRISES WITH NO LEGAL ENTITY<br />

A-2-9 IDENTIFICATION OF PUBLIC INSTITUTIONS<br />

A-2-10 IDENTIFICATION OF THIRD PARTIES WHO ACT ON BEHALF OF OTHERS<br />

A-2-11 AUTHENTICITY OF VERIFICATION DOCUMENTS<br />

A-2-12 IDENTIFICATION FOR SUBSEQUENT TRANSACTIONS<br />

A-3 IDENTIFICATION OF REAL BENEFICIARY AND LEGAL PERSONS DUE DILIGENCE<br />

A-4 TRANSACTIONS REQUIRING SPECIAL ATTENTION<br />

A-5 MONITORING OF CUSTOMERS AND TRANSACTIONS<br />

A-6 MEASURES TAKEN AGAINST TECHNOLOGICAL RISKS<br />

A-7 PRINCIPLE OF RELIANCE ON THIRD PARTIES<br />

A-8 REJECTION OF A TRANSACTION AND TERMINATION OF BUSINESS RELATIONSHIP<br />

A-9 CORRESPONDENT BANKING RELATIONSHIPS<br />

A-10 ELECTRONIC TRANSFERS<br />

A-11 ADDITIONAL MEASURES AGAINST HIGH RISK GROUPS<br />

A-12 RELATIONSHIPS WITH RISKY COUNTRIES<br />

A-13 SIMPLIFIED MEASURES<br />

A-13-1 TRANSACTIONS AMONG FINANCIAL INSTITUTIONS<br />

A-13-2 IN THE EVENT THAT THE CUSTOMER IS A PUBLIC ADMINISTRATOR OR AN<br />

OCCUPATIONAL INSTITUTE HAVING THE SPECIFICATIONS OF BEING A PUBLIC<br />

INSTITUTION<br />

A-13-3 IN THE EVENT THAT THE CUSTOMER IS INTERNATIONAL INSTITUTION OR EMBASSY<br />

OR CONSULATE RESIDING IN TURKEY<br />

4

A-13-4 COLLECTIVE CUSTOMER ACCEPTANCE WITHIN THE FRAME OF SALARY PAYMENT<br />

AGREEMENTS<br />

A-13-5 SALARY PAYMENT TRANSACTIONS OF MEMBERS OF UNITS OF INTERNATIONAL<br />

INSTITUTIONS RESIDING IN TURKEY OR MEMBERS OF EMBASSY OR CONSULATES<br />

A-13-6 IN THE EVENT THAT THE CUSTOMER IS A PUBLIC COMPANY WITH QUOTED SHARES<br />

IN STOCK EXCHANGE<br />

A-13-7 TRANSACTIONS RELATED TO PENSION AGREEMENTS, PENSION PLANS AND LIFE<br />

INSURANCE<br />

A-13-8 TRANSACTIONS OF PRE-PAID CARDS<br />

A-13-9 VERIFICATION OF ACCURACY OF TELEPHONE AND FAX NUMBERS AND E-MAIL<br />

ADDRESSES<br />

A-14 REPORTING OF MONITORING AND EVALUATION RESULTS TO THE BOARD OF DIRECTORS<br />

B- MONITORING AND CONTROLLING ACTIVITIES<br />

B-1 MONITORING AND CONTROLLING OF THE TRANSACTIONS OF HIGH RISK CUSTOMERS<br />

B-1-1 CONTROLS CONDUCTED BY AML UNIT RELATED TO HIGH RISK GROUP CUSTOMERS<br />

B-2 MONITORING AND CONTROL OF THE TRANSACTIONS PERFORMED IN RISKY COUNTRIES<br />

B-2-1 CONTROLS CONDUCTED BY AML UNIT RELATED TO THE RISKY COUNTRIES<br />

B-3 MONITORING AND CONTROL OF COMPLEX AND UNUSUAL TRANSACTIONS<br />

B-3-1 CONTROL OF SAFE DEPOSIT BOXES<br />

B-3-2 INSPECTION OF CASH AND TRANSFER TRANSACTIONS<br />

B-4 CROSS CHECK OF THE TRANSACTIONS ABOVE A CERTAIN AMOUNT WITH THE CUSTOMER<br />

PROFILE BY SAMPLING METHOD<br />

B-5 MONITORING AND CONTROL OF THE TRANSACTIONS WHICH EXCEED IDENTIFICATION LIMIT<br />

AND WHICH ARE INTERRELATED<br />

B-6 CONTROL OF THE INFORMATION AND DOCUMENTS RELATED TO CUSTOMERS THAT ARE KEPT<br />

IN WRITING OR IN AN ELECTRONIC MEDIUM; CONTROL OF THE INFORMATION THAT HAS TO BE<br />

STATED IN ELECTRONIC TRANSFER MESSAGES; COMPLETION AND UPDATING OF THESE<br />

INFORMATION<br />

B-7 ON-GOING MONITORING OF THE TRANSACTIONS IN ORDER TO CHECK THEIR CONSISTENCE<br />

WITH THE CUSTOMER’S OCCUPATION, RISK PROFILE AND SOURCES OF FUNDS<br />

B-8 CONTROLS OF THE NON-FACE-TO-FACE TRANSACTIONS<br />

B-9 RISK BASED CONTROL OF NEW PRODUCTS AND SERVICES THAT MAY BECOME VULNERABLE TO<br />

MISUSE DUE TO TECHNOLOGICAL INNOVATIONS<br />

B-10 SUSPICIOUS OR UNUSUAL TRANSACTION REPORTING<br />

B-10-1 LAUNDERING THE PROCEEDS OF CRIME<br />

5

B-10-2 SUSPICIOUS OR UNUSUAL TRANSACTION TYPES DESCRIBED IN GENERAL<br />

COMMUNIQUE NO. 6 OF THE FINANCIAL CRIMES INVESTIGATION BOARD<br />

B-10-3 TERRORIST FINANCING<br />

B-10-4 HOW TO FILL-IN, SIGN AND SEND THE SUSPICIOUS TRANSACTION REPORTING<br />

FORM TO THE COMPLIANCE DEPARTMENT<br />

B-10-5 REPORTING SUSPICIOUS OR UNUSUAL TRANSACTIONS TO THE FINANCIAL CRIMES<br />

INVESTIGATION BOARD<br />

C- TRAINING ACTIVITIES<br />

C-1 CONTENT AND SCOPE OF TRAINING ACTIVITIES<br />

C-1-1 METHODS OF TRAINING ACTIVITIES<br />

C-1-2 CONTENT OF TRAINING ACTIVITIES<br />

C-1-3 TARGET GROUPS<br />

C-1-4 TRAINING DOCUMENTS<br />

C-1-5 TRAINERS<br />

C-1-6 EVALUATION OF THE TRAINING RESULTS<br />

C-1-7 REPORTING TRAINING RESULTS TO FINANCIAL CRIMES INVESTIGATION BOARD<br />

D- INTERNAL AUDIT ACTIVITIES<br />

E- RELATIONS WITH NBG GROUP COMPLIANCE DIVISIOM<br />

APPENDICE<br />

6

A-RISK MANAGEMENT ACTIVITIES<br />

The below mentioned risk management activities are performed by our bank related to<br />

prevention of <strong>laundering</strong> proceeds of crime and terrorist financing in order to identify, scale,<br />

monitor, evaluate and minimize the risks that our bank is subject to.<br />

Record Keeping<br />

All records and documents obtained in line with the regulations on <strong>laundering</strong> proceeds of<br />

crime and terrorist financing are kept for at least 8 years.<br />

A-1 KNOW YOUR CUSTOMER AND ASSESSMENT OF CUSTOMERS<br />

Where new <strong>customer</strong>s are acquired without going through a careful review, the banks may be<br />

subjected to the risk of losing reputation, operational and legal risks which may impose<br />

significant financial costs. The principle of “Know Your Customer” is critically important not<br />

only in terms of protection from launderers of criminal income – prevention of <strong>money</strong><br />

