Governmental 457(b) Plan Massachusetts Deferred Compensation

Governmental 457(b) Plan Massachusetts Deferred Compensation

Governmental 457(b) Plan Massachusetts Deferred Compensation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

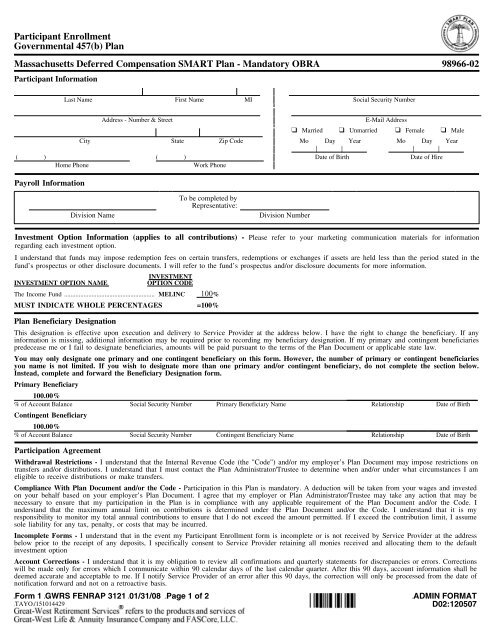

Participant Enrollment<br />

<strong>Governmental</strong> <strong>457</strong>(b) <strong>Plan</strong><br />

<strong>Massachusetts</strong> <strong>Deferred</strong> <strong>Compensation</strong> SMART <strong>Plan</strong> 98966-01<br />

Participant Participant<br />

Participant Information Enrollment<br />

Enrollment<br />

<strong>Governmental</strong> <strong>Governmental</strong> <strong>457</strong>(b) <strong>457</strong>(b) <strong>Plan</strong><br />

<strong>Plan</strong><br />

Last Name First Name MI Social Security Number<br />

<strong>Massachusetts</strong> <strong>Massachusetts</strong> <strong>Deferred</strong> <strong>Deferred</strong> <strong>Compensation</strong> <strong>Compensation</strong> SMART SMART <strong>Plan</strong> <strong>Plan</strong> - Mandatory OBRA 98966-02 98966-01 98966-02<br />

Participant Participant<br />

Information<br />

Information Address - Number & Street E-Mail Address<br />

Participant Enrollment<br />

❑ Married ❑ Unmarried ❑ Female ❑ Male<br />

<strong>Governmental</strong> Last Name First Name MI Social Security Number<br />

Last Name <strong>457</strong>(b) City <strong>Plan</strong><br />

State First Name Zip CodeMI Mo Day Year Social Security Number Mo Day Year<br />

| | | |<br />

<strong>Massachusetts</strong> ( ) <strong>Deferred</strong> Address <strong>Compensation</strong> - Number & ( Street SMART ) <strong>Plan</strong> - Mandatory OBRADate of Birth E-Mail Address Date of Hire98966-02<br />

Address - Number & Street E-Mail Address<br />

Home Phone Work Phone<br />

❑ Married ❑ Unmarried ❑ Female ❑ Male<br />

Participant Information<br />

❑ Married ❑ Unmarried ❑ Female ❑ Male<br />

City State Zip Code Mo Day Year Mo Day Year<br />

Payroll Information City State Zip Code Mo Day Year Mo Day Year<br />

| | | |<br />

❑ ( I elect ) to Last contribute Name % or ( $ First<br />

) Name (per MI | |<br />

pay period) of my Date compensation of Birth Social as Security before-tax Number | |<br />

Date contributions of Hire to the<br />

(<br />

<strong>Governmental</strong><br />

)<br />

Home Phone <strong>457</strong>(b) <strong>Deferred</strong> <strong>Compensation</strong><br />

