FinCEN SAR Activity Review, Trends, Tips & Issues, Issue 10

FinCEN SAR Activity Review, Trends, Tips & Issues, Issue 10

FinCEN SAR Activity Review, Trends, Tips & Issues, Issue 10

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

14<br />

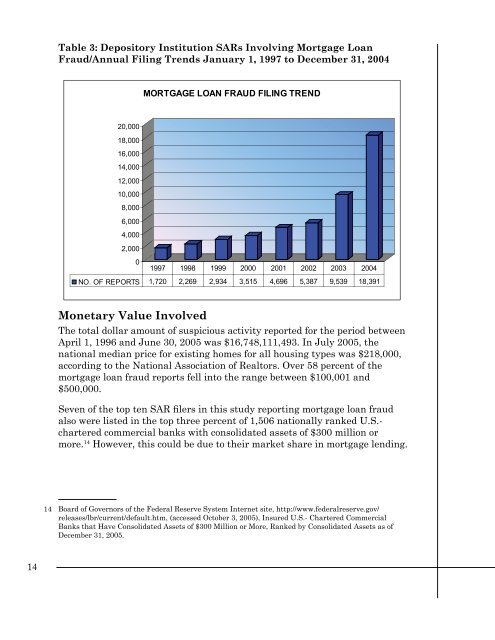

Table 3: Depository Institution <strong>SAR</strong>s Involving Mortgage Loan<br />

Fraud/Annual Filing <strong>Trends</strong> January 1, 1997 to December 31, 2004<br />

20,000<br />

18,000<br />

16,000<br />

14,000<br />

12,000<br />

<strong>10</strong>,000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

Monetary Value Involved<br />

0<br />

MORTGAGE LOAN FRAUD FILING TREND<br />

1997 1998 1999 2000 2001 2002 2003 2004<br />

NO. OF REPORTS 1,720 2,269 2,934 3,515 4,696 5,387 9,539 18,391<br />

The total dollar amount of suspicious activity reported for the period between<br />

April 1, 1996 and June 30, 2005 was $16,748,111,493. In July 2005, the<br />

national median price for existing homes for all housing types was $218,000,<br />

according to the National Association of Realtors. Over 58 percent of the<br />

mortgage loan fraud reports fell into the range between $<strong>10</strong>0,001 and<br />

$500,000.<br />

Seven of the top ten <strong>SAR</strong> filers in this study reporting mortgage loan fraud<br />

also were listed in the top three percent of 1,506 nationally ranked U.S.chartered<br />

commercial banks with consolidated assets of $300 million or<br />

more. 14 However, this could be due to their market share in mortgage lending.<br />

14 Board of Governors of the Federal Reserve System Internet site, http://www.federalreserve.gov/<br />

releases/lbr/current/default.htm, (accessed October 3, 2005), Insured U.S.- Chartered Commercial<br />

Banks that Have Consolidated Assets of $300 Million or More, Ranked by Consolidated Assets as of<br />

December 31, 2005.