<strong>laundering</strong> and terrorist financing, but also in terms of effective management of banking risks<br />

In addition to <strong>know</strong>ing the <strong>customer</strong> well and <strong>know</strong>ing the <strong>customer</strong>’s type of business, it is<br />

also important to <strong>know</strong> the relations of the <strong>customer</strong> with other <strong>customer</strong>s for prevention of<br />

the risk of concentration, which can be the case especially in credit transactions.<br />

This section sets out the principles to be implemented for new <strong>customer</strong>s at our Bank in<br />

account openings and in monitoring the transactions of existing <strong>customer</strong>s.<br />

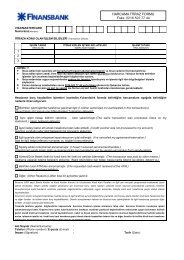

• First of all, a Customer Assessment Form (Appendix 1) has to be prepared by the<br />

Customer Representative for each <strong>customer</strong> who asks to open an account at our Bank.<br />

This form shall cover, The reason for the <strong>customer</strong>’s preference and opening an<br />

account at our Bank (in the event that the <strong>customer</strong> himself has applied to open an<br />

account),<br />

• Principles of working with our bank, types of transactions to be carried out,<br />

• Customer’s occupation, commercial activities, occupational history, financial status,<br />

country of residence, country where the <strong>customer</strong>’s business activities operate,<br />

country or region of origin or destination of funds<br />

• Where possible, <strong>customer</strong>s who work with our Bank, which may be used as reference,<br />

• Customer representative’s evaluation.<br />

If the <strong>customer</strong> is deemed as belonging to high risk group according to the assessment<br />

criteria above, related box in the Customer Assessment Form (Appendix 1) is checked.<br />

THE CUSTOMER REPRESENTATIVE SHALL DECIDE THAT THE ACCOUNT SHOULD BE OPENED<br />

IF THE INFORMATION S/HE RECEIVES FROM THE CUSTOMER IS CONSISTENT AND THE<br />

DOCUMENTS ARE CONSISTENT WITHIN THEMSELVES. ALL RESPONSIBILITY RELATING TO<br />

THE CUSTOMER (FULL PROCUREMENT OF DOCUMENTS AND DETAILS, COMPLIANCE WITH<br />

RECORDS IN COREFINANS SYSTEM AND UP–TO-DATE THEREOF, ETC.) BELONGS TO THE<br />

CUSTOMER REPRESENTATIVE.<br />

Banking Transactions Agreement shall not be signed and <strong>customer</strong> base account shall not be<br />

created upon power of attorney according to “Know Your Customer” principles even though<br />

there is a clearly defined authorization in the power of attorney.<br />

7

The Bank officers should visit the persons who do not have the physical capability to visit the<br />

Bank in order to identification of these <strong>customer</strong>s and signing Banking Transactions<br />

Agreement. After opening to the <strong>customer</strong> a base number, accounts under this base number<br />

can be opened by a power of attorney.<br />

Age limit must be observed for accounts to be opened in the name of minors.<br />

A-1-1 CONTROLS PRIOR TO OPENING BASE / ACCOUNTS<br />

• Customers who want to open base/accounts are checked against the bank’s in-house<br />

and international warning lists (such as OFAC; UN Sanctions List, EU Black List, SABAS,<br />

our bank’s warning list). The mentioned controls are automatically performed at base<br />

openings. The workflow is as follows;<br />

In the phase of <strong>customer</strong> identification by a branch, while the user is registering<br />

<strong>customer</strong>s’ information, the system cross checks potential <strong>customer</strong>’s information with<br />

the persons/institutions in the following lists:<br />

* OFAC SDN List (Office of Foreign Assets Control Specially Designated Nationals<br />

List), the list prepared by the Treasury of the USA.<br />

http://www.treas.gov/offices/enforcement/ofac/sdn/sdnlist.txt<br />

* EU Sanctions List, The warning list prepared by the European Union<br />

http://ec.europa.eu/external_relations/cfsp/sanctions/list/version4/global/e_ct<br />

lview.htm<br />

* Banned and sanctioned countries, the link for the details is<br />

http://www.treas.gov/offices/enforcement/ofac/programs/<br />

* List of countries with which no transactions will be performed prepared by<br />

Western Union; Western Union announces this list to its agencies. Information can be<br />

obtained from FOMER- Western Union Unit and our unit.<br />

* Finansbank Alert List which is prepared by AML unit including fraud, lost and<br />

fictitious document notifications by <strong>customer</strong>s, The Banks Association of Turkey,<br />

prosecution offices etc. Information can be obtained from AML Unit.<br />

* Capital Market Board Prohibited Investors including the persons/institutions that<br />

are banned from operating on capital market instruments by the Capital Market Board;<br />

it is included in the warning list. These persons/ institutions are banned from using only<br />

capital market instruments. An alert will be put on the <strong>customer</strong> name and they will be<br />

prevented from making such transactions on the internet.<br />

http://www.spk.gov.tr/apps/islemyasaklilar/index.aspx<br />

The user is notified on the basis of a certain ratio of matching before completing the<br />

transaction and details on warning lists and matching records are provided in the related<br />

menu. The user performs the following actions in order to decide whether s/he will continue,<br />

make a research on the record or end the transaction:<br />

* Finans_Base_OFAC - should be controlled in the OFAC list.<br />

* Finans_Base_EU/BL - should be controlled in the EU Sanctions List.<br />

8

* Finans_Base_Uyarı - should be controlled in the Finansbank Alert List. If there is a<br />

one-to-one match, AML Unit should be informed.<br />

* Finans_Base_Ülke - should be controlled in the banned, sanctioned countries list.<br />

* Finans_Base_WU – List of the countries prepared by Western Union with which no<br />

transactions will be performed. If there is a one-to-one match, FOMER-Western Union<br />

Unit or Compliance Department should be informed.<br />

Information checked in the phase of <strong>customer</strong> identification:<br />