(<br />

<strong>Plan</strong><br />

)<br />

until Work such Phone time as I revoke or amend my election.<br />

Date of Birth Date of Hire<br />

Home Phone Work Phone<br />

Home Phone Work Phone<br />

Payroll Address Effective - Number Date: & Street | |<br />

E-Mail Address<br />

Payroll Information<br />

Mo Day Year<br />

Investment<br />

Investment<br />

Option<br />

Option<br />

Information<br />

Information<br />

(applies<br />

(applies<br />

to<br />

to<br />

all<br />

all<br />

contributions)<br />

contributions)<br />

- Please<br />

Please<br />

refer<br />

refer<br />

to<br />

to ❑ your<br />

your Married marketing<br />

marketing ❑ Unmarried communication<br />

communication❑materials materials Female for<br />

for❑information information Male<br />

regarding<br />

regarding<br />

❑ I elect each<br />

each<br />

toinvestment investment option.<br />

contribute City option. % or $ State To be completed Zip Code by<br />

(per pay period) of Mo my Day compensation Year as before-tax Mo contributions Day Year to the<br />

<strong>Governmental</strong> <strong>457</strong>(b) <strong>Deferred</strong> <strong>Compensation</strong> <strong>Plan</strong> until such time as I revoke or amend my election.<br />

I understand<br />

understand<br />

that<br />

that<br />

funds<br />

funds<br />

may<br />

may<br />

impose<br />

impose<br />

redemption<br />

redemption<br />

fees<br />

fees<br />

on<br />

on<br />

certain<br />

certain Representative: transfers,<br />

transfers,<br />

redemptions<br />

redemptions<br />

or<br />

or<br />

exchanges<br />

exchanges |<br />

if<br />

if<br />

assets<br />

assets |<br />

are<br />

are<br />

held<br />

held<br />

less<br />

less<br />

than<br />

than<br />

the<br />

the |<br />

period<br />

period |<br />

stated<br />

stated<br />

in<br />

in<br />

the<br />

the<br />

fund’s<br />

fund’s (<br />

prospectus<br />

prospectus )<br />

or<br />

or<br />

Division other<br />

other Payroll disclosure<br />

disclosure<br />

NameEffective<br />

documents.<br />

documents. Date: (<br />

I will<br />

will<br />

refer<br />

refer ) | to<br />

to<br />

the<br />

the<br />

fund’s<br />

fund’s | prospectus<br />

prospectus<br />

Division and/or<br />

and/or<br />

Number disclosure<br />

disclosure Date<br />

documents<br />

documents of Birth<br />

for<br />

for<br />

more<br />

more<br />

information.<br />

information. Date of Hire<br />

Home Phone INVESTMENT Mo Work DayPhone Year<br />

INVESTMENT OPTION NAME<br />

OPTION<br />

INVESTMENT<br />

CODE<br />

INVESTMENT OPTION NAME<br />

OPTION CODE<br />

The Investment Income Fund Option ........................................................ Information (applies (appliesMELINC to all To contributions) be completed % by - Please refer to your marketing communication materials for information<br />

The regarding Income each Fund investment ........................................................ option.<br />

MELINC Representative: %<br />

MUST<br />

MUST INDICATE<br />

I understand that funds<br />

Division<br />

WHOLE<br />

may<br />

Name<br />

PERCENTAGES =100%<br />

impose redemption fees on certain transfers, redemptions<br />

Division<br />

or<br />

Number<br />

I understand<br />

INDICATE<br />

that funds<br />

WHOLE<br />

may impose<br />

PERCENTAGES<br />

redemption fees on certain<br />

=100%<br />

transfers, redemptions or exchanges if assets are held less than the period stated in the<br />

<strong>Plan</strong> fund’s Beneficiary prospectus or Designation<br />

other disclosure documents. I will refer to the fund’s prospectus and/or disclosure documents for more information.<br />

<strong>Plan</strong> Beneficiary Designation<br />

This Investment designation Option is effective Information upon execution (applies INVESTMENT<br />

to all contributions) - Please refer to your marketing communication INVESTMENT materials for information<br />

This<br />

and delivery to Service Provider at the address below. I have the right to change the beneficiary. If any<br />