Legal person inquiries are based on title and Taxpayer Identification Number (TIN). When<br />

the title and TIN match, necessary inquiries are made in order to decide on continuing or<br />

ending the transaction.<br />

Real person inquiries<br />

For Turkish citizens; the inquiries are based on name/surname, identity number, name of the<br />

father, place of birth and date of birth. When name/surname+name of the father+place of<br />

birth+date of birth or identity number match exactly, necessary inquiries are made in order<br />

to decide on continuing or ending the transaction.<br />

For foreign citizens the inquiries are based on name/surname, name of the father, place of<br />

birth and date of birth. When name/surname+name of the father+place of birth+date of birth<br />

match exactly, necessary inquiries are made in order to decide on continuing or ending the<br />

transaction.<br />

* For the transactions approved by the Plastic Cards BDS (the name of the system<br />

used by Plastic Cards Department), the system automatically creates a <strong>customer</strong><br />

number, and if there are similarities between the <strong>customer</strong> record and the<br />

persons/institutions in the warning lists, the records are listed in the menu<br />

Customer>Customer Identifications>Warning Lists Monitoring. The records in these<br />

lists are controlled, and the Plastic Cards Allocation Unit decides to stop the issuing<br />

of the card if there are any suspicions.<br />

* In case there are matching records among the persons who will be paid their<br />

salaries within the frame of FINBOR contracts, the system does not register them,<br />

and the transaction is transferred to the related branch in order to give the final<br />

decision after inquiry and continue the transaction if it is proper.<br />

The accuracy of the presented documents is checked in line with the Prevention of<br />

Fraud Attempts Directive (TAL.00460).<br />

If there are any doubts about the authenticity of the documents presented by the<br />

<strong>customer</strong>, authenticity of these documents is verified by consulting to the<br />

person/institution who has prepared the document.<br />

Whether the <strong>customer</strong> has high risk and his/her risk group is determined in terms of<br />

<strong>laundering</strong> the proceeds of crime and terrorist financing by considering his/her<br />

occupation, commercial activities, sources of funds, his/her country of residence and<br />

other relevant indicators.<br />

Individuals and organizations may not collect donations without having permission<br />

from public authorities. To the extent it is desired to open an account for collecting<br />

donations, if the activity of collecting donations covers more than one district of a<br />

province, then permission must be obtained from the governor of that province; if it<br />

is limited to the boundaries of a district, then permission must be obtained from the<br />

governor of that district. To the extent the donation collection operation covers more<br />

than one province, it is sufficient for the natural or legal persons to endeavor<br />

collecting donations to obtain permission from the governor of the province of that<br />

settlement. Which charitable association, agency or foundation may collect<br />

9

donations without obtaining permission shall be determined and announced by the<br />

Council of Ministers upon recommendation of the Ministry of Internal Affairs. The<br />

opinion of the Compliance Department shall be obtained for accounts to be opened<br />

for collecting donations. When such an entity has appointed more than one<br />

authorised signatories to operate its account, the identities of all authorised<br />

signatories shall be verified, according to the identity verification <strong>procedure</strong>s for real<br />

(natural) persons provided for.<br />

A-1-2 INDIVIDUALS AND ORGANIZATIONS NOT ACCEPTABLE AS CUSTOMERS<br />

• Persons and organizations in the bank’s in-house and international sanctions lists<br />

(such as OFAC; UN Sanctions List, EU Sanctions List, SABAS, our bank’s warning<br />

list).<br />

• Persons and organizations who ask to open an account under a name which is<br />

different from their real identities; who avoid to fill in the <strong>customer</strong> information forms<br />

and those who are reluctant to do so; or who supply misleading or unverifiable<br />

information.<br />

• Information exists from reliable sources, of their participation in illegal activities (eg.<br />

Drugs’ dealing, terrorism, organized crime), or investigation is conducted for their<br />

participation in illegal activities.<br />

• Information exists, that another Bank has refused the provision of services to the<br />

<strong>customer</strong>.<br />

• The verification of their identity is difficult (e.g. very complicated business structure<br />

of the company that makes impossible the understanding of the ownership and the<br />

identification of the person who exercises control).<br />

• Individuals and organizations asking to open an account, stating that they have<br />

international connections and they will bring a large amount of funds to our Bank to<br />

make investments in our country.<br />

• Individuals and organizations wishing to open an account with the request that<br />

foreign currency cheques drawn on international banks are collected or purchased.<br />

• Shell Banks and financial institutions which have no physical address in any country,<br />

comprising solely a web address, which are not subject to supervision or license of<br />

any government authority in respect of banking transactions and records, which are<br />

generally established at overseas jurisdictions <strong>know</strong>n as offshore tax heavens.<br />

• Persons and organizations for which there is doubt that their wealth and funds have<br />

been earned through legal means.<br />

• Those who demand to open accounts in the name of third parties under an<br />

anonymous name or nick name.<br />

• Real/legal persons working at Bill Payment Centers.<br />

Where it is believed that it is risky to open an account for the <strong>customer</strong> after the evaluation<br />

made by the Customer Representative but the <strong>customer</strong> insists on opening the account, the<br />

matter shall be forwarded to the Compliance Department.<br />

A-1-3 RISK-BASED ASSESMENT OF CUSTOMERS AND TRANSACTIONS<br />

The Bank differentiates its <strong>customer</strong>s according to risk assessment by subordinating them<br />

into three (3) categories, namely:<br />

• High risk<br />

• Medium risk<br />

• Low risk<br />

Analytic instructions on how this categorization will be practiced will follow in due course.<br />

10

HIGH RISK GROUP CUSTOMERS<br />

Customers who are in the high risk group are determined according to the following and other<br />

related criteria:<br />

• Their occupations/commercial activities,<br />

• Their transaction types and reasons,<br />

• Volume of transactions,<br />

• Sources of funds,<br />

• The countries they make transfers, and beneficiaries of those transactions,<br />

• The countries they receive transfers from and their principals<br />

• Real beneficiaries of the transactions,<br />

• The company profile and its shareholders,<br />

• Their country of residence.<br />

The below listed <strong>customer</strong> types are considered as belonging to high risk groups. The box<br />

indicating “high risk” in the Customer Assessment Form is checked at the opening of these<br />

kinds of bases/accounts.<br />

• Non-residents<br />

Customers having their residence abroad shall be subject to the same information<br />

requirements and identity verification <strong>procedure</strong>s as those who live permanently in<br />

Turkey. Special attention is paid to opening accounts for non-resident person or<br />

institutions, and information on their reason for opening an account in Turkey, their<br />

commercial or non-commercial activities, nature of transfers that will be made to and<br />

received from abroad together with their principals and amounts are asked. Especially<br />

before opening accounts for persons residing in high risk countries, the documents<br />

explained in Customer Identification section should be taken and be carefully examined.<br />

Furthermore, when there is any doubt concerning the identity of a person, the Bank shall<br />

seek verification and authentication of these documents by the embassy or consulate of<br />

the issuing country in Turkey, or by reliable Credit Institutions in the <strong>customer</strong>’s home<br />

country.<br />

• Residents in Offshore Regions and special purpose vehicles (SPVs)<br />

If the <strong>customer</strong> is a company that has no commercial or productive activity in the place<br />

of its establishment, such as an offshore company or a company referred to in, as<br />

currently in force, or a Special Purpose Vehicle (SPV), the Bank shall conduct enhanced<br />

<strong>customer</strong> due diligence.<br />

Countries/Regions named as Offshore or “Tax Heaven” are; Andorra, Anguilla, Antigua,<br />

Aruba, Bahrain, Barbuda, Belize, Bermuda, British Virgin Islands, Cayman Islands,<br />

Bahamas,Cook Islands, Gibraltar, Grenada, Guernsey/Sark/Alderney, Cyprus, Isle of Man,<br />

Jersey, Liberia, Malta, Mauritius, Montserrat, Niue, Panama, Vanuatu, Samoa, San<br />

Marino, St. Lucia, St. Vincent and Grenadines, Dominica, St. Kitts and Nevis, The<br />

Netherlands Antilles, The Prinsipality of Liechtenstein, The Principality of Monaco,<br />

Marshall Islands, Nauru, Seychelles, The US Virgin Islands, Turks and Caicos Islands.<br />

The Bank applies the following to the above companies:<br />

• Verifies the ownership structure and control of the company and identifies the<br />

beneficial owners. In order to identify the beneficial owners, the Bank shall require<br />

either (i) a declaration form (Appendix 2) in writing by the legal representative of the<br />

11

company regarding the verification of the beneficial owners’ identity or (ii)<br />

certification and verification of their identity by a credit officer of the Bank, following<br />

approval by a member of senior management, on the basis of documents, data or<br />

information from a reliable and independent source.<br />

• Obtains from the legal representative of the company a declaration in writing to the<br />

effect that, if the shares of the beneficial owners are transferred to a third party or<br />

there is any material change in the company's status, he shall immediately inform<br />

the Bank. If there is any change in the beneficial owners of the company, the Bank<br />

shall consider whether or not to continue the business relationship<br />

• Compares regularly the actual transactions through the account with those expected<br />

on the basis of the company’s economic/transaction profile. Any significant<br />

divergences shall be scrutinized and the findings shall be entered in the company’s<br />

file.<br />

• Persons Residing and Transactions Carried out in Countries Which Do Not<br />

Act in Accordance with the Recommendations of FATF<br />

The Bank shall examine with particular attention transactions and conduct additional<br />

measures for the continuous monitoring of the business relationships and transactions<br />

with natural persons or legal entities, including Credit Institutions and Financial<br />

Institutions, from countries that are considered as non-cooperative or non-compliant or<br />

inadequately compliant with the requirements of FAFT. All transactions with natural<br />

persons or legal entities from these countries shall be examined with particular attention.<br />

To assess country risk for AML/CFT purposes, the Bank uses the following criteria:<br />

• announcements by FATF concerning countries or territories that do not comply or<br />

comply inadequately with its recommendations,<br />

• country assessment reports issued by FATF, regional bodies that have been<br />

established and operate according to its standards (e.g. Council of Europe Moneyval<br />

Committee), the International Monetary Fund and the World Bank,<br />

• list of countries or jurisdictions which, according to the Common Understanding of the<br />

Committee for the Prevention of Money Laundering and Terrorist Financing, which<br />

assists the European Commission, have equivalent AML/CFT systems to the EU,<br />

• countries characterized by FATF as non cooperative or tax havens;<br />

• inclusion in the EU, UN and OFAC (Office of Financial Assets Control) lists;<br />

• FATF membership;<br />

• implementation of EU directives;<br />

• implementation of the Wolfsberg principles; and<br />

• countries that ratified the UN Convention Against Illicit Traffic in Narcotic Drugs and<br />

Psychotropic Substances of 1988<br />

• PEP-Politically Exposed Persons<br />

Politically exposed persons are natural persons that are or have been entrusted with a<br />

prominent public function, including their immediate family members or the persons<br />

<strong>know</strong>n to be their close associates.<br />

Specifically natural persons entrusted with a prominent public function include:<br />

12

(a) Heads of State, heads of government, ministers and deputy or assistant<br />

ministers;<br />

(b) Members of Parliament (MPs);<br />

(c) Judges of supreme courts, constitutional courts or other high-level judicial<br />

bodies whose decisions are not subject to further appeal, other than in<br />

exceptional circumstances;<br />

(d) Judges of courts of auditors;<br />

(e) Members of the boards of central banks;<br />

(f) Ambassadors and chargés d’ affaires;<br />

(g) High-ranking officers in the armed forces; and<br />

(h) Members of the administrative, management or supervisory bodies of stateowned<br />

enterprises.<br />

None of the categories (c) and (h) above shall be understood as covering middleranking<br />

or junior officials.<br />

The categories (b) and (g) above include functions exercised at the EU and<br />

international levels.<br />

Immediate family members of the persons referred to in the above paragraph shall<br />

include:<br />

(a) The spouse;<br />

(b) Any partner considered by national law as equivalent to a spouse;<br />

(c) Natural or adopted children and their spouses or partners; and<br />

(d) The parents.<br />

Persons <strong>know</strong>n to be close associates shall include:<br />

(a) any natural person who is <strong>know</strong>n to have joint beneficial ownership of legal<br />

entities or legal arrangements, or any other close business relationships, with a<br />

person referred to in the above paragraph and<br />

(b) Any natural person who has sole beneficial ownership of a legal entity or legal<br />

arrangement which is <strong>know</strong>n to have been established for the benefit of a person<br />

referred to in the above paragraph.<br />

Without prejudice to the application, on a risk-sensitive basis, of enhanced <strong>customer</strong><br />

due diligence measures, where a person has ceased to be entrusted with a prominent<br />

public function for a period of at least one year, the Bank shall not be obliged to<br />

consider such a person as politically exposed.<br />

The Bank must adopt the following additional <strong>customer</strong> due diligence measures when<br />

establishing a business relationship with a PEP:<br />

(a) Apply the appropriate <strong>procedure</strong>s, on a risk-sensitive basis, to determine whether<br />

the <strong>customer</strong> is a PEP;<br />

(b) Obtain senior management’s approval of the establishment of business<br />

relationships with such <strong>customer</strong>s;<br />

(c) Take adequate measures to verify the origin of the wealth and funds that the<br />

business relationship or transaction concerns; and<br />

(d) Monitor the business relationship on a continuous and enhanced basis.<br />

13

In the case of accounts of legal persons and other entities, the <strong>procedure</strong>s applied shall<br />

aim at verifying whether the beneficial owners, legal representatives and persons<br />

authorized to operate the relevant account are PEPs. If any of the above persons is<br />

identified as a PEP, these legal persons’ and other entities’ accounts shall automatically<br />

be subject to the enhanced <strong>customer</strong> due diligence measures.<br />

Standard <strong>customer</strong> due diligence measures must apply to PEPs established in Turkey<br />

• Companies with Bearer Shares<br />

Accounts which will be opened for companies that have issued bearer shares are<br />

considered as high risk group accounts. Especially companies founded in offshore regions<br />

issue bearer shares. It is possible to detect such cases from the companies’ main<br />

contracts. Therefore, careful examination of the main contracts of both resident and nonresident<br />

companies is of vital importance. Prior to opening accounts for such companies,<br />

verification of the obtained information on company owners, real beneficiaries and<br />

financial status should be sought from relevant sources or by paying visits to the office of<br />

the company.<br />

The legal representative of the company provides a declaration in writing to the Bank<br />

stipulating that, if the shares of the beneficial owners are transferred to a third party or<br />

there is any material change in the company’s status, he shall immediately inform the<br />