INVESTMENT<br />

information INVESTMENT regarding designation each is missing,<br />

OPTION investment is effective<br />

additional<br />

NAME option. upon execution<br />

information OPTION and delivery<br />

may be CODE<br />

to Service Provider INVESTMENT at the address OPTION below. NAME I have the right to OPTION change CODE the beneficiary. If any<br />

information is missing, additional information may be required<br />

required<br />

prior<br />

prior<br />

to<br />

to<br />

recording<br />

recording<br />

my<br />

my<br />

beneficiary<br />

beneficiary<br />

designation.<br />

designation.<br />

If<br />

If<br />

my<br />

my<br />

primary<br />

primary<br />

and<br />

and<br />

contingent<br />

contingent<br />

beneficiaries<br />

beneficiaries<br />

predecease The predecease SMARTPath I understand Income me Fund me 2000 that or<br />

or ........................................................ Retirement I funds fail<br />

fail<br />

to<br />

to<br />

may designate<br />

designate Fund impose ........................... beneficiaries,<br />

beneficiaries,<br />

redemption MELINC SMPT00 fees amounts<br />

amounts<br />

on certain will<br />

will 100<br />

be<br />

be<br />

transfers, %<br />

paid<br />

paid<br />

pursuant<br />

pursuant<br />

redemptions State to<br />

to Street the<br />

the<br />

terms<br />

terms Russ or exchanges 2000 of<br />

of<br />

the<br />

the Ind <strong>Plan</strong><br />

<strong>Plan</strong> Sec if assets Lnd Document<br />

Document Ser are A .................. held or<br />

or<br />

applicable<br />

applicable<br />

less SVR2IS than state the<br />

state<br />

period law.<br />

law.<br />

stated % in the<br />

SMARTPath fund’s prospectus 2005 Retirement or other disclosure Fund ........................... documents. SMPT05 I will refer to the % fund’s prospectus Fidelity Fund and/or ............................................................... disclosure documents for more information.<br />

FFIDX %<br />

You<br />

You MUST may<br />

may INDICATE only<br />

only<br />

designate<br />

designate WHOLE one<br />

one<br />

primary PERCENTAGES primary<br />

and<br />

and<br />

one<br />

one<br />

contingent<br />

contingent =100% beneficiary<br />

beneficiary<br />

on<br />

on<br />

this<br />

this<br />

form.<br />

form.<br />

However,<br />

However,<br />

the<br />

the<br />

number<br />

number<br />

of<br />

of<br />

primary<br />

primary<br />

or<br />

or<br />

contingent<br />

contingent<br />

beneficiaries<br />

beneficiaries<br />

SMARTPath 2010 Retirement Fund ...........................<br />

INVESTMENT<br />

SMPT10 % Eaton Vance Large Cap Value Eq Com Tr .................<br />

INVESTMENT<br />

ETCLCV %<br />

you<br />

you<br />

name<br />

name<br />

is<br />

is<br />

not<br />

not<br />

limited.<br />

limited.<br />

If<br />

If<br />

you<br />

you<br />

wish<br />

wish<br />

to<br />

to<br />

designate<br />

designate<br />

more<br />

more<br />

than<br />

than<br />

one<br />

one<br />

primary<br />

primary<br />

and/or<br />

and/or<br />

contingent<br />

contingent<br />

beneficiary,<br />

beneficiary,<br />

do<br />

do<br />

not<br />

not<br />

complete<br />

complete<br />

the<br />

the<br />

section<br />

section<br />

below.<br />

below.<br />

Instead, INVESTMENT Instead, <strong>Plan</strong> SMARTPath Beneficiary complete<br />

complete 2015 OPTION Retirement and<br />

and Designation forward<br />

forward NAME Fund ........................... the<br />

the<br />

Beneficiary<br />

Beneficiary OPTION SMPT15 Designation<br />

Designation CODE form.<br />

form. % INVESTMENT KLD 400 Social OPTION Index Series NAME Fund ............................ OPTION KLD400 CODE %<br />

Primary SMARTPath<br />

SMARTPath Beneficiary 2000<br />

2020<br />

Retirement<br />

Retirement<br />

Fund<br />

Fund<br />

...........................<br />

...........................<br />

SMPT00<br />

SMPT20<br />

%<br />

State<br />

State<br />

Street<br />

Street<br />

Russ<br />

S&P 500<br />

2000<br />

Flagship<br />

Ind Sec<br />

Series<br />

Lnd Ser<br />

A .....................<br />

A .................. SVR2IS<br />

SV500<br />

%<br />

Primary This designation Beneficiary is effective upon execution and delivery to Service Provider at the address below. I have the right to change the beneficiary. If any<br />

information SMARTPath<br />

SMARTPath<br />

100.00% 2005<br />

2025 is missing, Retirement<br />

Retirement additional Fund<br />

Fund<br />

...........................<br />

........................... information may SMPT05<br />

SMPT25 be required prior % to recording Fidelity<br />

Fidelity my Fund<br />

Growth beneficiary ...............................................................<br />