Bank, unless the same commitment is made in an agreement with the company. When<br />

there is a change of the person who is the real beneficiary of the company or a different<br />

transaction other than the regular transactions performed from that account, an<br />

evaluation should be made in line with the explanations stated in the Monitoring and<br />

Controlling section.<br />

A declaration form (Appendix 2) shall be signed by the legal representative of the<br />

company with bearer shares, by which further information about the company is<br />

requested.<br />

• Non-profit organizations<br />

Non-profit organizations such as associations and foundations can be used for terrorist<br />

financing. Funds that are obtained as subscription fees, donations and benefactions from<br />

good-intentioned people may be transferred to terrorist organizations or terrorists via<br />

these non-profit organizations. Most of the time, people are unaware of such transfers;<br />

believing that the <strong>money</strong> they donate will be used for the sake of the legal aim declared<br />

by these organizations. Accounts that will be opened for foundations, associations and<br />

charity foundations are high risk group accounts.<br />

With respect to accounts of non-profit or public benefit agencies, organizations,<br />

associations, societies and other unions, the Bank shall verify the legitimacy of their<br />

incorporation and objects, requiring the submission of a certified copy of their establishing<br />

deed (charter, private agreement etc.), their certificate of incorporation, certificate of<br />

registration and the number of their registration by the competent public authority. When<br />

such an entity has appointed more than one authorized signatories to operate its account,<br />

the identities of all authorized signatories shall be verified, according to the identity<br />

verification <strong>procedure</strong>s for natural persons provided for hereunder.<br />

• Persons with high amount of funds (Ex. Private Banking Customers)<br />

The Bank shall take the following additional due diligence measures when undertaking the<br />

management of portfolios of important clients:<br />

The Branch Manager approves the opening of portfolio management accounts of new<br />

important <strong>customer</strong>s.<br />

The identity of all the beneficial owners of such accounts is verified.<br />

14

It is verified whether the owner of the account is a PEP.<br />

The source of the assets managed and the expected use of the account by the<br />

owners are established.<br />

It is examined whether the operation of the account is consistent with its purpose<br />

and the owners’ economic/transaction profiles.<br />

It should be stated in the Customer Assessment Form that the person is a private<br />

banking <strong>customer</strong>.<br />

• Non-Face-to-Face Transactions<br />

Non-face-to-face transactions are conducted through alternative networks (e.g. ATMs,<br />

Internet / Phone / Mobile banking, etc.)<br />

Our bank is obliged to devote special attention to and take necessary measures against<br />

risks of using advantages of new and developing technology for <strong>laundering</strong> proceeds of<br />

crime and terrorist financing. Therefore, transactions like cash transactions and <strong>money</strong><br />

transfers carried out via alternative distribution channels such as internet, telephone<br />

banking and ATMs are inspected within the frame of monitoring and controlling activities.<br />

At the beginning of the business relationship, before establishing a business relation with<br />

the <strong>customer</strong>, a <strong>customer</strong> should be physically present in our branches for ID verification<br />

and other related actions such as signing the banking transactions agreement or other legal<br />

documents. Therefore, such transactions cannot be executed by walk-in <strong>customer</strong>s via<br />

internet banking, call center, etc.<br />

When the <strong>customer</strong> applies for the connection of his account with an alternative network,<br />

it shall be ensured that the identity verification and certification <strong>procedure</strong>s have been<br />

completed, before the account opening. Consequently, any information by declaration will<br />

not be accepted.<br />

• Risky sectors and profession groups<br />

The below listed sectors and occupational groups who make transactions on behalf of third<br />

parties and where there is an intense cash flow are considered as high risk groups.<br />

Authorized institutions (foreign currency dealers).<br />

Jewelers, traders of precious stones and metals like gold and diamond.<br />

Travel agencies, carriers of passengers and cargo.<br />

Casinos, operators of halls of games of chance.<br />

Gallery operators selling luxury vehicles.<br />

Antique dealers and art galleries, carpet dealers.<br />

Large real estate firms and any agents, representatives or commercial attorneys for<br />

the same<br />

Lessors of aircraft and sea vehicles.<br />

Manufacturers and traders of leather goods.<br />

Manufacturers and traders of car spare parts.<br />

Those operating in lines of business with high use of cash (car park operators,<br />

restaurants, fuel, lottery and newspaper dealers, distribution companies, traders of<br />

toys and stationery).<br />

Factoring firms.<br />

15

• Cash transactions<br />

Branch and Business Units’ Officers shall examine with particular attention cash<br />

transactions of a significant amount in order to verify the origin of cash and whether the<br />

amount and nature of the transaction are compatible with the <strong>customer</strong>’s<br />

economic/transaction profile. For that purpose, they shall obtain all the documents and<br />

data required to verify the necessity of carrying out a cash transaction of significant<br />

amount.<br />

Therefore, information on the sources of the funds and the reasons for opening accounts<br />

is obtained from the <strong>customer</strong> and check whether the transactions performed after<br />

opening the account are in accordance with the reasons for opening the accounts.<br />

If a <strong>customer</strong> requests to withdraw an amount of over TRY 500.000 (approx. the<br />

equivalent of €250,000.00) in cash, it is recommended that the <strong>money</strong> be delivered to the<br />

<strong>customer</strong> by cheque or an order for payment to a bank account, unless there are specific<br />

and adequately proved reasons that warrant a cash withdrawal.<br />

The results of the examination shall be documented and filed for at least eight years,<br />

including all supporting documents.<br />

• Correspondent Banking Relationship<br />

These relationships shall be established in line with rules and principles stated in Chapter A-9<br />

of this Document.<br />

Trusts<br />

Trusts are not separate legal entities and, therefore, business relationships are established<br />

through trustees acting on behalf of the trust. Our bank takes reasonable measures, on a<br />

risk-sensitive basis, to comprehend the ownership and control structure of trusts.<br />

Before establishment of such relationships and account opening the following shall be<br />

verified:<br />

the name and date of establishment,<br />

the identities of trustors, trustees and beneficial owners,<br />

the nature, objects and activities of the trust,<br />

the source of its funds.<br />

Copies of the establishing documents of the trust and any other necessary information on the<br />

beneficial owners should be obtained and shall keep the relevant data and information in the<br />

<strong>customer</strong>’s file.<br />

A-1-4 TRANSACTIONS WHICH SHALL NOT BE CARRIED OUT IN CUSTOMER<br />

ACCOUNTS<br />

The following transactions may not be carried out in <strong>customer</strong> accounts:<br />

No transaction of virtual nature (fictitious), seeking fulfillment of various legal<br />

obligations (capital increase of companies indicating that there are funds in the<br />

account at a specific time, etc.)<br />

Accounting records shall be established in line with the nature of transactions.<br />

Requests seeking to vary the nature of account-to-account transfers or cash payment<br />

transactions to be made from accounts (entering into books of wire-to-wire transfer in<br />

the form of cash payment, etc.) may not be accepted.<br />

16

Transactions which will allow the <strong>customer</strong> to avoid tax obligations or which would lead<br />

to loss of taxes.<br />

A-2 CUSTOMER IDENTIFICATION<br />

In this section, within the framework of the regulations issued by The Financial Crimes<br />

Investigation Board, the principles of identification which is one of the measures taken for the<br />

prevention of being an instrument of <strong>laundering</strong> proceeds of crime and terrorist financing on<br />

the part of our bank are explained.<br />

Besides our responsibilities brought about by legal regulations and the ones set out in this<br />

directive, attention needs to be paid to our bank’s in-house regulations in order to protect our<br />

bank’s reputation and avoid risky transactions. Apart from regulations set out in this directive<br />

relating to identification during payment transactions, it is obligatory to consider our bank’s<br />

in-house regulations with due care.<br />

The most important measure to take for not being an instrument of <strong>laundering</strong> proceeds of<br />

crime and terrorist financing transactions is <strong>customer</strong> assessment at the phase of gaining new<br />

<strong>customer</strong>s and proper identification. Therefore; identification of potential real and legal<br />

<strong>customer</strong>s prior to opening accounts, and obtaining information on their terms of working<br />

with our bank and activities are of utmost importance. The liability of these issues lies on the<br />

employee acquiring a new <strong>customer</strong> for the Bank. Finansbank also ensures that <strong>customer</strong>’s<br />

data are continuously updated during the business relationship,<br />

The principles of opening base/accounts have been explained in Section A-1.<br />

A-2-1 GENERAL EXPLANATIONS ON LIABILITY OF IDENTIFICATION<br />

Banks shall;<br />

Regardless of the monetary amount in permanent business relationships as in opening<br />

of accounts, hiring safe boxes, gr<strong>anti</strong>ng credit or issuing credit cards ;<br />

When the amount of a single transaction or the total amount of multiple linked<br />

transactions is equal to or more than TRY 20.000,-;<br />

When the amount of a single transaction or the total amount of multiple linked<br />

transactions is equal to or more than TRY 2.000,- in electronic transfers (such as<br />

SWIFT, Western Union, EFT)<br />

Regardless of the monetary amount in cases requiring Suspicious Transaction Report;<br />

Regardless of the monetary amounts in cases where there is suspicion about the<br />

sufficiency and the truth of previously acquired identification information,<br />

Identify persons carrying out transactions and the persons acting on behalf of or for the<br />

benefit of the <strong>customer</strong>s by means of obtaining information on identity and verifying their<br />

authenticity. Moreover, in the establishment of permanent business relationship, information<br />

about the purpose and the nature of the business relationship shall be obtained.<br />

In permanent business relationships such as opening of accounts, hiring safe boxes,<br />

gr<strong>anti</strong>ng credit or issuing credit cards;<br />

For real persons, besides verification of the below stated information from ID cards,<br />

the authenticity of the declared address is verified by a settlement license or a bill of a<br />

service which requires a subscription (like an electricity, water, gas, telephone bill)<br />

and has been issued within 3 months, and/or a document issued by a government<br />

office (or by other documents and methods approved by The Financial Crimes<br />

Investigation Board). A legible photocopy is made or digital image of this verification is<br />

taken or the distinctive information on these documents is recorded.<br />

17

For legal persons, unincorporated enterprises and other institutions and<br />

establishments, verification of address is performed as set out in the later chapters of<br />

this directive.<br />

In transactions which do not constitute a permanent business relationship but<br />

necessitates identification,<br />

It is obligatory to obtain the relevant person’s ID Card and number, address, contact<br />

information like telephone number, sample signature .<br />

Determination of the TRY equivalent of F/X transactions are based on the buying rate of<br />

exchange of the Central Bank on the day of the transaction.<br />

The relevant branch or unit employee in Turkey is responsible for the proper performance of<br />

identification. Our branches abroad carry out the transactions in line with the bank’s in-house<br />

policies and the legislation of the country of residence and “Regulation on Measures<br />

Regarding Prevention of Laundering Proceeds of Crime and Financing of Terrorism” of MASAK<br />

as far as authorities allow.<br />

In transactions which do not constitute a permanent business relationship and do<br />

not legally necessitate identification,<br />

The identification number should be obtained by branches even if the transaction does not<br />

exceed the above mentioned thresholds.<br />

A-2-2 IDENTIFICATION OF REAL PERSONS<br />

The following information should be obtained for the identification of a real person,<br />

Name, Surname<br />

Place and date of birth,<br />

Name of father and mother for Turkish Citizens.<br />

Nationality,<br />

Identity number for Turkish citizens,<br />

Type of identity card and number,<br />

Address and if possible fax, telephone number, email,<br />

Information on job and occupation,<br />

Occupational address<br />

Sample signature.<br />

The authenticity of name, surname, place and date of birth, name of father and mother,<br />

nationality, type and number of identity card is verified by,<br />

and,<br />

ID Card<br />

Driver’s License,<br />

Passport for Turkish citizens<br />

Passport,<br />

Residence Certificate,<br />

ID Cards approved by The Ministry of Finance for foreign citizens.<br />

In order to present to the authorities when demanded, a legible photocopy is made or digital<br />

image of this verification is taken or the identification information on these documents is<br />

recorded after the related documents are presented by the <strong>customer</strong>.<br />

18

The authenticity of the declared address during the transactions which constitute a<br />

permanent business relationship is verified by;<br />

Settlement license,<br />

Bill of a service which requires a subscription (like electricity, water, gas, telephone<br />

bill) and has been issued within 3 months including the electronic bills which can be<br />

confirmed by the obliged that they have been issued by the relevant institution.<br />

Any document given by a public institution,<br />

On the condition that they cover information pertaining to the last three months, lists<br />

prepared by institutions which have public institution specification like BEDAŞ and<br />

ASKİ or by telecommunication companies which provide subscription.<br />

Bill of a service which requires a subscription (like electricity, water, gas, telephone<br />

bill) and has been issued within 3 months in the name of the third party on the<br />

condition that a recognized document showing the relatedness with the third party is<br />

presented,<br />

Bill of a service which requires a subscription (like electricity, water, gas, telephone<br />

bill) and has been issued within 3 months in the name of the parents for majors who<br />

live with their parents,<br />

A declaration of address given by the education or institution or the dormitory for<br />

majors who reside in dormitories.<br />

A document showing that the <strong>customer</strong> has received a certified mail,<br />

For banks, credit card delivery forms which shows that the <strong>customer</strong> was in sight of<br />

the declared address,<br />

Reports showing that the posts sent by the obliged have been received by their<br />

<strong>customer</strong>s at the declared address,<br />

The originals or notarized copies of the above mentioned documents do not have to be<br />

presented. Legible photocopies or digital images of the documents are valid.<br />

ID Cards approved by The Ministry of Finance;<br />

Citizens of Council of Europe Member States: Identification of the residents of the<br />

countries listed in the appendix of “European Agreement on Travel of Council of<br />

Europe Member States” (Austria, Belgium, France, Germany, Greece, Italy,<br />

Liechtenstein, Luxembourg, Malta, Holland, Spain, Switzerland, and Portugal) who visit<br />