Company designation. Fund ................................. If my primary FFIDX<br />

FD-GRO and contingent beneficiaries<br />

%<br />

% predecease SMARTPath<br />

SMARTPath 100.00%<br />

of Account me 2010<br />

2030 Balance or Retirement<br />

Retirement I fail to designate Fund<br />

Fund<br />

...........................<br />

........................... beneficiaries, Social Security SMPT10<br />

SMPT30 amounts Number will be % Primary paid pursuant Beneficiary Eaton<br />

T Rowe to Vance the Price Name terms Large<br />

Structured of Cap the Value<br />

Research <strong>Plan</strong> Eq Document Com<br />

Comm<br />

Tr .................<br />

Tr ............. or Relationship applicable ETCLCV<br />

TRSRCT state law. Date % of Birth<br />

%<br />

SMARTPath<br />

SMARTPath<br />

of Account<br />

2015<br />

2035<br />

Balance<br />

Retirement<br />

Retirement<br />

Fund<br />

Fund<br />

...........................<br />

...........................<br />

Social Security<br />

SMPT15<br />

SMPT35<br />

Number<br />

%<br />

Primary Beneficiary<br />

KLD<br />

State Street<br />

Name<br />

400 Social<br />

Pass<br />

Index<br />

Tr Infl<br />

Series<br />

Pt Sc<br />

Fund<br />

Ind NL<br />

............................<br />

A .....................<br />

Relationship<br />

KLD400<br />

SVPTIP<br />

Date<br />

%<br />

of Birth<br />

Contingent You may only Beneficiary designate one primary and one contingent beneficiary on this form. However, the number of primary or contingent beneficiaries<br />

Contingent you SMARTPath<br />

SMARTPath name is 2020<br />

2040 Beneficiary not Retirement<br />

Retirement limited. Fund<br />

Fund If you ...........................<br />

........................... wish to designate SMPT20<br />

SMPT40 more than % one primary State<br />

PIMCO<br />

Street and/or High<br />

S&P<br />

Yield contingent 500<br />

Fund<br />

Flagship<br />

- Institutional beneficiary, Series A .....................<br />

..................... do not complete SV500<br />

PHIYX the section % below.<br />

Instead,<br />

SMARTPath<br />

SMARTPath 100.00%<br />

100.00% complete<br />

2025<br />

2045<br />

Retirement<br />

Retirement and forward<br />

Fund<br />

Fund<br />

...........................<br />

........................... the Beneficiary<br />

SMPT25<br />

SMPT45 Designation form.<br />

%<br />

Fidelity<br />

PIMCO<br />

Growth<br />

Total Return<br />

Company<br />

- Inst.<br />

Fund<br />

........................................<br />

................................. FD-GRO<br />

PTTRX<br />

%<br />

%<br />

SMARTPath<br />

SMARTPath<br />

of Account<br />

2030<br />

2050<br />

Balance<br />

Retirement<br />

Retirement<br />

Fund<br />

Fund<br />

...........................<br />

...........................<br />

Social Security<br />

SMPT30<br />

SMPT50<br />

Number<br />

%<br />

Contingent Beneficiary<br />

T<br />

State<br />

Rowe<br />

Street<br />

Name<br />

Price<br />

Pass<br />

Structured<br />

Bd Mkt<br />

Research<br />

Ind Sec Lnd<br />

Comm<br />

A ....................<br />

Relationship<br />

Tr ............. TRSRCT<br />

SVPBMI<br />

Date<br />

%<br />

of Birth<br />

% Primary of Account Beneficiary Balance Social Security Number Contingent Beneficiary Name Relationship Date of Birth<br />