Turkey for a maximum period of three months and do not seek profit is verified by the<br />

following documents:<br />

ID cards of the relevant countries,<br />

Form of entry/exit from border crossings for persons travelling with ID cards.<br />

Citizens of Turkish Republic of Northern Cyprus (T.R.N.C.);<br />

Identification is made by T.R.N.C ID card.<br />

Documents for identification of small business owners are;<br />

ID card of the real person, Tax form,<br />

Statement of signature (or a signature card signed in the presence of a bank<br />

employee),<br />

Notarized copy of Chamber of Tradesman/Trade Registry entry (to be taken only for<br />

transactions involving gr<strong>anti</strong>ng credits such as issuing a credit card or gr<strong>anti</strong>ng<br />

credit).<br />

19

A-2-3 IDENTIFICATION OF LEGAL PERSONS REGISTERED TO TRADE REGISTRY<br />

(Incorporated, Limited, Unlimited, Commandite companies and cooperatives)<br />

For identification of legal persons registered to trade registry, the following are needed:<br />

Title of the legal person,<br />

Trade registry number,<br />

Taxpayer identification number (TIN),<br />

Company’s field of activity,<br />

Detailed address, telephone number, and if possible fax number and email address,<br />

Name/surname, place and date of birth, nationality, type and number of ID card,<br />

sample signature and additionally for Turkish citizens name of the father and mother<br />

and ID Number of the authorized representative of the legal entity,<br />

The authenticity of the legal person’s title, trade registry number, field of activity and address<br />

is verified by below mentioned entries in the trade registry. Authenticity of TIN is verified by<br />

the documents issued by relevant departments of Revenue Administration.<br />

Authenticity of the ID information of the authorized representatives of the legal person is<br />

verified by the ID documents stated in the identification section for real persons and the<br />

authenticity of their power of attorney is verified by entries in the trade registry.<br />

In order to present to the authorities when demanded, a legible photocopy is made or digital<br />

image of this verification is taken or the identification information on these documents is<br />

recorded after the related documents are presented by the <strong>customer</strong>.<br />

In permanent business relationships, in the event that a transaction is performed on behalf of<br />

the legal person upon his/her written order by the person/s authorized to represent, the<br />

authenticity of the ID information of the authorized representative/s is verified by notarized<br />

signature circular including the information on ID cards, after being sure that the order is<br />

given by a company executive.<br />

In a permanent business relationship, the currency and authenticity of the information in the<br />

presented registration documents is verified by checking the records of the relevant trade<br />

registry office or by Trade Registry Gazette interrogation from The Union of Chambers and<br />

Commodity Exchanges of Turkey. (http://www.tobb.org.tr)<br />

With respect to the certification of the identity of legal persons or entities, if it is requested by<br />

branch, the completeness of the required authorizations and certificates shall be certified by<br />

the Bank’s legal department .Copies of the above documents shall be kept for a time period<br />

of at least eight years from the end of the business relationship or transaction, in a manner<br />

ensuring the confidentiality of the data received.<br />

In order to determine the real beneficiary,<br />

The identification of the real or legal person partners whose shares exceed 25% is made in<br />

line with the explanations in this directive.<br />

Documents that shall be obtained from incorporated companies are;<br />

Photocopy of the Trade Registry Gazette that covers the complete main contract<br />

(showing the establishment of the company),<br />

Original notarized signature circular of the member/s of Board of Directors who will<br />

represent the company in front of the bank, and photocopies of ID cards of such<br />

persons,<br />

Tax form of the company.<br />

20

Documents that shall be obtained from limited companies are;<br />

Photocopy of the Trade Registry Gazette that covers the complete main contract<br />

(showing the establishment of the company),<br />

Original, recently signed and notarized signature circular of the manager/s who will<br />

represent the company in front of the bank, and photocopies of ID cards of such<br />

persons,<br />

Tax form of the company.<br />

Documents that shall be obtained from Cooperatives are;<br />

Notarized copy of the main contract of cooperative, and photocopy of the Trade<br />

Registry Gazette showing the establishment of the cooperative.<br />

Photocopy of the Trade Registry Gazette showing resolution of the Cooperative<br />

General Board on the appointment and power of Board of Directors.<br />

Notarized copy of the resolution of the Board of Directors on the authorized<br />

representative/s,<br />

If attainable, resolution of Board of Directors on the opening of an account, Notarized<br />

original of the signature circular of the authorized persons,<br />

ID cards of the authorized persons,<br />

Tax form of the cooperative.<br />

Documents that shall be obtained from unlimited companies are;<br />

Photocopy of the Trade Registry Gazette that covers the complete main contract<br />

(showing the establishment of the company),<br />

Original notarized signature circular of the shareholder/s who will represent the<br />

company in front of the bank as stated out in the main contract, and photocopies of ID<br />

cards of such persons,<br />

Tax form of the company and its shareholders (Base is opened under the TIN of the<br />

company and tax forms of the shareholders are kept in the base folder.)<br />

Documents that shall be obtained from commandite companies are;<br />

Photocopy of the Trade Registry Gazette that covers the complete main contract<br />

(showing the establishment of the company),<br />

Original notarized signature circular of the shareholder/s who will represent the<br />

company in front of the bank as stated out in the main contract, and photocopies of ID<br />

cards of such persons,<br />

Tax form of the company and its shareholders (Base is opened under the TIN of the<br />

company and tax forms of the shareholders are kept in the base folder.)<br />

Documents that shall be obtained from the branch offices of companies are;<br />

Documents of the main company,<br />

Notarized copy of the resolution of the Shareholders Assembly/Board of Directors on<br />

the opening of the branch office (including commercial title of the branch office,<br />

detailed address, its representatives and powers),<br />

Photocopy of the Trade Registry Gazette showing the establishment of the branch<br />

office,<br />

Recently signed, notarized original of signature circular of the branch office manager<br />

and his/her ID card,<br />

Tax form of the company/shareholders.<br />

21

A-2-4 IDENTIFICATION OF ASSOCIATIONS AND FOUNDATIONS<br />

For identification of associations, the documents that shall be obtained are;<br />

Name of the association,<br />

Cause of establishment,<br />

Associations Record Registration number,<br />

Detailed address, telephone and fax number (if attainable) and email address,<br />

Name/surname, place and date of birth, nationality, type and number of the ID Card,<br />

sample signature, and additionally for Turkish citizens name of the father and mother<br />

and ID Number of the authorized representative of the association<br />

The authenticity of the name, cause, record registration number and address is verified by<br />

below mentioned documents related to association record and the registration; authenticity of<br />

the ID information of the authorized representatives of the association is verified by the ID<br />

documents stated in the identification section; and the authenticity of their power of attorney<br />

is verified by the documents showing this power.<br />

For identification of foundations, the documents that shall be obtained are;<br />

Name of the foundation,<br />

Cause of establishment,<br />

Central commerce registration number kept at General Directorate of Foundations,<br />

Detailed address, telephone and fax number (if attainable) and email address,<br />

Name/surname, place and date of birth, nationality, type and number of the ID Card,<br />

sample signature, and additionally for Turkish citizens name of the father and mother<br />

and ID Number of the authorized representative of the foundation.<br />

The authenticity of the name, cause, central commerce registration number and address is<br />

verified by below mentioned documents related to foundation record and the registration kept<br />

at General Directorate of Foundations; authenticity of the ID information of the authorized<br />

representatives of the foundation is verified by the ID documents stated in the “Identification<br />

of Real Persons” section; and the authenticity of their power of attorney is verified by the<br />

documents showing this power.<br />

In order to present to the authorities when demanded, originals or notarized legible<br />

photocopies/digital images of the verification documents are taken or the identification<br />

information on these documents is recorded.<br />

Identification of the branches and agencies of foreign associations and institutions is based on<br />

the documents kept at the Ministry of Internal Affairs.<br />

Documents that shall be obtained from associations are;<br />

Notarized copy of the Association Record<br />

Notarized copy of the document stating that the association is recorded in the<br />

Association Record Book,<br />

Notarized copy of the resolution of the Board of Directors on the members and powers<br />

of the General Assembly,<br />

Notarized copy of the resolution of the Board of Directors on the appointment of<br />

representative/s among themselves,<br />

Notarized copy of the resolution of the Board of Directors on the opening of an account<br />

(if attainable),<br />

Notarized original signature circular of the authorized persons, ID cards of authorized<br />

persons,<br />

TIN of the association.<br />

22

Documents that shall be obtained from foundations are;<br />

Notarized copy of foundation voucher,<br />

Copy of the Official Gazette stating the establishment of the foundation,<br />

Notarized copy of the resolution of the Board or Committee on the members and<br />

powers of the Board of Directors (for the foundations appointed by Board of Directors,<br />

Board of Trustees or General Assembly),<br />

Notarized copy of the resolution of the Board of Directors on the appointment of<br />

representative/s among themselves,<br />

Notarized copy of the resolution of the Board of Directors on the opening of an account<br />

(if attainable),<br />

Notarized original signature circular of the authorized persons, ID cards of authorized<br />

persons,<br />

TIN of the association.<br />

A-2-5 IDENTIFICATION OF UNIONS AND CONFEDERATIONS<br />

For identification of unions and confederations, the documents that shall be obtained are<br />

Full name of the union or confederation,<br />

Cause of the union or federation,<br />

Registry number kept at Regional Directorate of Working of Ministry of Labor and<br />

Social Security,<br />

Detailed address, telephone number, fax number (if possible), and email address,<br />

Name/surname, place and date of birth, nationality, type and number of the ID Card,<br />

sample signature, and additionally for Turkish citizens name of the father and mother<br />

and ID Number of the authorized representative of the union or confederation.<br />

The obtained information is verified by the statutes of these institutions and documents<br />

recorded in the registry kept at Regional Directorate of Working of Ministry of Labor and<br />

Social Security; the authenticity of the ID information of the authorized representative/s is<br />

verified by the identity documents listed in the “Identification of Real Persons” section; and<br />

their representative status is verified by documents recorded in the registry or a document<br />

stating their authorization.<br />

In order to present to the authorities when demanded, originals or notarized legible<br />

photocopies/digital images of the verification documents are taken or the identification<br />

information on these documents is recorded.<br />

Documents that shall be obtained from unions are;<br />

Notarized copy of the statute of the union,<br />

Copy of the registry document kept at Ministry of Labor and Social Security,<br />

Notarized copy of the resolution of the Union General Assembly on the members and<br />

powers of the Board of Directors,<br />

Notarized copy of the resolution of the Board of Directors on the appointment of<br />

representative/s among themselves,<br />

Notarized copy of the resolution of the Board of Directors on the opening of an account<br />

(if attainable),<br />

Notarized original signature circular of the authorized persons, ID cards of authorized<br />

persons,<br />

TIN of the union.<br />

23

Documents that shall be obtained from confederations at the opening of accounts<br />

are;<br />

Notarized copy of the statute of the confederation,<br />

Copy of the registry document kept at Ministry of Labor and Social Security,<br />

Notarized copy of the resolution of the Confederation General Assembly on the<br />

members and powers of the Board of Directors,<br />

Notarized copy of the resolution of the Board of Directors on the appointment of<br />

representative/s among themselves,<br />

Notarized copy of the resolution of the Board of Directors on the opening of an account<br />

(if attainable),<br />

Notarized original signature circular of the authorized persons, ID cards of authorized<br />

persons,<br />

TIN of the confederation.<br />

A-2-6 IDENTIFICATION OF POLITICAL PARTIES<br />

For identification of political party organizations, the documents that shall be obtained are;<br />

Name of the relevant unit of the political party,<br />

Detailed address, telephone number, fax number (if possible), and email address,<br />

Name/surname, place and date of birth, nationality, type and number of the ID Card,<br />

sample signature, and additionally for Turkish citizens name of the father and mother<br />

and ID Number of the authorized representative of the political party.<br />

The name and address of the relevant unit of the political party is verified by their statutes;<br />

the authenticity of the ID information of the authorized representative/s is verified by the<br />

identity documents listed in the “Identification of Real Persons” section; and their<br />

representative status is verified by the documents of authorization.<br />

In order to present to the authorities when demanded, originals or notarized legible<br />

photocopies/digital images of the verification documents are taken or the identification<br />

information on these documents is recorded.<br />

Documents that shall be obtained from political parties are;<br />

Notarized copy of the statute of the political party,<br />

Resolutions of Center and Central Executive Committee on the powers of<br />

Province/District Executive Committee (there is no need to obtain these documents if<br />

they are clearly stated in the statute),<br />

Notarized copy of the resolution of the Congress on the appointment of the chairman<br />

and members of Central Executive Committee,<br />

Notarized copy of the resolution of the Board of Directors on the appointment of<br />

representative/s of the political party among themselves,<br />

Notarized copy of the resolution of the Central Executive Committee on the opening of<br />

an account (if attainable),<br />

Notarized original signature circular of the authorized persons, ID cards of authorized<br />

persons,<br />

TIN of the political party.<br />

24

A-2-7 IDENTIFICATION OF NON-RESIDENT LEGAL PERSONS<br />

For the identification of the non-resident legal persons, equivalents of the documents that are<br />

necessary for identification of resident legal persons are required. These documents need to<br />

be approved by relevant Turkish Republic Consulates. Identification can also be made within<br />

the frame of “Agreement on Lifting the Obligation of Foreign Official Documents Ratification”<br />

by the notarized translations of the copies of these documents which have an annotation of<br />

ratification by the relevant institution of a country who has signed that agreement.<br />

Documents that shall be obtained from non-resident legal persons are;<br />

Documents related to the establishment of the company (approved by the Turkish<br />

Consulate/having an apostil) and notarized photocopies of their translations.<br />

Documents related to the authorized representatives of the company (approved by the<br />

Turkish Consulate/having an apostil) and notarized photocopies of their translations.<br />

Document showing the scope of the person authorized to perform transactions on<br />

behalf of the company (approved by the Turkish Consulate/having an apostil) and<br />

notarized photocopies of their translations.<br />

Newly signed signature circular (approved by the Turkish Consulate if it has been<br />

issued abroad/having an apostil) and notarized original of its translation<br />

ID cards of authorized persons,<br />