SMARTPath<br />

State Street Daily<br />

2035<br />

EAFE<br />

Retirement<br />

Sec Lnd<br />

Fund<br />

Series<br />

...........................<br />

T .................<br />

SMPT35<br />

SVEAFT<br />

%<br />

State<br />

The Income<br />

Street Pass<br />

Fund<br />

Tr<br />

........................................................<br />

Infl Pt Sc Ind NL A ..................... SVPTIP<br />

MELINC<br />

%<br />

Participation 100.00%<br />

Participation<br />

Agreement<br />

SMARTPath<br />

INVESCO Equity Agreement<br />

2040<br />

Real<br />

Retirement<br />

Estate Sec<br />

Fund<br />

Tr<br />

...........................<br />

Cl MA .............<br />

SMPT40<br />

IVERES<br />

%<br />

PIMCO<br />

Vanguard<br />

High<br />

Reserve<br />

Yield<br />

Prime<br />

Fund<br />

Money<br />

- Institutional<br />

Market<br />

.....................<br />

Inst ............<br />

PHIYX<br />

VMRXX<br />

%<br />

% of Account Balance Social Security Number Primary Beneficiary Name Relationship Date of Birth<br />

Withdrawal SMARTPath<br />

Active Withdrawal Small<br />

2045<br />

Cap Restrictions<br />

Restrictions Stock<br />

Retirement<br />

Portfolio - I<br />

Fund I understand ............................... understand that the<br />

........................... that the SMPT45<br />

WELASC Internal<br />

Internal<br />

Revenue<br />

Revenue<br />

% Code<br />

Code<br />

(the<br />

(the "Code") and/or my employer’s <strong>Plan</strong> Document may impose restrictions on<br />

transfers and/or distributions. I understand that I must contact the <strong>Plan</strong> Administrator/Trustee<br />

MUST PIMCO "Code") Total INDICATE and/or Return my<br />

to - WHOLE<br />

determine Inst. employer’s ........................................ PERCENTAGES <strong>Plan</strong> Document<br />

when and/or under PTTRX may impose<br />

what circumstances<br />

=100% restrictions % on<br />

transfers<br />

Contingent I am<br />

SMARTPath and/or<br />

Beneficiary<br />

eligible to receive 2050 distributions. Retirement distributions Fund I understand<br />

or ........................... that<br />

make transfers. SMPT50 I must contact the % <strong>Plan</strong> Administrator/Trustee State Street Pass Bd to Mkt determine Ind Sec Lnd when A .................... and/or under SVPBMI what circumstances % I am<br />

eligible<br />

State Street<br />

100.00% to receive distributions or make transfers.<br />

Daily EAFE Sec Lnd Series T ................. SVEAFT % The Income Fund ........................................................ MELINC %<br />

Compliance<br />

Compliance % of Account Balance With <strong>Plan</strong> Document and/or Social the Security Code Number - Participation Contingent in this <strong>Plan</strong> Beneficiary is mandatory. Name A deduction will be taken Relationship from your wagesDate andof invested Birth<br />

on INVESCO your behalf Equity With<br />

based Real <strong>Plan</strong> Estate Document<br />

on your Sec Tr employer’s Cl and/or MA ............. the<br />

<strong>Plan</strong> IVERES Code - Participation<br />

Document. I agree % in this <strong>Plan</strong><br />

that my Vanguard is mandatory.<br />

employer Reserve or <strong>Plan</strong> Prime A deduction<br />

Administrator/Trustee Money Market will be Inst taken ............ from<br />

may take VMRXX your wages and<br />

any action that % invested<br />

on your behalf based on your employer’s <strong>Plan</strong> Document. I agree that my employer or <strong>Plan</strong> Administrator/Trustee may take any action that may<br />

may<br />

be<br />

be<br />

necessary Active Participation Small to Cap ensure Agreement<br />

Stock that Portfolio my ............................... participation in the WELASC <strong>Plan</strong> is in compliance %<br />

necessary to ensure that my participation in the <strong>Plan</strong> is in compliance with<br />

with MUST any<br />

any INDICATE applicable<br />

applicable<br />

requirement<br />

requirement WHOLE PERCENTAGES of<br />

of<br />

the<br />

the<br />

<strong>Plan</strong><br />

<strong>Plan</strong><br />

Document<br />

Document<br />

and/or<br />

and/or =100% the<br />

the<br />

Code.<br />

Code.<br />

I<br />

understand<br />

understand that the maximum annual limit on contributions is determined under the <strong>Plan</strong> Document and/or the Code. I understand that it is my<br />

responsibility Withdrawal<br />

that<br />

Restrictions<br />

the maximum<br />

to monitor my - Itotal understand<br />

annual limit<br />

annual that<br />

on<br />

contributions the<br />

contributions<br />

Internal to ensure Revenue<br />

is determined<br />

that Code I do (the<br />

under<br />

not "Code")<br />

the<br />

exceed the and/or<br />

<strong>Plan</strong><br />

amount my<br />

Document<br />

employer’s<br />

and/or<br />

permitted. If <strong>Plan</strong><br />

the<br />

I exceed Document<br />

Code. I<br />

the contribution may<br />

understand<br />

impose<br />

that<br />

limit, restrictions<br />

it is my<br />

I assume on<br />

responsibility<br />

sole transfers liability and/or<br />

to<br />

for distributions.<br />

monitor my total<br />

any tax, penalty, I understand<br />

annual contributions<br />

or costs that may I must<br />

to<br />

be incurred. contact<br />

ensure<br />

the<br />

that<br />

<strong>Plan</strong><br />

I do<br />

Administrator/Trustee<br />

not exceed the amount<br />

to determine<br />

permitted.<br />

when<br />

If I exceed<br />

and/or<br />

the<br />

under<br />

contribution<br />

what circumstances<br />

limit, I assume<br />

I am<br />

sole<br />

eligible<br />

liability<br />

to receive<br />

for any<br />

distributions<br />

tax, penalty,<br />

or<br />

or<br />

make<br />

costs<br />

transfers.<br />

that may be incurred.<br />

Incomplete<br />

Incomplete Forms - I understand that in the event my Participant Enrollment form is incomplete or is not received by Service Provider at the address<br />

Compliance<br />

Forms<br />

below prior to With the <strong>Plan</strong><br />

- I understand<br />

receipt Document<br />

that<br />

of any deposits, and/or<br />

in the<br />

the<br />

event<br />

I specifically Code<br />

my<br />

- Participation<br />

Participant Enrollment<br />

consent to inService this <strong>Plan</strong><br />

form<br />

Provider is mandatory.<br />

is incomplete<br />

retaining Aall deduction<br />

or is not<br />

monies will<br />

received<br />

received be taken<br />

by Service<br />

and from allocating your<br />

Provider<br />

them wages<br />

at<br />

to and<br />

the<br />

the invested<br />

address<br />

below<br />

default<br />

investment on your<br />

prior<br />

behalf<br />

to the<br />

option based<br />

receipt<br />

on your<br />

of any<br />

employer’s<br />

deposits,<br />

<strong>Plan</strong><br />

I specifically<br />

Document.<br />

consent<br />

I agree<br />

to<br />

that<br />

Service<br />

my employer<br />

Provider retaining<br />

or <strong>Plan</strong> Administrator/Trustee<br />

all monies received and<br />

may<br />

allocating<br />

take any<br />

them<br />

action<br />

to<br />

that<br />

the<br />

may<br />

default<br />

be<br />

investment<br />

necessary to<br />

option<br />

ensure that my participation in the <strong>Plan</strong> is in compliance with any applicable requirement of the <strong>Plan</strong> Document and/or the Code. I<br />

Account<br />

Account<br />

understand Corrections<br />

Corrections<br />

that the maximum - I understand<br />

understand<br />

annual that<br />

that<br />

limit it<br />

it<br />

is<br />

is<br />

on my<br />

my<br />

contributions obligation<br />

obligation<br />

to<br />

to<br />

is review<br />

review<br />

determined all<br />

all<br />

confirmations<br />

confirmations<br />

under the and<br />

and<br />

<strong>Plan</strong> quarterly<br />

quarterly<br />

Document statements<br />

statements<br />

and/or for the<br />

for<br />

discrepancies<br />

discrepancies<br />

Code. I understand or<br />

or<br />

errors.<br />

errors.<br />

that Corrections<br />

Corrections<br />

it is my<br />

will<br />

will<br />

responsibility be<br />

be<br />

made<br />

made<br />

only<br />

only<br />

to monitor for<br />

for<br />

errors<br />

errors<br />

my which<br />

which<br />

total annual I communicate<br />

communicate<br />

contributions within<br />

within<br />

to ensure 90<br />

90<br />

calendar<br />

calendar<br />

that I days<br />

days<br />

do not of<br />

of<br />

the exceed<br />

the<br />

last<br />

last<br />

the calendar<br />

calendar<br />

amount quarter.<br />

quarter.<br />

permitted. After<br />

After<br />

If this<br />

this<br />

I exceed 90<br />

90<br />

days,<br />

days,<br />

the account<br />

account<br />

contribution information<br />

information<br />

limit, I shall<br />

shall<br />

assume be<br />

be<br />

deemed<br />

deemed<br />

sole liability accurate<br />

accurate<br />

for any and<br />

and<br />

tax, acceptable<br />

acceptable<br />

penalty, to<br />

to<br />

or me.<br />

me.<br />

costs If<br />

If<br />

I that notify<br />

notify<br />

may Service<br />

Service<br />

be incurred. Provider<br />

Provider<br />

of<br />

of<br />

an<br />

an<br />

error<br />

error<br />

after<br />

after<br />

this<br />

this<br />

90<br />

90<br />

days,<br />

days,<br />

the<br />

the<br />

correction<br />

correction<br />

will<br />

will<br />

only<br />

only<br />

be<br />

be<br />

processed<br />

processed<br />

from<br />

from<br />

the<br />

the<br />

date<br />

date<br />

of<br />

of<br />

notification<br />

notification forward and not on a retroactive basis.<br />

Incomplete<br />

forward<br />

Forms -<br />

and<br />

I understand<br />

not on a retroactive<br />

that in the<br />

basis.<br />

event my Participant Enrollment form is incomplete or is not received by Service Provider at the address<br />

below prior to the receipt of any deposits, I specifically consent to Service Provider retaining all monies received and allocating them to the default<br />

investment option<br />

][Form 1 ][GWRS FENRAP ][01/31/08 ][Page 1 of 3<br />

][ADMIN FORMAT<br />

Account ][TAYO][/151014421 Corrections - I understand that it is my obligation to review all confirmations and quarterly statements for discrepancies or errors. D02:120507 Corrections<br />

will be made only for errors which I communicate within 90 calendar days of the last calendar quarter. After this 90 days, account information shall be<br />

deemed accurate and acceptable to me. If I notify Service Provider of an error after this 90 days, the correction will only be processed from the date of<br />

notification forward and not on a retroactive basis.<br />

][Form ][Form<br />

1 1<br />

][GWRS ][GWRS<br />

FENRAP FENRAP<br />

3121<br />

3121 ][01/31/08 ][01/31/08<br />

][01/31/08 ][Page ][Page<br />

][Page 1 of 31<br />

1<br />

of<br />

of<br />

2<br />

][ADMIN ][ADMIN<br />

FORMAT<br />

FORMAT<br />

][TAYO][/151014421<br />

][TAYO][/151014429<br />

][TAYO][/151014429<br />

D02:120507<br />

D02:120507

Last Name First Name MI Social Security Number<br />

Required Signatures - I have completed, understand and agree to all pages of this Participant Enrollment form. I understand that Service Provider is<br />

required to comply with the regulations and requirements of the Office of Foreign Assets Control, Department of the Treasury ("OFAC"). As a result,<br />

Service Provider cannot conduct business with persons in a blocked country or any person designated by OFAC as a specially designated national or<br />

blocked person. For more information, please access the OFAC Web site at: http://www.ustreas.gov/offices/eotffc/ofac. Deferral agreements must be<br />

entered into prior to the first day of the month that the deferral will be made.<br />

Participant Signature Date<br />

Registered Representative Signature and ID Date<br />

Participant forward to Service Provider at:<br />

Great-West Retirement Services®<br />

PO Box 173764<br />

Denver, CO 80217-3764<br />

Express Address:<br />

8515 E. Orchard Road, Greenwood Village, CO 80111<br />

Phone #: 1-877-<strong>457</strong>-1900<br />

Fax #: 1-866-745-5766<br />

][Form 1 ][GWRS FENRAP 3121 ][01/31/08 ][Page 2 of 2<br />

][TAYO][/151014429<br />

][ADMIN FORMAT<br />

D02:120507